How to Play the New L2 Blast Launched by Blur Founder with Money and Interest?

Shortly after the launch of the new L2 network Blast by Blur founder Pacman, the TVL has already exceeded $27 million. NFT whale Christian has also deposited 500 stETH into Blast, with high hopes for its performance. What's even more surprising is that today, Blast announced the completion of a $20 million financing, with participation from Paradigm, Standard Crypto, eGirl Capital, Mechanism Capital co-founder Andrew Kang, Lido advisor Hasu, The Block CEO Larry Cermak, and others.

What does $20 million mean? Arbitrum's first financing in 2019 was $3.7 million, and Op's first financing in 2020 was only $3.5 million. Blast's first financing is in the tens of millions. At the same time, the bridging gameplay introduced by Blast has caused a wave of discussion on social media platforms. Some KOLs even expressed that Blur's move is both giving and sending, giving money, interest, and gas.

Next, the veDAO Research Institute will bring you an introduction and interpretation of Blast's gameplay.

What is Blast?

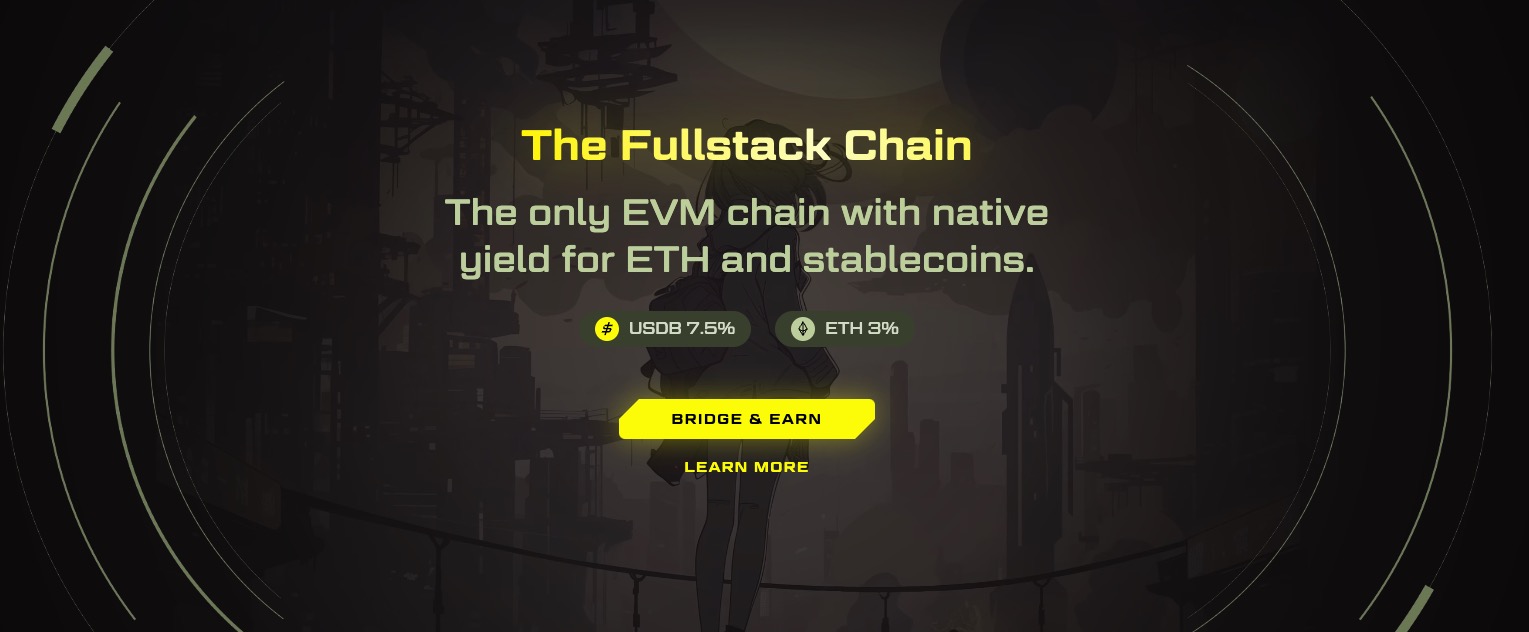

First, we need to understand a concept: Risk Free Rate (RFR). This concept believes that the cryptocurrency world also has inflation. ETH has a stable staking yield of 3%-4%, but most of the funds in Layer 2 accounts are only statically placed (yield 0%), which means that these assets are passively devalued due to ETH's inflation.

Blast hopes to solve this problem by providing the possibility of passive interest for funds in Layer 2 accounts.

Specifically, when a user deposits funds into Blast, Blast will immediately use the corresponding ETH locked on the Layer 1 network for native network staking and automatically return the ETH staking income to the user above Blast. In short, if a user holds 1 ETH in the Blast account, over time, it may automatically grow to 1.1 or 1.2 ETH.

In addition to participating in native staking with ETH, Blast also supports passive interest for stablecoins. Specifically, when a user bridges stablecoins (such as USDC, USDT, and DAI) to Blast, Blast will immediately use the corresponding stablecoins locked on the Layer 1 network to deposit them into DeFi protocols such as MakerDAO, and automatically return the income in the form of USDB (Blast's native stablecoin) to the user above Blast.

After users enter the Blast network in advance, they can not only immediately enjoy the passive interest of 4% for ETH or 5% for stablecoins, but also accumulate Blast Points rewards. Currently, the official only revealed that Blast plans to launch the mainnet and develop withdrawals on February 24 next year, and open the "redemption" of Blast Points on May 24.

Specific Operation Process:

- Users log in to the Blast official website and connect their wallets.

-

Users enter the invitation code, and currently, KOLs related to X platform are all publishing their own invitation codes.

-

After entering the invitation code, users can check whether they have received an airdrop by associating their X account and Discord account.

-

It's okay if you didn't receive the airdrop. Users can still use the bridging function. It is worth noting that starting today, bridging any amount within 7 days will earn double points (Blast Points), and the more the amount, the more points earned.

- After users complete the bridging action, they will receive a new invitation code. By distributing the invitation code, users can also receive corresponding point rewards. The specific rules are as follows:

In summary, the gameplay of Blast can be understood as forming a team with others, locking in at least 5 ETH, and unlocking the principal and interest together in February next year. It's somewhat similar to the early ETH 2.0 staking activity of 3 ETH.

With the popularity of the BlackRock Ethereum ETF and the upcoming Cancun upgrade next year, ETH may see a wave of increase next year. Through Blast's staking, you can passively earn the income brought by ETH, and also profit from the bridging, killing two birds with one stone.

Finally, as Blast is highly popular, we also provide some invitation codes for our readers:

Follow Us

veDAO is a one-stop platform for AI-driven web3 trend tracking and intelligent trading, combining market trend presented by big data analysis with trading depth, dedicated to creating a more suitable web3 AI exchange for Web2 and Web3 users to buy, sell, and invest.

veDAO has a leading AI language model composed of on-chain analysis and sentiment indicators, providing proactive data support for users, combined with intelligent, fast, secure, real-time monitoring AI trading functions. As of now, the platform has over 40,000 heavy users and is associated with 22,000+ Web3 vertical industry Twitter KOLs, and a veDAO expert committee composed of 180+ professional institutions. The platform project library exceeds 10,000, and there are 240+ scouts continuously adding Web3 projects with veDAO.

veDAO is continuously upgrading at a bi-weekly update speed, determined to build a bridge from Web2 to Web3 and become the preferred platform for future Web2 and Web3 users to check projects, find hotspots, see trends, primary investment, and secondary trading.

Website: http://www.vedao.com/

Twitter: https://twitter.com/vedao_official

Facebook: bit.ly/3jmSJwN

Telegram: t.me/veDAO_zh

Discord: https://discord.gg/NEmEyrWfjV

Investment carries risks, and the project is for reference only. Please bear the risks on your own.