Understanding Flashstake, a Web3 Bill Interest Discount Product in One Article

Would you be willing to deposit $10,000 and then receive $1 every day?

Many people would not be willing, because this is not a profitable deal.

On the one hand, due to the relationship between inflation and discount rate, the current value of the currency will depreciate at a rate of 3% per year. For example, the current 100 yuan, considering the interest rate factor, will be worth about 103.5 yuan in 1 year, in other words, 100 yuan in 1 year will be worth about 97 yuan now.

And receiving $1 every day means it will take nearly 28 years to recover the principal, which is unfair to the user. The user is giving up the purchasing power of the current currency, but is burdened with the cost of currency depreciation and inflation.

On the other hand, the reason is simpler, depositing $10,000 means a significant liquidity gap in hand, which is not conducive to the wealth's reinvestment and appreciation.

The above assumptions are a simple discussion about the issues of pledging and liquidity. The reason for discussing this issue is that the current industry is hot on the concept of LSD, and it also happens to propose a solution to the issues of pledging and liquidity. In the previous article, veDAO Research Institute also elaborated on the concept of LSD.

Now let's ask in a different way: if you were asked to deposit $10,000 and then prepay yourself $365 in interest for a year, would you be willing? This is not a hypothetical question, but one of the financial products that is currently favored in the LSD sector, Flashstake, which, along with Pendle Network, Gearbox, eigenLayer, and others, has recently received the attention of the industry's Smart Money and is considered to be an important wealth amplifier in the LSD sector.

What is Flashstake?

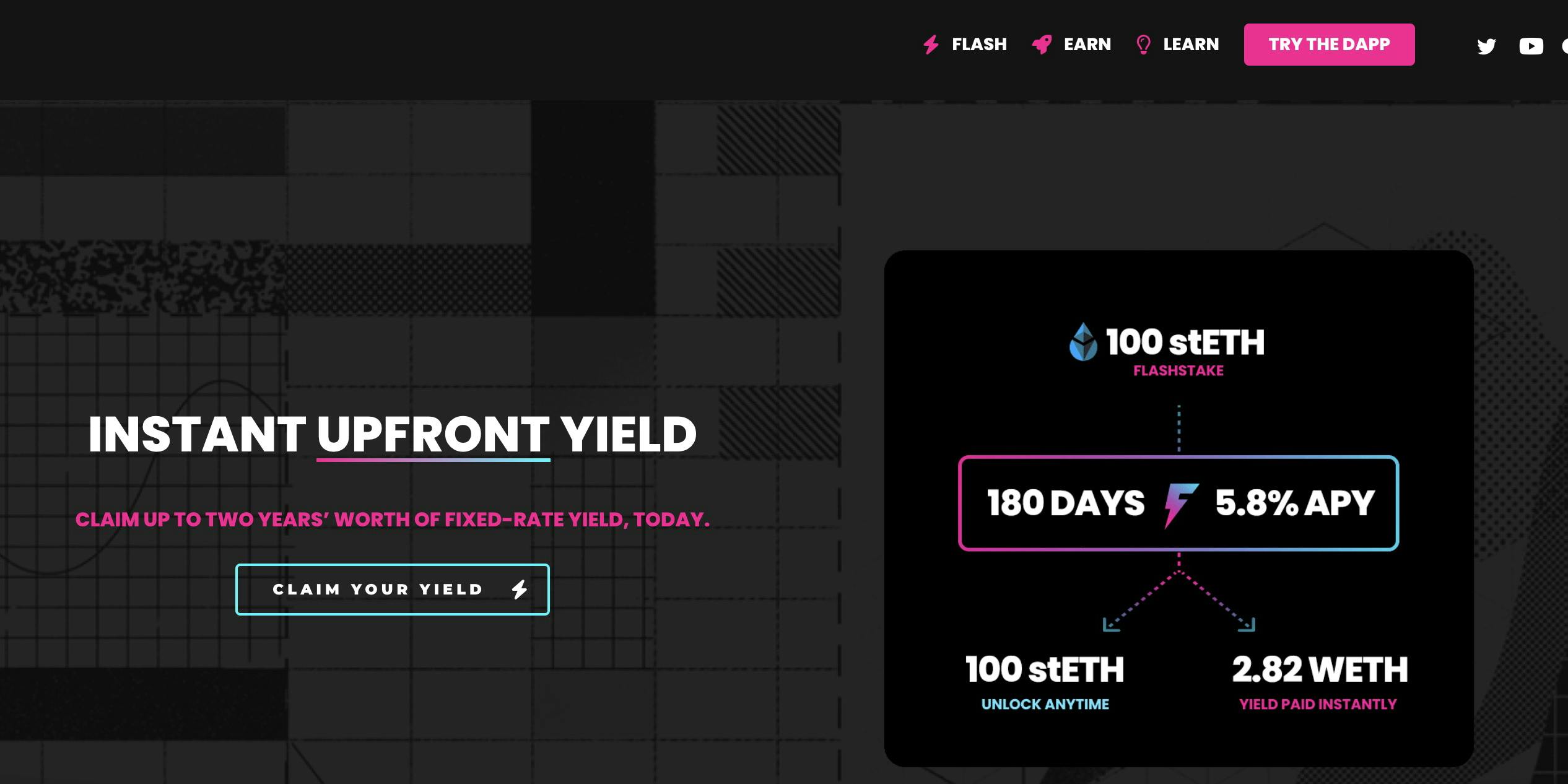

Flashstake is a novel financial infrastructure that allows users to immediately earn fixed interest on their deposited assets within a set period. For example, if a user chooses to pledge 100 stETH for 180 days, the Flashstake protocol will immediately give you about 2.82 wstETH, with an annualized return of about 5.8%.

Official website:

Twitter:

https://twitter.com/Flashstake

More information:

https://app.vedao.com/projects/e8aa342d9446679d363c7321c9539bf05783f2074aa76df2ba909e5b9305b149

According to the white paper, FlashStake consists of three main components:

-

FlashStake Protocol (FSP): Facilitates the creation and operation of Time Vault strategies. FSP is the core of FlashStake and has three main responsibilities:

-

Store the balance of all Flashstaking activities

-

Deploy and register Time Vault Strategies (TVS)

-

Create and mint time-based derivatives (TBD)

-

Time Vault Strategies (TVS): Custom smart contracts for buying, selling, and earning TBD, which can help people buy, sell, and earn TBD.

-

With almost unlimited possibilities, Time Vaults can make important Flashstaking decisions flexibly. Ultimately, Time Vault Strategies are where the complex logic of Flashstake occurs.

-

Here are examples of three different people using three different Time Vault strategies.

-

Vitalik uses the Lido Time Vault to generate early returns on his stETH

-

Stani uses the Aave v2 Time Vault to generate early returns on his USDC

-

Hayden uses the Uniswap v3 Time Vault to generate early returns on his ETH/DAI LP tokens

-

-

Time-Based Derivatives (TBD): Represents the time value of any digital asset

-

When people deposit into a Time Vault strategy, time-based tokens are generated. Each individual Time Vault strategy has a uniquely allocated TBD.

-

Example: Pledging USDC to the Aave v2 Time Vault strategy generates fUSDC TBD

-

Example: Pledging stETH to the Lido Time Vault strategy generates fstETH TBD

-

Example: Pledging ETH/DAI LP to the Uniswap Time Vault generates ETH/DAI TBD

-

TBD is an ERC-20 token created by the Flash protocol when a new strategy is registered. TBD is specific to a given strategy and represents the yield pool. This means that 100% of the total TBD supply can be redeemed in the yield pool of a given strategy.

The official token of Flashstake is FLASH, with a total supply of 150 million. No more tokens can be minted, and FLASH has not yet been released to the public through financing, public offering, or private placement. Flashstake is built on previous versions and is driven by Blockzero Labs and its community. About one-third (33.83%) is allocated back to the Blockzero ecosystem, making the development of Flashstake possible: of which, the DAO Treasury is allocated 15.17%; DAO Members are allocated 18.66%.

The remaining two-thirds (66.17%) is allocated to the Flashstake Treasury for various project activities: of which, the protocol growth budget is allocated 38.84%; Flash staking budget is allocated 12.34%; core contributor budget is allocated 15%.

Flashstake is jokingly referred to as a time-travel wormhole for interest. For users, Flashstake allows anyone to buy, sell, and earn potential future value of pledged funds today. And users only need to complete three steps: select the amount to pledge; select the time to pledge; and then prepay the interest.

In other words, Flashstake can unlock your immediate returns, which may be the reason why the project has received attention in the LSD race: for LSD users, the liberation of the liquidity of pledged funds is not enough, and Flashstake is needed to bring more short-term value to the funds.

There are two ways to pledge in Flashstake, each corresponding to different emotional user groups.

The first way to pledge is what we commonly understand as Stake:

Under this pledge mode, the user experience is consistent with other pledging products, where the user deposits the principal into Flashstake, and the latter invests the user's funds into the pledging pool, helping the user earn more returns through protocol strategies.

The other way to pledge is Flash stake, which is also a feature of this product: after the user deposits the principal into FlashStake, they immediately receive a fixed-term return.

It is worth noting that the interest received by the user is not generated out of thin air, but is based on the actual profit that the user would have received if they had used the ordinary Stake within a certain period of time. And this part of the profit comes from the ordinary Stake users themselves. As compensation, stake users can receive the returns on the pledged assets of Flashstake users during the pledge period.

As Twitter blogger @nanbeiblock said, Flash stake users are essentially shorting the interest rate, while stake users are longing the interest rate.

For some DeFi users, this can bring many benefits. First, users can get a higher annualized return.

Some may ask, if I deposit 100 ETH, I can only immediately get 2.82 wstETH, although the principal is not lost, the liquidity is still greatly compressed, and an annualized return of less than 3% is not attractive. But in fact, it is not so simple. Taking 100 ETH as an example, depositing for 1 year, an 8.9% APY means the user can get $15,818 USDC. If this portion of the assets is then repeatedly executed with the Flashstake strategy, it can achieve 8.9% + 8.9*8.9% = 9.69%, close to 10%. And depending on the logic of the collateral itself being able to generate interest, the TVL of this protocol can grow rapidly, and the best way is to deposit LP.

Secondly, the user's Flash Stake behavior will also receive rewards in the form of the protocol token FLASH. Unlike other Ethereum staking protocols such as Lido Finance, the payment date and original amount of the rewards are fixed. If the user does not immediately sell their FLASH tokens to realize a profit, they can use them to withdraw the original deposit early. Users also do not have to worry about their deposited tokens being liquidated, as is the case with Aave or Compound, because Flashstake is not a lending protocol.

However, the whole thing is not without drawbacks. Most importantly, the lack of liquidity in FLASH tokens is an economic risk, as if you want to exchange or sell them in large quantities on a decentralized exchange, you will face the threat of price decline (slippage) during the transaction.

Many users may decide to sell the tokens after Flash staking to realize their returns. A large sale of FLASH tokens can also reduce the returns of the pledgers who still hold the tokens or use them in other ways.

Finally, Flashstake, together with other DeFi products, constitutes a financial Lego effect.

For example, Pendle+Flashstake. Pendle Finance brings fixed income into DeFi returns, creating a revenue market that allows users to tokenize and sell future returns, while Flashstake can unlock your immediate returns, providing users with a higher annualized return.

Step 1: Lock GLP on Flashstake and receive 22.3% immediate interest. (Generally, immediate interest will be lower than the corresponding Stake time interest, 100 days Flashstake < 100 days Stake. This can be seen as giving up the long-tail interest of 100 days to immediately receive lower immediate interest.)

Step 2: Buy YT-GLP (interest warrants) on Pendle, which will exempt your YT-GLP from zero interest rate losses. (The YT-GLP notes on Pendle give users the right to receive 1 GLP rigidly after 364 days. In other words, the current player holds 100% GLP on FlashStake + 22.3% expected GLP on Pendle.)

VeDAO Research Institute will elaborate on the principles of Pendle in the next article.

The reason for this arbitrage window is that the fixed APY of Flashstake has always been higher than Pendle. Pendle has the deepest GLP yield rate trading market, so new ways to speculate on GLP yield rates will make this yield rate arbitrage possible.

Overall, the Flashstake protocol has many use cases. With the arrival of ETH upgrades and integration with more pledging tokens (such as GLP), FlashStake is likely to become a new star in the LSD race.

veDAO is a DAO-led decentralized investment and financing platform that is committed to discovering the most valuable information in the industry, and is passionate about exploring the underlying logic and cutting-edge tracks of the digital encryption field, allowing every role within the organization to fulfill their responsibilities and receive rewards.

Website: http://www.vedao.com/ Twitter: https://twitter.com/vedao_official Facebook: bit.ly/3jmSJwN Telegram: t.me/veDAO_zh Discord: https://discord.gg/NEmEyrWfjV

🔴Investment carries risks, the project is for reference only, please bear the risks on your own🔴