ARK: BTC is expected to reach $300,000 stablecoin size will reach $1.4 trillion

Reprinted from jinse

02/05/2025·2MTranslated by: Golden Finance

Catherine Wood, a famous Wall Street investor and its subsidiary ARK Invest have released the "Big Ideas" report at the beginning of each year since 2017, and have always attracted market attention.

The Big Ideas report in the previous two years saw Golden Finance’s previous report “ Big Ideas 2023 Report Quick View: The Currency, Finance and Internet Revolution is at a Turning Point ” and “ Big Ideas 2024 Report Encrypted Part List: How Institutional Configuration Will Impact BTC ” .

On February 4, 2025, ARK Invest released [the "Big Ideas 2025" report](https://www.ark-invest.com/thank-you-big- ideas-2025?utm_campaign=6838021-Big%20Ideas%202025&utm_medium=email&_hsenc=p2ANqtz-8IS832xzkymYHzfJMhFNcC_ubLzq- dkZRUm5xvhHjwOO_YV6EUp3fg6apABf4xcG8hh58C6b2DKwE9l1pM01a-hMLf5g&_hsmi=345632675&utm_content=345632675&utm_source=hs_email) , with a total of 12 parts.

There are four involved in encryption, namely: AI agent, Bitcoin, stablecoin and extended blockchain.

Golden Finance has compiled these 4 parts to reward readers.

1. AI agent: Redefining consumer interaction and business workflows

What is an AI agent?

AI agents are expected to accelerate the adoption of digital applications and bring epoch-making changes in human-computer interaction.

Understanding Intent: Understand user intentions through natural language.

Planning Action: Use reasoning and related contexts to plan.

Take Action: Take Action with the help of tools to achieve intentions.

Continuous learning: Continuous improvement through iteration and continuous learning.

AI is accelerating hardware and software adoption

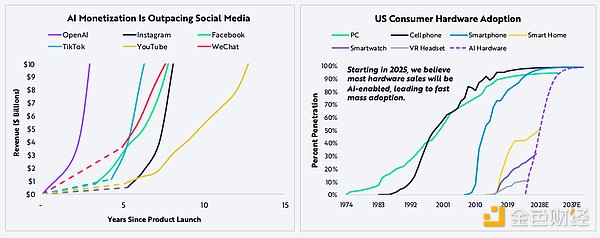

OpenAI may have revenue of more than $10 billion in 2025, making profits faster than social media companies in the past decade. Using ChatGPT as an indicator, AI will drive rapid demand for a range of new technologies.

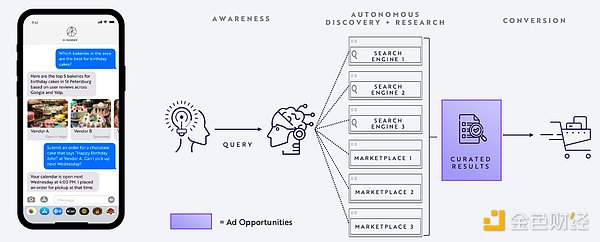

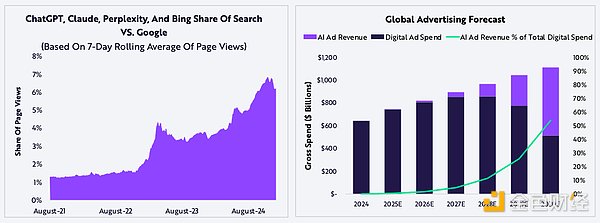

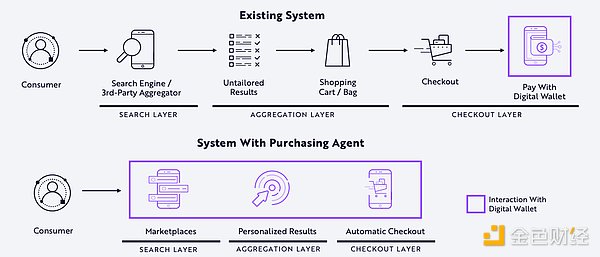

AI agents will change how consumers search and discover

AI agents are embedded in the operating system of consumer hardware, allowing consumers to hand over all search and research to AI, which greatly saves time. Filtered AI results will provide context for digital advertising displays. If searches turn to individual AI agents, AI-mediated advertising revenue could soar significantly. By 2030, AI advertising revenue is expected to account for more than 54% of the USD 1.1 trillion digital advertising market.

By 2030, AI-mediated advertising should account for the largest share of

digital advertising revenue

By 2030, AI-mediated advertising should account for the largest share of

digital advertising revenue

If searches turn to individual AI agents, AI-mediated advertising revenue could soar significantly. We believe that by 2030, AI advertising revenue could account for more than 54% of the $1.1 trillion digital advertising market.

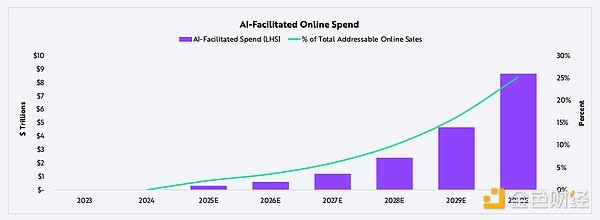

By 2030, AI-mediated shopping may approach 25% of global reachable online

sales

By 2030, AI-mediated shopping may approach 25% of global reachable online

sales

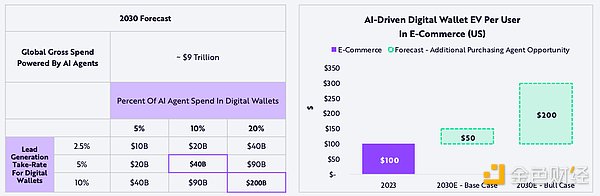

The increasing use of AI agents in consumer shopping will simplify product discovery, personalized recommendations and purchase processes. ARK's research shows that by 2030, AI agents can promote nearly $9 trillion in online consumption worldwide.

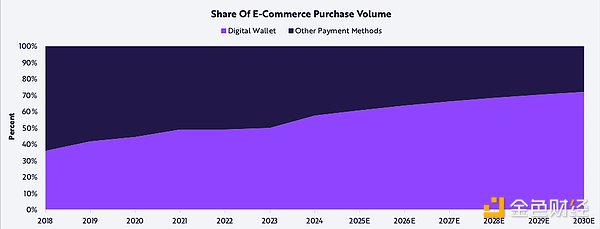

Digital wallets are expected to continue to grow in market share in

e-commerce

Digital wallets are expected to continue to grow in market share in

e-commerce

ARK's research shows that AI-powered digital wallets (which are taking market share from payment methods such as credit and debit cards) may account for 72% of all e-commerce transactions by 2030.

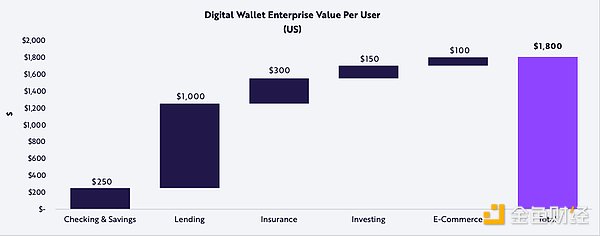

Digital wallets are integrating financial services and e-commerce

Based on its consumer-oriented business, the market currently values leading digital wallet platforms such as Block, Robinhood and SoFi at $1,800 per user. The purchase of a digital wallet agent may become the core of the shopping journey, and "one-click checkout" will give way to "one-click query purchases".

Digital wallet shopping agents may become the core of shopping journeys

Digital wallet shopping agents may become the core of shopping journeys

Agentic lead generation should promote the development of digital wallets to the upstream of the industrial chain to seize market share in the global e-commerce and digital consumption fields. "One-click checkout" will gradually be replaced by "one-click query and purchase".

Purchasing an agent will increase the corporate value of digital wallets, especially in the e-commerce sector

Based on the charge rates generated by prospects, AI purchase agents may bring $4 billion to $20 billion in global revenue to the digital wallet platform in 2030 (each is the basic situation and optimistic situation forecast for ARK, respectively). By 2030, AI-powered purchasing agents could increase the enterprise value of each user of the U.S. digital wallet by $50 to $200.

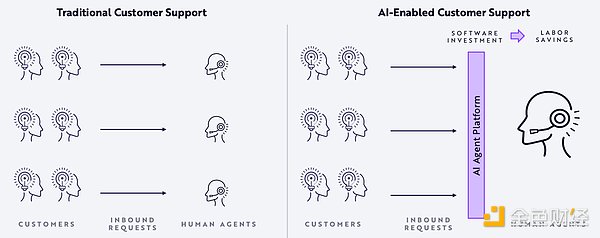

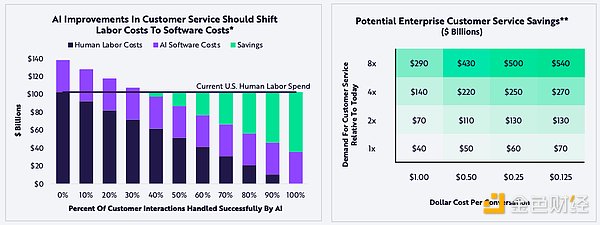

In enterprises, AI agents will increase productivity through software

In enterprises, AI agents will increase productivity through software

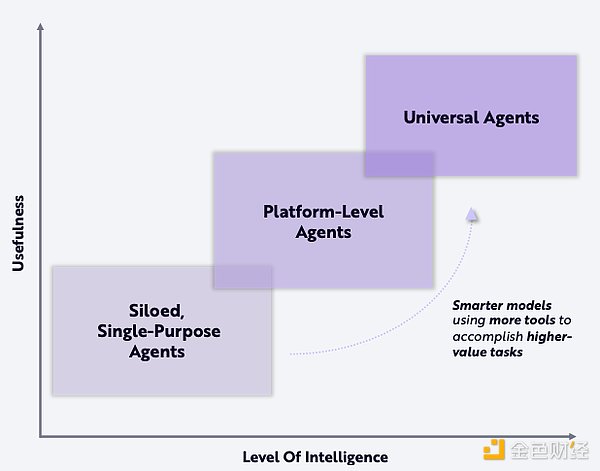

Companies deploying AI agents should be able to increase production without increasing their workforce and/or optimize their workforce for higher value activities. With the development of AI, agents may undertake a higher proportion of workload and independently complete higher value tasks.

The decline in AI costs will significantly affect the economic benefits of

agents

The decline in AI costs will significantly affect the economic benefits of

agents

New products from OpenAI and Salesforce are cost-effectively complementing the work of human customer service representatives. Even if the fixed cost per conversation is $1, once the AI agent can handle 35% of customer service consultations, it can save businesses a lot of money. AI agents should also reduce onboarding and recruiting costs, as well as seat-based software costs, and expand more easily than human resources.

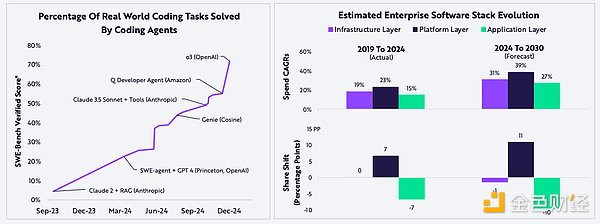

AI is reshaping software value chain

The coding skills of AI agents are rapidly improving, accelerating the software development cycle. As the cost of creating software falls, software production should accelerate and affect the company's decision to "build or buy on your own" and replace traditional software companies that adapt slowly. With the popularity of client software, growth at all levels of the software stack should accelerate, although share will shift to the platform layer.

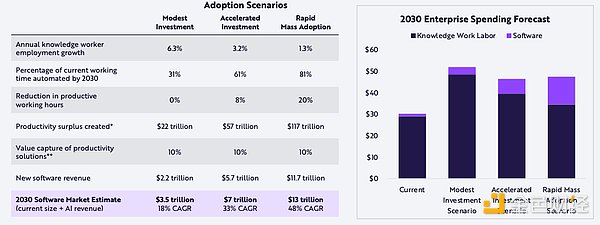

AI will help knowledge work take off

AI will help knowledge work take off

AI is promoting the "Cambrian explosion" in the software field. By 2030, as businesses invest in productivity-enhancing solutions, the amount of software deployed by each knowledge worker is expected to grow significantly. Depending on adoption rates, global software spending may accelerate from an annual growth rate of 14% over the past decade to 18% - 48%.

2. Bitcoin

A mature global monetary system with a robust network foundation and an increasing institutional adoption rate

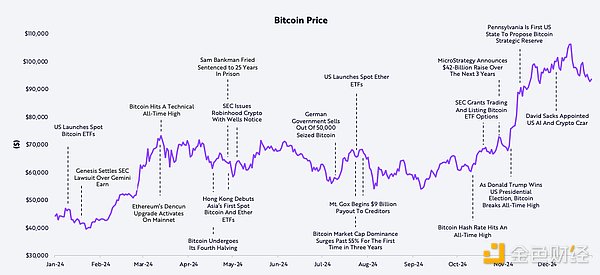

Bitcoin hits record highs in 2024

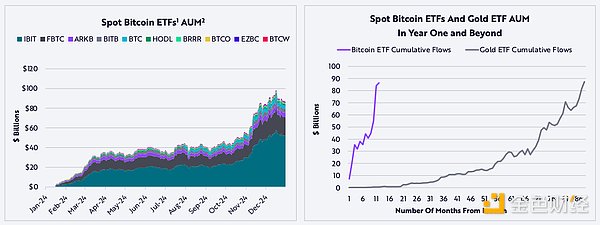

Spot Bitcoin ETF is the most successful ETF issuance in history

Spot Bitcoin ETF is the most successful ETF issuance in history

Spot Bitcoin ETF attracted more than US$4 billion inflows on its first trading day, setting a record high for capital inflows on the first day of ETF issuance, exceeding the inflows of US$1.2 billion inflows in the first month of gold ETF issuance in November 2004. The inflow of spot Bitcoin ETFs far exceeds the inflow of any of the approximately 6,000 ETFs launched in the past 30 years in the first month of issuance.

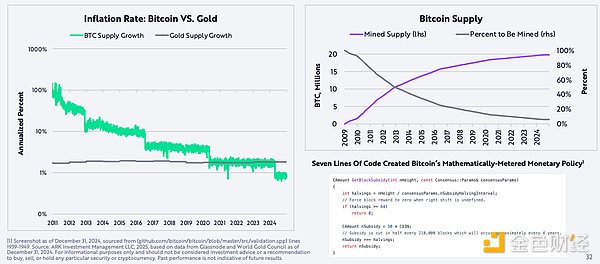

Bitcoin 's inflation drops below the long-term gold supply growth rate after the fourth halving

Bitcoin’s supply growth has been “halved” for the fourth time in history, with annual growth rate dropping from about 1.8% to about 0.9%. The halving highlights Bitcoin’s predictable monetary policy and its position as a scarce asset.

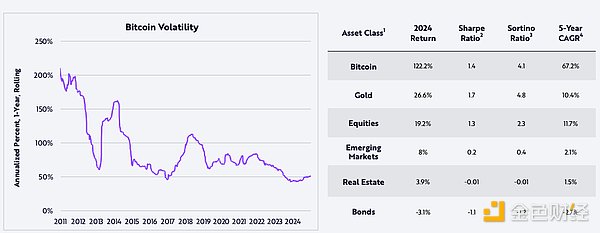

Bitcoin’s annual volatility has dropped to its all-time lowest, while its

risk-adjusted returns remain better than most major asset classes

Bitcoin’s annual volatility has dropped to its all-time lowest, while its

risk-adjusted returns remain better than most major asset classes

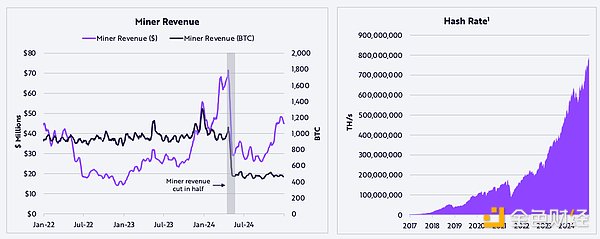

Despite sharp declines in miners ' income after halving, Bitcoin's computing

power hits a record high

Despite sharp declines in miners ' income after halving, Bitcoin's computing

power hits a record high

Even though the halving cuts Bitcoin miners’ income by 50%, its computing power (a measure of network security) hits an all-time high. This shows that miners' long-term confidence in Bitcoin remains strong.

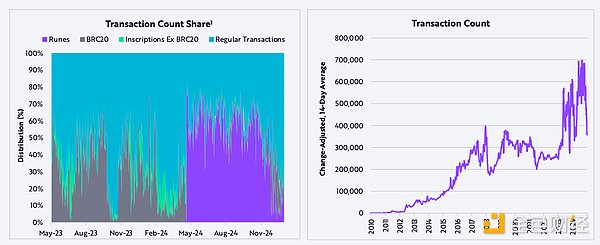

Bitcoin’s daily transaction number hits record high

Thanks to the launch of the Runes protocol, Bitcoin’s daily transaction volume hit an all-time high. The Runes protocol helps create alternative tokens directly on the Bitcoin blockchain.

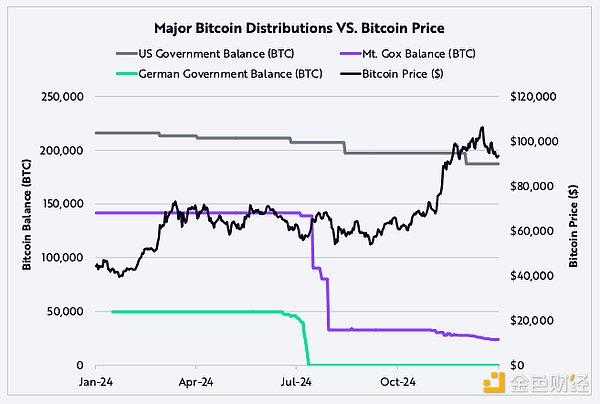

Bitcoin withstands significant selling pressure in 2024

In January 2024, the German government seized 50,000 bitcoins linked to an online piracy organization and sold them six months later. The market successfully absorbed this supply, and the price of Bitcoin then rose from $53,000 to $68,000. In addition, the highly anticipated Mt. Gox creditors distributed over 109,000 bitcoins during the repayment process in the mid- year, eliminating its biggest potential selling pressure.

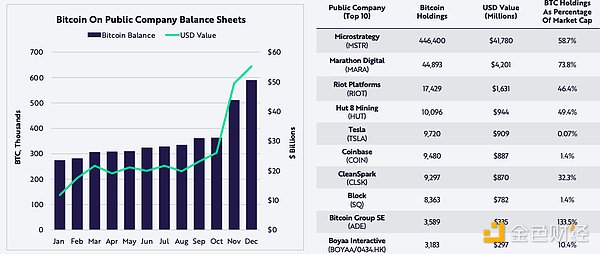

More and more listed companies hold Bitcoin

More and more listed companies hold Bitcoin

Currently, 74 listed companies hold Bitcoin on their balance sheets. The value of Bitcoin on the corporate balance sheet has increased fivefold over the past year, from $1.1 billion in 2023 to $5.5 billion in 2024.

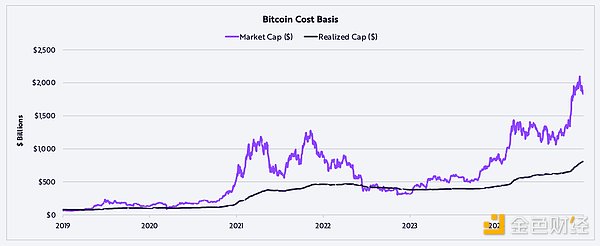

Bitcoin’s total cost base hits a record high in 2024

In 2024, Bitcoin’s realized market capitalization (i.e., cost basis) grew by 86%, with its average acquisition cost reaching an all-time high of $40,980 per coin, totaling $811.7 billion.

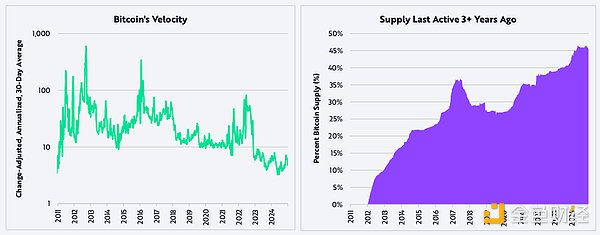

Bitcoin’s transaction speed and holding behavior highlight its role as a

store of value

Bitcoin’s transaction speed and holding behavior highlight its role as a

store of value

In 2024, Bitcoin’s trading speed dropped to a 14-year low, while the supply of Bitcoin, which has been held for three years or more, reached an all-time high.

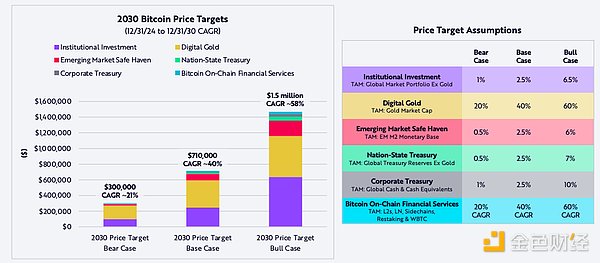

Bitcoin is expected to meet our forecastprice target for

2030 ($300,000 in the lowest

case, $710,000 in the normal case, and $1.5 million in the highest case)

Bitcoin is expected to meet our forecastprice target for

2030 ($300,000 in the lowest

case, $710,000 in the normal case, and $1.5 million in the highest case)

3. Stablecoins: Reshaping the digital asset field

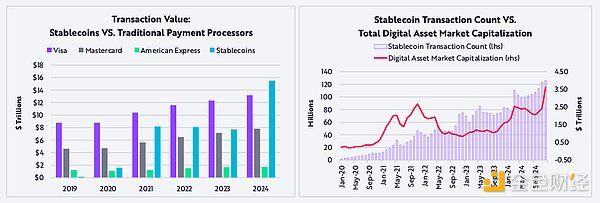

One of the fastest growing segments in the digital asset space, with stablecoins surpassing Mastercard and Visa in total transaction value in 2024

After two years of bear market and its market value has fallen by more than 70%, the development of stablecoins remains unabated. In 2024, the annualized transaction value of stablecoins reached US$15.6 trillion, approximately 119% and 200% of Visa and Mastercard respectively. The monthly transactions reached 110 million, which is about 0.41% and 0.72% of the transactions processed by Visa and Mastercard. This means that the value of stablecoins per transaction is much higher than that of Visa and Mastercard.

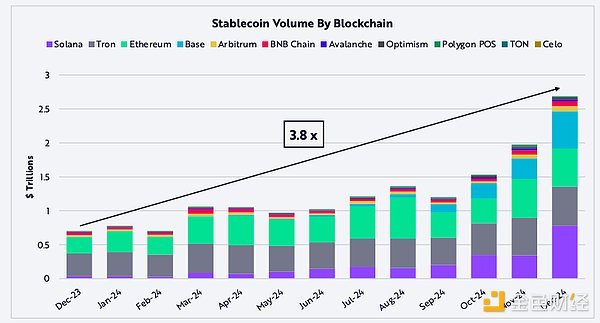

Stablecoin trading volume hits record high in December 2024

In December 2024, stablecoin trading volume reached a new high. Solana, Tron, Ethereum and Base are the main blockchains that drive stablecoin transaction volume in 2024. In that month, the daily trading volume of stablecoins reached US$27 billion and the monthly trading volume reached US$2.7 trillion, fully demonstrating the rapid development of this field.

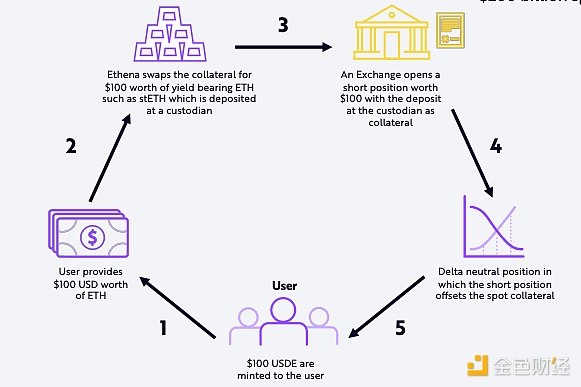

Ethena Labs tokenize popular niche transactions, amassing $6 billion in 12 months

The stablecoin field is innovative and Ethena Labs is one of the fastest growing projects. Despite its controversial design, the project has a significant share of the stablecoin market supported by illegal currency, becoming a major competitor in the $20 billion market. By tokenizing delta neutral positions, Ethena Labs can provide yields of up to 20%-30% based on market conditions, but the yield may be negative in bear markets. In the first 12 months of its establishment, its total locked position value reached US$6 billion, currently accounting for 10% of Ethereum's total open contracts and is expanding delta-neutral trading for Solana and Bitcoin.

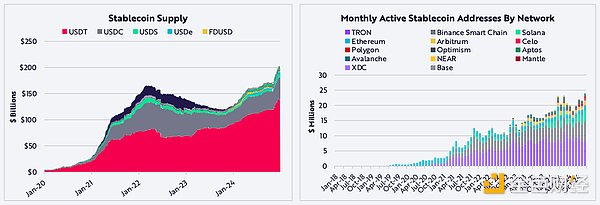

After experiencing a shrinkage in 2023, the supply of stablecoins and the number of active addresses hit a record high in 2024

USDT dominates the stablecoin market, followed by USDC (the stablecoin issued by Circle), which together account for 90% of the total supply. Stablecoins have the "multi-chain" characteristics and penetrate almost every major first- layer blockchain. The total supply of stablecoins is US$203 billion, accounting for about 0.97% of the US M2 money supply. In December 2024, the number of active stablecoin addresses reached 23 million, a record high. By monthly active addresses, Tron Network leads the way because of its low transaction fees, which are popular in emerging markets.

As some countries reduce their holdings of the US dollar, digital assets are

moving closer to the US dollar

As some countries reduce their holdings of the US dollar, digital assets are

moving closer to the US dollar

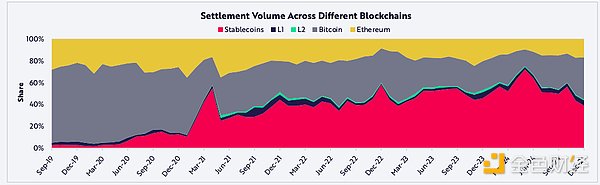

The digital asset field is undergoing "stable currency" and "dollarization". Meanwhile, China and Japan sold out large amounts of U.S. Treasury bonds, Saudi Arabia ended a 45-year petrodollar agreement, and the BRICS countries reduced their dependence on U.S. dollar payments by bypassing the SWIFT network. In the past, Bitcoin and Ethereum were the main bridges to enter the digital asset ecosystem, but in the past two years, stablecoins have replaced them and currently account for 35%-50% of the total on-chain transactions. Stablecoins pegged to the US dollar dominate, accounting for more than 98% of the supply, followed by gold-backed and euro-backed stablecoins, accounting for about 1% and 0.5% respectively. ARK's research shows that Asian currencies will also appear in the market in the future.

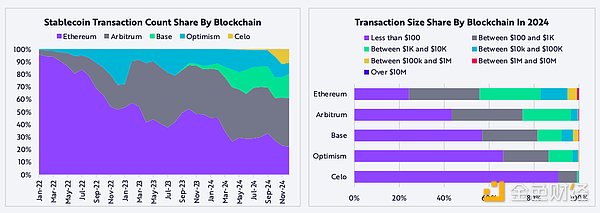

Stablecoins attract retail investors thanks to the low cost and high efficiency of Layer 2

Retail investors have poured into the field due to the lower cost and more convenient stablecoin trading provided by Layer 2, which has increased the market share of blockchains such as Arbitrum, Base and Optimism. Large investors and institutions are still mainly trading on the Ethereum main network. Trading below $100 on Base and Optimism dominates, while the Ethereum mainnet mainly deals above $100.

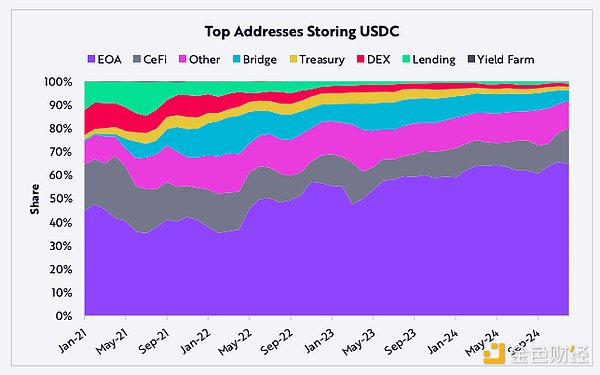

Peer-to-peer transactions and personal wallet storage dominate the use of stablecoins

In the use of stablecoins, externally owned accounts (EOAs), i.e. standard Ethereum addresses for peer-to-peer (P2P) transactions and storage, account for 60% of USDC usage, while centralized exchanges account for 11%, across Layer 2 The bridges of solutions account for 7%, while the decentralized exchanges (DEXs) and the money market each account for 1.7%. With the surge in decentralized finance (DeFi) usage in the coming years, DEXs, bridges and money markets may regain market share from P2P transactions. However, due to the fit between the product and the market, P2P trading and storage are more flexible in scenarios other than trading, and their usage fluctuates less with the market cycle.

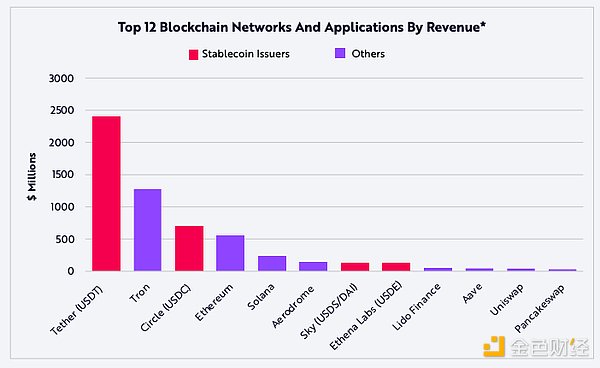

Four stablecoin issuers dominate revenue in the digital asset sector

In terms of revenue in the digital asset space, a few stablecoin issuers dominate. Tether (USDT) and Circle (USDC) account for 60% of revenue generated by the top five networks and applications. In the second half of 2024, stablecoins such as USDT, USDC, DAI/USDS and USDE generated a total of US$3.35 billion in revenue, with annualized revenue reaching US$6.7 billion. Among them, Tether, with less than 200 employees, reported a profit of US$5.2 billion in the first half of 2024, covering USDT and other products and services, as well as unrealized returns from digital assets. It is one of the most capital-efficient companies in history.

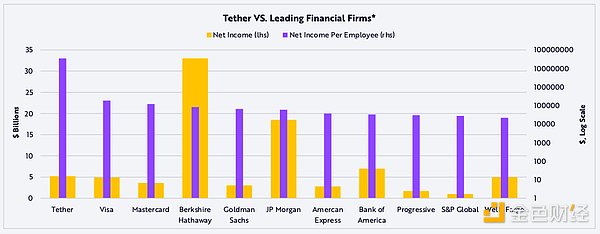

Tether 's financial performance is amazing

Tether has less than 200 employees, compared with JPMorgan Chase and Berkshire Hathaway each have more than 300,000 employees. In the first half of 2024, in the S&P Financial Select Industry Index, only Berkshire Hathaway, JPMorgan Chase, Bank of America and Wells Fargo had net income exceeding Tether.

Stablecoins increase demand for U.S. Treasury bonds

Under the trend of global deglobalization and de-dollarization, stablecoins may drive stable demand for U.S. Treasury bonds. As of December 2024, Tether and Circle have collectively become the 20th largest holder of U.S. Treasury bonds. In emerging markets with large populations, such as Brazil, Nigeria, Turkey, Indonesia and India, individuals and businesses use stablecoins as a means of storage of value, payment methods and cross-border currencies, and stablecoins may become an effective way to export US dollars.

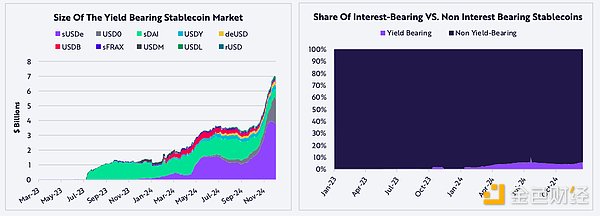

Stablecoin issuers transfer risk-free interest rate returns to users

Circle and Tether make billions of dollars in revenue through U.S. Treasury bonds and other securities that serve as collateral for stablecoins. However, in 2024, due to competition and market demand, stablecoins operating outside the United States began to return most of their interest income to users. While Circle and Tether are unlikely to follow this trend immediately, interest-bearing stablecoins have become the fastest-growing category in the stablecoin market.

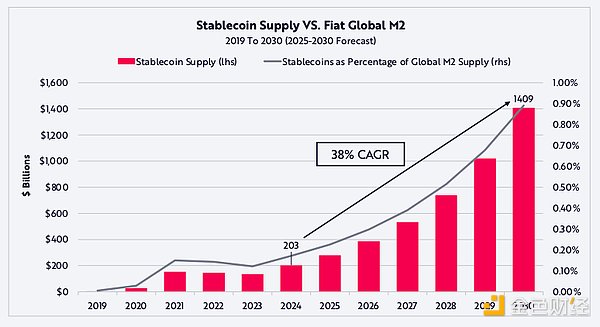

By 2030, the size of stablecoins may grow significantly, from 0.17% of

global M2 supply to 0.9%

By 2030, the size of stablecoins may grow significantly, from 0.17% of

global M2 supply to 0.9%

The current supply of stablecoin is US$203 billion, accounting for 0.17% of the global M2 supply. It is expected that by 2030, its supply may grow to US$1.4 trillion, accounting for 0.9% . If so, stablecoins will become the 13th largest currency in circulation in the world, ranking behind Spanish and ahead of Dutch currencies.

4. Blockchain expansion: achieve a significant drop in costs and enable

new use cases at the application layer

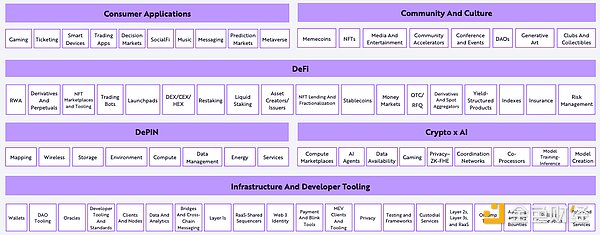

Smart contract map navigation

As the digital asset field becomes increasingly complex, smart contracts drive innovation in more and more industries. From user-centric gaming and SocialFi applications to advanced financial tools such as derivatives and structured products to decentralized infrastructure networks that power wireless connectivity and energy storage, related ecosystems are rapidly evolving to meet the needs of Diverse and dynamic demands.

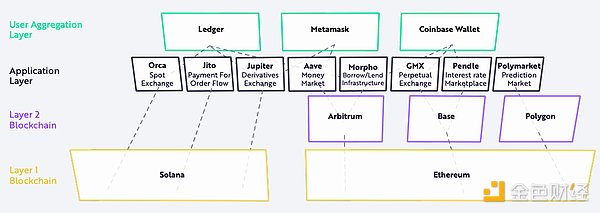

In pursuit of lower fees and higher efficiency, applications are either

deployed on high-throughput layer 1 blockchain Solana or on Ethereum’s Layer 2

scaling solution.

In pursuit of lower fees and higher efficiency, applications are either

deployed on high-throughput layer 1 blockchain Solana or on Ethereum’s Layer 2

scaling solution.

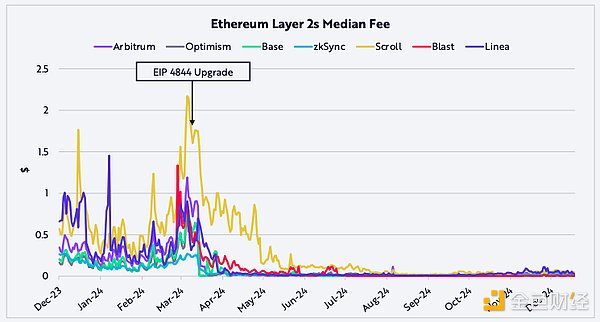

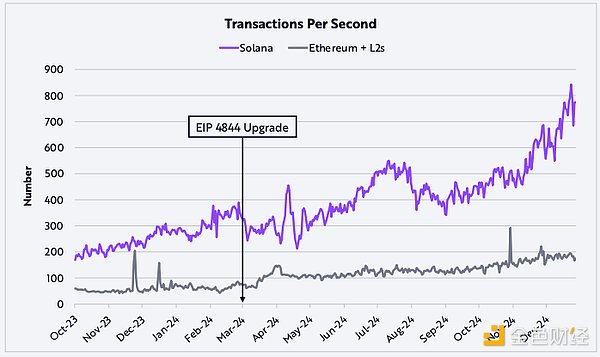

Ethereum EIP 4844 upgrade reduces transaction fees by 10 times

Ethereum’s EIP 4844 upgrade is one of its most important technology upgrades to date, which enables Layer 2 networks to enable faster and cheaper transactions, reducing transaction costs by 10 times, and stimulating the use of related applications. The EIP 4844 upgrade is an important milestone in the Ethereum roadmap, and is expected to increase transaction processing per second (TPS) by 250 to 1250 times from the current 400 transactions to 100,000-500,000 transactions. So far, more than 200 second-tier projects have been launched, and more projects are under preparation.

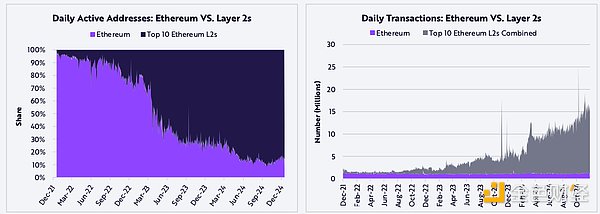

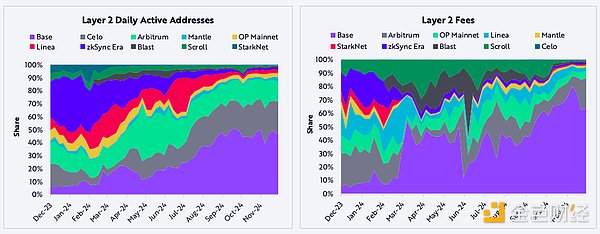

Decline of transaction costs drives Layer 2 development

The sharp decline in transaction costs has prompted a significant increase in activity in Layer 2, attracting a large number of users to move from the Ethereum main network. Layer 2 accounts for 85% of the daily active addresses for trading in the Ethereum ecosystem. In 2024, Layer 2's activity increased Ethereum's daily transactions by 400%, from 3 million to 15 million.

Base becomes the fastest growing Ethereum Layer 2 blockchain

Base becomes the fastest growing Ethereum Layer 2 blockchain

Base surpassed all other Ethereum Layer 2 solutions in terms of growth rate and market share within one year of its launch. In 2024, Base accounted for 46% of the active users of Ethereum Layer 2 and the expenses incurred accounted for 63%. Its total locked position value reached US$15 billion and more than 300 applications were deployed, making an important contribution to Coinbase's cash flow.

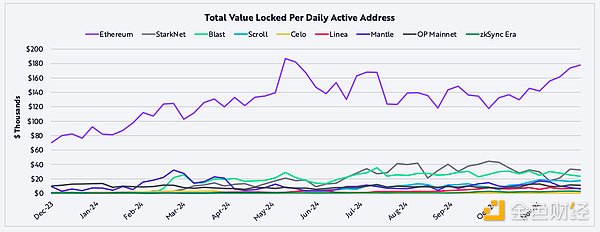

Although many transactions migrate to Layer 2, the Ethereum mainnet still dominates high-value storage and settlement

Institutions, high-value users and large cryptocurrency holders mainly conduct transaction settlements on the Ethereum main network. The unit economic benefits of the Ethereum main network are unparalleled by total locked value (TVL) and decentralized exchange (DEX) per user transaction volume.

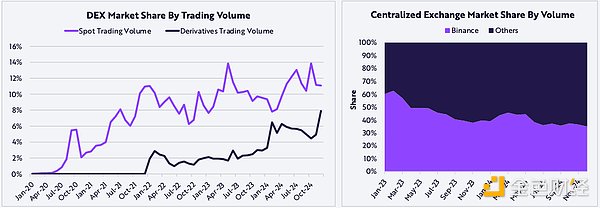

As DeFi soars to record highs, DEX challenges centralized trading venues in

both spot and derivatives trading

As DeFi soars to record highs, DEX challenges centralized trading venues in

both spot and derivatives trading

When Binance reached a settlement of more than $4 billion with the Securities and Exchange Commission (SEC) in 2024 and its CEO resigned, some of the market share of centralized exchanges (CEXs) was decentralized exchanges (DEXs) Spot and derivatives trading volumes taken away from January to peak, decentralized finance (DeFi) almost doubled, with market share growing from 8% and 3% to 14% and 8%, respectively, reaching record highs. During this period, Binance's market share in centralized exchanges fell from 62% to 35%.

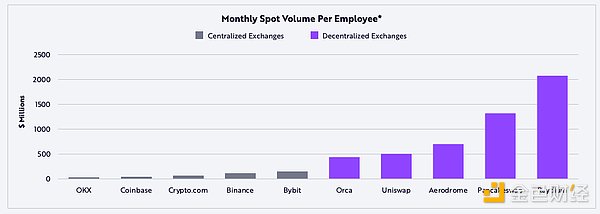

Smart contract-powered exchanges are 5 to 10 times more efficient than their

central counterparts

Smart contract-powered exchanges are 5 to 10 times more efficient than their

central counterparts

Decentralized exchanges like Uniswap, Aerodrome, and Raydium leverage the efficiency of small and agile teams to develop and maintain core protocol infrastructure. Compared with centralized exchanges, they have a huge efficiency advantage, with only one-tenth of the latter's employees. Binance has the largest number of employees in the centralized exchange field, with about 9,000 employees.

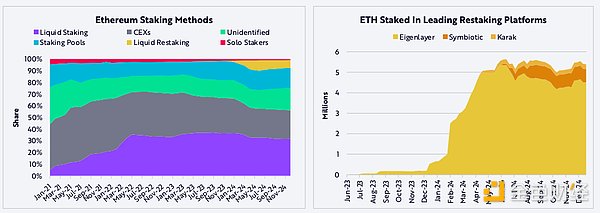

Liquid staking and re-staking agreements are the preferred solution for pledge and re-staking ETH

Liquid staking and restaking have become the preferred method of generating revenue on Ethereum. They now account for 40% of Ethereum staking due to their interest-generating characteristics, liquidity and accessibility. The demand for re-staking pledged Ethereum to increase revenue has spawned re-staking platforms. Currently these platforms hold about 5.5 million Ethereum, accounting for 17% of pledged Ethereum.

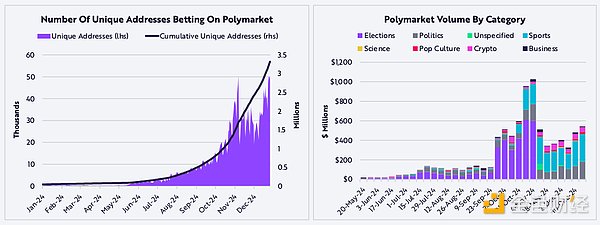

Leaded by Polymarket, the forecast market will become a breakthrough consumer application in 2024

In 2024, Polymarket had accumulated more than 3 million users, with monthly transaction volumes of US$1.2 billion, and elections and political activities drove 70% of its business. After a brief pullback after the election, its daily unique user count has recovered to 50,000, and the transaction volume has also rebounded as sports events become the most important category.

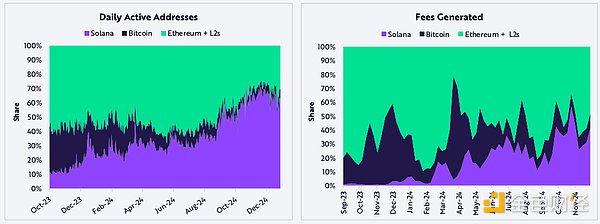

Solana has higher throughput than Ethereum, thanks to its high-performance design and strategic trade-offs

Thanks to the Layer 2 network and EIP 4844 upgrade, Ethereum's throughput has more than doubled to about 200 transactions per second (TPS). Still, Solana performs better, with an average throughput of about 800TPS. Solana's success is based on a range of tradeoffs, including more expensive hardware requirements and parallel transaction processing. Solana's new Firedancer client may increase its throughput to hundreds of thousands of TPS.

Thanks to retail investors ' adoption, Solana gains market share on multiple indicators

After falling to a bear market low of $8 in 2023, Solana has made a significant improvement compared to other layer one networks. Its daily active users, revenue, transaction number and total value lock-in (TVL) reached an all-time high or increased by an order of magnitude. Solana is the only first- tier network that competes with Ethereum and Bitcoin on metrics such as daily active addresses and revenue.

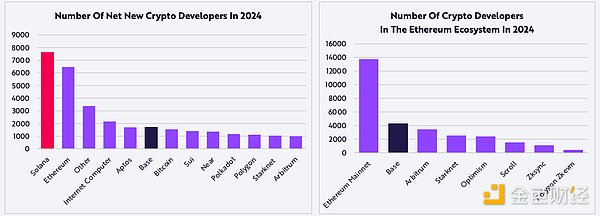

Solana and Base are leading the way in developer adoption and attention

In 2024, Solana leads with 7,625 developers, surpassing the Ethereum mainnet. Base has a total of 4,287 developers, ranking sixth in the overall ranking, surpassing Arbitrum and Starknet to become Ethereum’s leading second-tier solution.

chaincatcher

chaincatcher

panewslab

panewslab