Behind Base's war of words: net capital inflows in the past three months exceeded US$2.5 billion, and TVL exceeded US$14.2 billion, surpassing Solana

Reprinted from panewslab

01/13/2025·0months agoAuthor: Frank, PANews

For a long time, many public chains like to label their competitors as Solana, but no one seems to be able to truly pose a threat to Solana. However, recently Solana’s joint venture Toly seems to be willing to debate with Base joint venture. At the same time, in recent times, the data of Base ecology in all aspects have experienced explosive growth. Not only are many indicators in the leading position in the L2 ranks, but TVL, capital inflow and other data have even surpassed Solana.

It seems that Base is Solana's biggest potential opponent? PANews reviewed Base's recent data and compared it with Solana to see if Base's rise is a threat or another "crying wolf"?

The two Lianchuangs are constantly at war with each other.

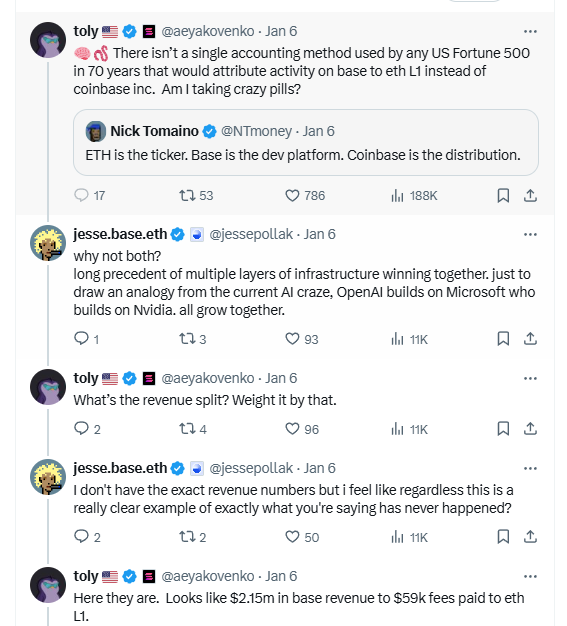

On January 6, Solana co-founder Toly commented on social media, believing that the development of Base has not brought real growth to the Ethereum ecosystem, but that Coinbase is sucking away the Ethereum ecosystem through Base. Base founder Jesse hit back on this comment on social media. He said that Base and Ethereum are not in a zero-sum competitive relationship. Base, like other L2s, develops within the overall route of Ethereum. With the With the development of Base, Ethereum is also developing and growing.

Toly then compared it to the competition between Google and Microsoft, both of which have contributed to Linux, but in terms of value capture, they are separate. As a result, no Fortune 500 company uses a single accounting calculation to attribute Base’s activity to Ethereum, but rather to Coinbase. Of the $2.15 million in revenue generated by Base, only $59,000 was paid to the Ethereum mainnet.

It seems that Toly is complaining about ETH not capturing value from Base. In fact, the reason behind this dispute may not be about the competition between Base and Ethereum, but about the competition between Solana and Base. Although there are many Solana competitors on the market, such as Sui, Aptos or Hyperliquid, they all position themselves as Solana competitors. But judging from the Solana team’s statement, perhaps the biggest competitor in their eyes is Base.

Back in December, Pudgy Penguins announced the issuance of tokens on Solana and gave the Solana network a record high of 66.9 million transactions in a single day after going online. During this process, Jesse also made a public statement, saying: "The Base community and I will welcome Pudgy Penguin and its token PENGU with open arms." This move was also considered by the community to be an open attempt to steal business from Solana.

In addition, the two have also interacted in many discussions. For example, Yuga Labs co-founder Garga.eth complained about the Ethereum ecosystem, which was dissatisfied by Jesse, while Toly added fuel to the comments below: "Bridge ETH As for Solana, I have absolutely nothing against ETH being the best currency on Solana.” Previously, Jesse had made many remarks comparing Base and Solana.

BaseTVL and capital inflows overtake Solana

Behind the bickering between the two is the undercurrent of data between Base and Solana. PANews compared several data indicators between Base and Solana in the past year. It can be seen that Base's current overall data is still not as good as Solana, but Base's growth rate is leading Solana. If it continues to develop at this rate, Base will have It may surpass Solana in terms of data within 1 to 2 years.

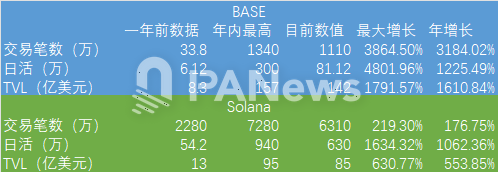

PANews selected several commonly used indicators for public chain comparison, such as the number of daily active addresses, the number of transactions, TVL, etc. The data selects data changes from one year ago to January 10, 2025.

First, let’s look at the changes in Base. One year ago, Base’s daily number of transactions was approximately 338,000, the number of daily active addresses was approximately 61,200, and its TVL volume was approximately US$830 million. These figures were equivalent to 1.48%, 11.29%, and 63.85% of Solana respectively at the time.

As of January 10, 2025, Base's data changes are that the number of daily transactions is approximately 11.1 million, the number of daily active addresses is approximately 811,200, and the TVL volume is approximately US$14.2 billion. The current ratios of these three data to Solana are: 17.59%, 12.88%, and 167.06%.

The annual growth rates of these three indicators of Base were 3184.02%, 1225.49%, and 1610.84% respectively. During the same period, the growth rates of these three indicators of Solana were 176.75%, 1062.36%, and 553.85% respectively.

It can be seen that after one year of development, Base's transaction number and daily activity data are still far behind Solana. In terms of TVL, Base has already achieved a lead. Interestingly, Jesse and other key team members shaved their heads during a live broadcast on January 9 to celebrate this data.

In terms of the growth rate of other data, Base's growth momentum is also more aggressive than Solana's. If both parties maintain their current growth efficiency, Base may surpass Solana in the number of transactions in a year's time.

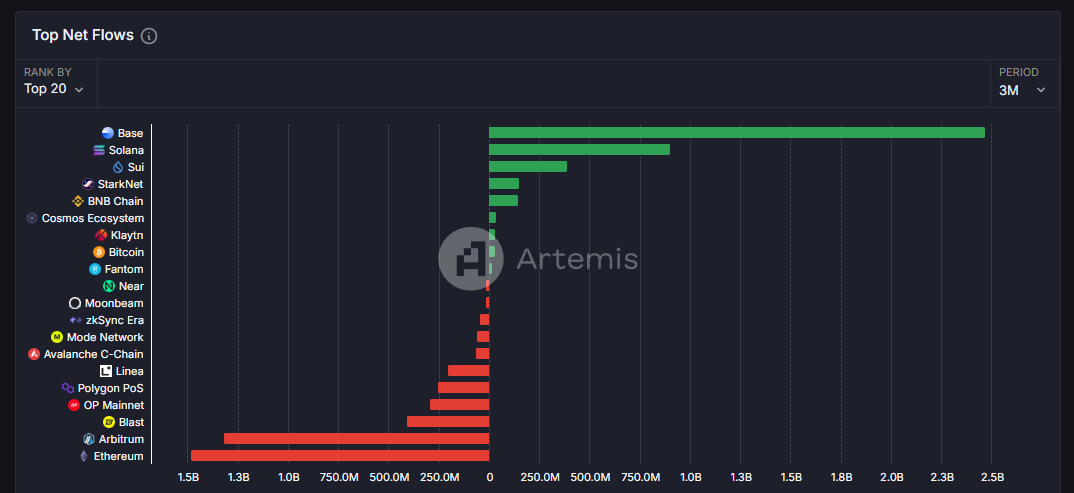

In addition to these data, a more important indicator is also quietly changing. For most of the past year, Solana has been the network with the largest inflow of funds into the public chain. Data from the past three months show that Base has become the public chain with the highest net inflow of US$2.5 billion, while Solana ranks second with a net inflow of US$900 million.

The main change in this data may occur in the near future. The total net inflow in the past year is approximately US$3.8 billion, which is equivalent to the net inflow in the past three months (2.5 billion) accounting for 65% of the year.

From the general election to Virtuals, Base is approaching step by step

with AI

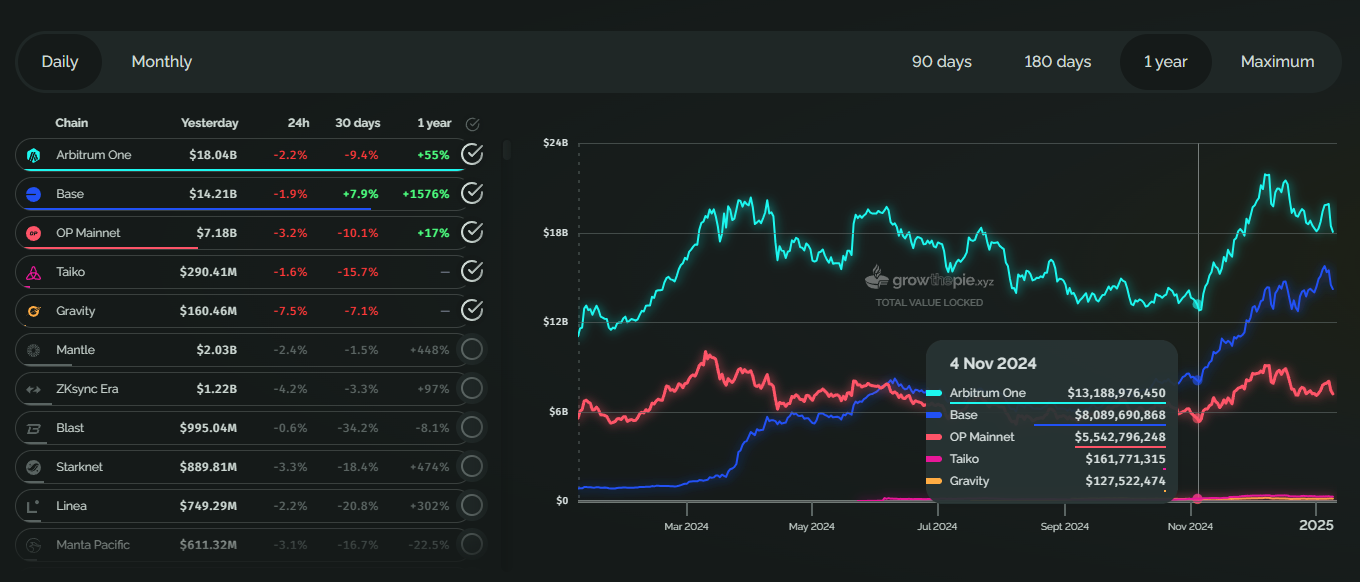

Judging from the changes in details, this is indeed the case. Base’s TVL volume seems to have experienced a significant increase since November 3. However, this is not an isolated case of Base. Arbitrum also ushered in a wave of rapid development during the same period.

The reason behind this wave of growth may mainly come from the overall market growth brought about by Trump's election after the US election. In the past month, the main reason why Base has attracted attention is that in the MEME track, which has long been competing with Solana, a product that can compete with it has finally appeared, Virtuals Protocol.

After various networks launched Pump.fun imitations one after another, they were basically silent. Virtuals Protocol has finally caught the attention of AI Agent and has become the most popular one-click publishing platform for AI Agent. Several AI Agent tokens with market values exceeding 100 million were born, including aixbt and GAME.

According to data from Dexscreener, the DEX trading volume on Solana on January 11 was US$6.88 billion, 5,324 new trading pools were created in 24 hours, the trading volume of Base was US$2.12 billion, and the newly launched trading pairs in 24 hours were 2673. The gap between the two in the MEME field is gradually narrowing, and Base seems to be the only public chain network that can approach Solana's popularity in MEME.

However, Sui had a brief period of explosion before, but after the popularity dropped, it inevitably fell into silence again. The relative advantage of Base is that its capital accumulation effect is much stronger than that of Sui. Therefore, as long as the TVL volume does not drop off a cliff, perhaps this popularity can still be maintained.

By comparing the data, we can find that Base is becoming Solana's strongest competitor, but the problem is that Base always lacks its own governance token, which makes it difficult to be priced by the market. The lack of public chain tokens also allows Virtuals protocol to obtain the base public chain. on more capital spillover effects. Perhaps in order to solve this problem, on January 4, Base developer Jesse Pollak tweeted that Coinbase is considering providing tokenized COIN stocks to U.S. users of its Base network.

If this goal can be achieved, perhaps the biggest significance is not that RWA has another important asset in the field, but that the value brought by Base's development can finally be more directly reflected in Coinbase's stock price, and it can only participate in cryptocurrency transactions. For investors, it can be considered as a disguised way to participate in the governance of Base and enjoy dividends. Judging from Base's current data performance, the market value converted into tokens should be above tens of billions of dollars. On January 11, Coinbase’s market capitalization was approximately US$64.7 billion. This market capitalization was placed among cryptocurrencies, ranking behind BNB and SOL. I wonder if Coinbase’s market value will be able to overtake BNB and SOL once the on-chain capital inflow of Base is added.

jinse

jinse

chaincatcher

chaincatcher