Behind the new high of XRP currency price: Parent company Ripple’s plan to instigate the New York Post?

Reprinted from panewslab

01/17/2025·3MAuthor: Yangz, Techub News

For XRP investors, yesterday’s market was nothing short of exciting.

In the morning, the US SEC submitted an appeal opening statement against Ripple, asking the appeals court to re-evaluate the ruling on securities laws. Although the Ripple team responded immediately, saying that "the appeal is a restatement of failed arguments and will probably not be adopted by the next government." However, affected by this, XRP still fell by about 6.5% in half an hour. Breaking 3 USDT. Since then, XRP has been hovering between 3 USDT and 3.1 USDT.

At around 7 p.m., a report from the New York Post ignited the XRP market. According to reports, the incoming new President Trump is open to establishing an "America First" cryptocurrency reserve, and specifically mentioned SOL, USDC and XRP. Affected by this, SOL rose to 217 USDT, rising by more than 8% in 2 hours, while XRP rose by nearly 10% in 2 hours, and hit 3.4 USDT in the early morning, setting a 7-year historical high.

However, these two "tit-for-tat" pieces of news also triggered speculation within the industry. Many investors viewed the New York Post report as a plan by the Ripple team.

Similar to the New York Post, the New York Times also published a relevant report yesterday, saying that when Ripple CEO Brad Garlinghouse had dinner with Trump at Mar-a-Lago, he encouraged him to invest in other currencies besides Bitcoin. Cryptocurrencies are included in the federal government’s potential cryptocurrency reserves. But the outlet did not mention whether Trump "accepted" the idea.

Separately, an Axios report on Wednesday, citing people familiar with the Trump campaign, noted Trump’s rebuke to an unidentified company representative: “You made so much money last year, and now you’re going to make it because of me. More...but where were you when I needed you? You were not with me, maybe you were with 'Harris'."

While Axios did not identify the company by name, two people familiar with the matter revealed to Unchained that the conversation was with a Ripple representative. This speculation is not groundless. During last year’s election, while Ripple donated heavily to the cryptocurrency political action committee (PAC) Fairshake, its co-founder Chris Larsen did donate millions to Future Forward USA, a political action committee supporting Harris. Dollar.

According to Unchained, after it published the "questioning" report, Ripple Labs senior communications director Susan Hendrick denied the above-mentioned "rumors" via email, but asked whether Ripple told the New York Post that Trump "accepts" XRP reserves Hendrick did not specify whether the company in the Axios report was Ripple. Additionally, the Trump-Vance transition team did not respond to a request for comment.

It is still unclear whether this is a deliberate plan by the Ripple team or whether it is true. But in the author's opinion, pursuing this issue is actually not that necessary. Putting aside the authenticity of whether Trump intends to establish an "America First" cryptocurrency reserve, if Ripple did instigate the "New York Post", it would be regarded as the team's "water ghost behavior" before the current US SEC stepped down. ” is a resolute counterattack, and it is not uncommon for such teams to release favorable words in the industry; and if XRP’s breakthrough to new highs is not driven by the independent planning of the Ripple team, this rise may also be realized after Trump officially takes office.

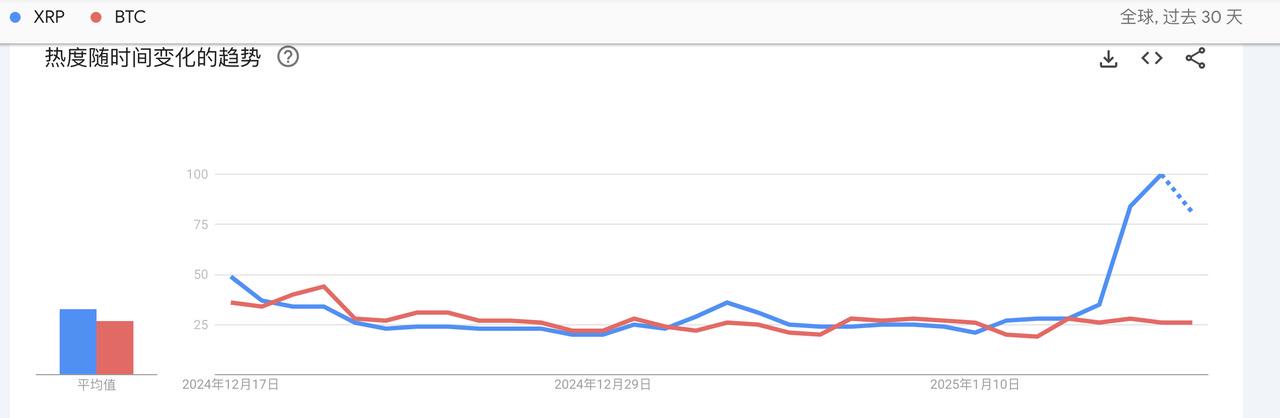

In fact, XRP has been rising steadily since Trump was declared the winner. According to a recent report by Reuters, the New US SEC leadership team plans to promote cryptocurrency policy reform immediately after Trump takes office. Given the various positive regulatory news, investors have high expectations for Ripple to end its battle with the US SEC. Google Trends also shows that XRP’s recent search popularity has surpassed Bitcoin globally.

From a macro perspective, it is only three days since Trump took office. After his official inauguration, the overall market trend of cryptocurrency has become the focus of the industry. Regarding this topic, the author would like to end by quoting the views expressed by Placeholder partner Chris Burniske yesterday. Burniske said there is a good chance we will break out of the simple four-year cycle. With the support of a new generation of U.S. governments, cryptocurrency asset returns may not experience parabolic growth in the next few years, but will tend to be more stable. Furthermore, mainstream assets are unlikely to experience another extreme retracement of 85-95%.

What do you think of the next market trend?