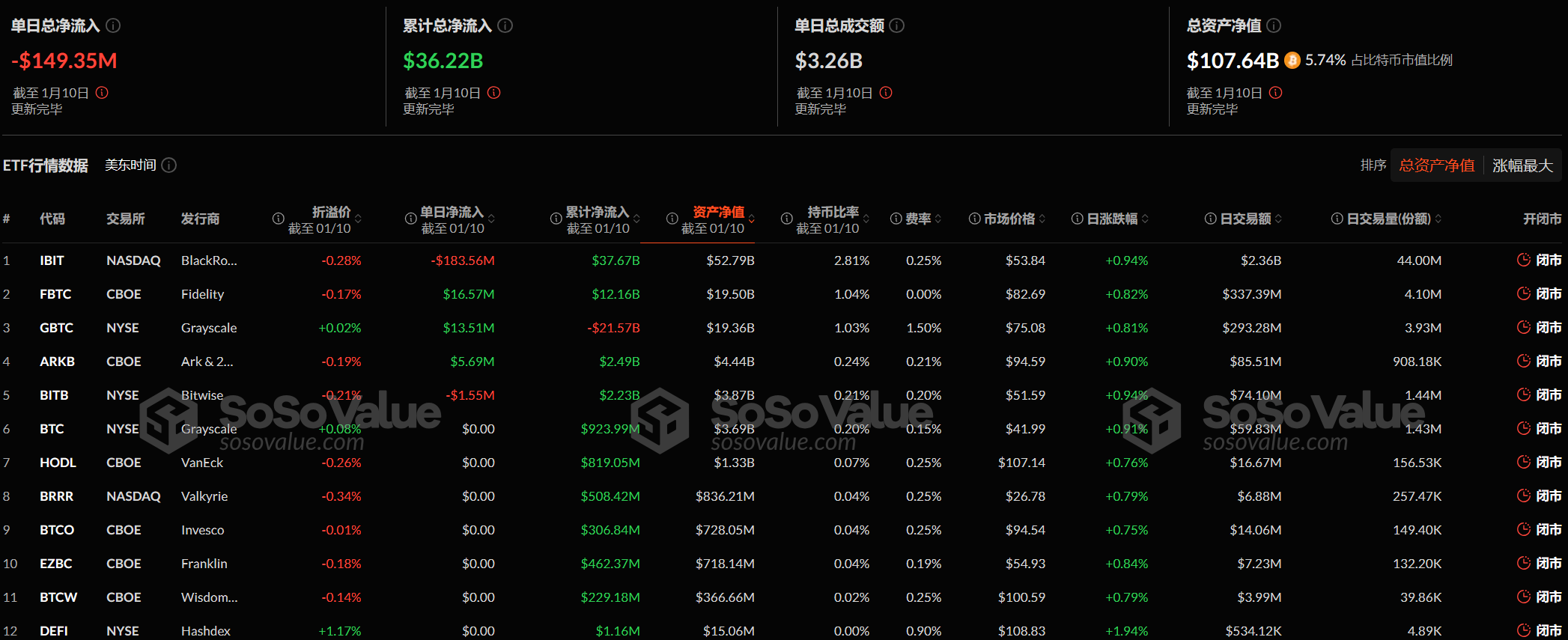

Bitcoin spot ETF had a net outflow of US$149 million yesterday, and the ETF net asset ratio reached 5.74%

Reprinted from panewslab

01/11/2025·1MPANews reported on January 11 that according to SoSoValue data, yesterday (January 10, EST), Bitcoin spot ETFs had a total net outflow of US$149 million. Yesterday, the Grayscale ETF GBTC had a single-day net inflow of US$13.5116 million, and the current historical net outflow of GBTC is US$21.567 billion. Grayscale Bitcoin Mini Trust ETF BTC had a single-day net outflow of US$0.00. The current total historical net inflow of Grayscale Bitcoin Mini Trust BTC is US$924 million. The Bitcoin spot ETF with the largest single-day net inflow yesterday was Fidelity ETF FBTC, with a single-day net inflow of US$16.5656 million. The current total historical net inflow of FBTC has reached US$12.157 billion. As of press time, the total net asset value of Bitcoin spot ETFs is US$107.639 billion, the ETF net asset ratio (market value as a proportion of Bitcoin's total market value) reaches 5.74%, and the cumulative historical net inflow has reached US$36.216 billion.