Black-turned fans, Cyber Capital founder explains why she fell in love with Solana

Reprinted from panewslab

04/16/2025·3DAuthor: Justin Bons, Founder of Cyber Capital

Compiled by: Luffy, Foresight News

Solana has the most dramatic counterattack path in crypto history and has been controversial since its inception. But now it should no longer bear the infamy. From the infamous FTX crash to false usage metrics, centralized design, downtime issues, Solana has gone through many hardships but has become stronger in its difficulties. It has changed tangibly and has forced us to change our view of it. Many people are keen on belittle Solana; but in reality, we really should change our damn prejudice.

It’s also my fault, I have to admit that I’m partly responsible for this perception of people, because I’ve been one of Solana’s toughest critics for years. However, today’s Solana is very different from the past. That’s why in 2023 I went from a Solana critic to a supporter.

In this article, we will dissect all my past criticisms in detail and demonstrate how Solana has become better and why it deserves our support now. For the concept of decentralization and for our common cryptopunk values, changing your view is not weakness, but a superpower.

Downtime problem

Solana has experienced many downtimes, which is indeed worthy of our serious criticism. After all, a mature blockchain should never have a downtime.

However, it is undeniable that Solana's stability continues to improve. The key here is whether technological changes can give us good reason to be confident about the future stability of their networks.

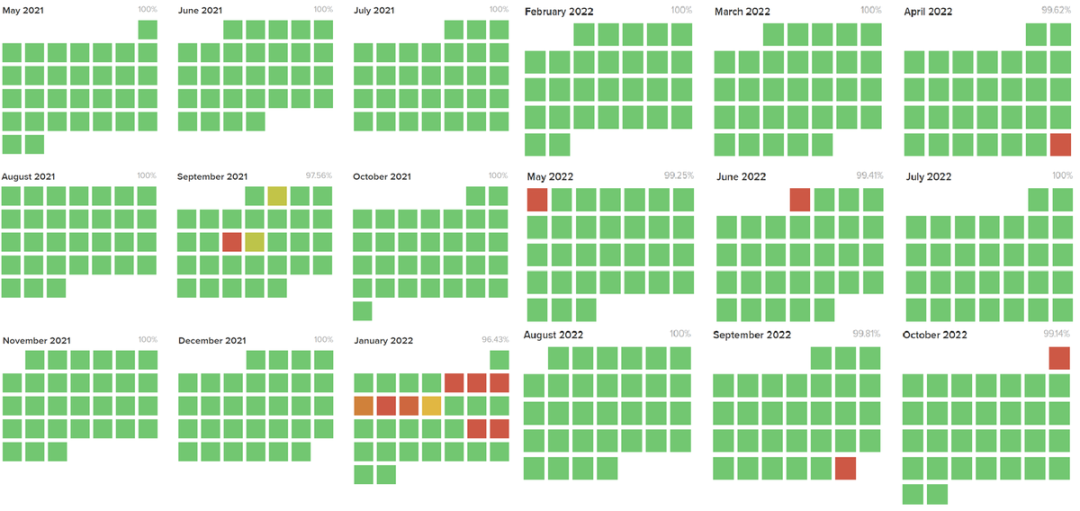

Let's take a closer look at past failures and their root causes, and the uptime charts for 2021 and 2022 are terrible:

Source: Solana Status

On September 14, 2021, Solana's network was down for more than 20 hours. Due to excessive node memory usage, it is extremely difficult to restore network operation. On June 1, 2022, Solana went down for more than 4 hours again, this time due to a transaction vulnerability, the entire network was stagnant. On October 1, 2022, Solana caused a chain fork due to invalid blocks, and it was down for more than 3 hours.

I won't go into details about Solana's downtime every time, and there are detailed records in other places. In short, everyone can understand that this was a serious test for Solana, when it was in a very poor condition and was full of loopholes. If it still looks like this now, I would definitely be critical. But on the contrary, it becomes stronger every time the problem is solved. Next, let's take a look at the follow-up situation:

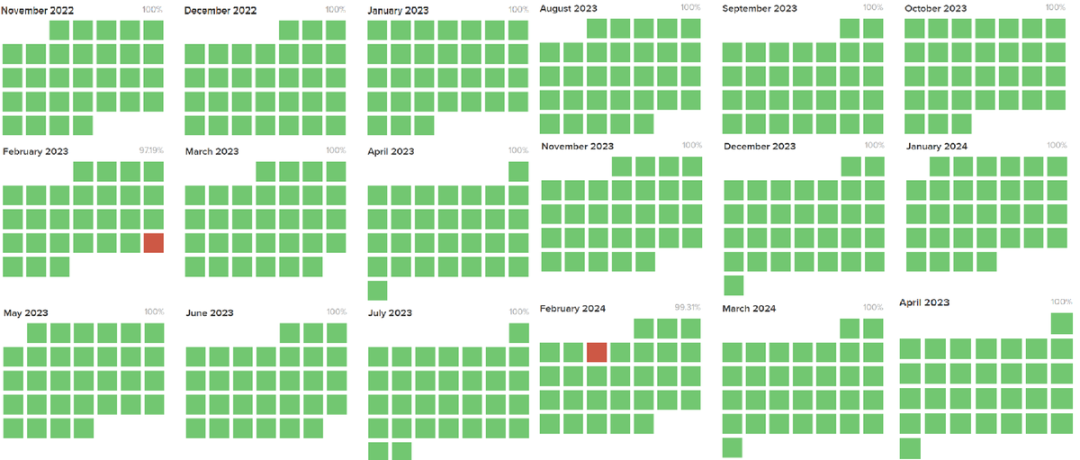

Source: Solana Status

The following year has improved significantly compared to before. Although it is not perfect enough, the progress is really impressive. Most of these failures are related to Solana's lack of a perfect handling fee market. The implementation of the fee market during this period was one of the main reasons I turned to support Solana, as it paved the way for perfect stability the following year:

Source: Solana Status

However, Solana still has other problems: congestion, spam, RPC failures, network bottlenecks, and more. For a blockchain that has repeatedly set new highs in usage, these are normal pains in the growth process. Importantly, there is no downtime, which is a huge improvement compared to previous years, indicating that Solana is becoming more mature.

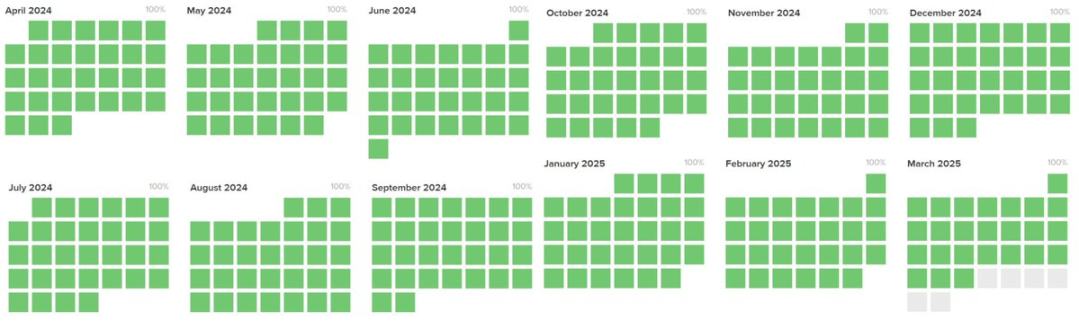

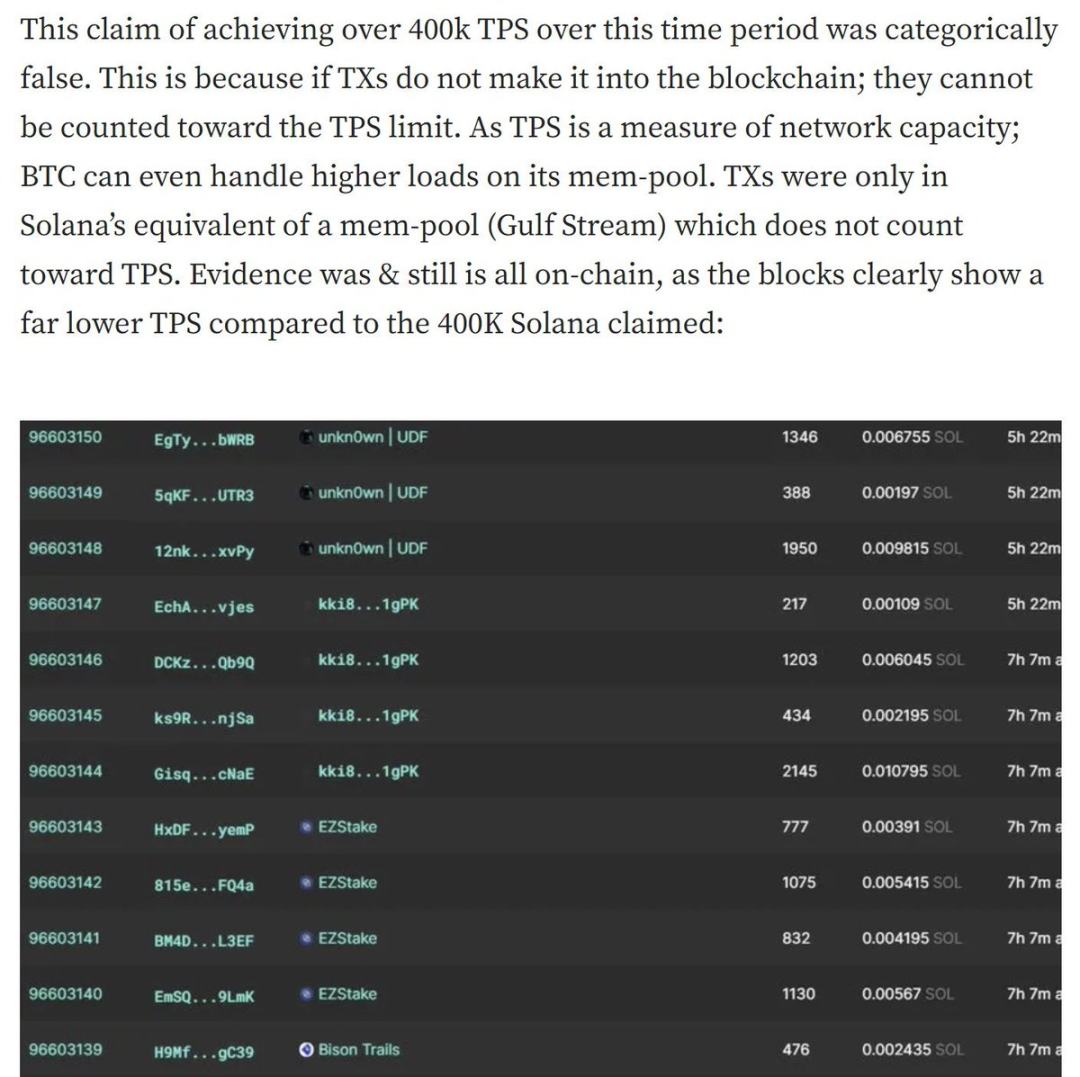

False TPS metrics

Let’s talk about fake usage data: When I first pointed out this issue in 2021, Solana had almost no real usage. So at that time it claimed to have reached more than 40,000 TPS, which was completely lying.

Since then, Solana has cleared up this false information when communicating with the outside world and no longer talks about TPS; in fact, Solana's leadership is much more honest when communicating with the outside world.

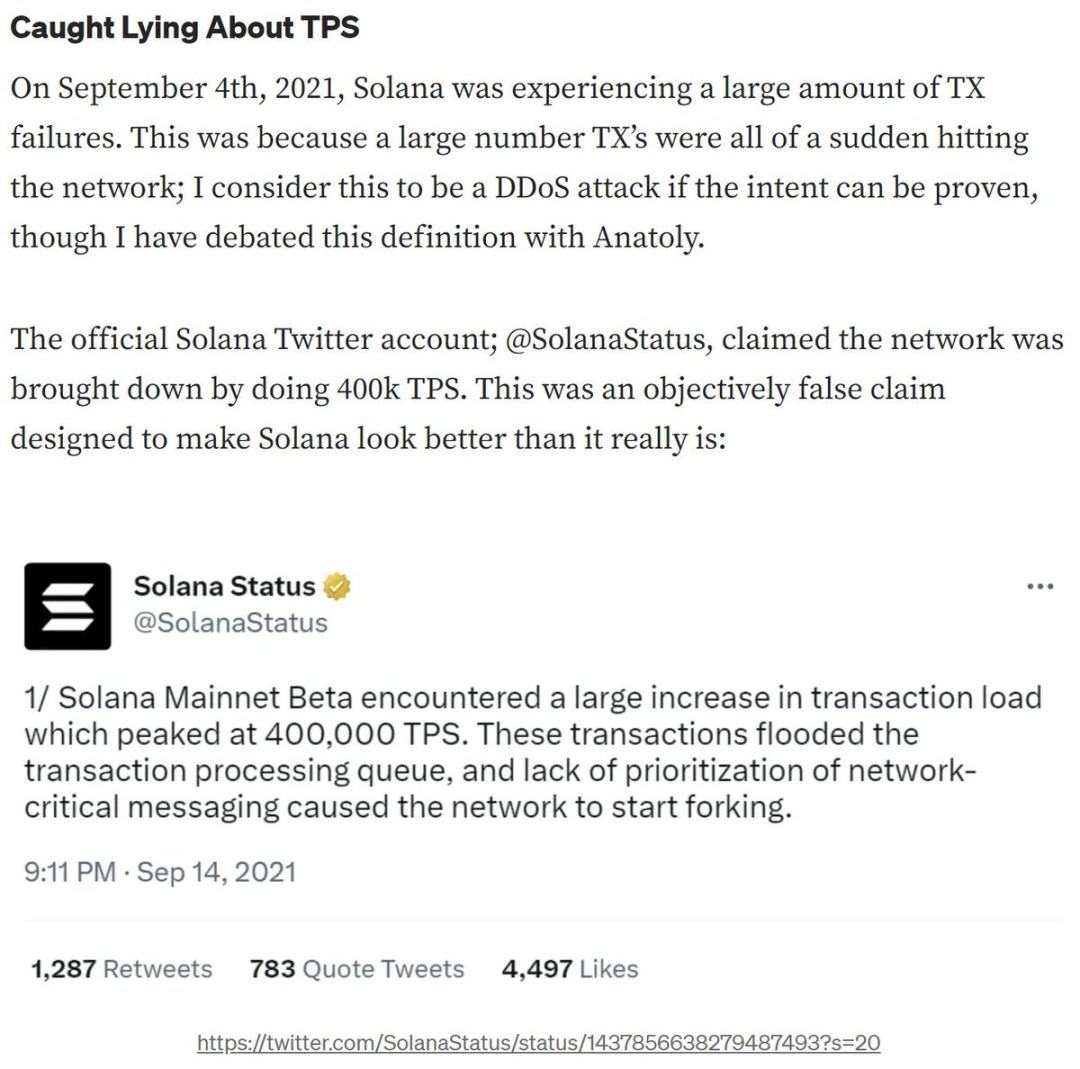

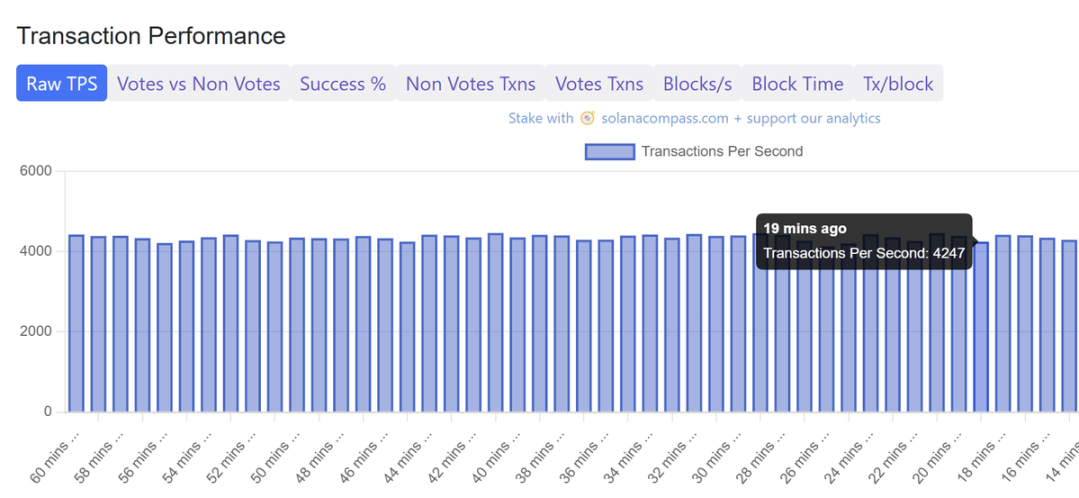

Even today, TPS data can still be misleading. According to the most conservative estimate, the adjusted figures are still extremely impressive. Let me calculate it in detail for you. First, the original TPS is currently 4247:

Source: Solana Compass

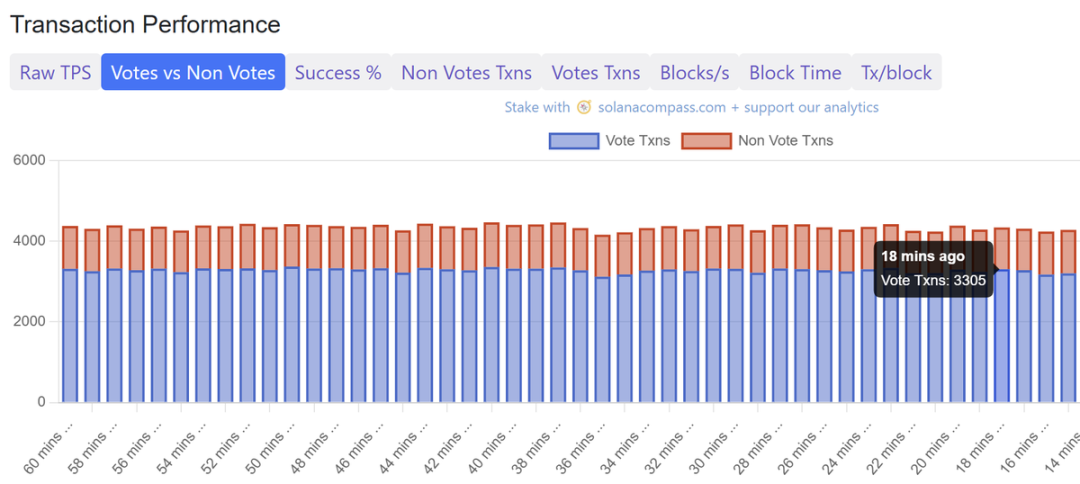

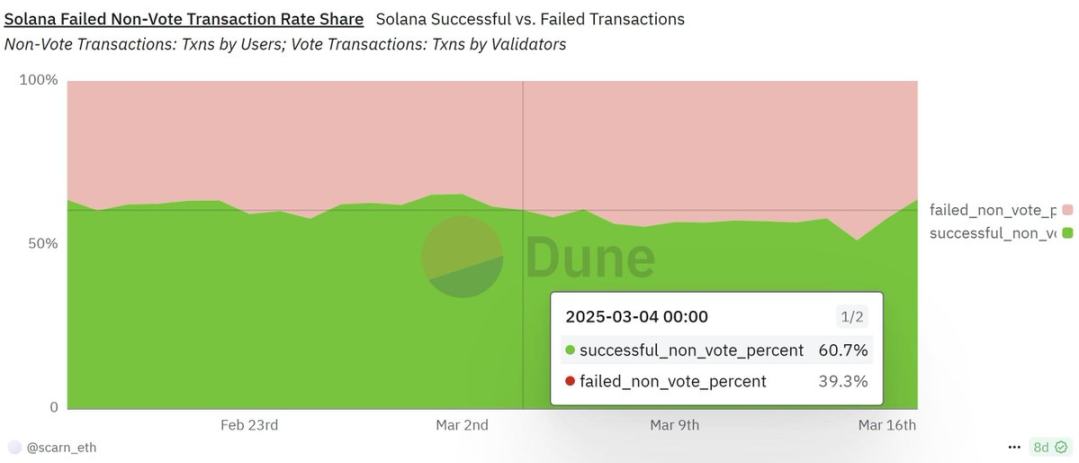

Now we eliminate voting transactions, and only 1109 TPS is left. For the convenience of argumentation, we can also eliminate "failed transactions".

So, 4247 original TPS - vote transaction = 1109; then remove "failed transaction" (calculated by - 40%) = 665.

Source: Solana Compass

Source: Dune Analytics

This adjusted usage is still far more than the sum of all other blockchains today.

This makes Solana a well-deserved leader in decentralized applications. This is also the reason why some criticisms seem unfair at present. They make people feel that Solana is not the leading in terms of usage, but the facts are obvious that even according to the most conservative estimates, it is also the leading.

Moreover, deducting "failed transactions" is not entirely reasonable, because these transactions are doomed to fail and a handling fee is required. These transactions are driven primarily by sophisticated participants who essentially make double payments to get their transactions into the block faster, and most of them are expected to fail. This cannot reflect the transaction failure rate of ordinary users. According to my own test, the transaction failure rate of ordinary users is less than 0.2%, which is in a completely reasonable range.

But for the sake of argumentation, Solana still takes the lead even if it eliminates the failed transaction.

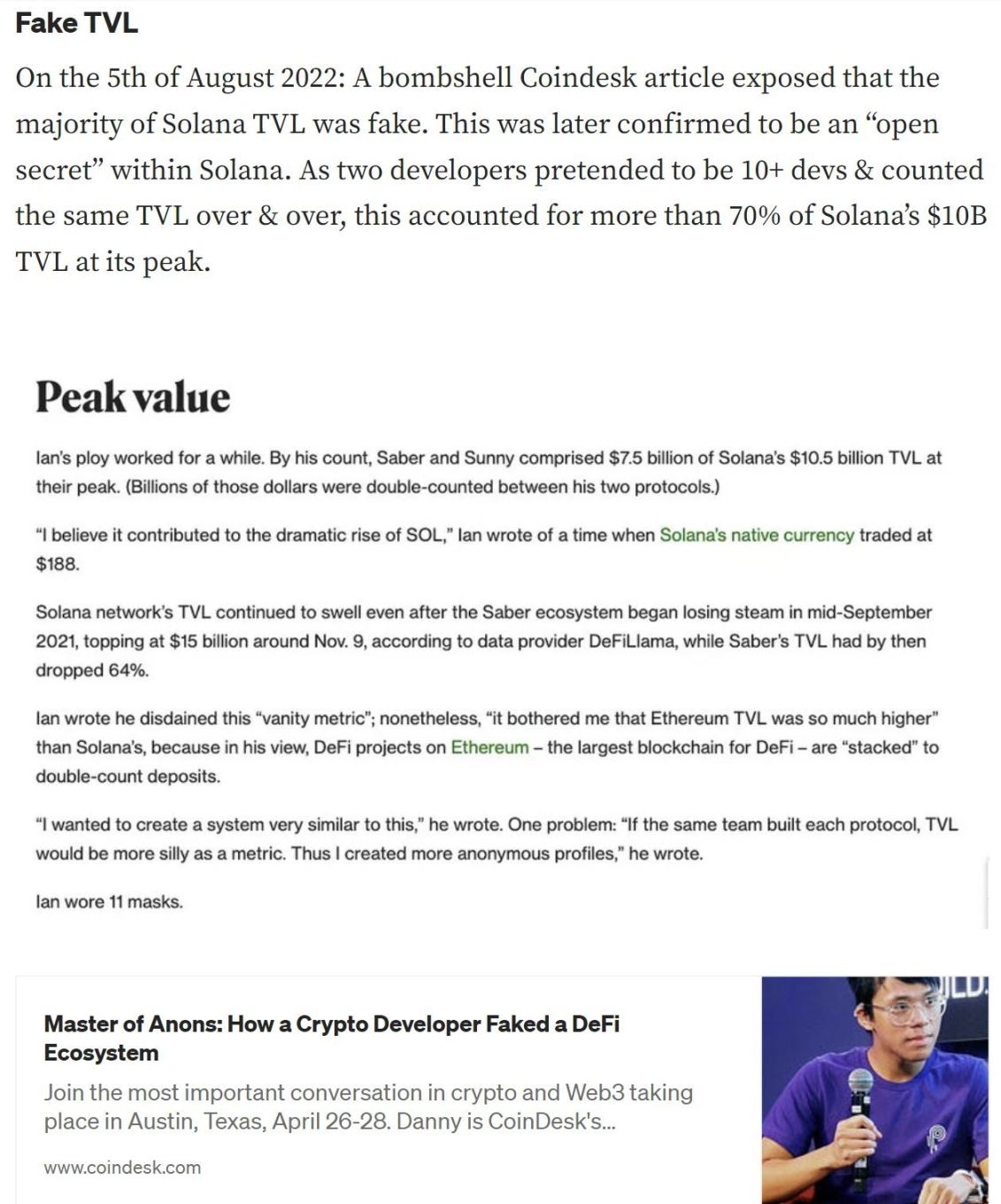

False TVL metrics

The same problem has existed in TVL data, sometimes greatly exaggerated:

Fortunately, with the adjustment of the ecosystem, these are just pains in growth. Nowadays, TVL indicators are more fair. Although they are not perfect, under the current statistical methods, no blockchain is perfect. To say the least, all blockchain ecosystems are now continuously applying the same standards uniformly.

Solana's TVL is still reaching a considerable $6 billion and is growing rapidly, with a bright future:

Source: DeFiLama

income

Even though L1 and DApp's revenue has hit new highs, many people are still reluctant to face the reality.

What many people don’t understand is that income indicators cannot be faked because Solana is already decentralized enough to ensure this.

The reason is that if you want to "forge" these handling fees, the "order brushers" have to pay all the fees out of their own pocket. Because it is ultimately impossible to control which verifiers can receive these fees, the "order brushers" really pay for all fees, and the fee income cannot be faked.

Source: DeFiLama

If someone thinks that the founder of Solana spends up to $5 million a day to "fake" expense income, then I really don't know what to say to such a person, which is already in a crazy conspiracy theory. Maybe I should suggest that such people examine their investment portfolios and see if they are prejudice.

Revenue is arguably the most important indicator because it demonstrates the actual use cases of cryptocurrencies while providing a solid and sustainable foundation for future decentralization and security.

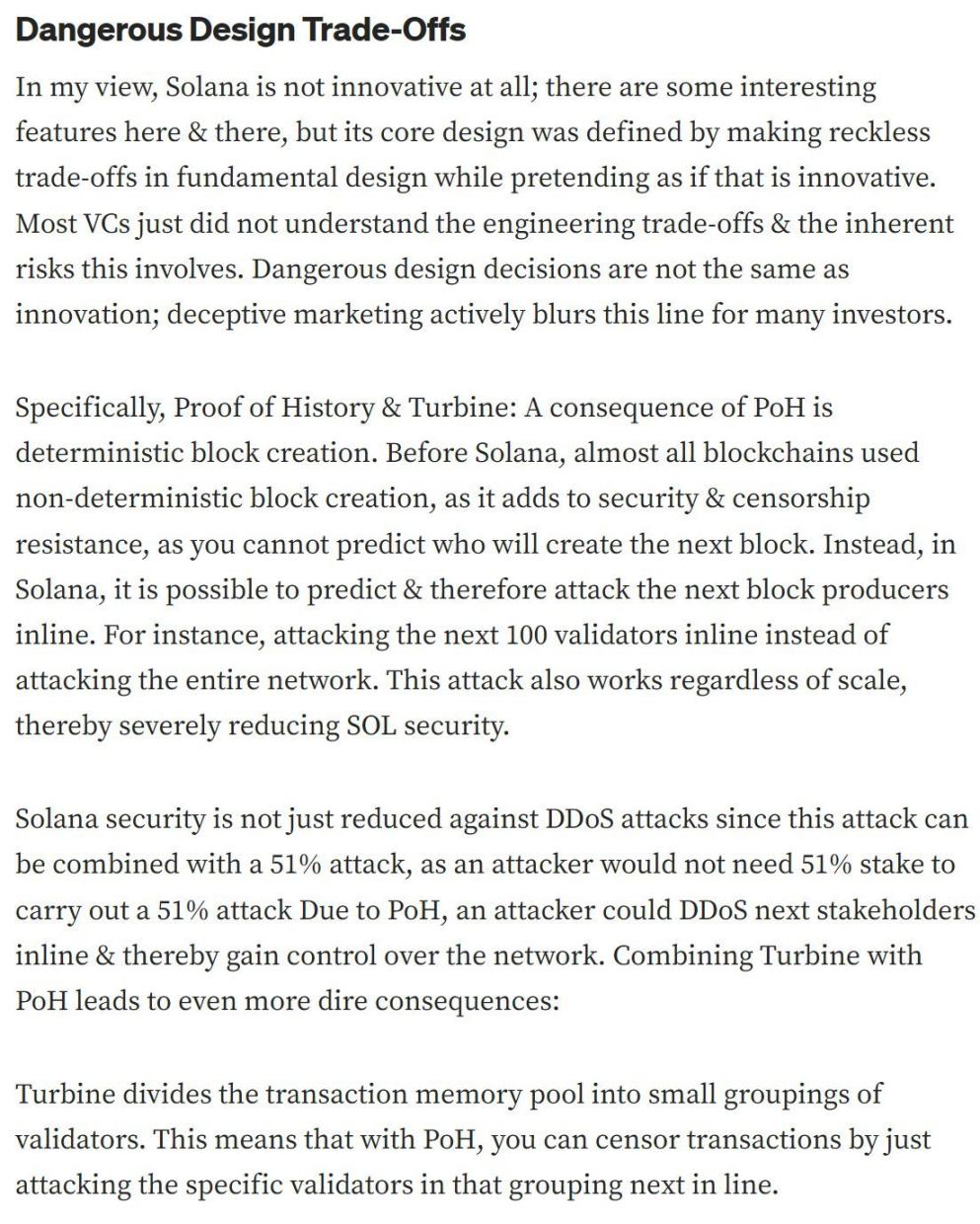

Dangerous design tradeoffs

Some of Solana's design decisions, such as the PoH and Turbine mechanisms, do sacrifice a certain degree of decentralization in pursuit of speed. I have to face this problem, what does it mean? In fact, this lowers the attack threshold.

It is roughly estimated that it may be reduced by about 20%. Nevertheless, this is only a small weakening of economic security. Because this allows the attacker to DDoS the next group of validators to become the leader, thereby reducing the amount of tokens required to launch a "51% attack". I have a more detailed explanation of this in my previous criticism:

Source: Screenshot of article \"Criticism of Solana: The Trade-offs of Lies, Fraud and Danger\"

Despite this, Solana's market value is still three times that of its L1 blockchain, and even with this trade-off, Solana still has high security. Is this specific trade-off worth it? It's hard to say.

However, it is certain that Solana is not unsafe today and is finally at a balance. Because from the actual situation, Solana is much safer than its competitors with a closer market capitalization.

Decentralization is a category involving multiple interaction factors. For example:

A high-capacity blockchain with 10,000 nodes running on supercomputers is more decentralized than a low-capacity blockchain with only 100 nodes running on a Raspberry Pi.

This is an extreme example, but highlights my point of view. That's why, although Solana is highly demanding on nodes and has centralized design decisions, it is actually very decentralized in terms of its scale. Because scale plays an important role in the actual decentralization process. Solana achieves this view by spreading its stake across 1,300 validators:

Source: Solana Beach

This actually confirms long-term theories and debates surrounding keeping decentralized, which can be traced back to Bitcoin’s block size dispute. There has always been a contradiction between expansion and decentralization, which is most typically reflected in the "blockchain triad dilemma". The solution is to find the right balance between the two extremes, as being at either end of the spectrum will lead to failure, either useless or overly centralized.

So, after Bitcoin and Ethereum deviate from this vision, it is a dream come true to see Solana realize this vision. Hopefully this will better explain my shift in position as a 2013-class old-school big block Bitcoin supporter and why I am now turning to Solana.

Governance and Client Diversity

Solana has multiple competing clients, which is of great significance to decentralization. Without multiple clients, blockchain is actually a single party governance system. You can vote, but there is only one party to choose from.

Multiple clients also greatly enhance network resilience, because this means that a single implementation vulnerability can no longer paralyze the entire network.

There are only a handful of blockchains that can do this, and Solana is on this list. Therefore, this achievement must not be underestimated, as it demonstrates a firm commitment to decentralization. Because maintaining two clients is much more difficult than maintaining one client. This explains why few people are willing to take this step, they tend to cover up obvious centralization issues, and these "shadow rulers" also pretend that this is an "elite management" system, and they can actually control any change.

Solana also has a basic on-chain governance mechanism, although it is still being improved. But just having such a promise is already a big step ahead of Bitcoin and Ethereum. In my opinion, Bitcoin and Ethereum are actually dictatorial in decision-making on rule changes.

Solana's recent failure to pass the SIMD228 proposal seems contradictory, but it is actually a major milestone. Because differences and conflicts are signs of true decentralization. Think about it… The proposal was supported by all the senior leaders of Solana, but stakeholders still rejected it. There is no better evidence of true decentralization than this. Nowadays, in Solana, the checks and balances for good governance are indeed working normally.

Turn off the switch

This is a ridiculous statement, which I have never mentioned in my previous criticism, but at least it is worth a brief response.

Solana does not have an "Off-Switch". Unlike chains with licensed links (such as XRP and HBAR) or chains with some licensed links (such as ALGO and BNB). Solana has no license elements, it is a truly public, trustless and decentralized blockchain, and it is undeniable.

This misunderstanding may stem from the lack of understanding of the difference between the blockchain stopping and the actual existence of a switch. The consensus mechanism is very complex, and blockchain has many ways to stop operating, and this is not the result of centralized control. I don't want to waste time on such ignorant criticism, because anyone with a little technical knowledge knows the truth.

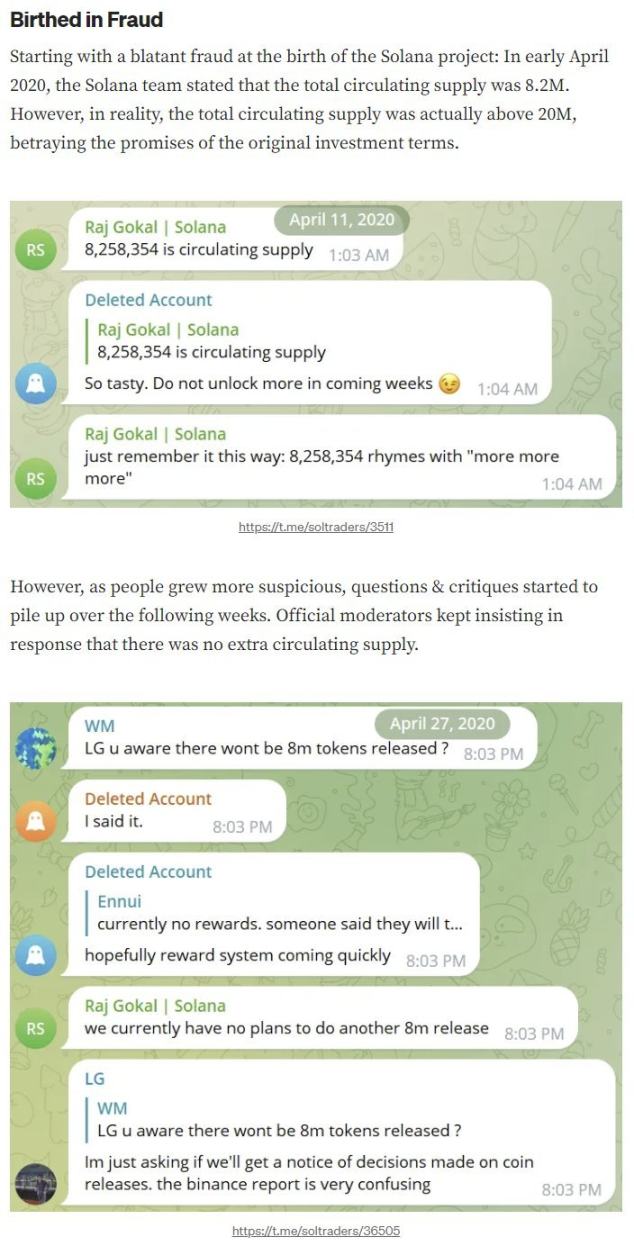

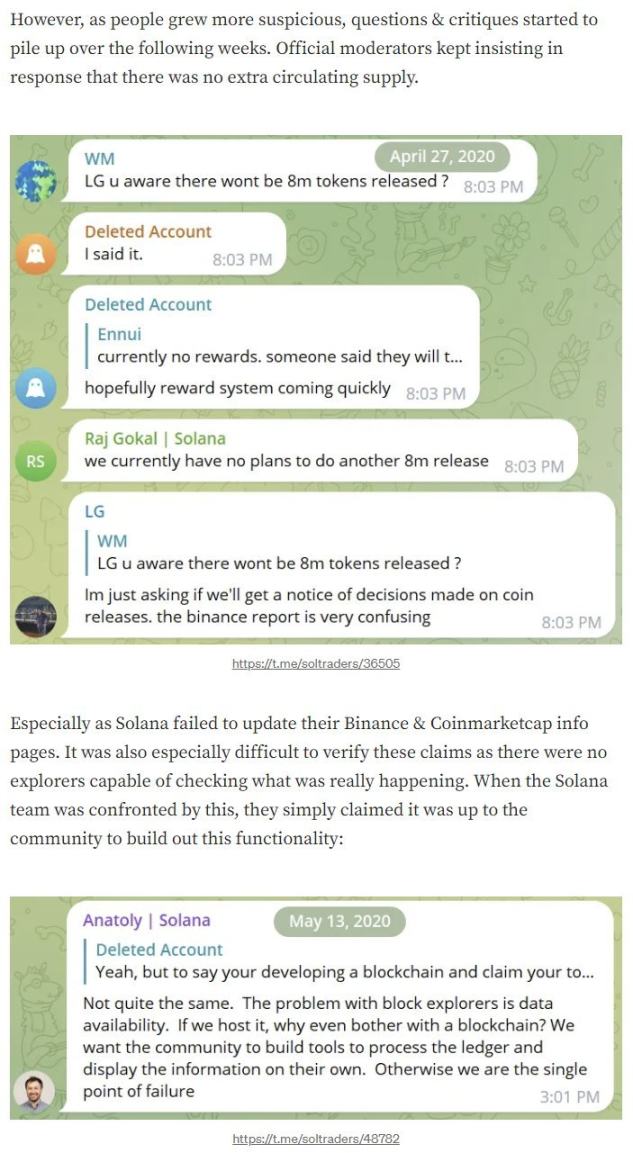

Fraud and lies

Fraud and lies are even more difficult to tolerate. As I said in my previous criticism, there have been a series of bad behaviors on the Solana team over the years. However, the Solana team has indeed improved a lot in terms of honesty and professionalism in communication since then.

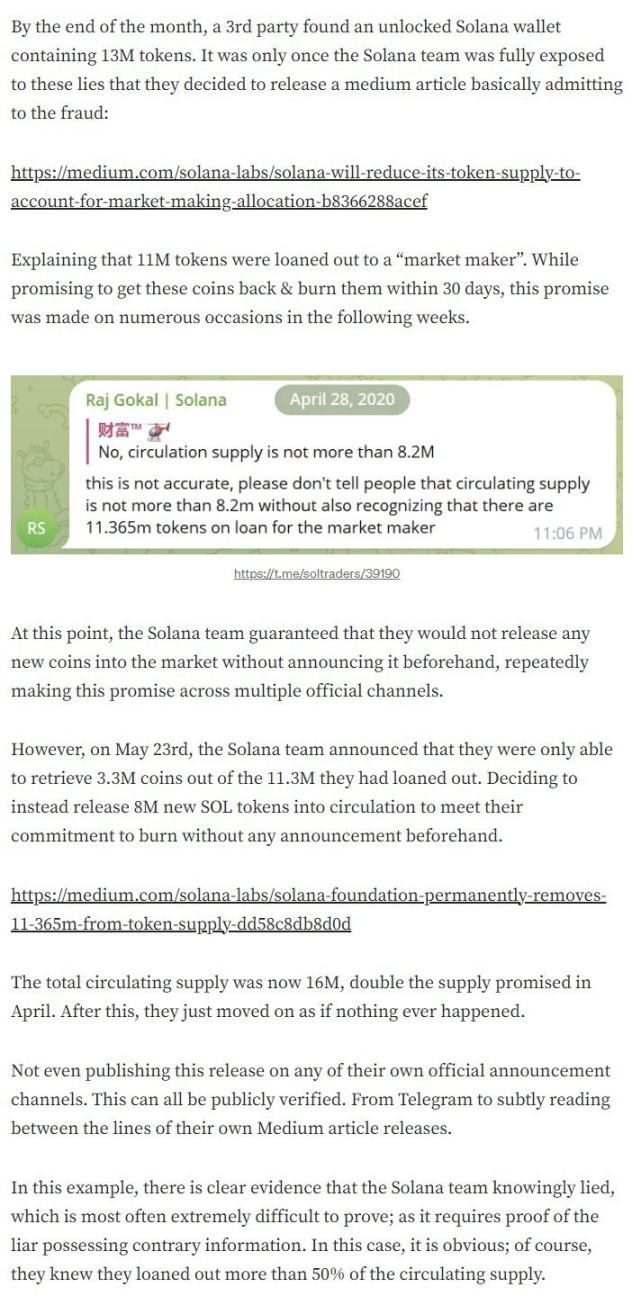

The ugly fact, however, is that in 2020, the Solana team did lie about circulation supply. Even though these quantities are no longer important to today’s market, it is undoubtedly a stain on Solana’s history. For complete transparency, I elaborated on this in my previous criticism, and I even attached evidence:

Source: Screenshot of article \"Criticism of Solana: The Trade-offs of Lies, Fraud and Danger\"

My response comes down to the concept of decentralization: a blockchain can transcend its state at the time of its creation. Decentralization means Solana is not defined by its leadership in the past. Especially with the advent of massive adoption, leadership will be diluted and change. This means that even if you don’t trust Solana’s current leadership, we can still support it.

Personally, I have rebuild my confidence in its leadership because the “bad behavior pattern” has stopped. But what I mainly want to say is that you don’t actually need to trust leadership.

This is what decentralization means: you don’t need to trust anyone! Past mistakes still exist, but we can look at the future.

A summary of old criticism

Let me summarize my past criticism, just like I did at the time:

In 2020, Solana’s leadership lied about supply, but that had no substantial impact on the present.

Solana has improved external communication, and now the real TPS has hit new highs!

The blockchain browser now displays "Real TPS".

TVL is no longer "false".

Most dangerous trade-offs have been corrected

I have been firmly defending the crypto principle and constantly adjusting my position as cryptocurrencies develop. Some people accuse me of being a child care because my position change does seem sudden.

This accusation is not only a personal attack, but it is also ridiculous on the surface, just think about how negative I had in the past towards Solana. Even if they want to buy people, I will definitely be the last one to be bought.

Perfect is an excellent enemy

If we are too picky, the blockchain field will split into thousands of chains, which is not good for the development of cryptocurrencies. Or, at least in achieving the goals of the crypto-punk movement, we should rationally allocate support.

Remember, this is from a person who rejects 95% of blockchain. I even loudly criticized blockchains (Bitcoin and Ethereum) with market caps in 2016 and 2022, respectively, because they deviated from the on-chain expansion route.

That's why, if we reject the third largest blockchain (Solana), we'd better have a complete reason. My life was already difficult enough, managing the world's oldest liquidity fund and always adopting a counter-trend strategy. That's why, as far as conscience is concerned, I can no longer continue to criticize Solana because they have fixed the flaws I criticized… I have to become an admirer.

Even the most popular content I've ever posted is a criticism of Solana. This has led to a lot of my audience loathe me because of my shift in position, and many in the Solana community are cautious about me as a former critic. I think sometimes, this is the price of free thinkers.

Of course, there may be better blockchains in technology, but is there any road to mass adoption as smooth as supporting Solana? I would rather introduce real income data to clients than theoretical data…

Importantly, Solana is already decentralized enough to achieve many features such as censorship resistance, immutability, financial sovereignty, and is in a blockchain that can now achieve large-scale applications. This is the ultimate key.

in conclusion

As a value investor supporting the overall expansion theory, it was natural for me to turn to support it as Solana gradually emerged.

Solana was far from perfect; it wasn't even my favorite design at the time. However, we must respect its success in use, because real value is contained in it.

There is no point in expanding without decentralization; vice versa, of course, Solana's opponents claim it ignores this, and that's not the case.

In the environment where Ethereum decided not to expand L1 at all, Solana has become the new king. Of course, there are definitely many competitors who covet the throne, and diversification is still key. However, in areas that really matter: practicality, usage and revenue, we cannot ignore Solana's obvious advantages in the market today.

This is ignored at this stage either stems from a serious misunderstanding of Solana or its competitors or is too prejudice. We all need to correct our damn prejudice! That's why in this industry, being able to change your mind is a superpower.

As an early adopter of Bitcoin and Ethereum, I became a critic later when these blockchains deviated from the on-chain expansion route.

Solana’s success deserves our cheers as a crypto punk. Because only through scalable technology can the public be liberated, and Solana is realizing this beautiful vision at this moment.

Perfect is the enemy of good, and Solana is excellent enough. If you are not free, you will rather die. You will fall in love with Solana like me.

chaincatcher

chaincatcher