BlackRock: Why can IBIT change the Bitcoin investment landscape?

Reprinted from jinse

01/14/2025·25days agoSource: Blackrock; Compiler: Deng Tong, Golden Finance

summary

-

Bitcoin is the world's leading crypto-asset, with rapid adoption attracting the attention of individual and institutional investors.

-

Traditionally, investing directly in Bitcoin has come with numerous hurdles, such as opening a new account, potentially high transaction fees, and dealing with security challenges.

-

IBIT provides convenient access to Bitcoin investment through a familiar and common investment vehicle, ETF.

Bitcoin is the world's leading and most widely used crypto-asset, with a market capitalization of nearly $2 trillion. Bitcoin’s global and decentralized nature gives it the potential to be viewed as a global currency alternative that could benefit from geopolitical chaos and declining trust in institutions and governments issuing fiat currencies. Investors have noticed that both institutions and individuals are adding Bitcoin to their financial holdings. Until now, however, investing in Bitcoin has often presented investors with many obstacles, including the need to open new accounts, facing high transaction fees, and dealing with security challenges. But just as ETFs have provided millions of investors with efficient access to previously inaccessible markets such as gold and international stocks, IBIT now allows investors to invest in Bitcoin in a convenient way.

The rapid popularity of Bitcoin

Since its launch in 2009, Bitcoin has gained popularity even faster than other breakthrough technologies such as the Internet and mobile phones. Several factors have accelerated this popularity, including:

-

Demographic Patterns: Younger generations are more likely to be considered “digital natives,” making them more likely to adopt Bitcoin than Generation X and Baby Boomers.

-

Global changes: Certain trends such as inflation concerns, global political divisions, and banking and fiscal issues have increased Bitcoin’s resonance as a decentralized asset.

-

The Future of Finance: Finally, the continued digital transformation of the global economy is changing the world of finance, with the maturation of digital asset infrastructure lowering barriers to entry and creating new use cases for Bitcoin.

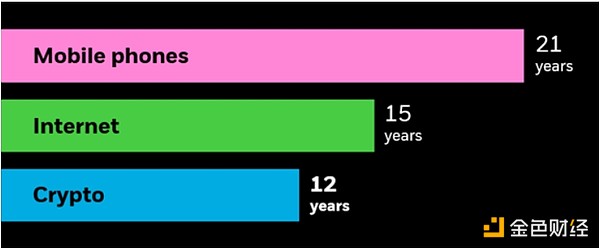

Figure 1: Cryptoasset adoption has outpaced the growth of mobile phones and the internet

Time required to reach 300 million users

The first cellular phone came into use in 1973. Source: NPR, Our World in Data. January 1, 1983 is considered the official birth date of the Internet. Source: University System of Georgia, Our World in Data. Bitcoin's initial price was set in 2010. Sources: Bloomberg, Cambridge Center for Alternative Finance, Crypto.com.

Chart Caption: Bar chart showing the time it took for cryptocurrencies, the internet, and mobile phones to reach 300 million users since their inception. Cryptocurrencies are reaching 300 million users faster than the internet and mobile phones.

3 reasons why IBIT can change the Bitcoin investment landscape

Despite Bitcoin's rising adoption, investing directly in Bitcoin presents unique complexities for investors. That’s why we launched IBIT (iShares Bitcoin ETF), to make investing in Bitcoin easier for everyone.

We believe IBIT can be a game-changer for investors for the following reasons:

-

Access: IBIT allows you to access Bitcoin exposure within a traditional brokerage account. As an ETF, IBIT offers Bitcoin exposure but trades like a stock. As such, it can be traded alongside other investments such as stocks, bonds, and other ETFs through traditional brokerage platforms—either through taxable accounts or through tax-advantaged accounts such as TFSAs.

-

Convenience: IBIT can help reduce the complexity for investors to gain exposure to Bitcoin. Buying Bitcoin directly usually requires opening a new account at a cryptocurrency exchange or choosing an online broker. To ensure their Bitcoins are as safe as possible, investors often need to set up their own custody arrangements outside of cryptocurrency exchanges, which can be expensive and risky. IBIT can help minimize these unique cryptocurrency barriers through a familiar and common investment vehicle – ETFs.

-

Integrated Technology: IBIT is managed by the world's largest asset manager and leverages years of technology integration developed with Coinbase Prime, the world's largest institutional digital asset custodian.

Conclusion: IBIT opens a new era of Bitcoin investment

The emergence of Bitcoin ETFs marks an important milestone for digital assets and traditional markets. The launch of IBIT stems from iShares' commitment to provide access to enable more investors to invest in Bitcoin through the convenience, efficiency and familiarity of ETFs.

chaincatcher

chaincatcher

panewslab

panewslab