Can Ethereum still be "rescued" in 2025?

Reprinted from jinse

01/17/2025·3MLu Xun never said: "No matter what sins you have committed in your previous life, holding Ethereum will be considered as repayment." This round of Ethereum holders never expected that Ethereum would be such a drag, and it was once at the bottom of the mainstream projects. , but it is too early to draw a conclusion, and the big market does not seem to be over. If the adoption of Bitcoin has just begun, then Crypto and Web3 as a whole are in their early stages. In 2025, can Ethereum still be "rescued"? What “events” and “breakthroughs” are worth looking forward to?

01Inflow of spot ETFs

At this stage, the Ethereum spot ETF has been approved for listing on the US

stock market for some time. Compared with the Bitcoin spot ETF, there is a

certain gap in the speed and volume of capital inflows. However, except for

Ethereum, it does not have the "out of the circle" and broad consensus as

Bitcoin. In addition to the height of Ethereum, another very important reason

is that compared with the pledge and other benefits brought by directly

holding Ethereum itself, spot ETFs that have no additional benefits and need

to pay management fees and other expenses have no advantages.

However, the good news coming in 2025 is that people from relevant financial

institutions are actively promoting the listing of Ethereum spot ETFs that

allow additional returns from staking operations. There is still sufficient

motivation to promote this matter, because financial giants are the main

stakeholders in the "hot" trading demand for crypto-asset spot ETFs. There is

not only potential demand for pledged Ethereum spot ETFs, but also the

friendly atmosphere brought about by Trump's coming to power. The regulatory

environment makes it easier to obtain approval.

02 Ethereum strategic reserve

The current Bitcoin strategic reserve being promoted by the United States is

one of the main driving forces of the Bitcoin and crypto markets. You must

know that among the important strategic reserve assets of the United States,

in addition to gold, there is also oil. Therefore, "digital gold" Bitcoin

has certain feasibility and significance as a strategic reserve. At the same

time, Ethereum, which was once called "digital oil", is also expected to be

included in the list. Reserve assets for strategic purposes.

Compared with Bitcoin, in fact, the Trump family WLFI project supported by

Trump is an ecological project deployed on the Ethereum main network. Its

main business is based on the support brought by the Ethereum DeFi ecosystem

AAVE and Chainlink. At the same time, the project treasury is more It has

successively begun to reserve a large amount of ETH and Ethereum ecological

project Tokens, and recently it has exchanged a large amount of WBTC for ETH.

According to the analysis of 7 multi-signature wallets in the project's

treasury, it was found that some wallet addresses are already "veterans" in

the Ethereum DeFi ecological chain. Therefore, the project team has a high

degree of understanding of Ethereum and its ecology, and its operations are

relatively professional.

Given that the team behind Trump took the lead in launching the adoption

project of the Ethereum ecosystem, we can believe that it has a high degree

of recognition of the subsequent development of Ethereum and its ecosystem,

and supports the development of high-tech industries such as Web3 , which is

also in line with Trump's proposal "America First" philosophy. Therefore, the

possibility of Ethereum being mentioned as a strategic reserve asset in 2025

is not low.

03The next big upgrade of Ethereum

Due to the unsatisfactory performance of Ethereum, its next major upgrade

called "Pectra" has not received much attention. It is reported that 10 EIP

improvement protocols have been added to this upgrade plan, mainly involving

user experience and feedback. Layer2 support optimization, the main highlights

are as follows:

1) Optimization of account abstraction <br>This upgrade will optimize the

wallet experience so that ordinary wallet addresses can also have complex

functions and flexible operations of "contract wallets", such as "gas payment,

social recovery, multiple Signature" and so on, these optimizations will

further reduce the user's threshold for use. When users use Web3 applications,

they can achieve the same operating experience as Web2 applications. Lay the

foundation for the large-scale adoption of Web3 applications in the future.

2) Layer 2 support optimization <br>Provide more data space (blob) for

Layer 2 solutions and improve the expansion capabilities of Ethereum. Re-

evaluate and adjust the cost of calldata to optimize block throughput and

storage. To put it simply, it is to expand the Layer data space and optimize

the cost, so that the supported Layer 2 capacity is large and the cost is

lower.

3) Improve the security and flexibility of verifiers <br>Optimize the

voting processing, extraction and other operations of verifiers to improve

security and efficiency, and at the same time increase the pledge limit of

32ETH, which is equivalent to merging running verification nodes and reducing

operation costs. While improving efficiency, it also reduces the pressure on

point-to-point messaging and data storage between a large number of node

networks.

In short, Ethereum’s Pectra upgrade will bring support at the bottom of the

technology to the Ethereum ecosystem with a more user-friendly experience,

higher scalability, and a more stable node network.

04 Ecological application explosion and technological progress

At this stage, more and more major institutions such as the Trump family's

DeFi project, Sony's Layer 2, and Deutsche Bank's Layer 2 are building Web3

applications and infrastructure solutions on Ethereum, and the Ethereum

ecosystem is the first choice.

The Ethereum ecosystem is mature, rich, diverse and leading in terms of

technical resource reserves, development history, development team support,

on-chain capital volume, client security and wallet user experience. By the

same token, in the next stage of the big market in 2025, whether it is the

strong recovery of DeFi or the popularity of tracks such as AI Agent,

Ethereum as the underlying infrastructure will grow due to the adoption of

these ecological applications and the prosperity of on-chain activities.

Benefits include but are not limited to capital inflow, Gas consumption,

deflation of Token supply, etc.

With the launch of Unichain, the OP super chain family has added a heavyweight

player. Layer 2 cross-chain liquidity is expected to make progress in 2025. By

then, combined with the upgrade and optimization support of Ethereum itself,

the potential formed by major Layer 2 groups will Combined, they form

unprecedented competitive pressure on some high-performance new public

chains.

In the past, some people always said that Layer 2 of Ethereum was a failure,

sucking blood from the main network and not bringing any benefits to the main

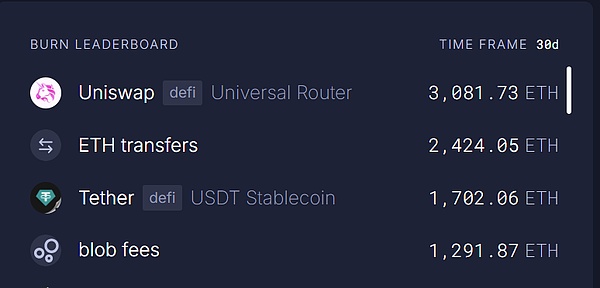

network, but in recent times we have also seen the prosperity of Layer 2. Data

from ultra sound money shows that Layer 2’s Blob fees have become one of the

largest gas burners on the Ethereum main network, which also illustrates the

success of Layer 2’s expansion plan.

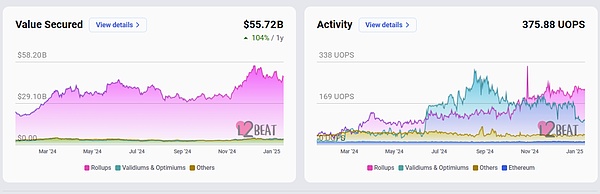

L2Beat's real-time statistical data chart also shows that the inflow of funds from Layer 2 exceeds 55 billion US dollars. Calculated based on transaction volume, the total expansion rate is more than 2,500% of the original main network.

For large companies and institutions outside the circle such as Sony and Deutsche Bank, Layer 2 is an excellent entry point for Web3 business. It can be started without a large amount of technical reserves and resource investment. It is natively supported by the Ethereum ecological community, so in Led by the success of these institutions, the real institutional adoption wave of Layer 2 will soon come.

05 Summary

In fact, many people know that the advantages of Ethereum and its ecology in all aspects are quite obvious, but they did not expect that the scale of Ethereum today can no longer be raised as quickly as the funds in the first two rounds of market conditions. Obviously this is not an easy thing, as the Bitcoin-level volume, the large inflow of institutional funds to obtain spot ETFs, and the strong expectations of U.S. strategic reserve assets have allowed it to rise rapidly. However, compared to Bitcoin, Ethereum has additional support from technical upgrades and Web3 ecological development. There is still a lot to see in 2025. Let’s wait and see.

panewslab

panewslab