Can Trump's encrypted administrative order break the four -year cycle of cryptocurrencies

Reprinted from jinse

02/02/2025·2MAuthor: Matt · Hougan Bitwise Chief Investor; Compilation: 0xjs@作

In the past week, I have been thinking about the four -year cycle of Bitcoin most of my time.

Specifically, I have been pondering whether Washington's recent change in the attitude towards cryptocurrencies is enough to become a major catalyst. The four -year cycle of "breaks" has continued the bull market of the current cryptocurrency to 2026.

This is a question I have recently been asked frequently. Let's discuss in depth.

What is the four -year cycle?

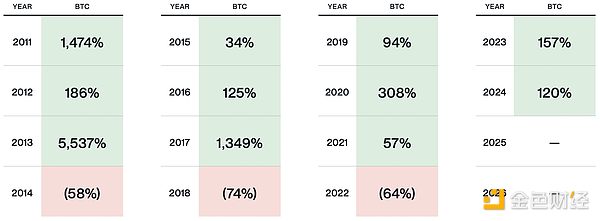

Historically, Bitcoin fluctuates in four years, first rose sharply in three years, and then recovered.

Source: bitwise asset management company. The data interval is from December 31, 2010 to December 31, 2024.

Performance information only provides reference. The income reflects the return of Bitcoin itself, not the income of any fund or account, and does not include any costs. Past performance cannot predict the future performance of any investment strategy. The length of the cycle of cryptocurrencies in the future may not be four years; the four -year increase is based on historical data to explain the purpose, not a prediction of future results. This material represents the assessment of a certain time market environment, not a prediction of future events or a guarantee of future results.

Readers who are concerned about this memo know that since mid -2022, I have been talking about the four -year cycle. At that time, Bitcoin was deeply embarrassed. My point of view was "waiting."

Sure enough, Bitcoin performed well in 2023 and 2024. According to this model, it should also perform well in 2025, which is what I expected. But investors will naturally start thinking whether the market will usher in reset in 2026.

What are the four -year cycle?

The four -year cycle of cryptocurrencies is the same as promoting a wider growth in the macroeconomic and the power of the recession cycle.

This cycle began in a catalyst -a technical breakthrough or event, which stimulated investors' interest and brought new funds to the market. For example, in 2011, the first batch of companies that allowed individuals to buy Bitcoin (such as Coinbase, MT. GOX, etc.) were established, and retail investors brought new funds into the cryptocurrency field. Before that, only computer scientists knew how to buy Bitcoin. Unsurprisingly, the price of Bitcoin rose.

Once the bull market starts, it will form its own development momentum. The price increase attracts attention, and more funds are influing. As the bull market accelerates, investors have become greedy, and leverage has begun to accumulate. Sometimes fraud occurred. In other cases, traditional infrastructure will be overwhelmed due to excessive demand. In any case, there will be problems in the end. In 2014, MT. GOX, the largest custody agency at that time, closed down; in 2018, the US SEC crashed the first token issuance (ICO).

The callback is painful, and deleveraging brings despair. But then, new breakthroughs will inevitably appear to restart this cycle.

I emphasize again: This cycle is not unique to cryptocurrencies. Some people try to associate it with Bitcoin's "halving" every four years, but these halves incidents do not match the cycle, and the minus occurs in 2016, 2020 and 2024, respectively.

This is the ancient economic cycle, but it has been amplified under the high volatility of cryptocurrencies.

Current cycle

The current cycle originated from a series of major scandal (such as FTX, Sanjian Capital, Genesis, BlockFi, CelSius, etc.) in a series of major scandals and bankruptcy events in 2022.

In BITWISE, we call this cycle "mainstream cycle". We believe that its significant feature is that mainstream investors enter the cryptocurrency field.

The catalyst that launched the current cycle appeared on March 10, 2023. At that time, GrayScale was in the legal lawsuit of the Bitcoin Exchange Trading Fund (ETF) for the US Securities and Exchange Commission (SEC). Victory. The grayscale prosecution has a "arbitrary and repeated impermanence" behavior when refusing the spot Bitcoin ETF application, and asked the court to order SEC to re -consider.

The victory of grayscale is very thorough. Although the verdict was issued in a few months, the launch of the Bitcoin ETF has been obvious from then on, and this will make cryptocurrencies go to the public. Sure enough, Bitcoin ETF was launched in January 2024, and set a record of capital inflow.

When the ash filed a lawsuit, the price of Bitcoin was $ 22,218. The price is now $ 102,674. The mainstream era has arrived.

The possibility of changing attitudes in Washington and breaking the four

-year cycle

If you follow the classic four -year cycle, 2025 will be a good year for cryptocurrencies. I also think that this is the case: we publicly predict that due to the inflow of ETF funds and the promotion of the purchase of enterprises and the government on Bitcoin, the price of Bitcoin this year will double and exceed 200,000 US dollars. This prediction may be relatively conservative.

Having said that, I still see signs of early overheating in the system. Today, a large number of companies are raising funds and debts to purchase Bitcoin. The "Bitcoin borrowing project" has increased significantly, which makes Bitcoin holders use their wealth without selling Bitcoin assets. These behaviors themselves are not fault, but they are leveraged form, and they are just the tip of the iceberg. The growth of derivatives contracts, leverage ETFs and other tools shows me that the market is beginning to really rise.

All these situations have made me think that the four -year cycle continues.

But then President Trump issued an administrative order.

Last week, President Trump issued an extremely good administrative order for the cryptocurrency field, which made me think rethinking. The administrative order lists the development of the US digital asset ecosystem as "national priority." It indicates the direction for the clear regulatory framework of cryptocurrencies, and also considers the establishment of "National cryptocurrency reserves". Coupled with the actions taken by SECs that support cryptocurrencies today, it has opened a way for large banks and investors in Wall Street and investors.

In my opinion, the launch of ETF is a major event, bringing hundreds of billions of dollars of funds for new investors to the cryptocurrency ecosystem, which is also a factor that promotes the current cycle. However, the comprehensive mainstreamization of cryptocurrencies -the kind of Trump administrative order, that is, the bank will custody of cryptocurrencies with other assets, stabilize coins into the global payment ecosystem, and large institutions establish positions in the cryptocurrency field-- I firmly believe that this will bring trillions of dollars.

My view of the future

The problem I am thinking about is that the positive impact of this administrative order and other changes in Washington will appear for several years instead of months. Under the ideal circumstances, it takes one year to formulate and implement a new cryptocurrency regulatory framework. Wall Street giants must comprehensively adapt to the possibilities brought by cryptocurrencies, and the time required is longer.

If you want to feel these influences until next year, will we really usher in a new "encrypted winter" in 2026? Even if investors know that we have entered a new world of cryptocurrencies, will they still enter the state of dormancy? If Blackrolk CEO Larry Fink is calling on Bitcoin to rise to $ 700,000. Will we really see 70% of the callback?

I guess that we have not completely got rid of the four -year cycle. With the advancement of the bull market, leverage will continue to accumulate, the market will be overheated, and those with bad actors will also appear. At a certain time, when the market is excessively expanded, significant callback may occur.

But I guess that any callback will be shorter and lighter than in the past. Why? The cryptocurrency sector has matured, and there are more types of buyers than in the past, and more investors pay attention to value. I expect to fluctuate, but I am not sure that I will be empty cryptocurrencies in 2026.

At present, everything is moving at full speed. Cryptocurrency trains have set off.

panewslab

panewslab