Changes in on-chain liquidity: 15 months of ups and downs, who still stands firm after the hype fades?

Reprinted from chaincatcher

04/17/2025·12DOriginal title:Where is Onchain Volume Rotating?

Original author: Stacy Muur

Original translation: Tim, PANews

In the past 15 months, DeFi's liquidity map has been reshaped among chains, and those projects driven by the hype craze have gradually withdrawn from the stage, and liquidity has quietly concentrated in places where fundamentals are strong rather than market speculation.

Core Insights

- DEX trading volume fell 35% in the following two months after hitting an all-time high of $380 billion in January 2025, and it can be speculated that January may form a short-term top.

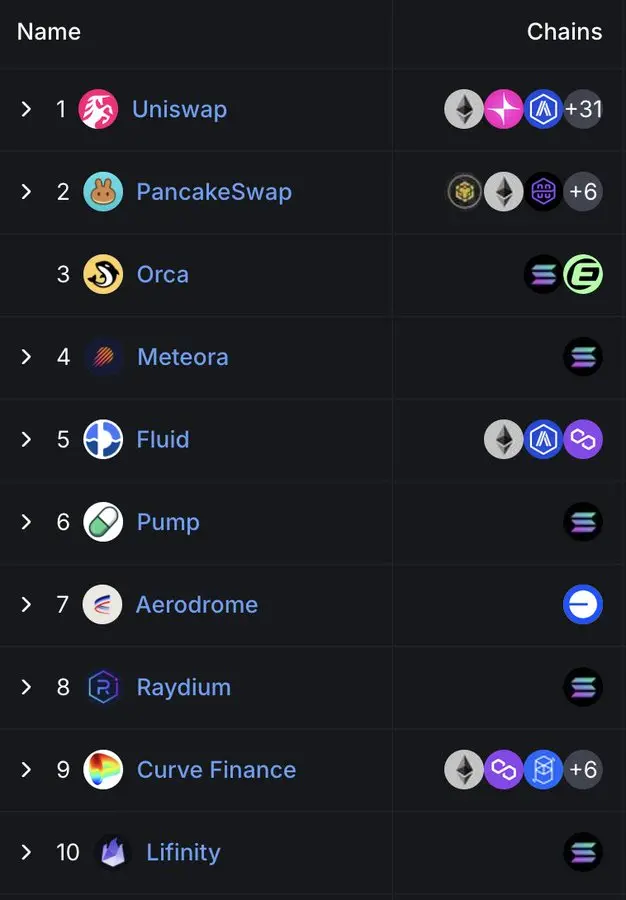

- Currently, the top ten DEXs account for nearly 80% of the total transaction volume; Uniswap and PancakeSwap alone account for about 40%.

- Solana-based DEX has quietly dominated the rankings, with five of the top 10 seats, and its market share growth is mainly driven by the transaction volume brought about by the Meme coin boom.

- Hyperliquid has completely changed the landscape of the perpetual contract field, from the rise of industry rookies to the point where it has occupied more than 60% of the market share in March 2025.

All insights in the article are based on public data. Special thanks to DefiLlama for its continued high-quality statistics.

The cycle defined by surges and slowdowns

DEX trading volumes performed strongly in March and May in early 2024 before gradually slowing down before mid-year.

The situation changed drastically in the fourth quarter, with trading volumes surged in November and December, and the momentum continued into January 2025 and reached an explosive peak of $380 billion.

However, this rebound was only a flash in the pan. By February, market trading volume had plummeted to $245 billion, and a 35% cliff-like decline came to an end to a three-month vertical soar. The decline set the tone for a more prudent second quarter.

DEX dominance: Head agreements take power

The market structure of DEX is still highly concentrated. Currently, the top ten agreements account for 79.5% of daily trading volume, while the top five alone account for 59.1%.

Uniswap and PancakeSwap account for about 40% of DEX's trading volume, making them the only two platforms with cumulative trading volumes exceeding one trillion US dollars so far. Their leading position comes from first-mover advantages, extensive support for multi-chain ecosystems, and deep liquidity.

Uniswap Labs also launched Unichain, an Ethereum layer 2 network built on Optimism Superchain. The chain is designed to enable fast, low-cost transactions through native multi-chain interoperability.

Solana's Quiet Rise

What's noticeable is that Solana's position in the DEX field is becoming increasingly prominent. Among the top ten DEXs currently ranked, there are five: Orca, Meteora, Raydium, Lifinity and Pump.fun. All are developed natively based on Solana.

Orca (8.02%) and Meteora (6.70%) alone account for about 15% of global decentralized exchange activity.

This growth stems from low GAS fees, fast block time and the Solana Meme coin boom. Pump.fun soared to the top ten, which is a clear proof of this passion.

Emerging Agreements: Fluid and Aerodrome

Fluid (7.09%) is the most capital-efficient platform among the top five DEXs. The protocol is active on Ethereum, with monthly liquidation of more than $10 billion. It was particularly eye-catching after the launch of the Arbitrum ecosystem: transaction volume surged from US$426 million in February to US$1.6 billion in March, fully demonstrating that its adoption speed is far beyond the industry average.

As a native project of Base, Aerodrome shows the continued growth of liquidity on Base L2.

Although Hyperliquid is not at the forefront of the spot market, it dominates the perpetual contract market with a market share of more than 60%.

DEX market share of each chain: easy to grow, difficult to retain

The past 15 months have clearly shown a phenomenon: Most blockchain projects can attract attention, but only a few can continue to be attractive. From January 2024 to March 2025, the market share of chain-level decentralized exchanges has changed rapidly, and only a few projects have truly user stickiness.

Solana made its biggest breakthrough. It climbed steadily in 2024, driven by the TRUMP and MELANIA Meme coin boom, and reached a market share peak of 45.8% in January 2025. However, by March, its market share was halved to 21.5%, but it still ranked first among all public chains with an average share of 25.1%.

Ethereum is the exact opposite. It started with a share of about 32% in early 2024, fell to 15.3% in January 2025, and then rebounded to 26.4% in March. Of course, even if Ethereum loses its growth momentum, its ecological resilience remains.

Base is the most stable chaser. From 3% in March 2024 to 12.4% in December, it fell back to 7.4% in March 2025, maintaining an average share of 6.6% during the period. There is no hype, only slow but sticky growth.

BNB Chain remained stable with an average share of 14.7%. There was neither a surge nor a crash, and the stable flow of retail investors was always maintained.

Arbitrum started strongly (16% share) but was weak afterwards, and it had fallen to 4.8% by January 2025, surpassed by Base and Solana.

Blast disappeared the second month after hitting a 42.3% market share peak in June 2024. This is a typical case of obvious incentive-driven transaction volume and zero user retention rate.

Summary: The DEX dominance of each public chain is highly volatile. Solana once emerged as a new force, Ethereum achieved value restoration, Base gradually expanded its ecology, and the market speculation cycle showed characteristics of ups and downs. The public chain that ultimately dominated is not the one with the most voice, but the network with the highest actual usage rate.

Centralized exchanges still dominate spot trading volume

Although DEX experienced explosive growth in early 2025, centralized exchanges still dominate the spot market. Even in January when DEX trading volume peaked, CEX still accounted for nearly 80% of the total trading volume.

Although centralized exchanges’ dominance has fallen from 90% at the beginning of 2024 to a low of 79%, the broader trend is obvious: While DEX continues to grow, CEX remains the default choice for most traders.

Perpetual Agreement Market Share

The pattern of on-chain perpetual contracts has undergone a fundamental change in 2024.

More than two years after dYdX firmly sat in the top spot in perpetual contract trading, Hyperliquid emerged and redefined what dominance is. The platform topped the list for the first time in February, but was briefly surpassed by SynFutures in the middle of the year, and then stood out after regaining the top spot in August. As of March 2025, Hyperliquid has occupied nearly 59% of the total trading volume of perpetual contracts, completely consolidating its position as the preferred platform for professional traders.

This rising momentum has attracted a lot of market attention, and its product experience is closer to a centralized exchange than any previous decentralized exchange. In contrast, dYdX's market share declined rapidly. From occupying 13.2% of the market share at the beginning of 2024, it plummeted to only 2.7% in March 2025, users have turned to faster, simpler interfaces and more modern alternative platforms.

Jupiter's perpetual contract has taken a different approach, climbing to second place with 8.8% market share with Solana's native liquidity and its spot DEX diversion effect. Although it rose rapidly, it lacked stamina and eventually came to the heperliquid. Other projects such as SynFutures, Vertex Protocol and Paradex also briefly made their mark.

Perpetual contract chain: The execution layer completes reconstruction

within one cycle

The biggest change in the field of perpetual contract infrastructure in the past year is not what protocols users prefer, but which chains they trust to execute transactions.

By March 2025, the share of perpetual contract transactions of Ethereum and Arbitrum had plummeted to 11.8%, which was in sharp contrast to the two market dominance of a total of more than 65% in January 2024. The updated and faster execution layer has dominated the market at this time.

The core force driving this transformation is the blockchain independently developed by Hyperliquid. The chain significantly increased its market share from 13.6% to 58.9% during the same period, replacing various Layer1 and Layer2 solutions that once defined industry standards in less than a year, becoming the default execution environment for perpetual contract transactions. Its advantages are not only reflected in faster trading speeds, but more importantly, it provides the reliability and low latency guarantees required by professional traders.

Solana has also experienced a strong round of gains, driven by the Jupiter and Phoenix projects at the end of 2024, and its market share once climbed to nearly 16%. But in the end, it stabilized in the 10-11% range, failing to continue the breakthrough growth momentum. Although the Base and ZKsync ecosystems have shown vitality (the peak market share reaches 6-7%), they have never been able to join the top public chains.

At the same time, Blast has become a warning case: this flash-for-money project reached 18.8% market share in June 2024, but disappeared at the same astonishing speed. In a field driven by product quality and user retention, simple hype will never last long. The new industry implementation standard has been clarified: performance-centric public chains redefine the competitive benchmark, and traditional infrastructure no longer occupies the default dominance.

The future of DeFi does not lie in multi-chain expansion, but in protocols that can transform industry narratives into user habits.

jinse

jinse

panewslab

panewslab