CoinGecko: Crypto Industry Annual Report 2024

Reprinted from panewslab

01/20/2025·3MAuthor: CoinGecko

Compiled by: Vernacular Blockchain

Bitcoin’s fourth halving in 2024 marks the beginning of the cryptocurrency market’s fourth bull run, albeit not in the way many expected. Market momentum, on the 15th anniversary of Bitcoin, has been significantly driven by macroeconomic policy changes, including the approval of U.S. spot ETFs, central bank interest rate cuts, and the re-election of Donald Trump. The changes have brought cryptocurrencies back into the mainstream spotlight following the FTX crash, with ETFs providing new channels for capital inflows. Bitcoin hit an all-time high of $108,135 on December 17, pushing the total cryptocurrency market capitalization to a new record of $3.91 trillion.

Our annual crypto industry report for 2024 covers analysis from the crypto market landscape to Bitcoin and Ethereum, delves into the decentralized finance (DeFi) and non-fungible token (NFT) ecosystem, and reviews centralization Performance of trading platforms (CEX) and decentralized exchanges (DEX).

We have summarized the main seven highlights, and you can read the full 53-page report if you want:

-

In the fourth quarter of 2024, the total market value of the cryptocurrency market increased by 45.7%, ending at $3.91 trillion, a year-on-year increase of 97.7%.

-

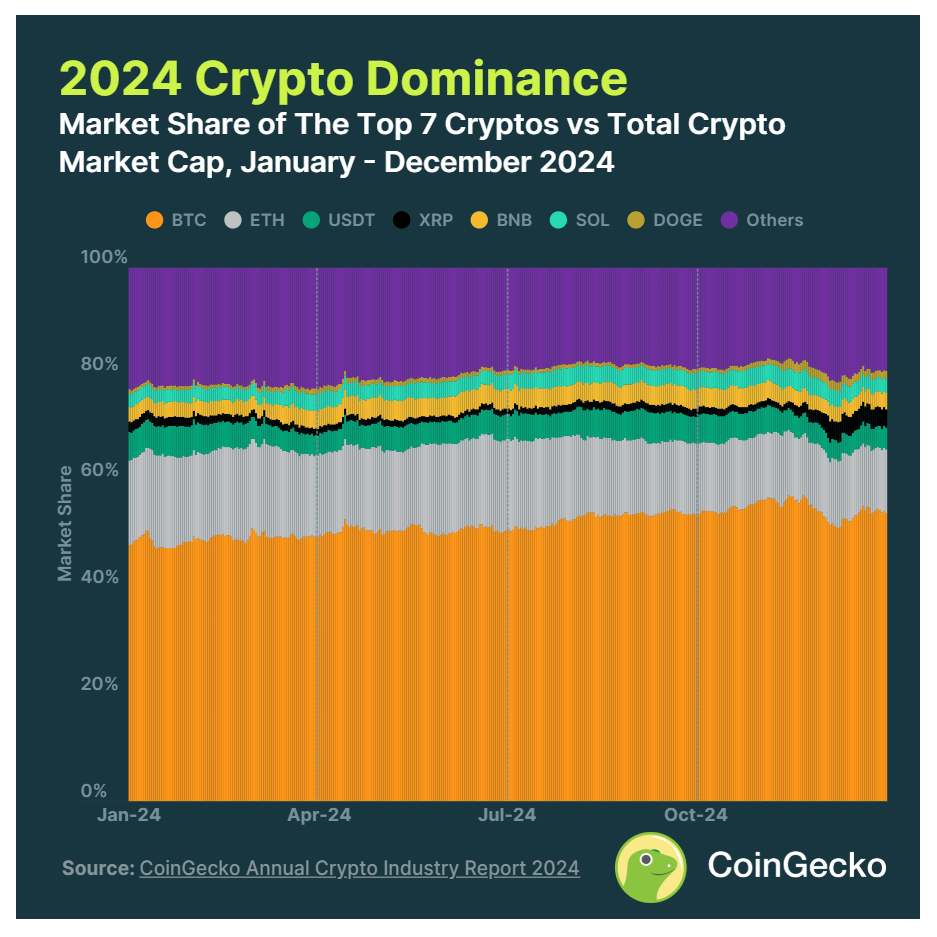

Bitcoin has increased its market dominance and currently accounts for 53.6% of the total crypto market capitalization.

-

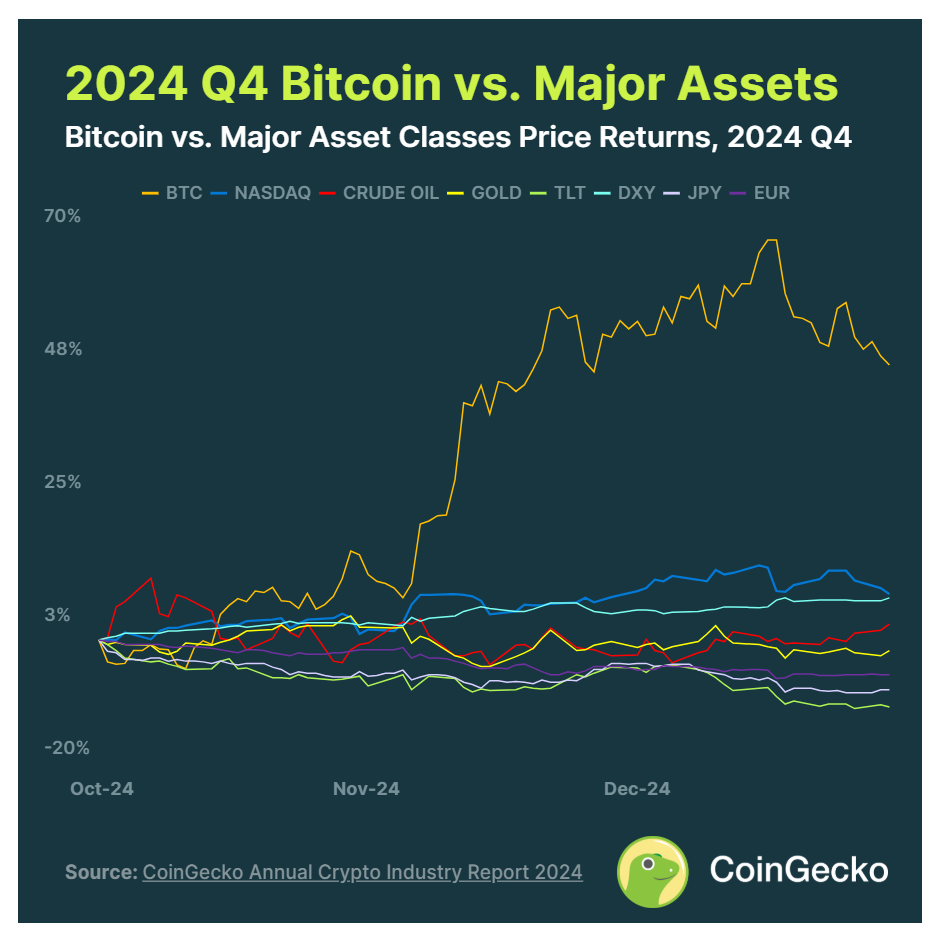

Bitcoin outperformed major asset classes throughout 2024 and in Q4.

-

The market value of AI agents increased by 322.2% in the fourth quarter of 2024, from US$4.8 billion to US$15.4 billion.

-

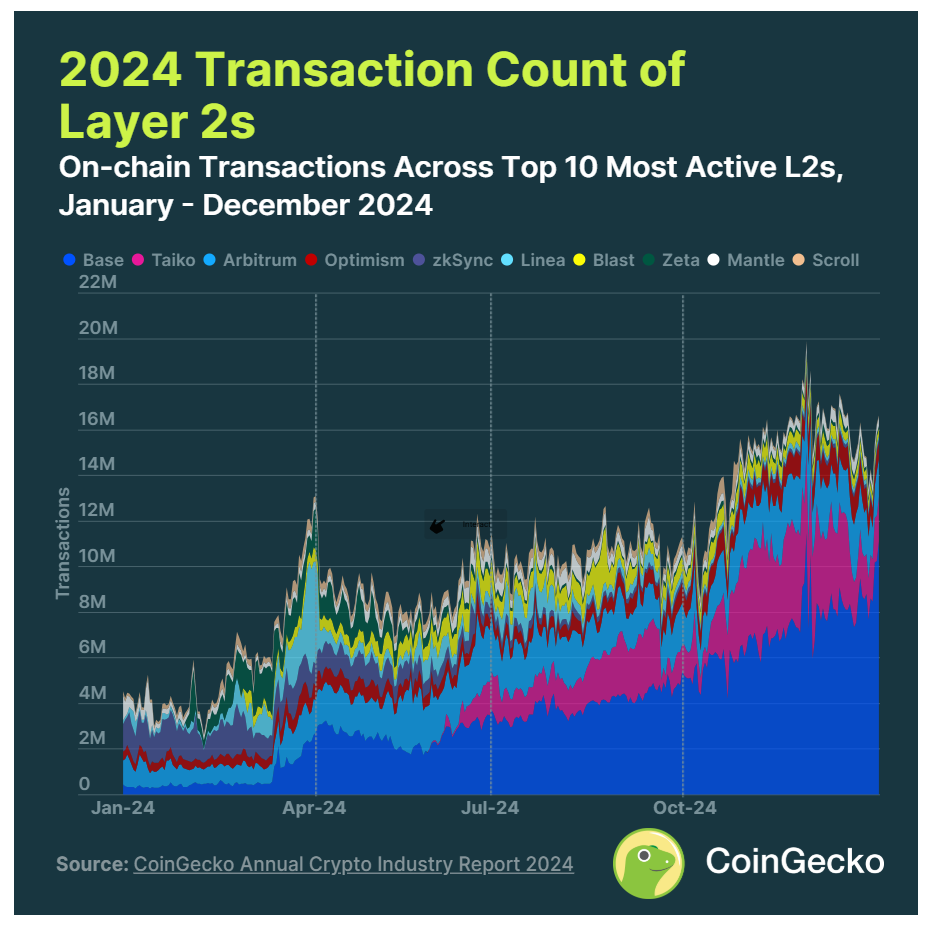

In the fourth quarter of 2024, the transaction volume of the top ten Ethereum Layer 2 increased by 48.3%, of which Base accounted for 48.3% of the transaction volume.

-

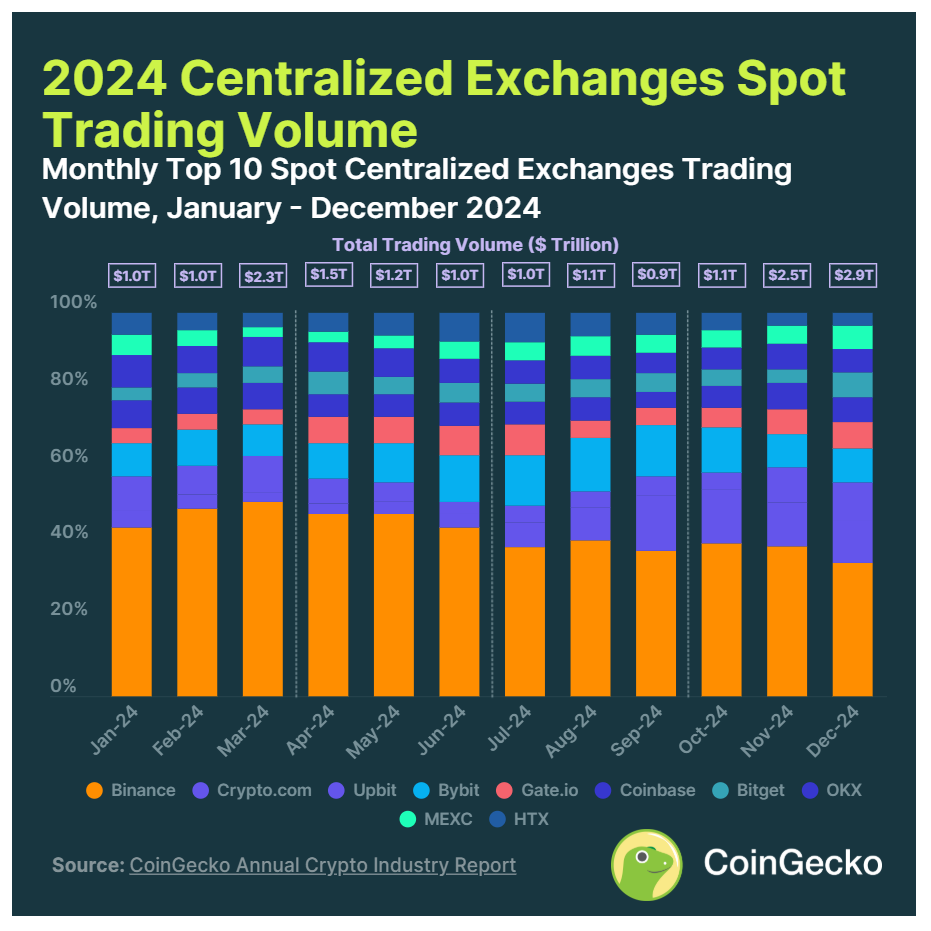

In the fourth quarter of 2024, the spot trading volume of centralized trading platforms reached US$6.45 trillion, a quarter-on-quarter increase of 111.7%, setting a new historical record.

-

In the fourth quarter of 2024, Solana surpassed Ethereum and became the dominant chain in DEX transactions, accounting for more than 30% of all DEX transactions.

1. In the fourth quarter of 2024, the total market value of the

cryptocurrency market increased by 45.7%, ending at US$3.91 trillion.

In the fourth quarter of 2024, the total market value of the cryptocurrency market increased by 45.7% (or $1.07 trillion), finally closing at $3.40 trillion. Although the market lost some momentum in the third quarter, after a brief bottoming, the market rebounded in the middle of the fourth quarter, especially after Donald Trump won the US presidential election.

In 2024, the total cryptocurrency market capitalization almost doubled, growing by 97.7%. Its market value reached an all-time high of $3.91 trillion in mid-December, before falling back to $3.40 trillion. Meanwhile, the average transaction volume in the fourth quarter of 2024 was US$200.7 billion, an increase of 128.2% from US$88 billion in the third quarter.

2. Bitcoin’s market share has increased, currently accounting for 53.6%

of the total market value of the cryptocurrency market.

Bitcoin’s (BTC) market share continues to climb, albeit at a slower pace, growing by 0.9% in the fourth quarter of 2024. During this quarter, XRP performed most prominently, with its market share rising to 3.5% (an increase of 2.0%). This allowed XRP to jump from 7th to 4th position, surpassing BNB and Solana (SOL).

In addition, Dogecoin (DOGE) has become the top 7 new currencies by market capitalization, replacing USDC. This is the first time since April 2021 that USDC has failed to enter the top 7. Meanwhile, Ethereum (ETH) continued its decline in the fourth quarter, with its market share falling to 11.8% from 13.4% in the third quarter, reaching its lowest level since April 2021.

3. Bitcoin will outperform major asset classes in 2024 overall and in Q4

Q4 2024 was a milestone quarter for Bitcoin (BTC) as it surpassed the $100,000 mark for the first time and reached a high of $108,135 on December 9 before retreating slightly to end the year at $93,508. This means Bitcoin is up +121.5% year-to-date.

Bitcoin’s rise began with a low of $54,000 in the third quarter, but the price saw another significant surge following Donald Trump’s victory in the U.S. presidential election. This upward momentum has also been supported by the U.S. Federal Reserve's interest rate cuts, and the market generally expects that monetary easing policy will continue to be implemented in 2025.

Meanwhile, average daily trading volume soared to $62.6 billion in the fourth quarter from $31.1 billion in the third quarter, a quarter-on-quarter increase of +101.3%. On December 6, when Bitcoin exceeded $100,000, spot trading volume exceeded $190 billion, setting a new yearly high.

Equity markets also had a strong fourth quarter, with the Nasdaq up +8.0% and the S&P 500 up +3.0%. Meanwhile, the U.S. Dollar Index (DXY) also performed well, rising by +7.0%, mainly driven by the depreciation of other major currencies. The Japanese yen (JPY) had its worst performance in the fourth quarter, falling -8.0%, almost erasing gains from the end of the yen carry trade.

4. The market value of AI agents increased by +322.2% in the fourth

quarter of 2024, from US$4.8 billion to US$15.5 billion.

AI agents as a category rose rapidly after GOAT was launched on Solana in early October. Although Terminal of Truths pioneered the AI agent KOL in the X prototype, this narrative trend has mostly faded. However, the category’s market cap growth in Q4 2024 was astonishing, growing by +322.2% from $4.8 billion to $15.5 billion.

Currently, the Solana and Base blockchains are the only places where there are significant AI agents. At the end of 2024, Base Blockchain significantly captured the market share of Solana and GOAT through projects such as AIXBT and Virtuals Protocol (VIRTUAL). However, Solana has begun to regain some market share after launching GRIFFAIN and AI Rig Complex (ARC) in late December.

5. In the fourth quarter of 2024, the transaction volume on the top 10

Ethereum Layer 2 increased by +48.3%, of which the Base blockchain accounted for 48.3% of the transaction share

Ethereum Layer 2 continued to grow in the fourth quarter of 2024, with the average daily transaction volume of the top 10 Layer 2 reaching 15 million. The increase in transaction volume was mainly driven by Base, which had an average daily transaction volume of 7.2 million in the fourth quarter, an increase of +78.7% from 4 million in the third quarter. By comparison, the Ethereum mainnet processed an average of approximately 1.2 million daily transactions in the fourth quarter. In the fourth quarter, 48.3% of the top 10 Layer 2 transactions occurred on Base.

Meanwhile, Taiko became the second most active Layer 2, surpassing Arbitrum, with Taiko accounting for 20.6% of transaction shares in the fourth quarter, ahead of Arbitrum’s 13.7%. Taiko’s trading volume increased by +85.5% month-on-month, while Arbitrum only increased by +14.0%. Taiko’s significant growth can be attributed to the launch of multiple DeFi protocols on this relatively new chain.

6. In the fourth quarter of 2024, the spot trading volume of centralized

trading platforms reached US$6.45 trillion, a quarter-on-quarter increase of +111.7%, setting a new high.

In the fourth quarter of 2024, the spot trading volume of the top 10 centralized exchanges (CEX) reached US$6.5 trillion, a quarter-on-quarter increase of +111.7%.

This is the first time that quarterly transaction volume has exceeded the $6 trillion mark. The top 10 CEX’s total trading volume will be $17.4 trillion in 2024, compared with $7.2 trillion in 2023.

BN continues to maintain its dominance, ending December with a 34.7% market share among the top 10 CEXs. Notably, BN’s trading volume crossed the $1 trillion mark in December, reaching this milestone for the second time in 2024.

Upbit was the fastest-growing CEX in the fourth quarter, with its trading volume increasing from $135.5 billion to $561.9 billion, a quarter-on-quarter increase of +314.8%. As South Korea declared martial law on December 3, Upbit’s trading volume increased dramatically. During this tumultuous period, average daily trading volume reached approximately $21 billion, six times its average daily trading volume.

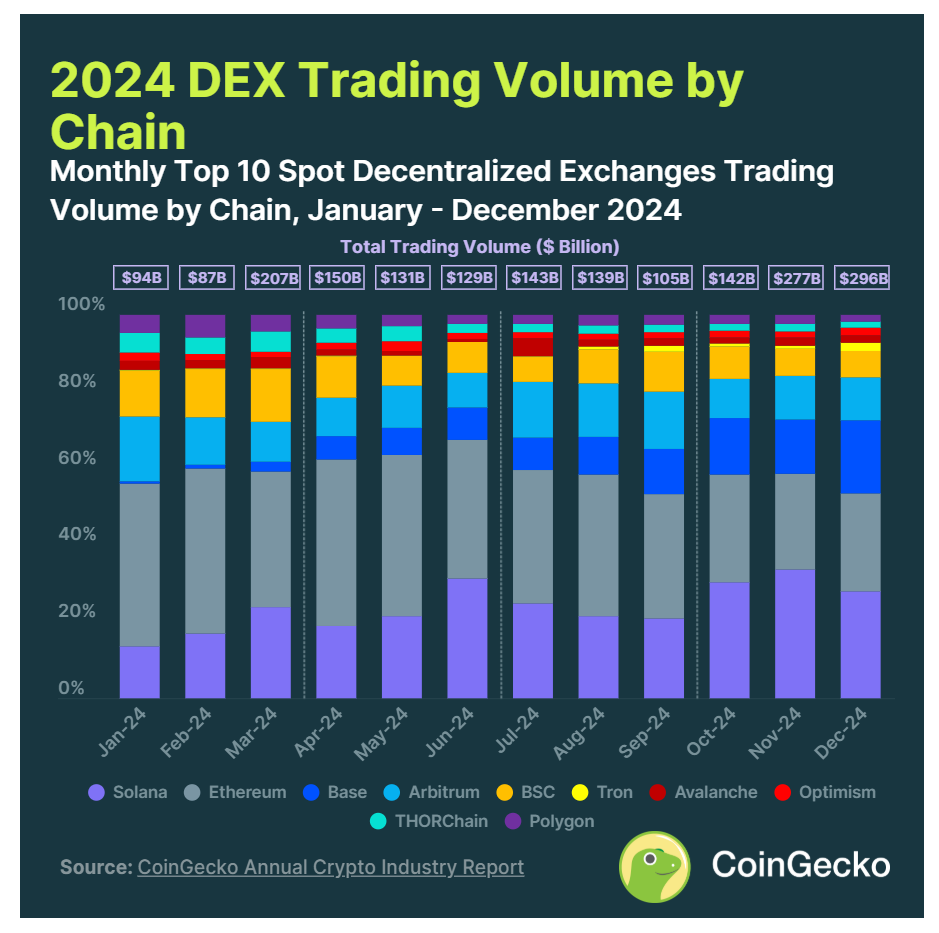

7. Solana surpassed Ethereum and became the dominant chain for

decentralized exchange platform (DEX) transactions in the fourth quarter of 2024, accounting for more than 30% of all transactions.

In the fourth quarter of 2024, Solana became the dominant chain in decentralized exchange (DEX) trading, with its market share exceeding 30%. In the fourth quarter, Solana’s transaction volume reached $219.2 billion, a quarter-on-quarter increase of +152.0%. In comparison, Ethereum has a transaction volume of $184.3 billion and its market share ranges from 25% to 28%. Despite this, Ethereum still leads Solana on an annual basis, accounting for 33.5% of DEX trading volume, while Solana’s market share is 25.2%.

At the same time, Base successfully surpassed Arbitrum in the fourth quarter and firmly maintained its leading position. Its market share exceeded 14% in the fourth quarter, while Arbitrum's market share remained between 10% and 11%. Layer 2, backed by Coinbase, reached 19.0% market share in December, up +206.5% month-on-month. Base’s trading volume is $116.7 billion, while Arbitrum’s is $79.2 billion.

Tron is the fastest growing chain among the top ten chains, with a month-on-month growth of +232.7%. Its transaction volume increased from $2.9 billion in the third quarter to $9.6 billion in the fourth quarter. In December 2024, Tron’s market share was 2.1%, making it the sixth largest chain.