Cryptocurrency Industry Report for the First Quarter of 2025: DeFi and NFT Ecological Trends, CEX and DEX Market Performance

Reprinted from panewslab

04/17/2025·2DAuthor: CoinGecko

Translated by: Shan Oppa, Golden Finance

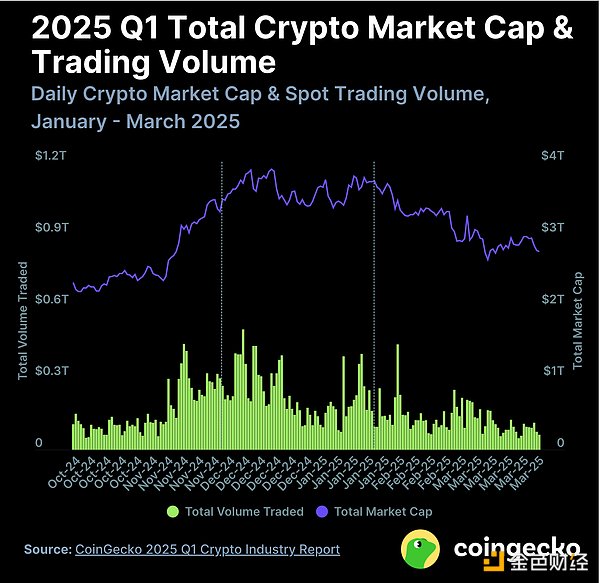

At the beginning of 2025, the cryptocurrency market suffered setbacks, in stark contrast to the fanatical highs at the end of 2024. The total market value of cryptocurrencies fell -18.6% in the first quarter to close at $2.8 trillion, after briefly hitting $3.8 trillion on January 18 — just before Donald Trump’s inauguration. Along with the decline was a decrease in investor activity, with quarterly average daily trading volume plummeting -27.3% to $146 billion.

Bitcoin strengthened its dominance at a time of market downturn, reaching 59.1% at the end of the first quarter – the highest level since the beginning of 2021 – as altcoins bear the brunt of the decline. Although Bitcoin hit an all-time high of $106,182 in January, it had fallen back to $82,514 by the end of the quarter, a drop of -11.8%.

Our comprehensive Cryptocurrency Industry Report for the First Quarter 2025 covers a comprehensive cryptocurrency market profile to analyzing Bitcoin and Ethereum, delving into the decentralized finance (DeFi) and non-fungible tokens (NFT) ecosystems, and reviewing the performance of centralized exchanges (CEX) and decentralized exchanges (DEX).

Eight highlights of CoinGecko's "Cryptocurrency Industry Report for the

First Quarter of 2025"

- The total market value of cryptocurrencies fell -18.6% in the first quarter of 2025, after hitting a year-to-date high of $3.8 trillion

- Bitcoin’s dominance has increased, currently accounting for 59.1% of the total market capitalization of cryptocurrencies

- Bitcoin fell -11.8% in the first quarter of 2025, underperforming gold and U.S. Treasury bonds

- Ethereum price plummeted from $3,336 to $1,805 in the first quarter of 2025, erasing all gains in 2024

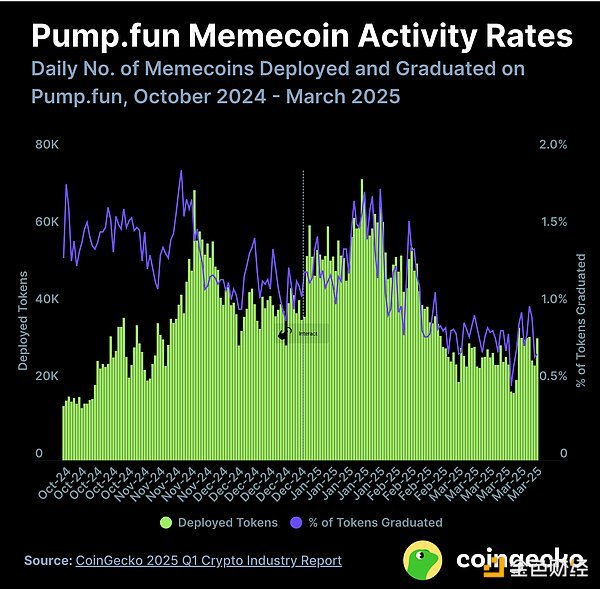

- After the Libra incident, Meme coins plummeted, and the number of tokens deployed on Pump.fun dropped sharply -56.3%

- In the first quarter of 2025, the spot trading volume of centralized exchanges reached US$5.4 trillion, a month-on-month decrease of -16.3%

- Solana continues its dominance in on-chain spot decentralized exchange trading since the end of 2024, accounting for 39.6% of all transactions in the first quarter of 2025

- In the first quarter of 2025, the total TVL of Multichain DeFi evaporated by US$48.9 billion, a decrease of -27.5%.

1. The total market value of cryptocurrencies fell -18.6% in the first

quarter of 2025, after hitting a year-to-date high of $3.8 trillion

The total market value of cryptocurrencies fell -18.6% ($633.5 billion) and closed at $2.8 trillion at the end of the first quarter of 2025. The market hit a local high of $3.8 trillion on January 18, two days before Donald Trump's inauguration. However, the market has been on a downward trend for the rest of the quarter.

Meanwhile, the average daily trading volume in the first quarter also fell sharply, down -27.3% month-on-month to $146 billion. Trading volume in the fourth quarter of 2024 was US$200.7 billion.

2. Bitcoin’s dominance has increased, currently accounting for 59.1% of

the total market value of cryptocurrencies

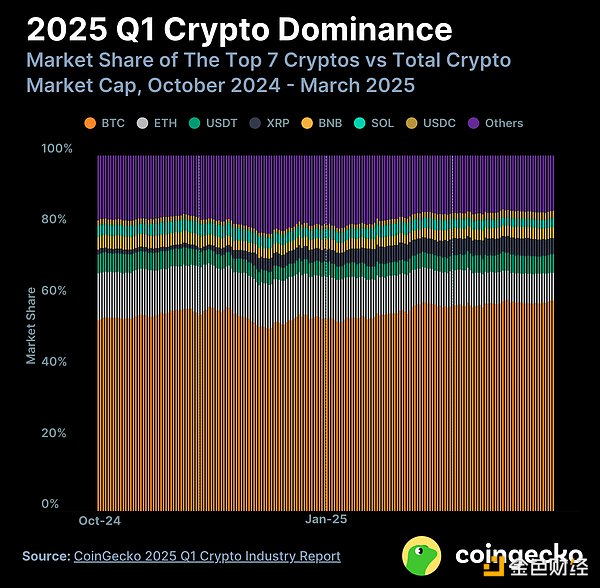

Bitcoin (BTC) dominance continues to climb, up 4.6 percentage points in the first quarter of 2025. Bitcoin dominated at 59.1% at the end of the quarter in a downward trend in the fight against altcoins. This is the highest level since the first quarter of 2021.

Stablecoins also benefited from market declines as investors flocked to stability. Tether (USDT) rose slightly to 5.2%, while USDC regained seventh place, replacing Dogecoin (DOGE).

Ethereum (ETH) fell sharply by -3.9 percentage points in the first quarter, with a dominance of 7.9%, the lowest level since the end of 2019. The "other" currencies have a small decline, down -3.5 percentage points, accounting for 15.7% of the market share. Among the major currencies, only XRP and BNB managed to maintain their market share.

3. Bitcoin fell -11.8% in the first quarter of 2025, underperforming

gold and U.S. Treasury bonds

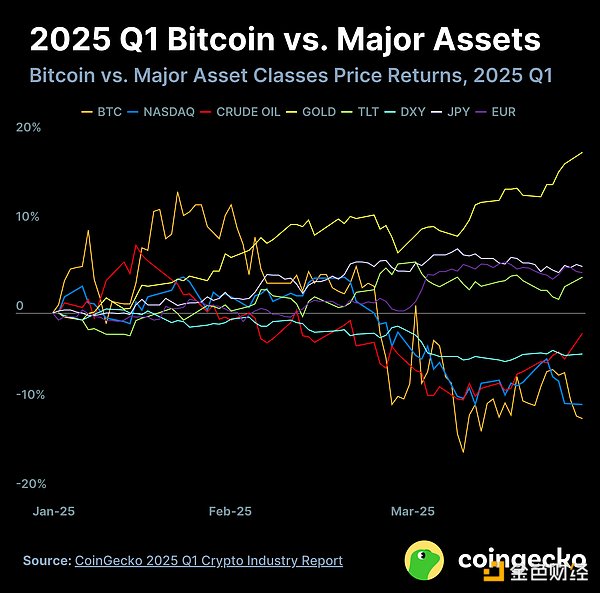

Bitcoin (BTC) rebounded at the beginning of the year and hit a slightly new all-time high on January 22, 2025, reaching $106,182. This is two days after Trump's inauguration, marking the highest point of Bitcoin year-to-date, followed by a downward trend, falling -11.8% at the end of the first quarter to close at $82,514.

In this turbulent and uncertain quarter, gold (+18.0%) became the strongest-performing asset class in the first quarter of 2025. Along with Bitcoin, risky assets such as Nasdaq and S&P 500 also fell, down -10.3% and -4.4% respectively.

The dollar index (DXY), which is usually negatively associated with risky assets, fell -4.6%, which may be due to uncertainty about U.S. tariffs. The yen (+5.2%) and the euro (+4.5%) strengthened against the dollar, at least in part because of further closing positions in the yen arbitrage trading after the Bank of Japan raised interest rates in January.

4. Ethereum price plummeted from $3,336 to $1,805 in the first quarter

of 2025, erasing all gains in 2024

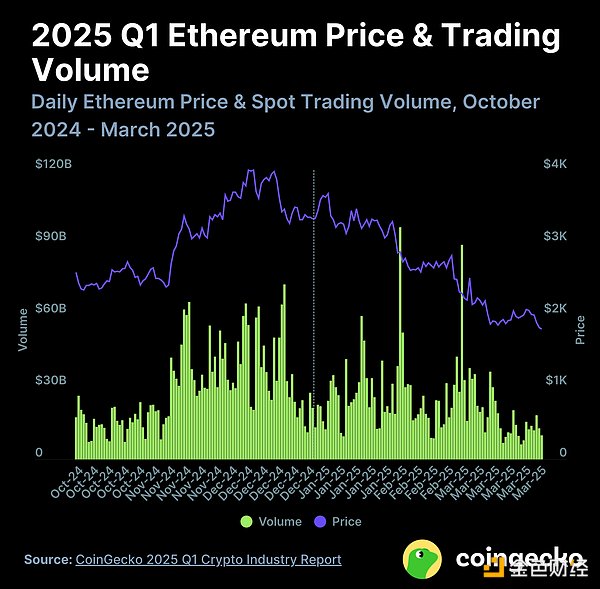

Ethereum (ETH) closed at $1,805 at the end of the first quarter of 2025, down -45.3% in the quarter, after reaching $3,336. It has wiped out all gains in 2024 and returned to 2023 levels. Its performance is far inferior to major currencies such as Bitcoin, Solana, XRP and BNB, which have seen much smaller declines.

Trading volume also declined in the first quarter, from an average of $30 billion in the fourth quarter of 2024 to $24.4 billion in the current quarter. Days of soaring transaction volumes are often accompanied by plunges in Ethereum prices.

5. After the Libra incident, Meme coins plummeted, and the number of

tokens deployed on Pump.fun dropped sharply -56.3%

Before Trump's inauguration, the sudden release of his official TRUMP Meme coins and the soon-to-be-launched MELANIA triggered a wave of Meme coins and pushed the number of tokens deployed on Pump.fun to an all-time high of 72,000.

This has spawned the trend of "political Meme coins", with dozens of tokens related to politicians and countries being launched one after another. However, this trend came to an abrupt end with the launch of LIBRA, which Argentine President Javier Mile. Shortly after his tweet, the token's price plummeted as developers conducted Rug Pull, causing its market cap to plummet from its peak of $4.6 billion to $221 million in just a few hours.

Since then, activity on Pump.fun has dropped significantly, with the number of tokens deployed daily dropping by more than -56.3% from its peak in January to 31,000 at the end of the first quarter of 2025. The ratio of “graduate” tokens also fell from 1.4% in January to 0.7% at the end of the quarter.

6. In the first quarter of 2025, the spot trading volume of centralized

exchanges reached US$5.4 trillion, a month-on-month decrease of -16.3%

In the first quarter of 2025, the spot trading volume of the top 10 centralized exchanges (CEXs) was US$5.4 trillion, a month-on-month decrease of -16.3%.

Binance remains the dominant spot CEX with a market share of 40.7% in March. Its market share continued to rise this quarter. However, its trading volume plummeted to $588.7 billion in March, after breaking the $1 trillion mark in December.

HTX is the only exchange among the top 10 exchanges to achieve growth in the first quarter, with trading volume increasing by +11.4%. Other top 10 CEXs fell between 1.8% and 34.0%. Upbit has the biggest drop, with trading volume plummeting -34.0% from $561.9 billion in the fourth quarter of 2024 to $371 billion in the first quarter of 2025.

After being hit by major hackers in February, Bybit's monthly decline was the biggest month-on-month, falling from $178.2 billion to $84.7 billion, a drop of -52.4%.

7. Solana continues its dominance in on-chain spot decentralized

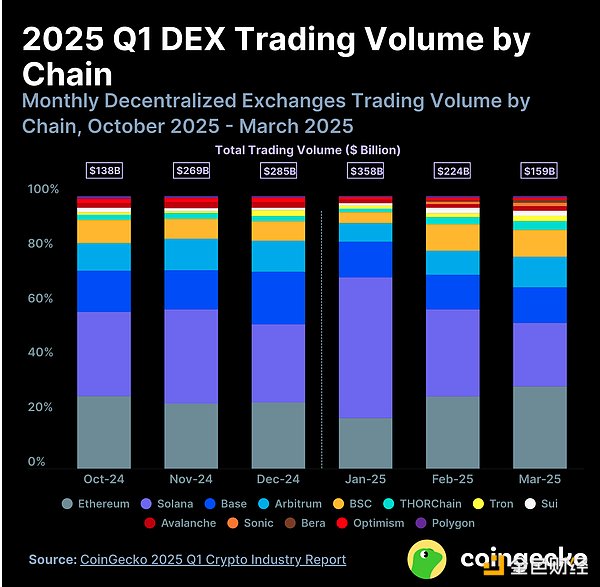

exchange trading since the end of 2024, accounting for 39.6% of all transactions in the first quarter of 2025

Continuing the trend at the end of 2024, Solana continues to dominate the DEX trading, with market share reaching 52% in January 2025; newcomers Sonic and Bera are emerging.

Solana is the main chain of DEX trading in the first quarter of 2025, with a quarterly market share of 39.6%. It grew by +35.3%, from $217 billion in the fourth quarter to $293.7 billion in the first quarter.

In January, Solana accounted for 52% of the top 12 blockchain transactions, driven by a craze for “political Meme Coin” led by $TRUMP. Its transaction volume exceeded US$184.8 billion, setting a record high for the chain. This caused Ethereum's market share to fall below 20% for the first time.

However, as the Meme coin trend faded, Ethereum successfully regained the top spot in March with a market share of 30.1%, while Solana had 23.4%.

Optimism and Polygon were squeezed out of the top 10 by newcomers Sonic and Berachain in March. However, both chains remain ahead for the whole quarter.

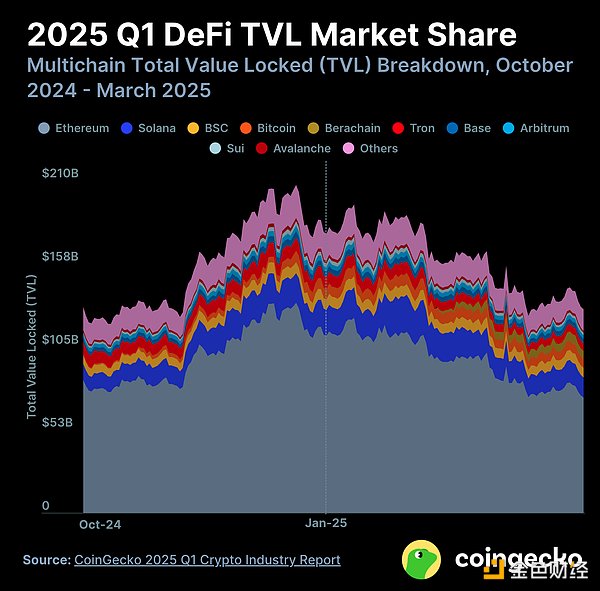

8. In the first quarter of 2025, the total TVL of Multichain DeFi

evaporated by US$48.9 billion, a decrease of -27.5%.

The total lock-in value of Multichain DeFi (TVL) was downward in the first quarter of 2025, down -27.5%, from $177.4 billion at the end of 2024 to $128.6 billion at the end of March 2025. This is mainly due to the substantial depreciation of the altcoin value.

Ethereum in particular lost a large portion of TVL, with its dominance falling from 63.5% at the beginning of 2025 to 56.6% at the end of the first quarter. Its TVL fell 35.4%, from $112.6 billion to $72.7 billion.

Solana and Base's TVL also fell sharply, down by -23.5% and -15.3%, respectively, but this was mainly due to the sharp drop in prices of SOL and ETH. Despite this, TVL dominance in both networks has risen slightly.

Launched on February 6, Berachain, which grew rapidly to $5.2 billion at the end of the first quarter of 2025, currently has the sixth largest TVL share. Its Boyco pre-deposit vault alone attracted about $2.3 billion in funding, thus improving its first-day liquidity.

jinse

jinse