Current status of digital trading robots: Solana is still on the main battlefield, and the rookies surpass the old ones in multiple scenarios

Reprinted from panewslab

04/11/2025·18DAuthor: Nancy, PANews

As more participants move from off-chain to the on-chain world, transactions enter a higher-dimensional game stage. Trading Bots once became the core weapon of traders for a time, especially in the MEME boom, thanks to its ability to quickly snipe new coins, automated trading and high-frequency arbitrage. However, as market sentiment gradually cools down, the on-chain ecosystem has entered a cooling period, and the trading volume and returns of trading robots have experienced a cliff-like decline, and are forced to usher in a new round of adaptation and transformation. At the same time, trading robots are becoming increasingly "inverted", and the original simple high-speed buying strategy is gradually failing, replaced by more complex function expansion, more flexible trading strategies and higher standards of security capabilities.

Solana still occupies the main battlefield , **Axiom

surpasses the old leader**

The market size of trading robots fluctuates with the fluctuations in the ecological popularity on the chain. In the past two months, despite a sharp decline, Solana has quickly achieved a strong rebound, fully demonstrating its ecological resilience and resilience. In this drastic change, the competitive landscape of the Solana trading robot market is accelerating its reshaping, the share of leading players has shrunk, emerging forces are rapidly rising, and a game around market dominance has quietly begun.

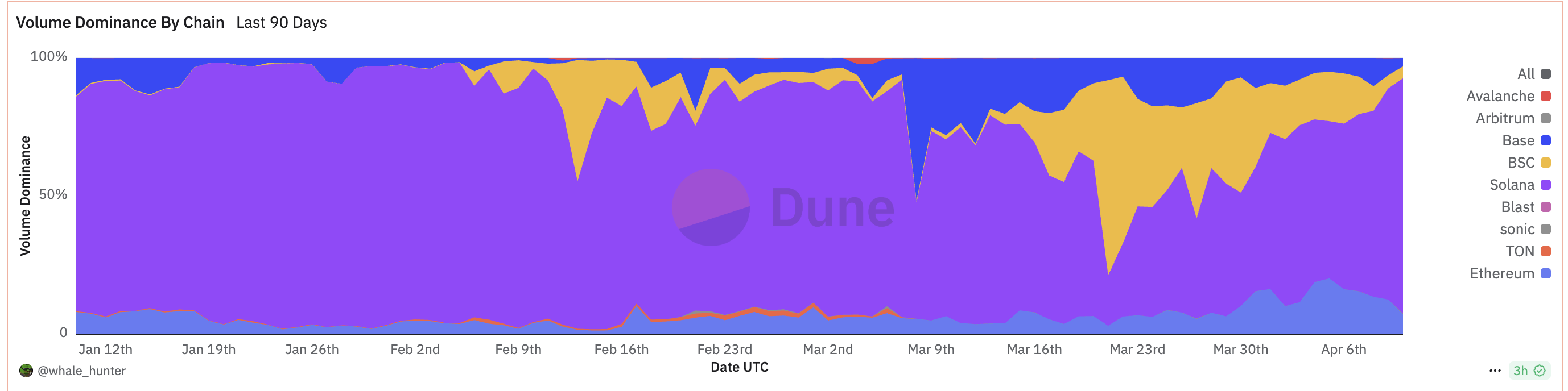

According to Dune data, the market share of trading robots on Solana has experienced significant fluctuations in the past two months, falling sharply from the peak of 91.8% to the lowest trough of 18.2%. As of April 10, this proportion has rebounded to 85.1%, reestablishing its absolute dominance in the trading robot market. However, during this period, the transaction volume of Base and BSC on-chain trading robots briefly exceeded that of Solana. Especially in late March, BSC's share soared to 70.7%, while Solana fell to only 18.2%.

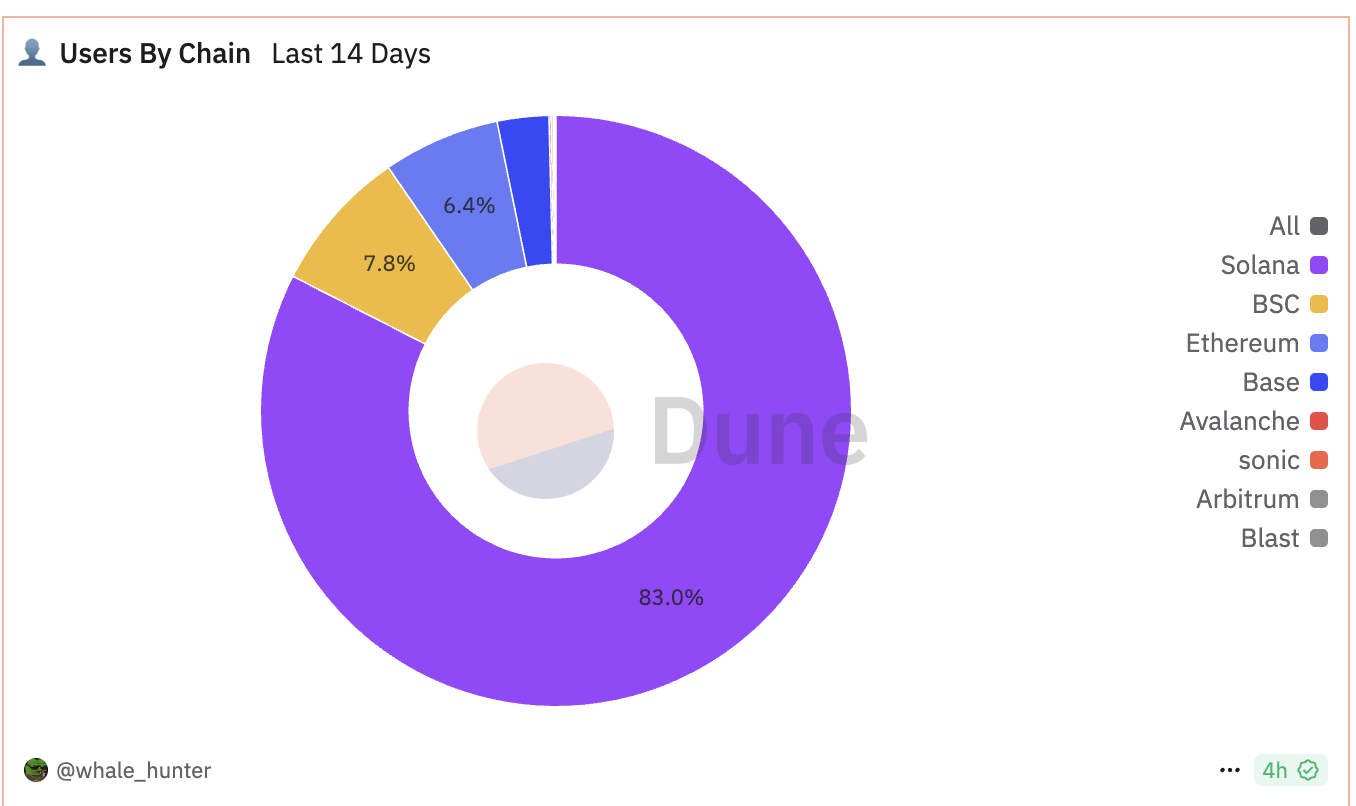

In terms of user scale, Dune data shows that as of April 10, the number of users of trading robots on Solana far exceeded BSC and Ethereum, with a total of more than 202,000 users, accounting for 83% of the total, highlighting its absolute advantageous user base.

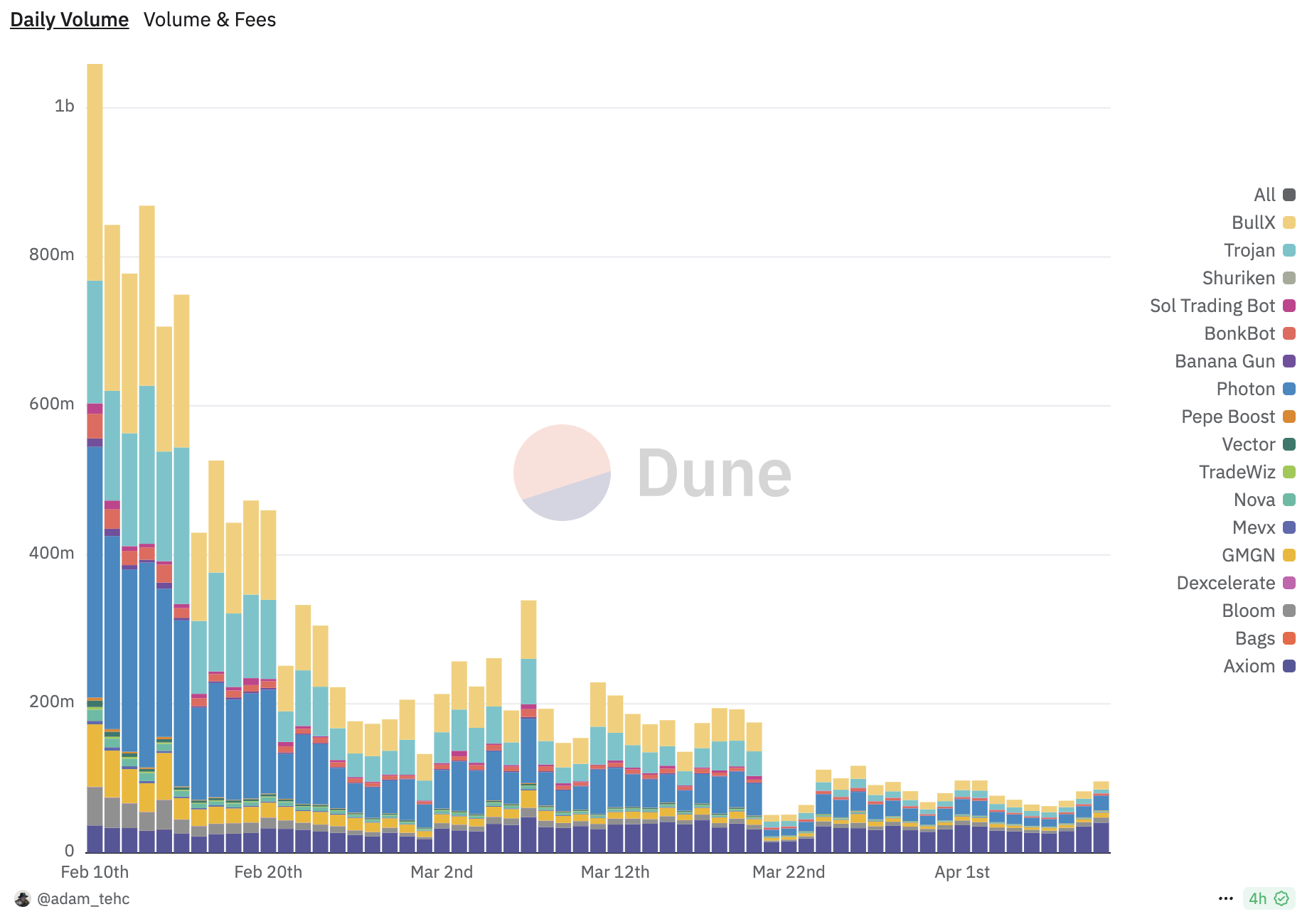

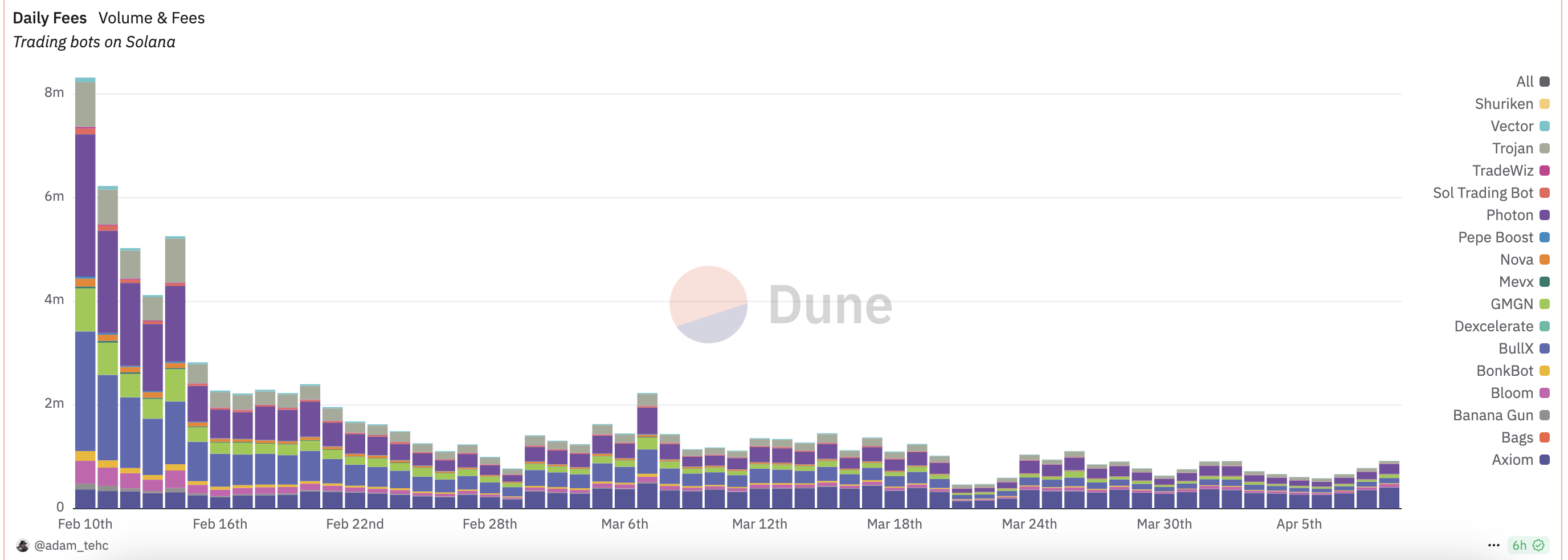

Specifically, the trading volume of trading robots on Solana has shown a significant downward trend. Dune data shows that the transaction volume of these trading robots has dropped from nearly $1.06 billion to about $96 million in the past two months, a drop of 90.7%. Meanwhile, daily income also fell about 88.9% to $922,000 during this period.

Changes in the degree of on-chain participation have also accelerated the reshaping of the market structure of trading robots. Veterans are stalling and emerging forces are rising rapidly.

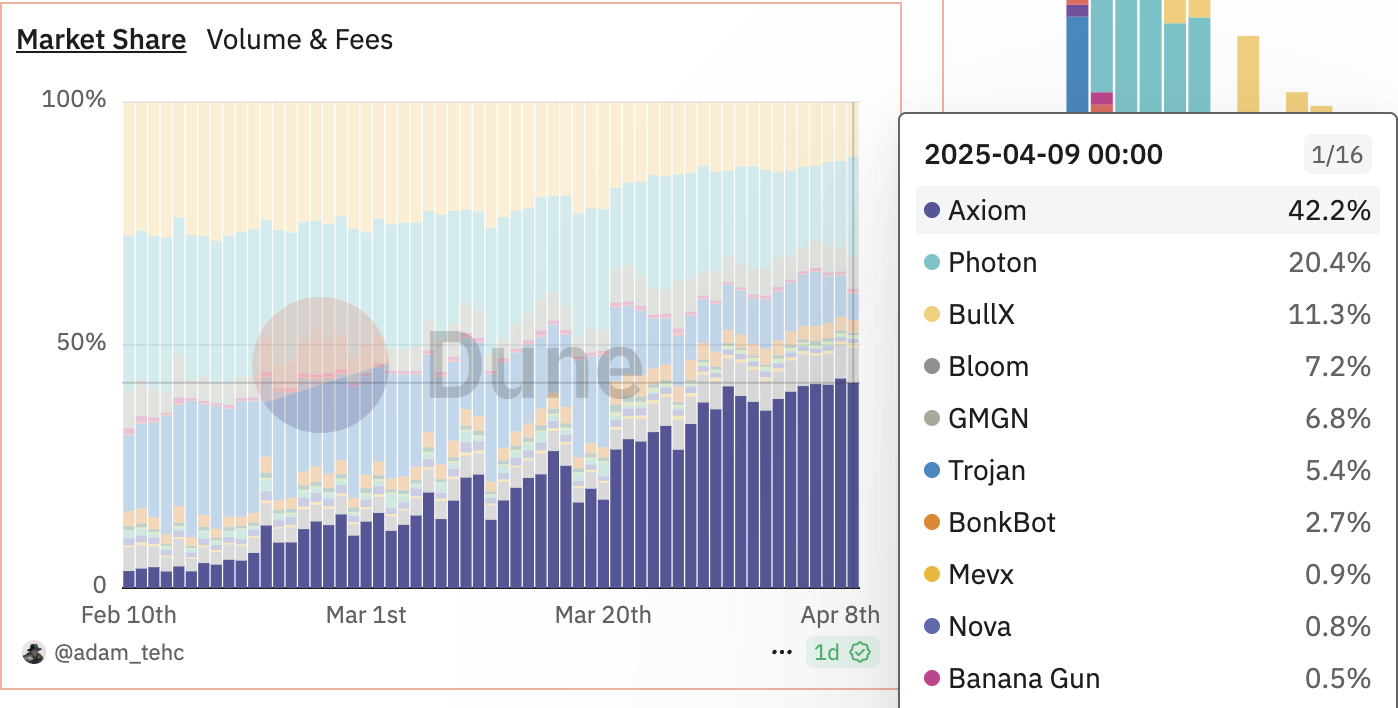

Dune data shows that among the 17 Solana trading robots, the top three transaction volumes are: Photon ranked first with US$3.96 billion; BullX follows closely with US$3.59 billion; Trojan ranked third with US$2.82 billion. However, the market share of leading trading robots has shrunk significantly during this period. Dune data shows that in the past two months, Photon's market share has shrunk from the original 31.8% to 20.4%, a drop of about 35.85%; BullX has dropped from 27.5% to 11.3%; Trojan, which was originally ranked third, further fell to 5.4%.

It is worth noting that the emerging trading robot Axiom has shown strong growth momentum, with its market share rising against the trend from the initial 3.5% to 42.2% in just two months, jumping to the top as of April 9. Judging from the growth momentum, Axiom's dominance in the Solana ecosystem is rapidly expanding. Taking the data on April 9 as an example, Axiom's daily trading volume accounts for nearly 42.2%, while daily revenue accounts for about 44.2%.

**From trading functions to user experience, trading robots are welcomed

to** upgrade in multiple scenarios

With the popularization of the "coin grab" strategy, trading robots have become an important tool for traders to seize the initiative and capture market opportunities. However, in the context of increasingly fierce market competition and increasingly complex on-chain ecology, traders not only need to execute quickly, but also need precise market insights and higher asset security.

By sorting out the latest market trends of the five leading trading machines in the Solana ecosystem (Axiom, Photon, BullX, Trojan and GMGN), PANews found that these platforms are constantly improving their ecological layout through multi-dimensional function iteration and upgrading, full-scene coverage and security enhancement, and meeting traders' diversified needs for speed, insight and asset security.

Axiom

Axiom is incubated by Y Combinator and has rapidly expanded its market size in the past month. Axiom's function has many highlights: (1) Automation tools: For example, one-click sniping can support users to quickly participate in the issuance of new currency, copy transactions, allow users to follow the strategies of senior traders to conduct automated trading, advanced strategies support setting dynamic take-profit and stop-loss, condition orders and other complex trading logics and automatically execute them by the platform; (2) Data analysis tools: For example, professional trading indicators can track large wallets in real time, capital flow and smart money dynamics, InsightX bubble chart can intuitively display token popularity, trading volume and community activity, integrate X to capture project dynamics, KOL views and market sentiment in real time; (3) Diverse financial tools: Axiom integrates HyperLiquid perpetual contracts, Marginfi financial management, etc. to meet different risk preferences; (4) User asset security: Axiom provides unmanaged wallets, integrated Coinbase, etc. to support up to $500 per week for free KYC purchases, effectively reduces jump-offs and sandwich attacks through the MEV protection mechanism; (5) Multi-dimensional reward system: For example, users can get SOL rewards and Axiom points through transaction volume, recommend friends or complete tasks.

However, compared with other competitors, Axiom also has many flaws, such as multi-language support, Solana ecosystem only, and mobile phones.

Photon

In recent months, Photon has focused on updating and optimizing transaction functions, such as the online SNAP function, which allows users to customize transaction settings (wallet tracking, X dynamic tracking, notification functions); the multi-wallet function supports the distribution of one wallet funds to multiple wallets and buy/sell any tokens at the same time, etc., as well as the planned launch of the BNB beta version and launch of USDC trading peer on Solana.

BullX

In February, BullX announced a major update, launching several new features including the fastest migration sniper tool, faster order fill and chart performance, Twitter (now X) tracker, enhanced Hyper Vision (tracking past X usernames, developer migration behavior, and bot consumption fees), and several UX improvements are also mentioned. BullX strengthens security measures and prohibits third-party extensions.

Trojan

A few months ago, Trojan launched the core function TrojanSniper, which allows users to set parameters such as sniper amount, slippage, and fees, customize them according to their own risk preferences and trading strategies, and introduce filter functions (such as minimum/maximum liquidity, token pool supply ratio, developer holding ratio and support platform, etc.) and MEV protection mechanism. At the same time, TrojanSniper has also introduced whitelists and blacklists, which users can use to filter specific tokens or developer addresses to exclude targets that do not want to snipe. In addition, Trojan also launched developers to sell trigger reminders and increase broadcast speed by 70%.

GMGN

In the past few months, GMGN has launched a series of feature upgrades, such as adding support for TRON chain withdrawals, closing the Telegram robot withdrawal portal, forcing users to operate through the web platform, and introducing Google 2FA (two-step verification) forced binding and whitelist address restrictions to ensure that transfers are limited to preset addresses to significantly reduce security risks. In terms of trading functions, the platform has launched the Solana chain multi-wallet management function, which supports users to seamlessly manage multiple wallets through a single interface. At the same time, new coin holders trends, rat holding coin holding trends and blue chip index trend analysis are added to help users understand market dynamics. In terms of transaction decisions, GMGN has introduced functions such as paying attention to wallet grouping, fast ordering, and monitoring the new Smart Money and KOL buying and selling dynamic functions, and marking KOL avatars on charts. It also has a limited time opening of the Twitter scraper tool (it can automatically identify token contracts and support fast transactions by monitoring tweets, replies, introductions, etc. updates and forwarding, and these upgrades allow users to track smart wallets and market trends more accurately. In order to further improve transaction speed and stability, GMGN completed a global distributed deployment in March this year, through AWS deployment, Solana verification nodes and self-built RPC trading nodes.

In addition, GMGN has also further expanded its platform by launching mobile apps, expanding BNB Chain, and friend invitation reward mechanisms.