Dapp Industry Research Report: What are the tracks and projects worthy of attention?

Reprinted from jinse

01/15/2025·21days agoAuthor: Sara Gherghelas, Dapp Radar; Compiler: Deng Tong, Golden Finance

The number of daily Dapp users reaches 24.6 million, 32% of which

participate in DeFi, which is the most important industry this year

2024 is a year of change for the dapp industry, finally pushing us to the brink of mainstream adoption. The year marked significant regulatory progress, with MiCA in Europe laying a solid foundation and Trump's election in the US setting the stage for a new wave of institutional interest. Bitcoin’s all-time high marks the start of a much-anticipated bull run, breathing new life into the crypto space.

Across sectors, DeFi stole the show and became the most active category. It’s not just DeFi innovation that’s driving this trend — the memecoin narrative will define much of 2024 and give DeFi an extra boost. At the same time, NFT trading volume and sales have had their weakest year since 2020. Maybe 2024 will make us realize that NFTs don’t need to be expensive to prove their importance in the broader Web3 ecosystem.

2024 is a year of laying the groundwork for the future. Looking ahead to 2025, we expect the industry to mature further. In the meantime, dive into this report to learn about all the exciting developments, breakthroughs and narratives that shaped the past year.

summary

-

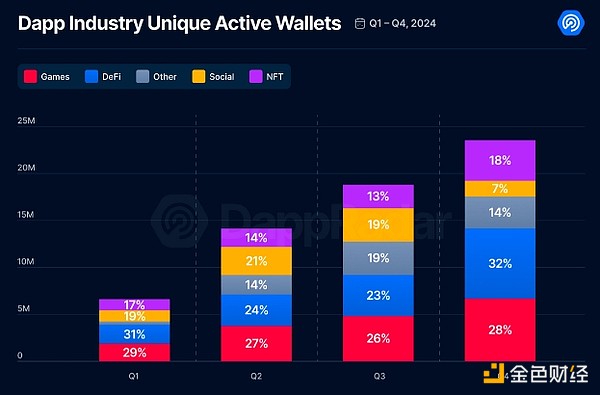

In 2024, the number of unique active wallets (UAW) in the dapp industry increased by 485%, reaching an average of 24.6 million UAW per day by the end of the year.

-

Activity in the “Other” category driven by AI dapps increased by 2,269%, highlighting the growing importance of AI in the dapp ecosystem.

-

DeFi activity grew 532%, ending the year with 7 million UAWs per day, and dominating the market by 32% in Q4 2024.

-

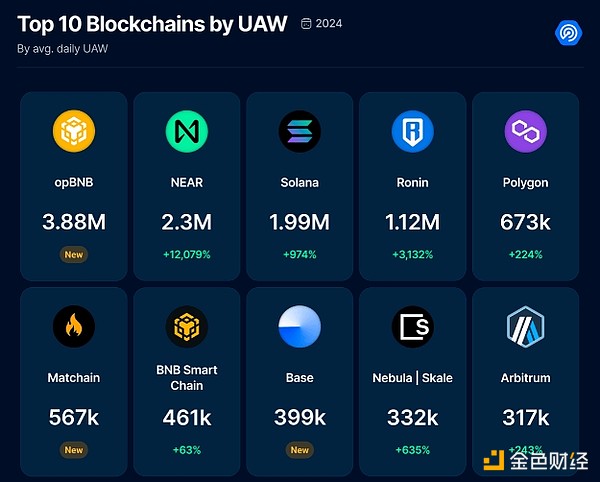

New chains such as opBNB, Matchain, and Base have made significant progress, with opBNB becoming the most used chain, with 3.88 million dUAWs in 2024.

-

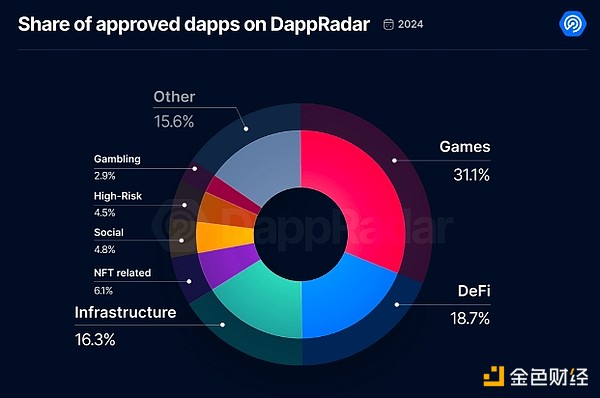

DappRadar approved 5,138 new dapps in 2024, a 72% increase from 2023, with gaming and DeFi being the main categories.

-

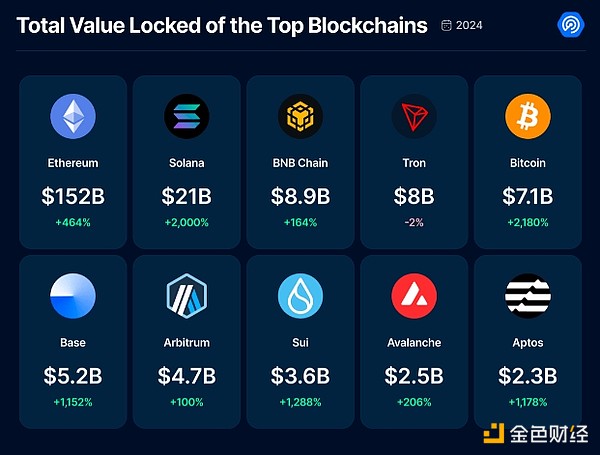

In 2024, DeFi’s total value locked (TVL) increased by 211% to $214 billion, which is only 20% below the December 2021 peak.

-

New chains such as Sui, Base, and Aptos gained traction, but Solana stood out, growing TVL by 2,000% to become the second largest TVL chain after Ethereum.

-

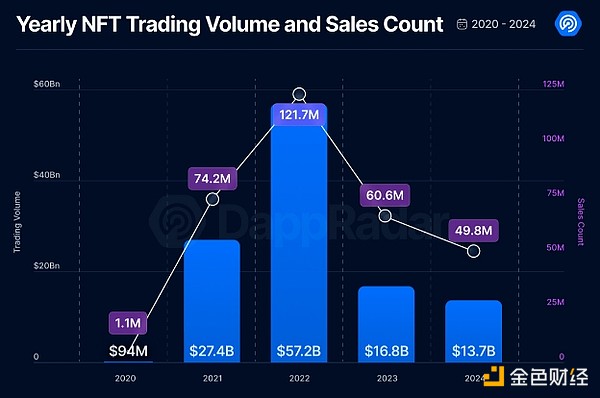

Compared to 2023, NFT transaction volume is down 19% and the number of sales is down 18%, making 2024 one of the worst years since 2020.

-

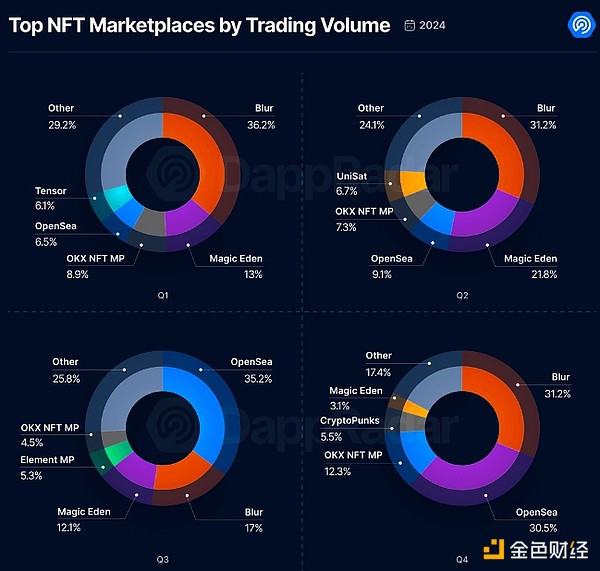

Blur maintained its dominance in the NFT market, holding the largest market share by trading volume for much of 2024, thanks to airdrop activity and a zero-fee trading model.

-

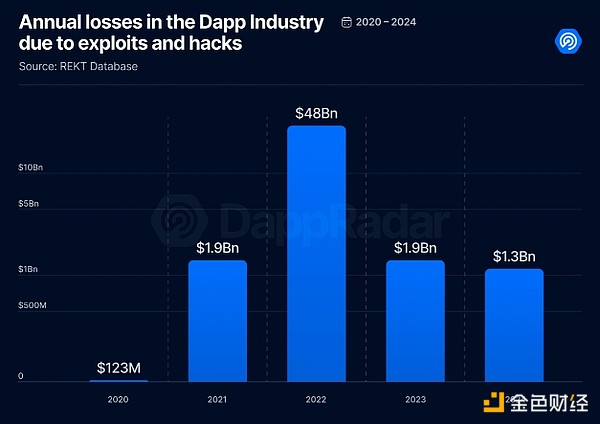

In 2024, the dapp industry suffered losses of $1.3 billion due to hacking attacks and vulnerability exploitation, a 31% decrease from the previous year and the lowest amount since 2020.

Table of contents

-

Industry-wide expansion: Record year for UAW growth

-

DeFi is near all-time highs: TVL reaches $214 billion in 2024

-

NFT market has worst performance since 2020

-

A year in which losses diminish but threats persist

-

Conclusion

1. Industry-wide expansion: Record year for UAW growth

The dapp industry experienced staggering growth in 2024, with unique active wallets (UAW) growing by 485%. By the end of the year, the surge meant daily UAW averages reached 24.6 million.

The most significant growth occurred in the "Other" category, which saw a significant 2,269% increase in activity. This surge can be attributed to the rise of AI dapps, which has led to the launch of a dedicated AI dapp ranking on DappRadar. Initially, the “other” category was an umbrella term for emerging or poorly defined dapps, including early-stage AI solutions. Over time, AI dapps have gained significant traction, demonstrating their transformative potential and spurring their emergence as a category in their own right.

DeFi ranked second with 532% activity growth, becoming the most dominant category at the end of the year, with 7 million UAWs per day and a market share of 32% in Q4 2024. This is driven by memecoins and AI agent coins, which have caused a lot of buzz throughout the year.

Meanwhile, blockchain games ranked third with a growth of 421%. Although DeFi’s dominance fluctuated between 26-29% throughout the year, in the first and fourth quarters of 2024, DeFi overshadowed the game.

The NFT industry grew by 412%, driven by the airdrop narrative, while the social industry (which is still emerging) saw a 70% increase in activity. Although the growth is modest, social dapps are likely to gain more attention in 2025.

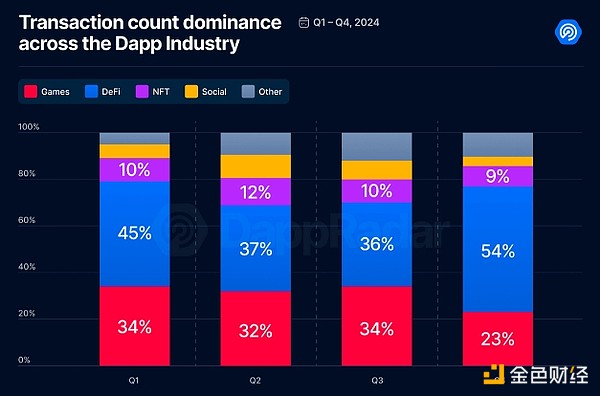

Transaction analysis reveals a different story. Social dapps saw the highest growth in transaction volume, up 455%, mainly due to the task platform, where users must complete on-chain or off-chain tasks to receive rewards. Game transaction volume has dropped 16% since the beginning of this month, but it still achieved more than 5 billion transactions this year. This shift may indicate that gaming is moving more off-chain than on-chain.

DeFi’s transaction volume this year exceeded 8 billion, an increase of 66% from the previous year, and it dominated 54% of the total transaction volume. This is consistent with trends we have observed - meme trading, newly launched on-chain tasks promising rewards, and a significant uptick in trading activity last quarter as rumors of a new bull run began to gain traction.

Blockchain Performance: Emerging Stars and Top Blockchains in 2024

Among these chains, opBNB has become the most used chain, which utilizes Optimistic Rollup technology to enhance scalability and reduce transaction costs. Particle Network is the leading dapp on the chain.

Newcomers Matchain and Base have also found success. Matchain rose in the rankings with LOL dapp becoming its top performer, while Base hit an all-time high with $15.65 billion in Uniswap V3 trading volume in 30 days.

While the largest blockchains always steal the limelight, we're seeing a lot of growth in smaller ecosystems as well. Above we have listed the six blockchains with the largest increases in average daily number of unique active wallets. This list includes Oasys, Internet Computer, Core, WEMIX 3.0, and SKALE. Dapps such as video game app ChainArena on Oasys, social email platform Dmail Network on ICP, and gaming platform Pixudi on Core have contributed to this growth, reflecting the diverse growth of the ecosystem.

Defining DappRadar Metrics in 2024

However, since DappRadar aims to become the global Dapp store, we decided to look at some indicators to see what the trends are this year and what we will see next year. DappRadar approved 5,138 dapps through its developer dashboard in 2024, a 72% increase from 2023, which is consistent with the fact that we are seeing more and more dapps enter the mainstream this year. Gaming accounted for 31.1% of this, followed by DeFi at 18.7%, underlining their dominance as this year’s main trend.

According to DappRadar page views, the top-ranked dapps in 2024 are mainly games. Their continued presence in the rankings highlights the strength and engagement of their communities.

2. DeFi is close to an all-time high: TVL reaches $214 billion in 2024

This year, the DeFi space has become a cornerstone of the dapp industry, as highlighted in Chapter One. DeFi performed the best, with total value locked (TVL) growing by 211% to close 2024 at $214 billion, just $47 billion less than its December 2021 peak.

There are several key factors behind DeFi’s remarkable success this year. First, the meme coin hype played a big role. The rise of meme coins such as GOAT and PEPE has brought a surge in trading activity and liquidity to DeFi platforms, attracting the attention of traders and speculators.

In the second half of the year, the launch of artificial intelligence agents brought a layer of change to the ecosystem. These AI-powered agents facilitate tasks such as transactions and governance, streamlining operations and driving user engagement. This innovation is likely to be further explored and expanded in 2025, positioning artificial intelligence as a core component of DeFi development.

Finally, the Federal Reserve’s interest rate cuts have reignited interest in DeFi lending protocols. In the low interest rate environment, investors turned to platforms such as Aave and Compound to obtain higher returns, leading to a significant increase in lending activity.

Additionally, Bitcoin hit an all-time high of $108,000 in mid-December 2024, driven by major regulatory milestones. In January this year, the U.S. Securities and Exchange Commission (SEC) approved a number of spot Bitcoin ETFs, including BlackRock’s iShares Bitcoin Trust (IBIT). As of January 19, 2024, IBIT quickly became the first spot Bitcoin ETF to exceed $1 billion in trading volume. On this basis, the SEC subsequently approved a spot Ethereum ETF, and institutions such as Fidelity also launched their own products.

Newer blockchains like Sui, Base, and Aptos had a stellar year, launching multiple updates and grabbing the spotlight. However, Solana stole the show, bouncing back from a challenging 2023 to achieve a staggering 2,000% growth in TVL, becoming the second-ranked blockchain by TVL. This recovery solidifies Solana 's redemption arc and highlights its resilience.

A lot is happening in 2024. The DeFi industry has firmly established itself as a transformative force in finance through innovation, institutional adoption, and regulatory advancements.

Key trends affecting DeFi in 2024

-

Memecoins: In 2024, memecoins such as GOAT, PEPE, and ShibaDoge reignited retail interest and drove liquidity and activity on DeFi platforms. These highly speculative tokens often serve as a gateway for users exploring DeFi for the first time.

-

AI Agents: The rise of AI-driven agents has revolutionized DeFi by automating complex operations such as yield farming, arbitrage, and governance voting. These agents increase efficiency, reduce human error, and allow users to optimize returns with minimal effort.

-

Tokenization of Real World Assets (RWA): DeFi continues to connect traditional finance with decentralized systems, unlocking new liquidity and investment opportunities through tokenized assets such as real estate and commodities.

-

Layer2 solutions: Optimism, zkSync, Arbitrum, and Base gain greater traction by addressing scalability and reducing transaction costs.

-

Bitcoin Layer2 Solution: The development of the Bitcoin network has facilitated the creation of dapps on Bitcoin, extending its functionality beyond a store of value.

-

Points and airdrop dollars: The project uses a points system and airdrops to incentivize user participation and promote community participation and loyalty in the DeFi ecosystem.

-

Sustainability: DeFi platforms employ environmentally friendly protocols that comply with ESG standards, attracting environmentally conscious investors.

-

Cross-chain interoperability: Seamless transfer across networks expands the capabilities of DeFi. The interoperability solution enables users to access a variety of liquidity pools and decentralized services without being restricted by a single chain.

Regulatory development and agency engagement

2024 brings significant changes to the regulatory landscape, particularly in the United States and Europe, with frameworks such as the EU Markets in Crypto-Assets (MiCA) regulation providing much-needed clarity. While these regulations pose challenges, they mark a critical step toward industry maturity and wider adoption. Institutional interest surged, and DeFi further diversified with innovations in prediction markets, lending, and financial instruments.

MiCA’s main impact on cryptocurrencies:

-

Establish clear rules for cryptocurrency businesses to ensure legal certainty.

-

Strengthening consumer protection through stablecoin regulations.

-

Require encryption service providers to obtain licenses to improve security.

-

Address market manipulation and insider trading issues and enhance trust.

-

Promote global regulatory harmonization and pave the way for wider adoption.

As DeFi enters 2025, the industry is expected to stabilize, with clearer regulations, further integration of risk-weighted assets, and technological advancements such as zero-knowledge proofs that will improve security and scalability. DeFi remains poised to redefine global finance, providing transparent, inclusive and efficient services while connecting traditional and decentralized economies.

3. NFT market performance hits new low since 2020

The NFT market in 2024 has experienced severe fluctuations. At the beginning of the year, transaction volume surged to approximately $5.3 billion in the first quarter, a 4% increase compared to the first quarter of 2023. The momentum was short-lived, however, as transaction volume fell to $1.5 billion in the third quarter before rebounding to $2.6 billion in the fourth quarter. Despite these fluctuations, a closer look at NFT sales tells a different story: sales numbers are lower than in 2023, highlighting that NFTs will generally be more expensive in 2024, consistent with rising token prices, especially ETH.

On an annual basis, NFT trading volume fell by 19% compared with 2023, and NFT sales fell by 18%. This makes 2024 one of the worst years for volume and sales since 2020.

Top NFT Collectibles: Shift in Dominance

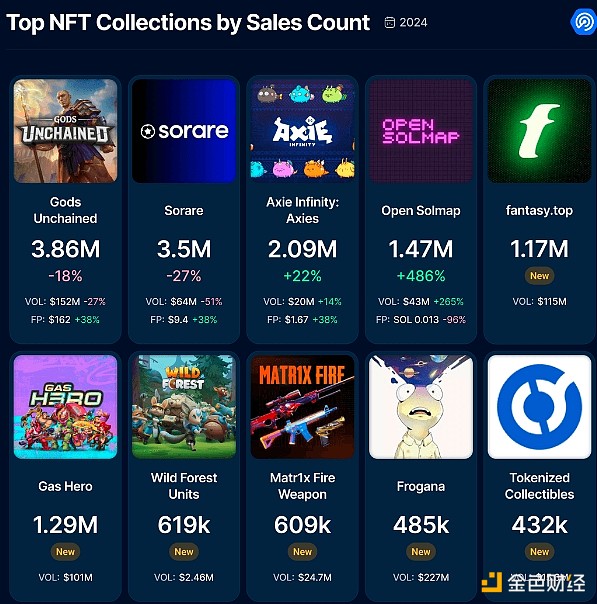

In terms of transaction volume, Pudgy Penguins took the lead, but sales fell by 44%. Interestingly, their base prices are up 114%, reflecting the impact of significant efforts in 2024. They have launched plush toys in major retailers such as Walmart, Walgreens and Target across the US, as well as Selfridges and Argos in the UK. In May 2024, they partnered with Mythical Games to develop a blockchain mobile game designed to blend their popular penguin characters with a high-quality gaming experience. In September 2024, Pudgy Penguins partnered with Spanish football club CD Castellón to become the first PFP NFT to appear on professional football uniforms. This reinforces the notion that NFTs with real-world utility continue to perform well.

Yuga Labs' series, while still one of the most traded, has seen its dominance decline, and FP has been severely affected. Despite the challenges, Yuga Labs has plans for 2025 to focus on its immersive metaverse platform Otherside and launch new projects in partnership with PP Man. This commitment to innovation may shape their future trajectory.

Gaming industry dominates NFT sales

Judging from the sales volume, game-related NFTs clearly dominate. This trend reflects the gaming industry’s growing adoption of NFTs, which allow players to truly own in-game assets and facilitate player-driven economies.

Platform performance: Blur and OpenSea

Speaking of platforms, Blur maintained its market dominance throughout 2024 (except for the third quarter). By the fourth quarter, Blur and OpenSea were neck and neck in market share. Blur’s success is driven by multiple airdrop campaigns and its zero-fee trading model, which attracts cost-conscious traders.

OpenSea has had a challenging year. In August 2024, the U.S. Securities and Exchange Commission (SEC) issued a Wells Notice to OpenSea, citing concerns about unregistered securities. Coupled with market decline and fierce competition, OpenSea announced large-scale layoffs in November, reducing the number of employees by 56%. The company is currently focusing on “OpenSea 2.0” to regain market share and revitalize its platform, while hinting at a possible token launch.

Meanwhile, Magic Eden outperforms OpenSea. Magic Eden initially focused on Solana and has since expanded to include Ethereum, Polygon, Bitcoin, and emerging networks such as Base and Arbitrum. On December 10, 2024, Magic Eden launched its native ME token and conducted a $700 million airdrop to enhance its ecosystem.

Broader ecosystem trends and future outlook

The NFT ecosystem has diverse use cases, gaining traction in areas such as gaming, music, real estate, and real-world applications such as ticketing. Environmental concerns drive platforms to adopt sustainable blockchain solutions, while layer 2 scaling solutions such as Polygon and zkSync increase transaction efficiency and reduce costs. Regulatory pressure highlights the need for clearer compliance standards and signals a maturing market.

Looking ahead, 2025 is expected to be a year of consolidation and innovation. Mainstream adoption is likely to grow, driven by improved user experience, broader utility in areas such as supply chain management and digital identity, and stronger secondary markets. With regulatory clarity, technological advancements such as artificial intelligence integration, and enhanced smart contracts, the NFT industry is poised to redefine digital ownership and continue to be a cornerstone of Web3.

4. A year in which losses diminish but threats persist

In 2024, security challenges remain a major concern for the dapp industry. According to the REKT database, the industry has suffered losses of up to $1.3 billion due to hacking attacks and exploits. While this figure is still considerable, it is down 31% from the previous year and represents the lowest loss amount since 2020.

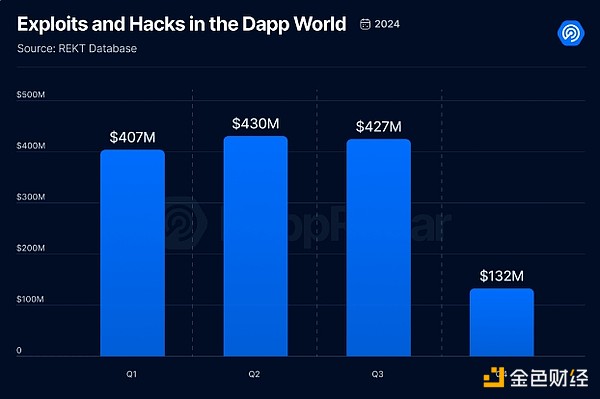

Q4 2024 is the quietest quarter of the year, with the least damage from hackers and breaches. In comparison, losses in other quarters have hovered around the $400 million threshold, highlighting the ecosystem's continued fragility.

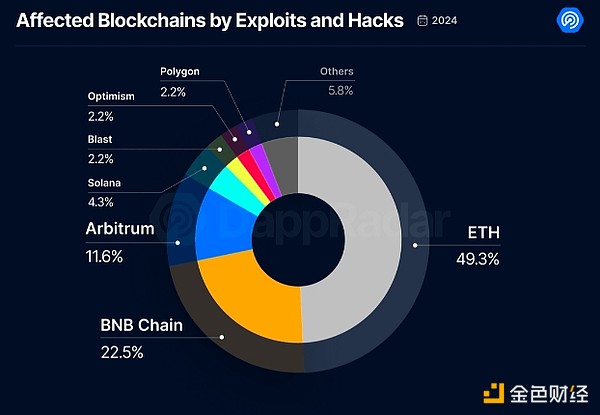

Among the affected blockchains, Ethereum topped the list, accounting for 49.3% of the total losses, followed by the BNB chain, accounting for 22.5%. Ethereum’s dominance in the DeFi ecosystem makes it a prime target for sophisticated attacks such as flash loan vulnerabilities and reentrancy attacks. Its complex smart contracts, frequent upgrades, and reliance on vulnerable cross-chain bridges further exacerbate risks.

Access control: the most common attack vector

Access control vulnerabilities become the most prevalent attack vector in 2024. This occurs when an attacker exploits weaknesses in a system's access control mechanisms to gain unauthorized access to resources, data, or functionality.

Rugpulls also continue to plague the Web3 space, fueling suspicion and eroding trust in the ecosystem. Despite efforts to mitigate the impact of these deceptive practices, these deceptive practices remain an ongoing problem.

The most significant achievement of 2024

Among the most impactful attacks of the year, the following stand out:

-

DMM Bitcoin CEX vulnerability: The centralized exchange was hacked, resulting in a loss of US$300 million.

-

WazirX Indian exchange vulnerability: WazirX major vulnerability, loss of $230 million.

-

Ripple co-founder breach: Hackers stole $112.5 million from Chris Larsen’s cryptocurrency holdings.

-

Munchables Fund Exhaustion Vulnerability: The Munchables platform lost $62.5 million due to a vulnerability.

-

Radiant Capital Breach: A breach against Radiant Capital resulted in a loss of $58 million.

As the Web3 landscape continues to evolve, security challenges will continue to be a major issue. At DappRadar, we always advise users to prioritize the safety of their funds by staying informed about potential scams and vulnerabilities. Use a trustworthy platform, enable multi-factor authentication, and be wary of offers that seem too good to be true. Staying vigilant is critical to safely navigating the ever-evolving dapp ecosystem.

5. Conclusion

The 2024 Dapp Industry Report documents a year of significant progress, challenges, and innovation in the blockchain ecosystem. From the explosive growth of DeFi and the rise of AI-driven Dapps, to the volatility of the NFT market and ongoing security wars, the industry has shown resilience and adaptability. These developments highlight the enormous potential of Web3 to reshape industries and create new opportunities.

As we enter 2025, the focus will likely shift to refining these innovations, achieving greater regulatory clarity and driving mass adoption. The decentralized space is set for another groundbreaking year with advancements in scalability solutions, enhanced security measures, and a wider range of use cases.

chaincatcher

chaincatcher

panewslab

panewslab