December Macro Monthly Report: U.S. hawks cut interest rates causing uncertainty, looking ahead to key crypto trends in 2025

Reprinted from panewslab

01/10/2025·1MThe U.S. economy ran smoothly in December, and core economic data were within expectations. However, the Fed 's hawkish remarks intensified short-term market fluctuations; in the macroeconomic greenhouse, both U.S. stocks and Bitcoin broke record highs this month, and investors welcomed Big red envelope at the end of the year; looking forward to 2025, institutions are generally optimistic and believe that Bitcoin may exceed US$200,000 in 2025.

Caption

Caption

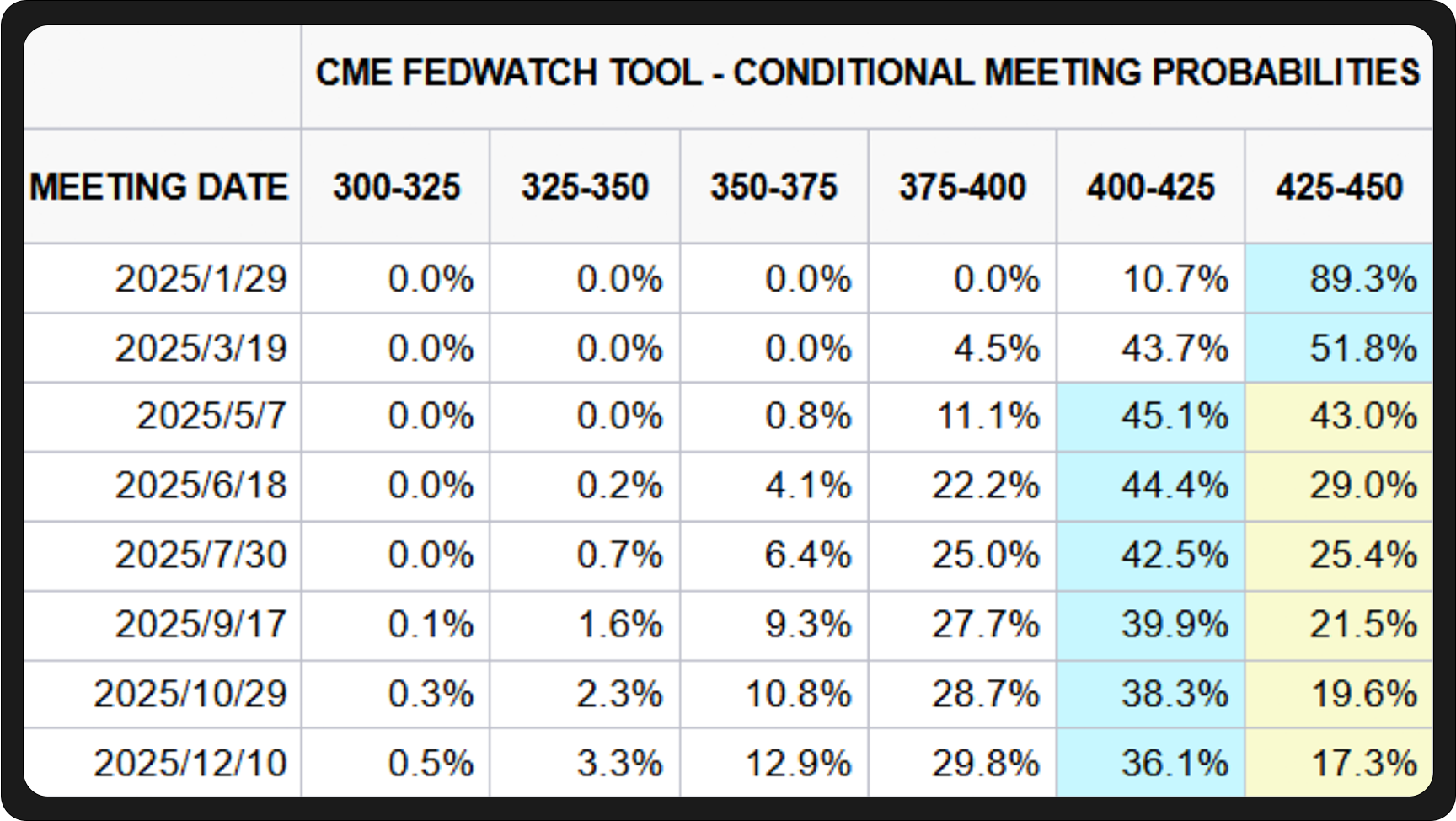

The newly released economic data in the United States in December were basically within expectations: non-farm employment increased by 227,000 in November, slightly better than market expectations (expected 220,000); CPI in November increased by 2.7% year-on-year and 0.3% month-on-month, both in line with expected. Subsequently, it was announced that the federal funds rate target range would be lowered by 25 basis points to a range of 4.25% to 4.50%, in line with expectations. However, after announcing the interest rate cut, the Federal Reserve made a "make-up" sentence: It is expected that the rate of interest rate cuts in 2025 may be narrowed to 50 basis points. This undoubtedly poured cold water on the market, because it means that the number of interest rate cuts in 25 years has dropped from the previously expected 4 times to 2 times. This also makes the market expect that the Federal Reserve will not cut interest rates in January next year. Affected by the U.S. hawks' interest rate cut, U.S. stocks and currency circles fell sharply that day.

On the day it announced the rate cut, the Federal Reserve also released its latest economic outlook, predicting that the U.S. economy will grow by 2.5% and 2.1% this year and next, respectively, which is an increase of 0.5 percentage points and 0.1 percentage points respectively compared with the September forecast. The unemployment rate this year and next is expected to be 4.2% and 4.3% respectively, which is lower than the previous forecast. Inflation rates measured by the personal consumption expenditures price index are forecast to be 2.4% and 2.5% respectively, and core inflation rates excluding food and energy prices are 2.8% and 2.5% respectively, both exceeding the long-term inflation target of 2%. This shows that the U.S. economy is currently running smoothly, but inflation is still far from the 2% target.

Complementing this economic forecast is the December PMI index: the preliminary value of the US Markit service industry PMI in December reached 58.5, exceeding market expectations of 55.8 and higher than the previous value of 56.1. However, at the same time, the initial manufacturing PMI value was recorded at 48.3, lower than the expected 49.5 and the previous value of 49.7. The preliminary comprehensive PMI value was 56.6, which also exceeded the expected 55.1 and the previous value of 54.9. The service economy is experiencing the fastest growth period since the epidemic blockade was lifted in 2021. The lower-than-expected manufacturing PMI is caused by insufficient export demand.

In the "hothouse" of macroeconomics, U.S. stocks rose in small steps, and the Nasdaq index successfully exceeded 20,000 points. Five of the Big 7 U.S. stocks, Apple (APPL), Amazon (AMZN), Google (GOOG), Tesla (TSLA) and Meta, all continued to hit record highs in December. OpenAI’s 12 consecutive days of press conferences this month also pushed AI to another climax. When there is no crisis on the macro front and there is no new narrative in the market, the market will still run in the direction of least resistance, and this direction may only be the AI with the strongest consensus.

Behind the Nasdaq's new high is "super optimistic" investor sentiment. Bank of America's December global fund manager survey found that investor sentiment was "super optimistic" in December. According to the report, investors' allocation to cash is at an all-time low, while allocation to U.S. stocks is at an all-time high. According to the report, global risk appetite is at a three-year high, driven by optimism about economic growth related to Trump's second term and the Federal Reserve's interest rate cuts. Bank of America also lists many chip stocks such as Nvidia (NVDA) as top investment options in 2025. Highly optimistic market sentiment has contributed to the current prosperity of the U.S. stock market, but it has also increased the possibility of a collapse due to a black swan event in the complex and chaotic financial system.

It is worth noting that this month, the Dow Jones Industrial Average experienced a "tenth consecutive decline", setting a record for its worst consecutive decline since 1974. The deviation between the trend of the Dow and the Nasdaq and S&P 500 is mainly caused by the differences in the constituent stocks. This month, the medical sector giant UnitedHealth was mired in political turmoil, causing its stock price to plummet continuously. At the same time, Nvidia, which was newly added to the Dow Jones Industrial Average, performed weakly this month, contributing to the Dow Jones Industrial Average's continuous decline.

This month there is another U.S. stock event that is attracting attention in the currency circle - MicroStrategy (MSTR) was officially included in the Nasdaq 100 Index constituent stocks. In WealthBee's November monthly report , we analyzed that the "digital gold standard" strategy and capital operation model being implemented by MicroStrategy may become an industry pioneer and promote Bitcoin to be recognized as a top-level asset as the market continues to rise. Eater. This month, MicroStrategy was included in the Nasdaq 100 Index, which is undoubtedly another victory for the crypto world and another progress for the traditional financial world. This may be just an introduction, and behind it, some bigger things will happen in the encryption world in the future. We will wait and see.

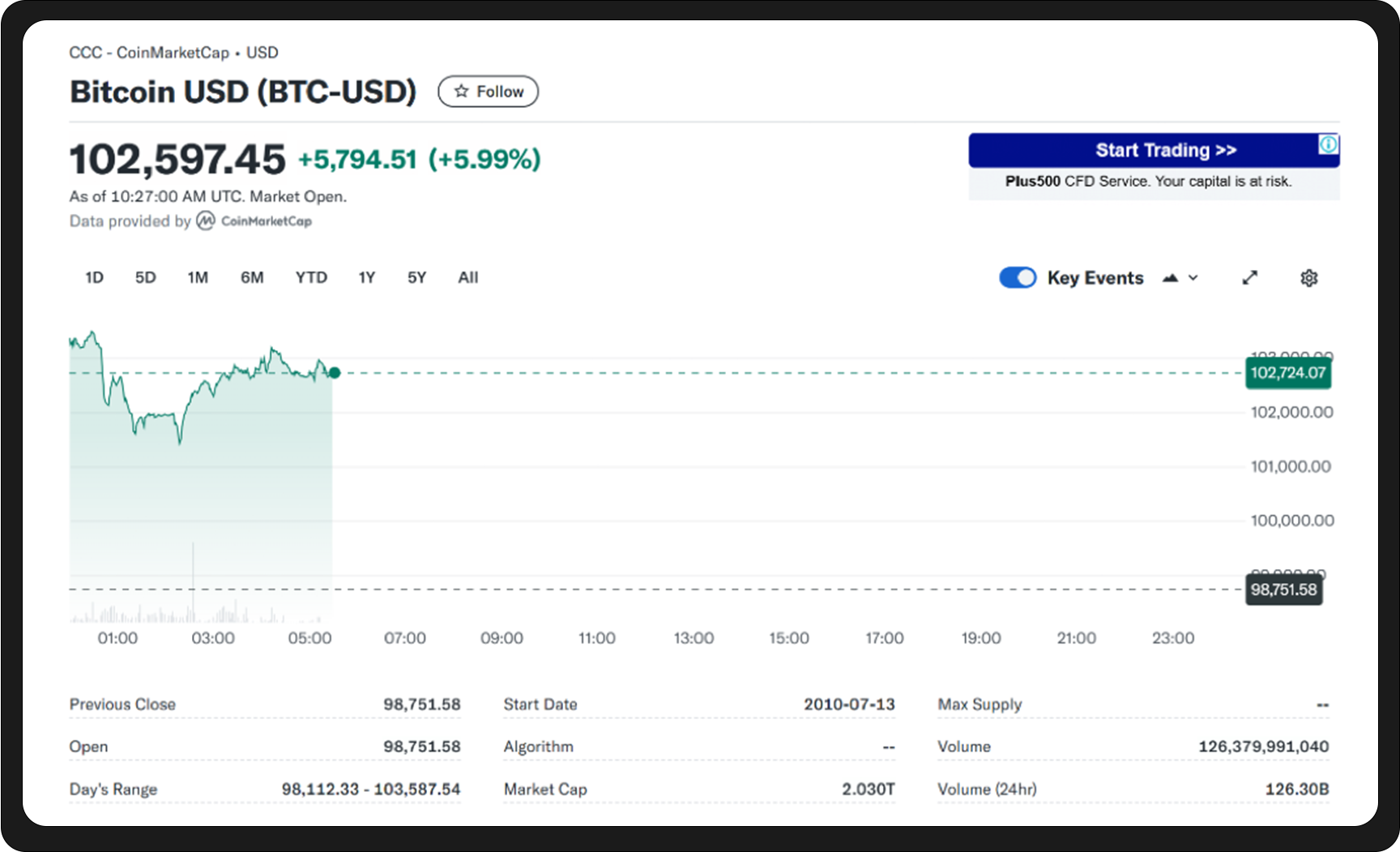

On December 5, Beijing time, Bitcoin finally ushered in its own historic moment - officially breaking through 100,000 US dollars.

At the same time, Ethereum also exceeded $4,000. It can be said that the fact that Bitcoin broke through the psychological barrier of $100,000 has completely ignited the market's emotions.

This wave of Bitcoin surge is mainly driven by political factors. We don’t know whether Trump will really fulfill his promises on cryptocurrency after taking office, but at least the “emotional value” aspect is really filling the market. At present, serious FOMO sentiments are spreading among the entire public abroad. The proportion of cryptocurrency holders in South Korea has reached 30%, which is equivalent to three out of every ten people holding cryptocurrency (data from the Bank of Korea), which is higher than that in our country. The proportion of shareholders is even higher.

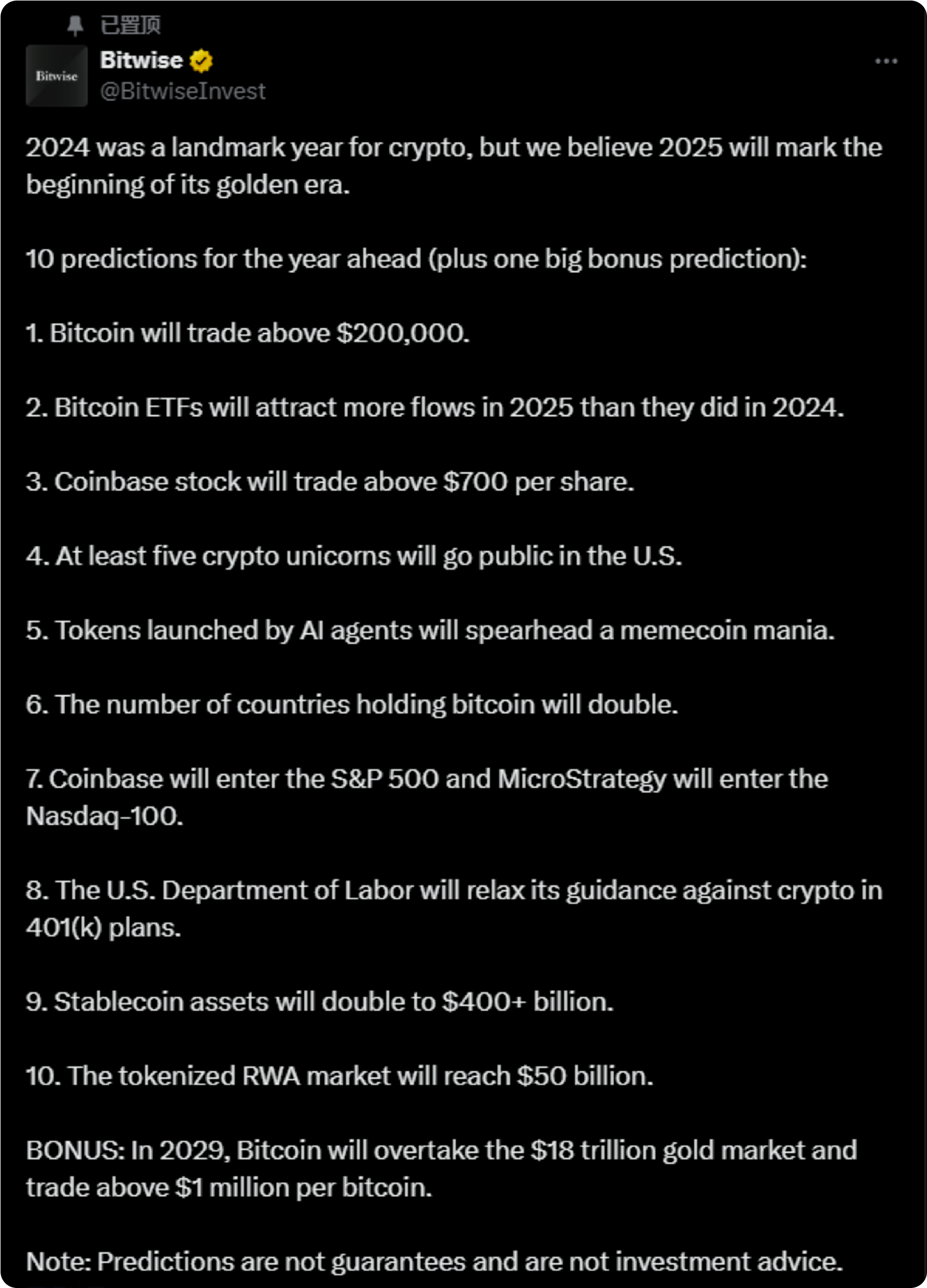

The current fomo situation is obvious to all, and institutions are giving future predictions at this juncture: Bitwise, the largest crypto fund index in the United States, predicts that Bitcoin will reach $200,000 in 2025. The Bitwise team believes that Coinbase will enter the S&P 500 index, and 2025 will be an even more carnival year than this year.

At the end of 2024, the Federal Reserve entered an interest rate cut cycle, creating a more friendly macro environment for high-risk assets. Bitcoin has also been favored by domestic and foreign institutional liquidity. 17 US icon and Japanese icon listed companies around the world have announced their holdings or board of directors Approves plan to adopt Bitcoin as a war-ready asset. The market may continue to support high-risk transactions in the first quarter of 2025, and funds may continue to flow to cryptoassets such as Bitcoin.

Looking forward to 2025, several of the most high-profile key story lines in the crypto space have already emerged - Bitcoin's changing role in global asset allocation, where new incremental markets are, new price ceilings, and regulation. Each of these story lines currently has new important clues that deserve continued attention.

Currently, only 0.01% of listed companies in the world hold Bitcoin, which means that this is just the tip of the iceberg of the purchasing power of large institutions, and the market is still in the "elite experimental stage." OKX Research Institute predicts that the statisticable funds entering Bitcoin in the next year will be approximately US$2.28 trillion. The volume of these funds can push the price of Bitcoin to about US$200,000, which is roughly consistent with the predictions of Bernstein, BCAicon Research and Standard Chartered Bank icon financial institutions. JMP Securities, a well-known Wall Street investment institution, predicts that Bitcoin spot ETFs may have capital inflows of up to US$220 billion in the next three years. Overall, institutions currently generally predict that Bitcoin will reach around US$200,000 in 2025. At the same time, Bitcoin is still a “non-mainstream” investment, which indicates that the incremental market is still unimaginably large.

Bitcoin has added value to multi-asset portfolios during the 2024 rally, but it remains a volatile and riskier asset. Citi analysts say cryptocurrency returns would need to be a few percentage points higher than expected returns from stocks to justify a 1% portfolio allocation, and would be much higher if the share were larger . Therefore, the allocation proportion of Bitcoin in the investment portfolio may still be relatively low, but for investors pursuing high risk and high return, their allocation may be appropriately increased.

The regulatory environment has been an important factor supporting the long-term trend of Bitcoin prices. With Trump taking office, regulation will become a major theme in 2025. The United States will usher in a critical moment to establish regulatory clarity for the crypto industry. Bipartisan support for cryptocurrencies means that regulation is expected to transform from a resistance to a driving force. The EU’s Cryptoasset Market Supervision Framework (Mica) will take full effect in 2025, unifying member states’ cryptocurrency regulations. Japan and South Korea in Asia also continue to encourage innovation while increasing supervision of exchanges and wallet service providers. Regulatory clarity around the world will help attract more institutional and individual investors to the market.

In addition to Bitcoin, institutions predict that AI and stablecoins will become new highlights in 2025. At present, many banks are jealous of the profits of Tether (USDT) and have chosen to enter the game. According to Bloomberg, France’s Société Générale, Germany’s Oddo BHF, Britain’s Revolut, and even China’s Hong Kong Monetary Authority have begun to lay out the stablecoin market, hoping to get a share of the pie in this field. Stablecoins may be the tool that shows the most application scenarios in the current currency circle. This has also become a key step for the currency circle to further break out of the circle and become a new consensus.

In the current rising market sentiment, no matter how optimistic the forecast is, it seems reasonable. However, we need to understand that even if the future is bright, the road is still full of thorns, and we must also pay attention to the risks that short-term market fluctuations may bring. Counting from 2008, the encryption world has been growing vigorously for 16 years—according to human age, it is about to enter the "coming of age ceremony". In adulthood, Bitcoin has become a consensus investment product in the mainstream financial circle, and stablecoins may soon become a real practical application tool. The encryption market in 2025 will be more interesting than in 2024!