Each performs its own duties, and the public chain has its own purpose every day

Reprinted from panewslab

04/18/2025·12DLooking back at the last round of market conditions, the biggest gameplay can actually be summarized in PVP.

Go here to PVP, go there to PVP, go to any chain that has some popularity and narratives.

As time goes by 2025, these chains have already entered the stage of stock competition--from the Hundred Chain War a few years ago to the name of Ethereum killer, most chains are now labeled as "no dogs are not used", and the rest are also working hard to solve their own food problems.

Not only the young players in PVP, but these chains are actually in PVP.

But every chain seems to want to replicate the excitement of Solana, but no matter how they toss, they cannot replicate the meme scenery of Solana.

One area of land and land support the other people, and a public chain may only do one thing.

Every public chain that is still alive has been secretly marked for use.

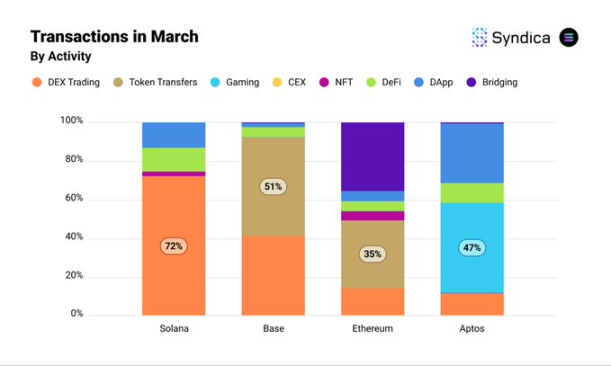

Recently, a March L1/L2 data insight report released by the overseas news and research organization Syndica (@Syndica_io) has made this sense of fate more concrete through numbers:

- Of all Solana's transactions, 72% are related to decentralized exchanges (DEXs), which obviously fits your dog-beating impression.

- Base has 51% of transactions used to transfer money;

- Nearly 40% of ETH transactions are used across chains (Purple columnar above)

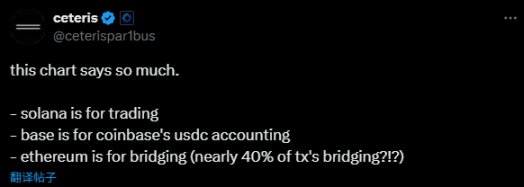

Delphi Digital l's research director @ceterispar1bus When facing this set of data, he pointed out the essence directly:

- Solana is for trading

- Base is used to record USDC for Coinbase

- Ethereum is used to transfer assets across chains

As the industry has reached this point today, projects are no longer just a technical competition, but rather finding their own "anchored ground" - a natural purpose positioning.

It's an identity tag, but also a fate

On the surface, the purpose of public chains is like users and markets to choose; but if you think deeply, this is more like the result of "secretly priced" by resource endowment and background.

Let’s summarize the identity tags of the three public chains:

Solana is a hot spot for trading, Base becomes Coinbase's "Mr. Accountant" and Ethereum is kidnapped by the bridge, and its assets are expelled at a faster pace.

Behind the current status of each chain, there are dual driving forces between technology and non-technical.

Let’s talk about Solana first.

Solana's on-chain ecosystem will still be the most lively Meme trading hotspot in the circle in 2025.

The DEX trading volume in its ecosystem has firmly ranked first for two consecutive months, with a far ahead in market share. Since October 2024, Solana has created more than 500,000 MEME coins every month, like a "dog-beating party" that never stops.

P young players are brave enough to sit and find angles. Traders are busy monitoring the pool and the front of the car. When people who have played Meme mentioned Solana, their first reaction was: "Isn't this chain a big casino?"

Solana's high throughput (12 times that of Base) and low cost (high transactions below $0.01) are the basis of its trading hot spot. Syndica reports show that Solana leads in small transactions (under $100) and is suitable for high-frequency trading of MEME coins.

As for whether to decentralize or not, practical and physical and physical sensation may not be that important.

More importantly, the startup advantage in resource endowment.

From 2019 to 2023, Solana received investment support from a16z, Multicoin Capital and other companies, attracting DeFi and MEME currency developers through grants and incubators;

Solana's Breakpoint conference will often become the inspiration for Meme coins. Do you remember that Toly wore a green cartoon dragon image costume at the conference two years ago, which triggered a wave of attention to the phenomenal Meme SillyDragon afterwards?

The founder took the initiative to set up his image and implying a certain Meme connection intentionally or unintentionally has gradually become an ordinary way of playing today.

Community culture also "reserved" its Meme soil. Through social media (such as X) and Meme coin competitions, Solana has become a paradise for "grassroots players", and PEPE, BONK and POPCAT have also successfully formed positive feedback.

The user's mind is framed: "Solana=Transaction", various devs are flocking to us, and the emergence of Pumpfun is even more natural.

Let’s talk about Base.

There is also Meme on Base, and there are also many eye-catching tokens in the ecosystem in the last wave of AI Agent, but this is more like the previous results of Solana's capital spillover and the low-difficulty arbitrage behavior of PVP.

March data showed that 51% of transactions on Base were token transfers, and the deeper reason was Coinbase’s interest relationship with Circle.

Coinbase and Circle jointly established Centre Consortium in 2018, an organization dedicated to the issuance and management of USDC. Coinbase and Circle, as co-sponsors, not only jointly promote the popularity of USDC, but also formulate USDC operating standards through Centre.

As Coinbase's "own son", Base has become the preferred channel for USDC transfers.

In addition, Circle's recent IPO filings show that Coinbase and Circle's cooperation on USDC have a clear share of interest—Coinbase takes 50% of the remaining income from USDC reserves.

This means that Coinbase gets a share of every USDC transaction precipitated or promoted the use of USDC.

Base's low cost and high efficiency are just right for this "bookkeeping" requirement - whether it is internal funds transfers of Coinbase or user USDC transactions, Base can efficiently record and manage these on-chain activities, such as transfer records, liquidity management and settlement operations. This "bookkeeping" not only reduces the operating costs of Coinbase, but also directly generates revenue through USDC's revenue sharing.

Looking at ecological culture, Base prefers service agencies and compliant users. Most of Coinbase’s 100 million+ users are “serious players”, so naturally developers will not choose Base to hold “dog-beating parties”.

Since its birth, Base has been booked as USDC's "Mr. Accountant" by Coinbase and Circle's strategy, and is firmly framed by the interests of this pair of partners.

Finally, when it comes to Ethereum, it is undoubtedly an old topic that disappoints.

Nearly 40% of transactions are related to cross-chain bridges and have become "transfer stations" for other public chains.

The price of ETH is more like being roasted on fire and gradually losing moisture. Although Ethereum is still the leader in DeFi, with locked-in value (TVL) accounting for more than 60% (Syndica data), negative sentiment in the community is spreading.

Ethereum's "bridged fate" is technically forced out by high gas fees.

When the market is good, ordinary users are already overwhelmed and can only transfer assets to lower-cost chains through cross-chain bridges; not to mention that there is nothing to play when the market is bad.

In addition, ETH's main network throughput is also limited, far less than Solana's high performance, and the inefficient transaction efficiency further pushes up cross-chain demand.

The deeper reason comes from the diversion of historical status.

As the earliest smart contract platform, Ethereum has accumulated the most assets and dApps, and naturally becomes the hub of cross-chain bridges.

Ecological path dependence allows DeFi projects and funds to be concentrated on Ethereum, but high costs force users to flow out, and bridging becomes an "inevitable choice".

At the same time, the rise of Layer 2 diverted users, the Ethereum Foundation's multiple rounds of adjustments, Vitalik and women were accused of being inactive, and even breathing was wrong when the currency price fell...

Dreams are "world computers", and the current situation is "cash machines".

Its life is like being locked by network effects and market changes, turning from a DeFi overlord to an asset transfer station. Ethereum's breakthrough path is probably more difficult than Solana and Base.

Accept fate and find anchor points

The competition for public chains in 2025 is no longer a fanaticism in the Hundred Chain War, but a calmness in the game of stocks.

The way to survive in public chains is ultimately "accepting fate and finding anchor points."

Transactions can be anchor points, stablecoins circulation can be anchor points, and even cross-chain can be used. But the solidification of the "anchor point" also means that the imagination space of the public chain is compressed.

Can Solana get rid of the label of "Meme Casino"? Can Base break out of the box of "bookkeeper"? Can Ethereum break through the "transit station"?

There is no answer to these questions.

But even more ironic, most P teenagers don’t care about these issues.

If you have the popularity, go to the chain that "beat the dog" and go to the chain that has the arbitrage space to "get the wool". The dispute over the public chain is actually just the background board behind every passerby who is eager to cash out and is looking forward to a thousand times profit.

Perhaps, only when the next cycle arrives can the real answer be given - who can pull the increments and find a new "anchor point".

The future of the industry and the future of public chains are still unresolved.

jinse

jinse