Ethena and Securitize join forces to understand the high-performance EVM chain Converge in three minutes

Reprinted from panewslab

04/18/2025·10DAuthor: 19122212.eth, Foresight News

On April 17, the crypto project Converge jointly released the preliminary technical specifications and development roadmap by Ethena Labs and Securities. As an innovative platform aimed at bridging traditional finance (TradFi) and DeFi, Converge takes high performance, institutional-level security and user-friendliness as the core, and plans to launch the main network this year and promote the implementation of large-scale financial applications. This article will analyze Converge's technical specifications, roadmap points and its potential impact in detail.

1. Ethena Labs jointly created with financial technology company

Securities

Created by Ethena Labs and fintech company Securities, Converge is positioned as a high-throughput blockchain network focused on supporting tokenized real-world assets and DeFi applications. The project aims to attract institutional capital into the crypto ecosystem through technological innovation and compliance design, while providing retail users with an efficient DeFi experience. Its core vision is to break the barriers between traditional finance and crypto finance and promote the global integration of capital flows and interest rate markets.

Ethena Labs has accumulated rich DeFi experience with USDe's rapid growth (a market value of over US$6 billion, ranking third largest stablecoin), while Securitize has deep compliance and technical expertise in the field of asset tokenization. The cooperation between the two gives Converge a unique advantage: it can not only meet the organization's strict requirements for security and compliance, but also provide the openness and innovation of DeFi.

2. High-performance EVM chain, USDe and USDtb as Gas fees

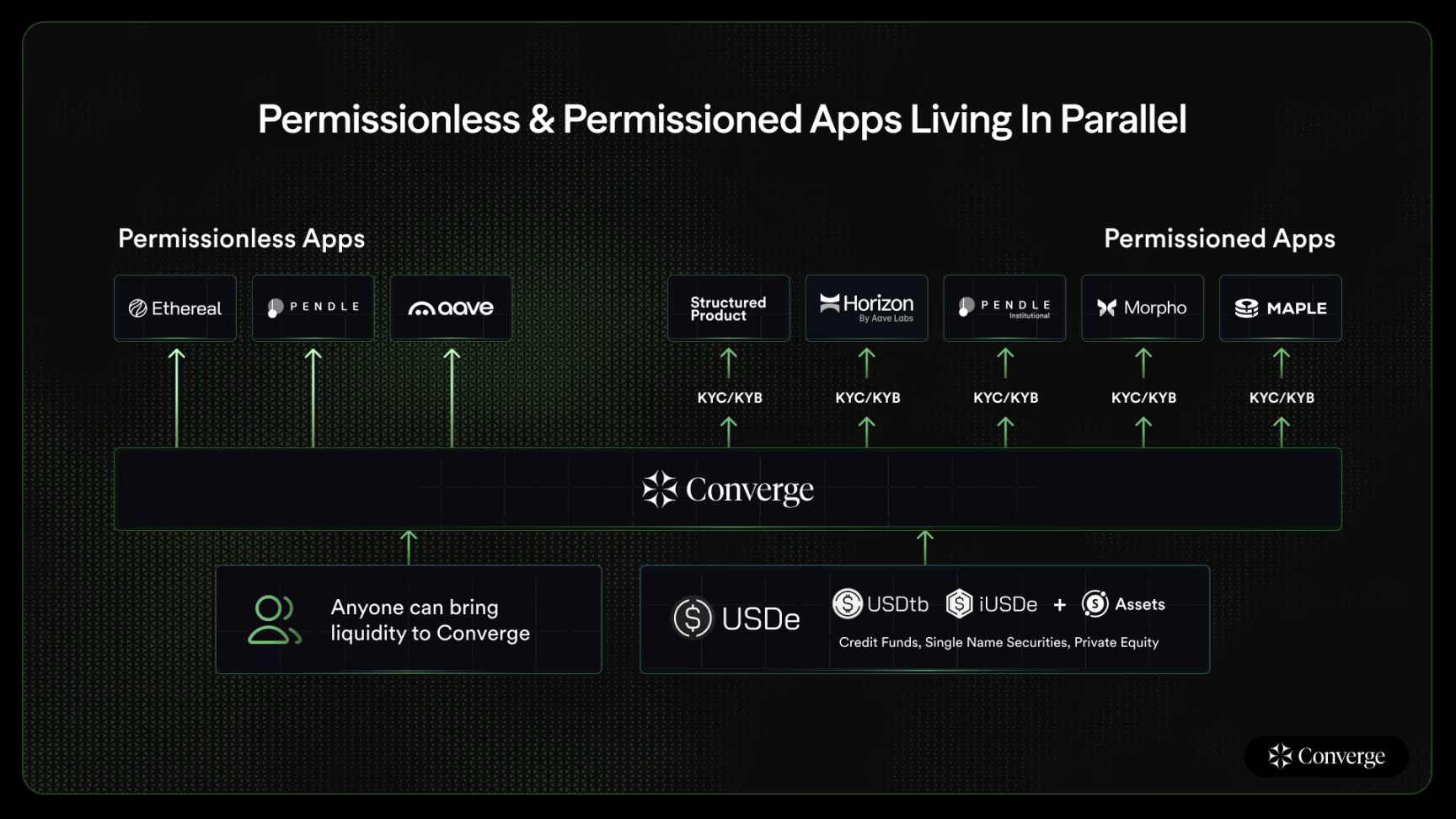

The Converge network will support both licenseless DeFi applications and licensed institutional-level products, enabling the integration of traditional finance and encryption infrastructure on the same chain. Converge's technical architecture is designed around the three pillars of performance, security and user experience. The following is a detailed interpretation of its core technical specifications:

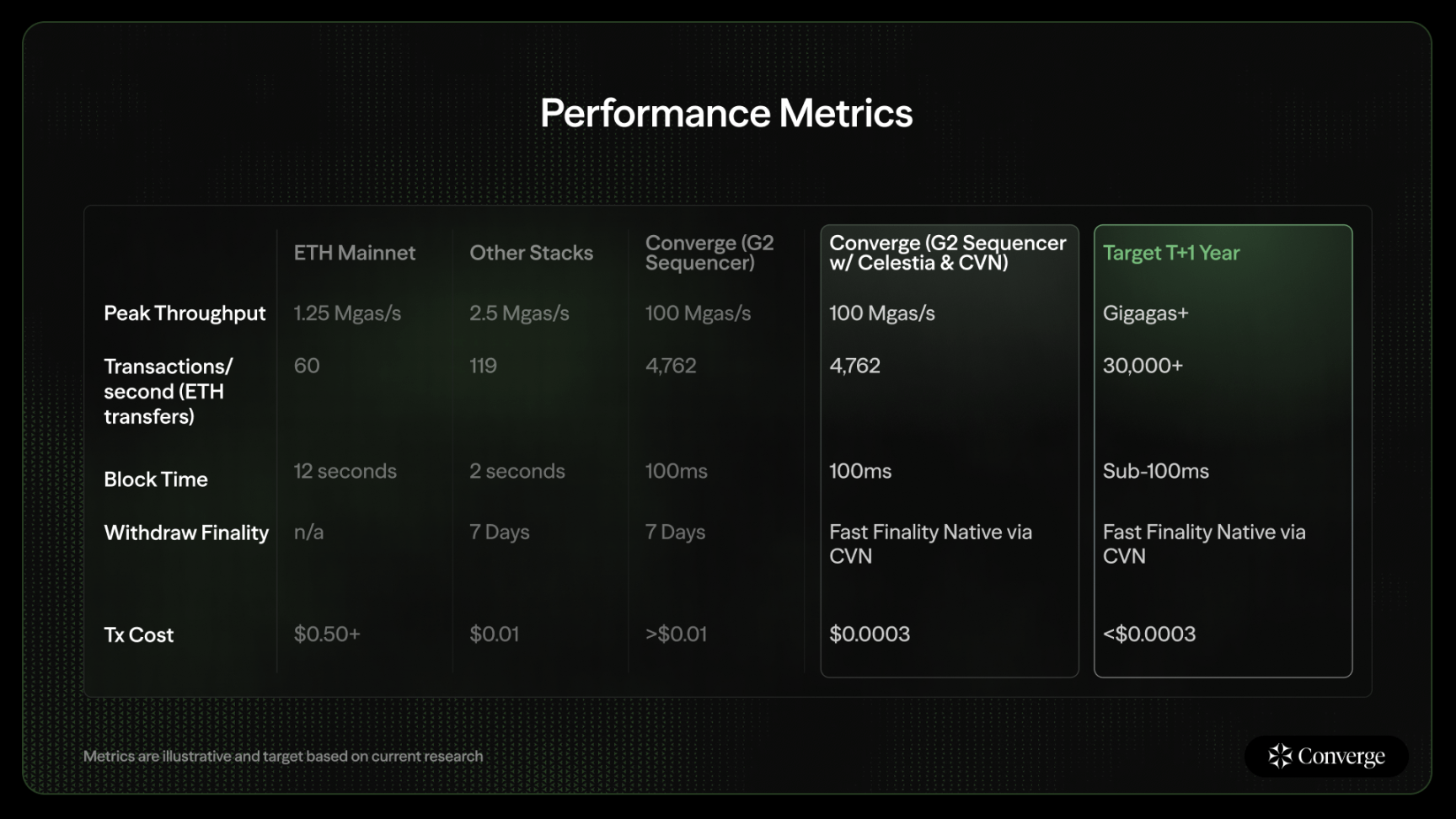

High-performance EVM

Converge adopts an Ethereum Virtual Machine (EVM)-based architecture to ensure compatibility with the existing DeFi ecosystem while achieving ultra-high performance through customized optimization. The network will achieve 100 milliseconds of native block time, with a maximum throughput of 100 million gas/second (Mgas/s). The roadmap shows that by the fourth quarter of 2025, block time will be further shortened to 50 milliseconds, with throughput expected to reach 1 billion gas/second (Gigagas/s). This performance metric is far beyond most existing Layer 1 and Layer 2 networks, and is sufficient to support large-scale financial transactions and complex smart contract execution.

Arbitrum and Celestia integration

Converge achieves low latency and high scalability by integrating Arbitrum's Rollup technology with Celestia's data availability layer. Arbitrum provides an efficient transaction processing and smart contract execution environment, while Celestia reduces network costs by separating data storage, ensuring transaction fees are stable and predictable. This modular design allows Converge to balance performance and cost, especially suitable for institutional-level applications.

Stablecoins as Gas Fees

To improve the user experience, Converge chose stablecoins such as USDe and USDtb as Gas fee tokens rather than traditional native tokens with higher volatility. This design allows users to estimate and pay transaction fees in units denominated in USD, avoiding uncertainty caused by crypto asset price fluctuations. In addition, the network supports ERC-7702 account abstraction standard, simplifies wallet operations, and eliminates the pain points of ERC-20 token pre-authorization and complex Gas management.

Converge Verifier Network (CVN)

Converge introduces a unique Verifier Network (CVN) that is staked through Ethena’s ENA tokens to ensure network security. CVN adopts the permission verifier model (PoS, License Set) and combines the KYC/KYB (Know Your Customer/Business) mechanism to ensure that verifiers comply with compliance requirements. This design is specifically aimed at institutional users to meet their risk management and compliance needs. At the same time, the network adopts a two-layer architecture: the core network strictly controls access rights, and the application layer supports optional license-free interfaces, providing flexibility for developers. To participate in CVN, validators must stake Ethena's governance token ENA. The team said that CVN will be online shortly after the mainnet is launched.

Customized G2 Serializer

Converge uses a G2 sequencer customized by Conduit, combined with the Arbitrum technology stack to provide efficient transaction sorting and confirmation. This sequencer is a key component for achieving 100 millisecond block time and ultra-high throughput, ensuring the stability of the network in high load scenarios.

3. The test network will be launched in the next few weeks, and the main

network will be launched in the end of Q2.

Converge also released the 2025 roadmap, clearly outlining the key milestones from testnet deployment to mainnet launch, which are divided into the following stages:

Q2 2025: Testing Network Online

The test network is expected to launch in the next few weeks, providing developers with early access opportunities, testing network performance, smart contract deployment and user interaction capabilities. The test network will focus on verifying the actual performance of the 100 millisecond block time and stablecoin Gas fees.

Q2 2025: Main Network Online

In an interview, Securities CEO Carlos Domingo said Converge plans to go online by the end of the second quarter. The main network will support institutions and retail users, and initially focus on promoting the institutional-level distribution of USDe (such as through special purpose carrier SPV) and the development of DeFi applications.

Q4 2025: Performance upgrade

By the end of 2025, Converge plans to reduce block time to 50 milliseconds and increase throughput to 1 Gigagas/s to meet the needs of tokenized assets and real-time financial transactions. In addition, the network will introduce more developer tools, such as enhanced account abstraction functions and smart contract templates, lowering the development threshold.

4. Summary

The launch of Converge coincides with the wave of convergence of traditional finance and DeFi, with its high-performance architecture and compliance design giving it certain advantages in institutional adoption. For example, Franklin Templeton CEO Jenny Johnson said in January 2025 that a clear regulatory framework will drive the integration of TradFi with DeFi, and Converge's KYC/KYB mechanism and permission validator model are a positive response to this trend.

However, Converge also faces challenges. The permission validator model may raise community concerns about centralized risks, and although its application layer supports permissionless interfaces, control of the core network remains concentrated in the hands of a few validators. In addition, the implementation of high-performance goals depends on the stability of Arbitrum and Celestia, and any technical bottlenecks can affect the progress of the roadmap.

Converge represents an opportunity to have both technological innovation and practical application potential. However, its success still needs time testing, especially in terms of regulatory environment, technical stability and ecological competition. Converge's performance is undoubtedly worth paying close attention to in the coming year.

References

2. https://www.convergeonchain.xyz/blog-posts/converge-tech-specification-roadmap

chaincatcher

chaincatcher