Excess liquidity is about to dry up

Reprinted from jinse

02/11/2025·7DSource: Liu Jiaolian

Overnight BTC continued to remain around 97k, slightly rising.

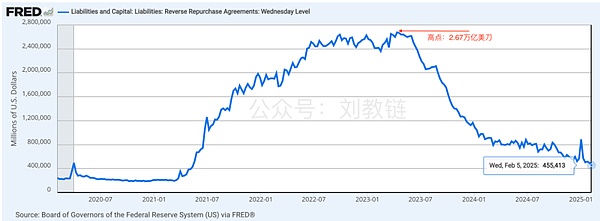

A noteworthy macro trend is that the excess liquidity of the US dollar seems to be on the verge of exhaustion. Intuitive data is that the Federal Reserve's RRP (overnight reverse repurchase) reservoir has less than US$500 billion left, and it has plummeted by more than US$2 trillion from its high of US$2.6 trillion in early 2023.

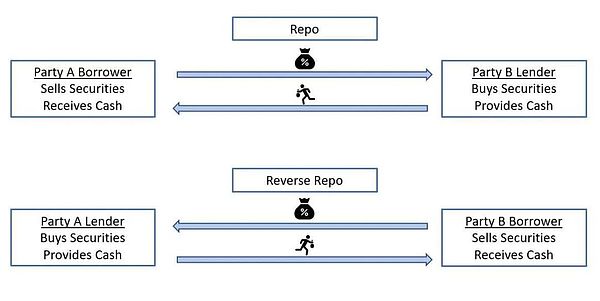

Regarding the operating principle of RRP, simply put, banks lend the US dollar to the Federal Reserve, which uses US bonds as collateral and calculates interest once a night.

In the Implementation Note after each FOMC interest rate meeting of the Federal Reserve, we will see this sentence:

" Conduct standing overnight reverse repurchase agreement operations at an offering rate of 4.25% and the daily limit for each counterparty is US$160 billion. " with a per‑counterparty limit of $160 billion per day. ) (Teaching Link Note: This sentence comes from the executive summary on January 29, 2025)

It can be seen that the interest rate given by RRP is exactly the lower-limit interest rate for the Federal Reserve to adjust the federal interest rate.

This means that investment opportunities in the market that are less than 4.25% lost their investment meaning - you might as well put the US dollar in the Fed's RRP pool to eat the risk-free interest given by the money printing machine.

The actions of the institution are predictive. Starting from the second half of 2021, RRP soared, which shows that institutions expect the Fed to raise interest rates quickly, so as to recycle liquidity from the market and put it into RRP in advance. Since mid-2023, RRP has begun to plummet, which also shows that institutions expect the Federal Reserve to cut interest rates, or that more attractive investment opportunities appear in the market, causing funds to withdraw from RRP.

After all, the RRP liquidity accumulation, which was once recovered from the market, which was as high as US$2.6 trillion, actually comes from the water released by unlimited QE (quantitative easing) during the 2020 epidemic rescue.

Jiaolian once pointed out that " throughout 2020, the Federal Reserve printed money crazily, printing US dollars in one year, accounting for 21% of the total dollar printed in the 107-year history of the US dollar, equivalent to an additional 26.6% of the dollar in one year. " It shows that in 2020 alone, the liquidity of the US dollar soared by about US$4.5 trillion.

In order to cope with the inflationary impact of liquidity, the Federal Reserve used the "Star-absorbing Method". The RRP reservoir once absorbed and accumulated over liquidity of up to US$2.6 trillion, exceeding half of the large-scale release in 2020. "May great contribution".

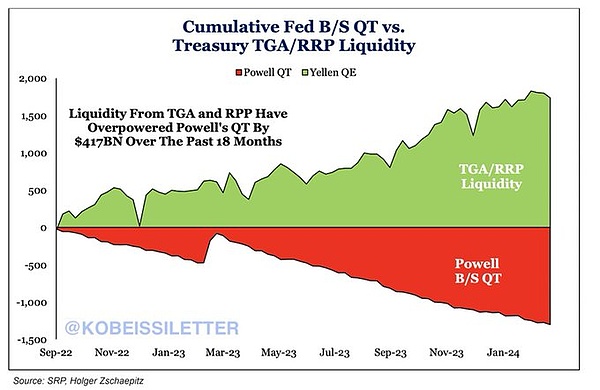

During the QT (quantitative austerity) process that the Federal Reserve immediately initiated and continued to this day, the RRP reservoir acted as a buffer for the "secret crossing Chen Cang".

On the one hand, if better investment opportunities appear in the market, such as gold or BTC, funds will be withdrawn from RRP and back to the market.

On the other hand, RRP also provides a source of purchasing power for the Ministry of Finance to issue bonds and financing. As long as the yield given by the Ministry of Finance is good enough, funds can be attracted from RRP to TGA, that is, the Ministry of Finance account. This part of the money will be quickly spent through US government spending projects and flow back to the market.

Therefore, we can think of TGA/RRP as a hedge for the Federal Reserve QT.

In fact, the liquidity released by TGA/RRP into the market has indeed overwhelmed the liquidity that the Federal Reserve QT recycled from the market.

Why do we see BTC making rapid progress in 2023, breaking through $100,000, and setting a record high? Why do we see gold rising steadily? Why do we see US stocks continuing to sing and dance? Ultimately, the Fed QT has become a fool. Excess liquidity is rapidly releasing from RRP to the market.

The magic of finance lies in the transfer of wealth across time and space. Many people can't understand when the dealer's harvest happened.

The US dollar will be released in 2020, and will accumulate in RRP from 2021 to 2022, and will be released from 2023 to 2024.

If USD is regarded as a Dogecoin, then the harvest did not occur when the "minted" 4.5 trillion yuan in 2020, nor when the "locked" 2.6 trillion yuan in 2021-2022, This happened in the process of "selling" of 2.5 trillion yuan from 2023 to 2024. In this process, the dealer sells Dogecoin USD to you, exchanging the real value in your hands (such as useful goods) or hard currency (such as BTC, gold).

Those who have experienced the corruption circle will generally have a clear understanding of all financial harvesting methods in the world.

The dealer issued a lot of Dogecoins at zero cost. How to trade to reap the maximum profit? If you ship directly without any brains, you will definitely not be able to sell at a good price.

First of all, we must first engage in "airdrops" to attract leeks and establish the so-called "consensus". ——This is the "helicopter money" in the years around 2019-2020, which made the world envious.

Then, it is engaged in "locking the warehouse" and "storing coins to generate interest", giving high returns, artificially creating scarcity, and creating a situation where one currency is difficult to find. ——This is the Fed's violent interest rate hike, high interest rate deposits, and attracting global liquidity backflow.

We must also start public opinion propaganda, and use various cooperative media and KOLs to speak with money to shout orders all over the world, hype the market and raise expectations, and cover every leek without blind spots. ——This aspect is simply too easy for controlling global public opinion, global media and world-class long-term breeding technology.

Only when a huge trend has emerged, causing the leeks all over the world to rush in, is it the last step, against the leeks, decisively shipped and sold them, and divided the chips in their hands into batches. Sell it to these stupid leeks rhythmically. ——We are currently in this critical final stage.

From the perspective of trading harvesting, it is easier to understand why it is hesitant about rate cuts.

What are inflation and employment, they are all excuses. The most important thing is that it must try its best to maintain the strength of the US dollar during the entire high-level shipment process, that is, it cannot let the leeks see through the truth and stop charging.

Just like a Dogecoin dealer, when shipping at a high level, you must cooperate with the preparation of various favorable factors and constantly test the market support. In fact, it is the confidence and strength of the leeks to charge. Try to maintain the price level during the shipment process, and don’t just do it. The market is destroyed, so that the chips can be sold at the best price and the ultimate profit can be maximized.

Unlike some meme Dogecoin that runs away after cutting one hand, the US dollar plate cannot be cut only, but it needs to be played for a long time.

After all, it will take only a few minutes to post a meme dog on the chain. So if you play with a dish, you will start another dish and play with a new one. It takes a lot of time and effort to establish a US dollar system.

But the US dollar is not even as good as the native dog. Dogecoin is at least a smart contract on the chain, so the dealer may not be able to over-issuance at will. After cutting a wave and want to continue next time, he can only smash the market and wash the market and recover chips at a low level. It is very difficult. If you are not careful, you will be backfired by retail investors, so most meme Dogecoin choose to abandon the market directly, "leave it to the community", and instead issue a new coin and play it again. The US dollar can be controlled by the dealer and is super-issued at will, so the dealer can win.

Therefore, it is better to regard the batch of US dollars that are issued by QE as a new Dogecoin. However, these Dogecoins have a brand continuity, all called USD. This is easy to understand.

The Federal Reserve is doing QT quantitative tightening to recover a batch of USD, a group of local dogs. This is like recycling old chips, laying the foundation for the next wave of casting and distributing new chips, and opening up a new harvest.

Therefore, if we use the language of the currency circle to describe the current RRP reservoir that is about to run out, it will roughly mean:

The last local dog USD plate is about to be finished. After finishing, you should start preparing to start the next Dog USD plate and start a new round of coin issuance and harvesting.

panewslab

panewslab

chaincatcher

chaincatcher