Forbes: Nuggets Guide to 2025 Copycat Season

Reprinted from panewslab

01/03/2025·3MSource: Forbes

Compiled and organized: BitpushNews

Bitcoin halving, all-time highs and alt season coming – is this a classic bull market recipe? Or not?

First, the BTC halving reduces its issuance rate, thereby triggering a supply shortage. After that, BTC will climb all the way to a new all-time high, followed by altcoin speculation. Investors will be more inclined to pursue higher returns, and the altcoin season will break out in full force. Shortly after Bitcoin’s latest halving, it passed the $100,000 mark – a historic milestone. However, the altcoin market is currently not seeing a surge.

Where is the usual rebound? Has the classic plot been ruined? The surge in institutional capital and the liquidity crunch brought about by high interest rates, coupled with Trump’s aggressive and bold views on cryptocurrencies, have made one thing certain: this cycle will be unlike any we have seen before.

How is this cycle different?

Each cycle has four phases: accumulation, rise, distribution, and decline. Although the mechanics behind these stages are well known, timing the market is one of the most recognized skills. You are trying to predict when we will enter a specific phase in order to develop a trading strategy. However, while cycles follow predictable patterns, we must not forget the broader market context - cryptocurrencies have experienced a lot of changes over the past year.

institutional capital

The increasing presence of institutional investors in the Bitcoin market has reshaped the dynamics of the Bitcoin market. Supported by the emergence and growth of cryptocurrency ETFs, Bitcoin has become the seventh largest asset in the world and has become a new choice for institutional investors. Increased participation from institutional investors generally leads to greater price stability. However, this may not be good news for altcoins. After all, volatility and large corrections redirect capital flows into altcoins. Lower volatility means lower returns that may flow back into the altcoin market.

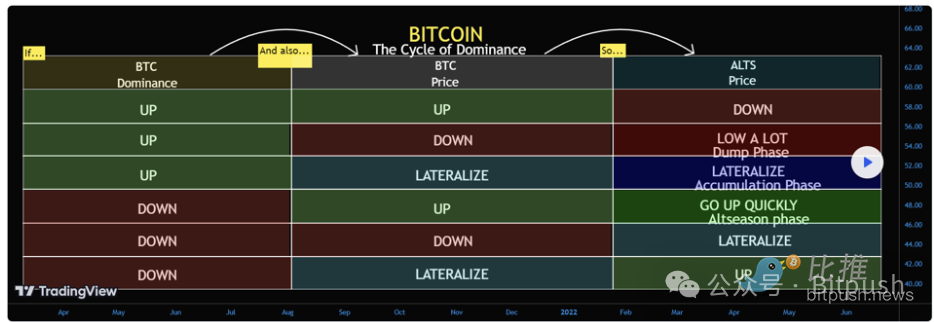

This year is a special year. The launch of the Bitcoin Spot ETF has brought a large inflow of traditional financial capital to the cryptocurrency market. Institutional flows into these ETFs triggered a Bitcoin supply shock, reinforcing its dominance. The demand for Bitcoin triggered by the ETF directly affects Bitcoin dominance, which is currently around 56%, an important metric often overlooked by novice traders. It measures BTC’s market share relative to altcoins, providing insight into whether we are in Bitcoin season (where BTC outperforms) or altcoin season (where altcoins outperform). What does strong BTC dominance coupled with stable Bitcoin prices mean? Altcoin selloff. And during this cycle, the Bitcoin spot ETF extended Bitcoin’s dominance. This new variable was not present in previous bull markets and will make the 2025 altcoin season undoubtedly unique.

Macro: Liquidity and Regulation

If you ask any financial executive what the most important financial metric is, they will tell you liquidity.

In 2023 and 2024, U.S. interest rates rise to one of their highest levels in a long time. Although it has fallen from 5.25% a year ago to 4.19% now, it is still a relatively attractive yield for a risk-free asset. On the other hand, rate cuts tend to fuel cryptocurrency bull markets for one simple reason – they create a favorable environment for riskier assets to flourish. After all, risk-free government bonds yielding 0.11%, as they do in 2021, are just as attractive as losing capital to inflation. Low interest rates equal cheaper borrowing and higher liquidity, which in turn drives investors to where to park their money to get higher returns. Where? Yes, you guessed it. Cryptocurrency.

Trump’s victory undoubtedly shook up the crypto world. The Bitcoin Act has sparked heated debate in crypto and non-crypto circles. If passed, the Senate legislation would require the Treasury Department and the Federal Reserve to purchase 200,000 Bitcoins per year over five years to accumulate 1 million Bitcoins. In other words, about 5% of global supply. Needless to say, pro-crypto regulations are a very meaningful step for the widespread adoption of crypto assets, and Trump’s stance has proven to inspire positive sentiment, with BTC hitting a record not long after the future president confirmed plans to create a BTC Federal Reserve reached a record high.

With BTC maintaining dominance, high interest rates, and US-backed crypto regulations, should we expect a full-blown altcoin supercycle in 2025? This is the billion dollar question.

When does the copycat season come?

If history has taught us anything, it’s that altcoin surges typically follow major Bitcoin moves. However, estimating how big these price swings will be — or how soon after Bitcoin hits all-time highs before altcoins explode — is impossible.

David Siemer, CEO of Wave Digital Assets, said: “I don’t think we will see an altcoin season as dramatic as 2021 in the near future, which means BTC dominance will fall below 40%. But as BTC continues Up, we will see altcoin values rise significantly.”

Siemer later added: “For altcoins to breakout relative to BTC like they did in 2021, altcoin usage (adoption) and value (revenue capture) will need to increase by several orders of magnitude,” emphasizing that this will likely take at least 3 years . But once it starts, the altcoin season itself is easy to identify, as there are some pretty bullish signals:

Altcoin prices are growing rapidly and outperforming Bitcoin, especially large-cap altcoins. This means that not only are altcoins overall rising, but they are rising more than Bitcoin.

Altcoin dominance is surging, just like the May 2021 altcoin season. These tokens dominate the market, with the combined market capitalization of the top 100 altcoins reaching 1.3 times that of Bitcoin.

FOMO-driven sentiment, high trading volumes, and risky investors are adding to buying pressure and price momentum.

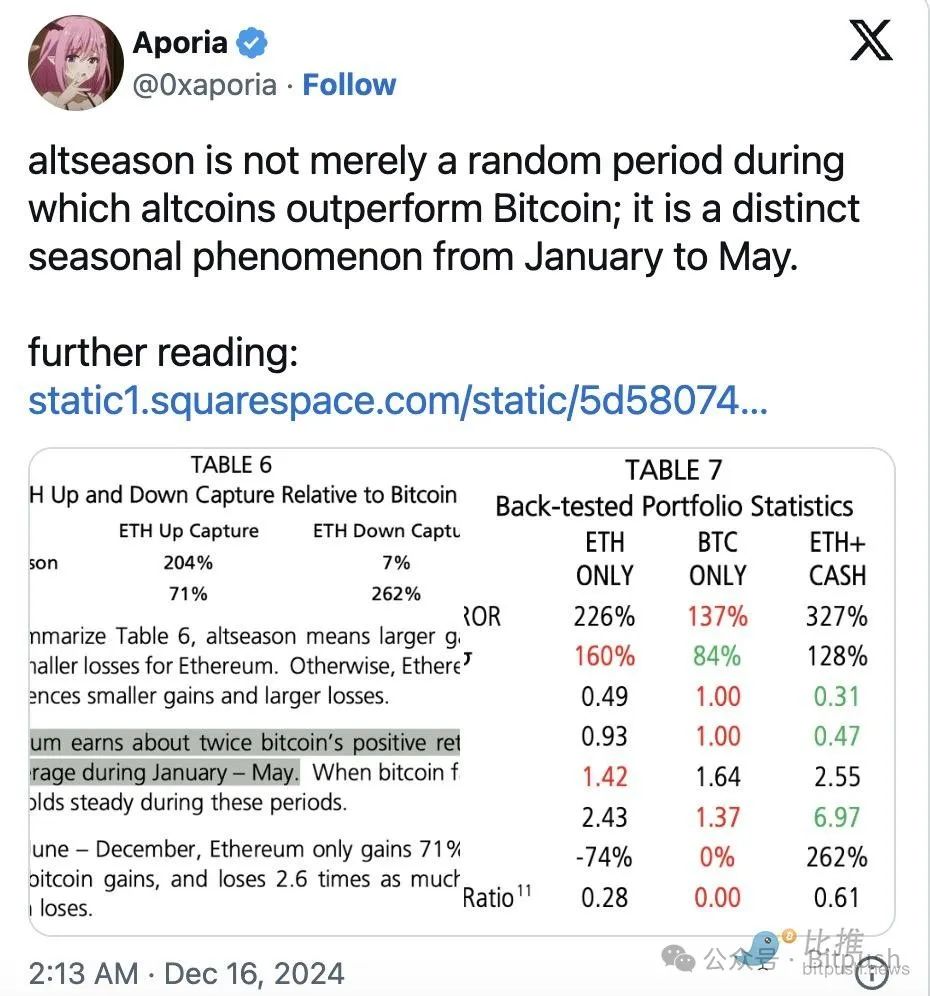

Cane Island Digital Research shared findings on altcoin rally seasonality in its “Altcoin Peak Season Proof,” suggesting that ETH is a proxy for altcoins experiencing a bull run. Additionally, it mentioned the repeating pattern of the altcoin peak season from January to May.

narrative dominance

While the upcoming altcoin season may be very different from what we are used to, certain niche tracks are already taking hold in the cryptocurrency space. After the VIRTUAL token experienced a 24908.4% surge (or 249x), it’s safe to say that we have entered a new level of narrative dominance.

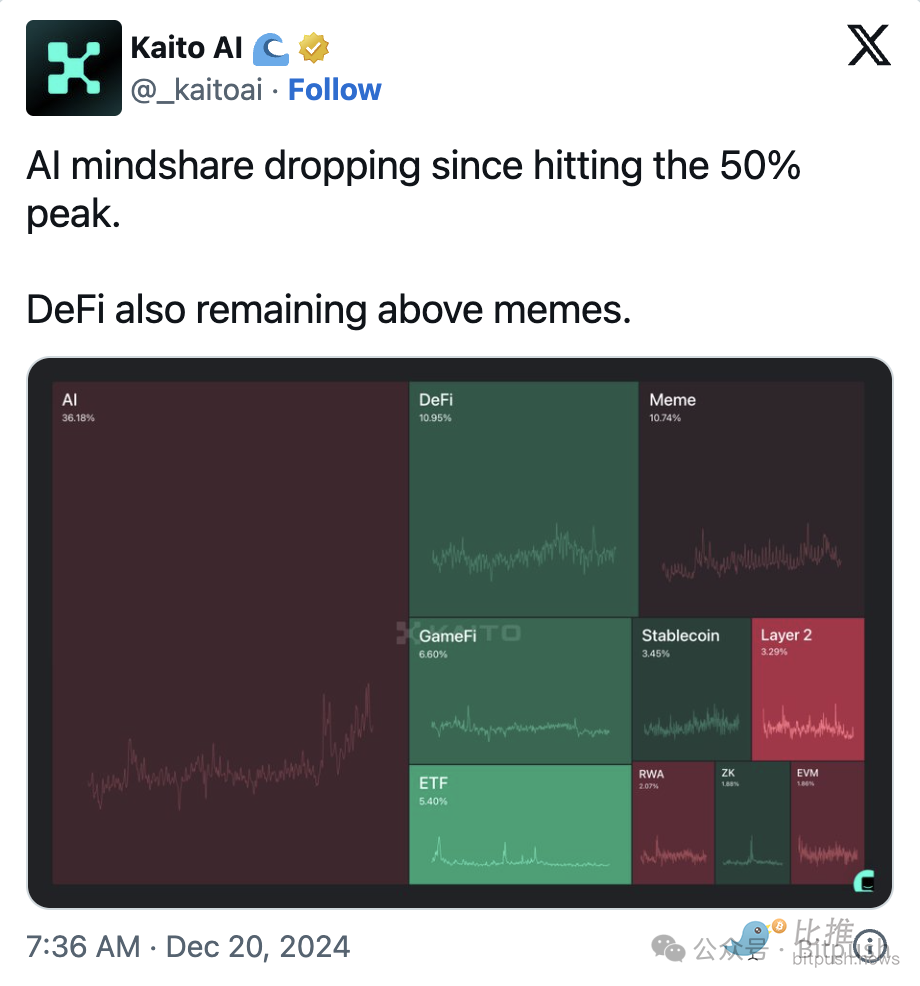

While memecoins may overtake areas like real-world assets or AI, AI agents are in a league of their own and are often seen as the driver of the next supercycle. Artificial intelligence is still at its peak, and with the advancement of artificial intelligence agents, the on-chain artificial intelligence economy has captured a large portion of the market share, which will peak at 50% in 2024, according to Kaito AI. This trend is likely to continue in 2025, driven by unprecedented demand for AI services.

Institutional adoption, sparked by major companies like BlackRock, has also impacted areas such as real-world assets, legitimizing tokenization as a fundamental part of the crypto world. While much of the attention has been focused on artificial intelligence and artificial intelligence agents, traditional finance is exploring tokenization as a viable business option, and large banks such as JPMorgan Chase and Goldman Sachs are trying to disrupt financial markets.

How to prepare for altcoin season?

As we enter 2025, here are a few things to keep in mind before altcoin season begins.

Bitcoin dominance is a classic reference indicator, please use it to seize the opportunity to trade. Websites like BlockchainCenter.net can help assess whether the market is currently in altcoin season or Bitcoin season. Things to note are:

Cryptocurrency markets are largely driven by sentiment, so keep an eye on regulatory moves, macroeconomic trends, or crypto-native narratives (DeFi, AI agents, meme coins).

Not all altcoins will follow the dynamics of Bitcoin’s price. Historically, projects with strong fundamentals or that fit into an emerging narrative (such as AI projects) have performed better. However, prioritize quality over quantity, and focus on projects with strong fundamentals, active teams, and ideally product-market fit that inspires a large community.

Pullbacks are healthy. They indicate that the market is consolidating and allow investors to enter positions before the next move higher. Altcoin season usually occurs in the later stages of a bull market. Please be patient.

Conclusion

The cryptocurrency market is maturing. Each cycle is a stepping stone and should be viewed as a learning lesson. While meme coins are still reaping the rewards, new narratives are becoming increasingly influential. But the most interesting thing is—currently popular narratives, such as AI agents, are not just passing fads. The bottom line is that we will now face greater impact from macro factors and institutional adoption than in any previous bull market. Does this mean we should expect different altcoin dynamics this time? To some extent yes. Nor should we blindly follow the patterns of past years. The question is not if altcoin season will happen, but when it will happen, and how it will differ from past years.

Get ready for the challenge!

chaincatcher

chaincatcher