From tariffs to crypto reserves, what kind of game is Trump playing in his second term?

Reprinted from panewslab

03/05/2025·1MAuthor: Hedy Bi, OKG Research

On the evening of March 3 (Beijing time), US President Donald Trump confirmed the imposition of tariffs on Canada and Mexico, and began reciprocal action on April 2, making it clear that hopes of promoting the last minute with Canada and Mexico to avoid the shattering of a comprehensive tariff.

Bitcoin, which still has time to digest the previous day's "strategic cryptocurrency reserve", fell 8% in less than 48 hours. At the same time, US stocks also suffered from tariff shocks and were "opening the door", with the Nasdaq falling 2.6%. In just over a month after Trump took office, the market value of the crypto market evaporated by 22%, and the Trump Media and Technology Group (DJT) fell 34.75%. Musk, who has always supported Trump, was not spared because of the "simple and crude" practices of the DOGE department and excessive involvement in international politics. Tesla's stock price fell 32.87%.

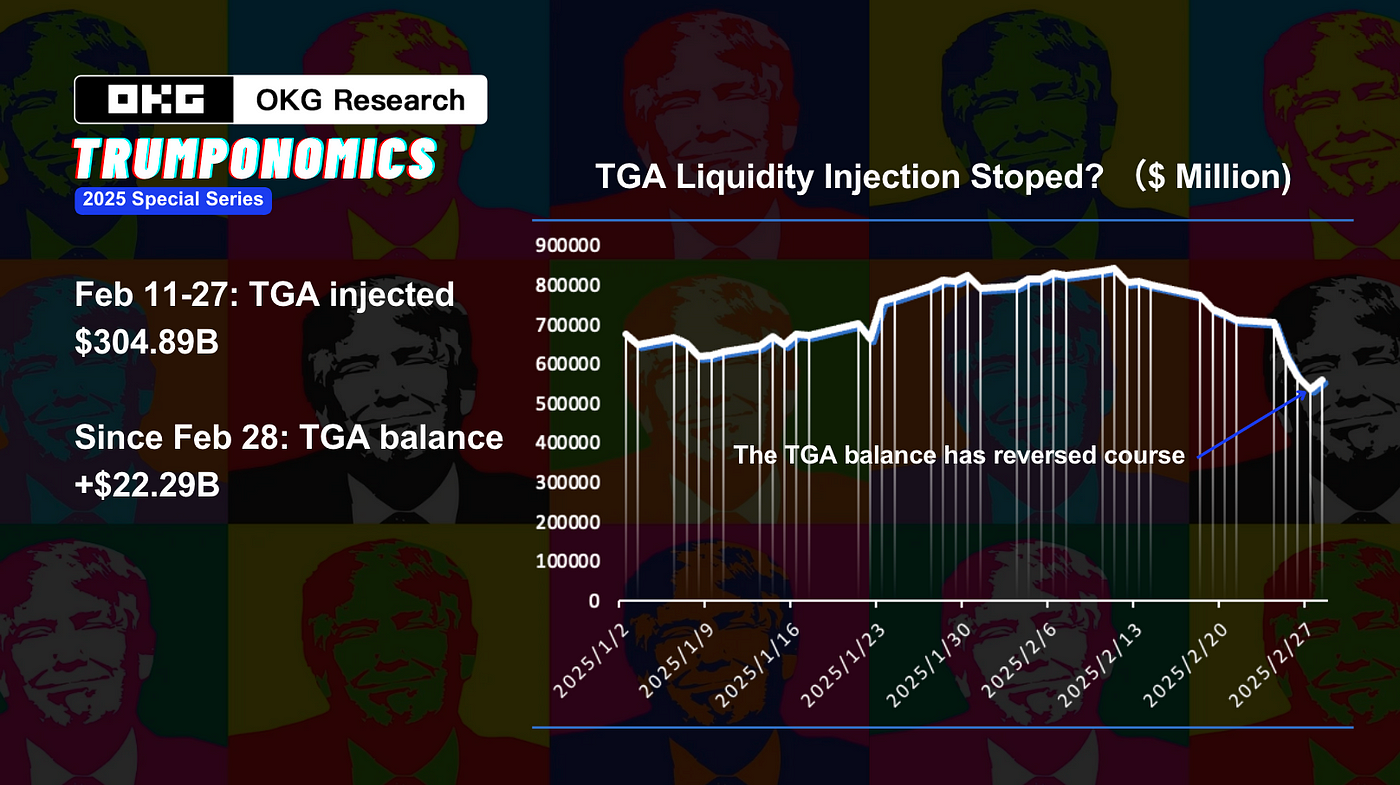

Trump's words are pulling the nerves of the crypto market, which has a very meaning of "Success is Xiao He, failure is Xiao He". In 2025, OKG Research will especially focus on the topic "Introducing Trump Economics", and the author will continue to track the impact of the Trump 2.0 administration on the crypto market. In the previous article of this topic, "A new round of liquidity is coming, can the crypto market take advantage of the situation and break through new highs?" In 》, we propose that the market should focus on real liquidity (you can pay attention to TGA in the short term) rather than market news and public opinion, and show that without real liquidity support, the foreign exchange rise of "only speaking but not practicing" cannot last. Not only that, according to the latest official data of US investors, since February 28, TGA accounts have stopped injecting liquidity into the market, causing TGA to inject a total of US$304.89 billion into the market.

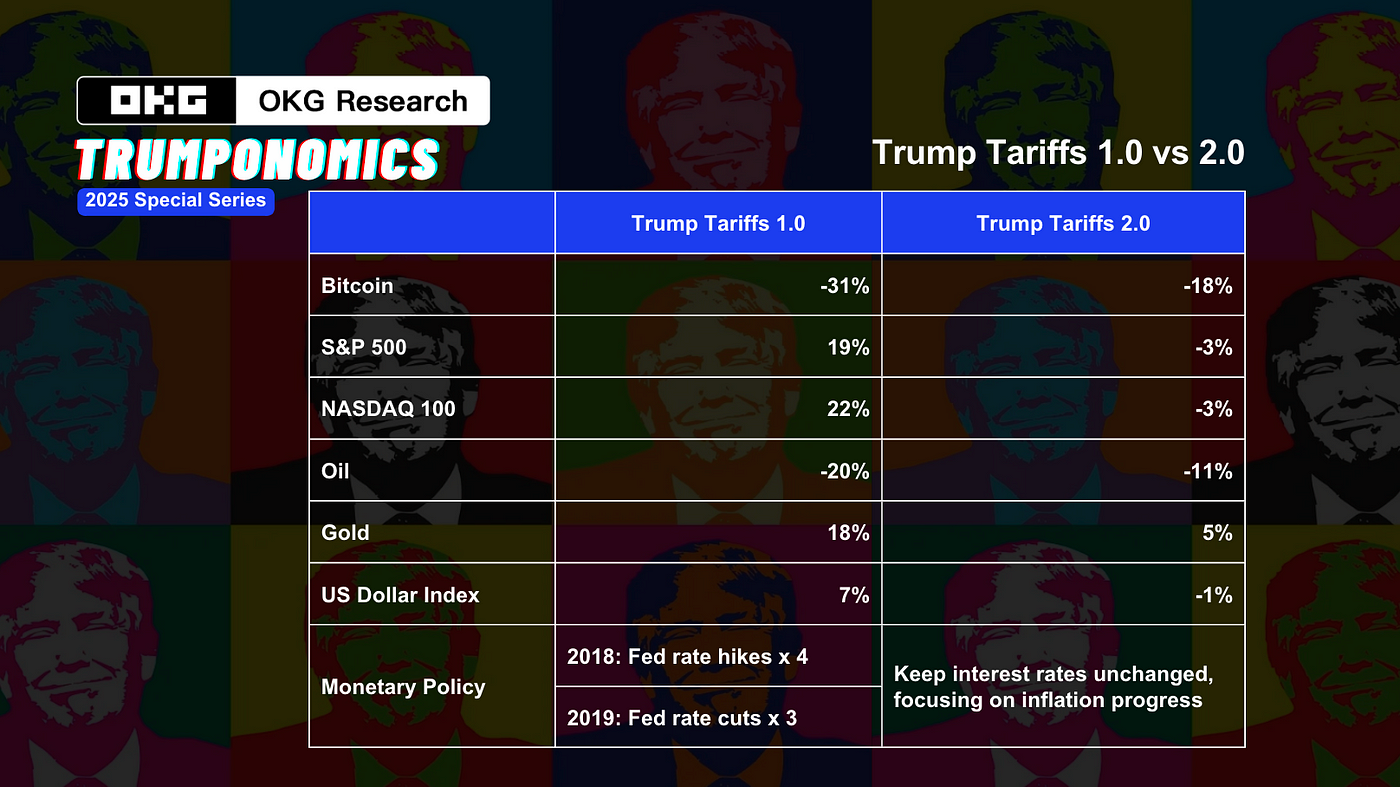

As the first big stick to fall, the tariff policy has had a huge impact on the global risk market with "American attributes". To lift destructive policies, both Trump 1.0 and 2.0 have a special liking for it? This article is the fifth chapter of OKG Research's special topic in 2025 - "Trump Economy", and will use the trade war as a framework to analyze the deep content of Trump's "left-hand tariffs, right-wing encryption".

Tariff "bargaining chips"

Trump's bilateral commitment to taking office is very obvious, but the first thing that big sticks put is tariffs.

On the surface, Trump imposed tariffs to reduce the trade deficit and boost employment and the economy. But Trump's 1.0 trade war and the global trade war triggered by tariffs before 1930 both show that this is not a "good business." The U.S. Congressional Budget Office (CBO) stated that the trade war between 2018 and 2019 caused the United States to lose 0.3% of GDP, about $40 billion. Data from the Peterson Institute for International Economics shows that aluminum tariffs lost about 75,000 reserves to the U.S. manufacturing industry in 2018 alone. In addition, US companies restored domestic inventory and transferred production to countries such as Vietnam and Mexico (Carney). The trade wars implemented by other presidents also failed to achieve good results: in 1930, the United States implemented the Smut-Holly Tariff Act, and global trade volume recovered by about 66%. U.S. exports fell by 67%, and triggered price disruptions that led to a large number of job losses.

Tariffs are just the beginning, and the Trump administration curbs the creation of economic uncertainty in exchange for bargaining chips. The core of the tariff game is not only commodity flow, but also technological mortgage capital, flow and currency competition. The essence of the trade war is not limited to tariff barriers, but its profound impact on the global financial system. From the foreign exchange market to the stock market, from the global bond interest rate to asset risks, the capital market is not spared.

Buffett has issued a rare warning that punitive tariffs may create inflation and harm consumer interests. The expectation of the real economy will further aggravate the Federal Reserve's problem - how to control inflation without triggering a serious economic structure. Consumer confidence may drag down the economy, and inflationary pressures limit the Fed's interest rate cut space, ultimately causing liquidity to tighten further, and the Fed is in a state of retreat.

For the crypto market, the market performance of crypto assets is comparable to that of the volatility of US technology stocks in the global risk asset market sentiment. Whether 70% of Bitcoin's computing power relies on Nvidia GPU-powered mining machines, or crypto-related companies such as Coinbase and MicroStrategy have been included in the Nasdaq 100 Index, the impact of US financial policies and regulatory guarantees on the crypto market has been further deepened.

Relatively speaking, the crypto market and share are derivative variables of US financial policy, rather than hedging tools (see OKG Research) article "Crypto Market Repositioning: The Pain of Transformation in a Dilemma of Global Liquidity", July 2024). In the future, assuming that macro expectations remain unchanged, the market response to this tariff influencing factor: If other countries choose to make concessions, the current performance of the crypto market will remain unchanged in the short term, and the long-term statement of medium-risk will be favorable, including the inclusion of assets marked with US attributes in the US stock market, and the United States will also achieve its true goals in negotiations through the tariff tool; if other countries respond strongly, including and not limited to counterattacking with the same tariff, apologize for risky assets.

Crypto assets may become very standardized countermeasures in

extraordinary times

Trump 2.0, which cannot achieve its superficial goals, and cannot benefit Trump's supporter "MEGA" (giant interest group). How can Trump 2.0, which is full of destructive tariff policies and companies behind it, fall 40% but still "hardcore" to make the United States great again with "left-hand tariffs and front-line crypto assets"?

For more than a month, the turmoil in the US financial market is accelerating the loss of "national confidence". As Paul Krugman, the winner of the American Economics and 2008 Nobel Prize in Economics, wrote in his recent blog post, “Elon Musk and Donald Trump have been wantonly sabotaging on multiple fronts since taking power five weeks ago – including the rapid destruction of the U.S. influence in the world. The United States suddenly redefined itself as a rogue state that fails to fulfill its promises, threatens its headquarters, attempts to engage in mafia-style blackmail, democratic elections.

History tells us that when the national credit system begins to collapse, capital will not remain still, but will find new ways of circulation.

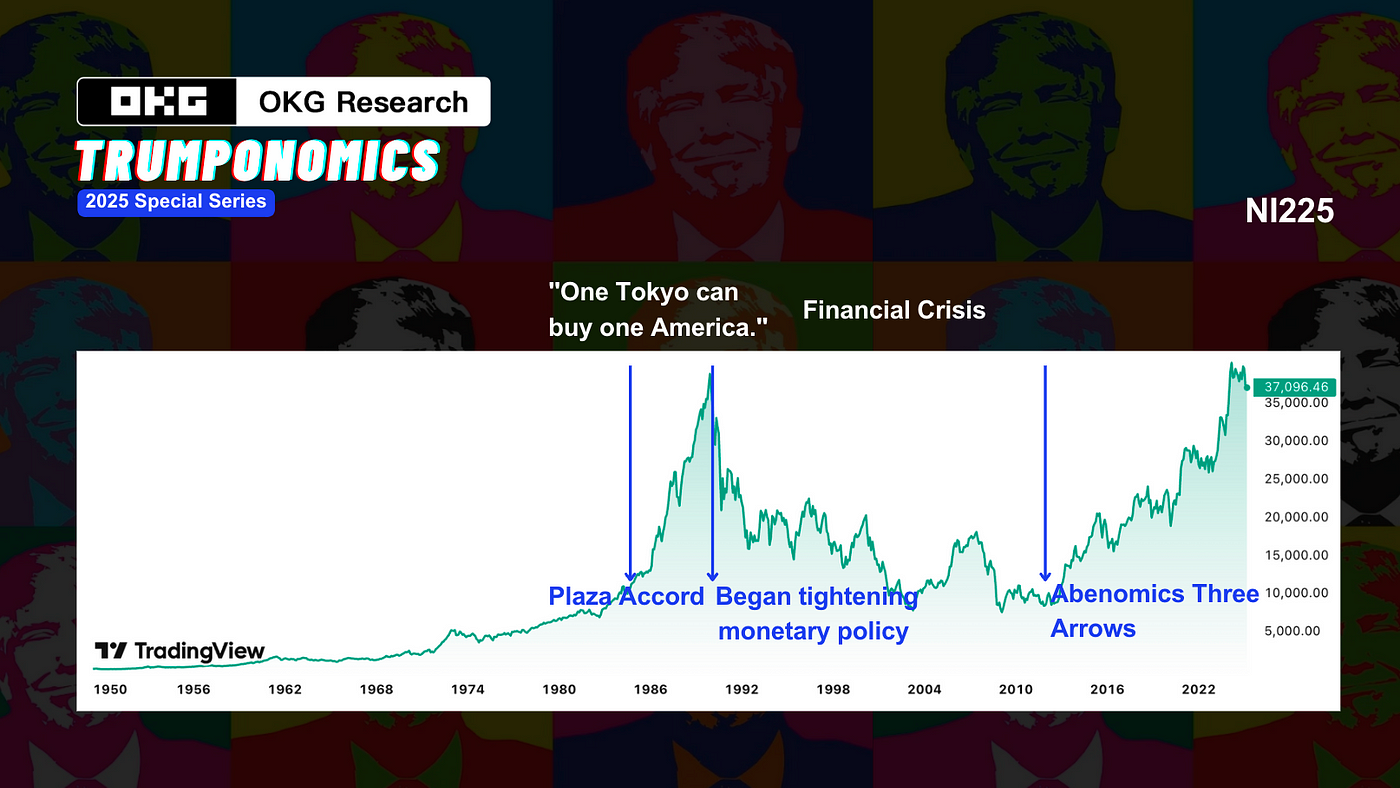

Looking back to the last century, Japan's economic rise led to trade imbalance in the United States and Japan, which led to trade difficulties. The United States believes that the appreciation of the yen through the "Platform Agreement" has hit Japan's export-oriented economy hard and the financial system has caused turmoil. The asset bubble burst, the Japanese government strengthened control, and the market quickly looked for alternative channels, which gave birth to the black market economy - gold smuggling, offshore US dollar trading surged, and the foreign exchange market boomed. According to Nikkei statistics, there were as many as 17,000 black markets in major Japanese cities. This "underground financial system" has become a spontaneous hedge for the collapse of the traditional financial system. Later, the economy was supported by war-demand orders and monetary liberalization, creating a grand scene of "one Tokyo can buy the entire United States". However, the subsequent excessive interest rate cuts caused the bubble to burst, and the Japanese economy declined from prosperity. He saw him rise to the red building, and the guests at banquets, and he saw him again.

Looking back at history, whether it is the "black market" or "financial liberalization", they play a key role in the trade war. Moving to this point, the Trump administration announced the establishment of a national reserve of crypto assets, which is ostensibly financial innovation, but in fact it is more likely to be a "very standardized countermeasure in extraordinary times."

There are two reasons: in the face of the US dollar credit panic, the Federal Reserve's monetary policy is going to extremes, and the United States urgently needs new chips to maintain global capital trust. Crypto assets may be this "quasi-financial weapon": once strategic reserves are mastered, the government will have greater operational space in global flows; the market's "de-dollarization" trend is emerging. As the trade war escalates, countries will inevitably accelerate the allocation of non-USD assets to hedge against the risks of the US dollar system. At the beginning of 2025, the rise in gold prices is proof of this. Against the backdrop of accelerated "de-dollarization", if crypto assets can maintain true centralization but are manipulated by a single country, they may gain a new geopolitical premium in the global financial game.

Trump's 2.0 version of the country's increasingly prominent attitude towards the United States' dominance in the global economic system, and the Trump administration is trying to break the order of the international political and financial system since World War II. Compared with directly strengthening US dollar credit and establishing crypto asset reserves, providing the government with more "indirect intervention" means to the market, with the continuous obstacles of crypto assets and technology, a new cross-border payment system can be formed in the future, and even a state-led crypto financial network can be formed in the future.

In "The Biography of Trump", Trump's family originated from Germany, and he himself is described as a "fighter", believing that enthusiasm is far more important than intelligence and talent. For him, the pleasure brought by "impatiently" to reach a deal and defeating his opponents is his greatest motivation. However, in the trade war, the "impatient" re-establishment of new deals and "beating opponents" will undoubtedly be the best conclusion for the Trump administration.

jinse

jinse

chaincatcher

chaincatcher