FTX repayment is imminent, which currencies will generate huge selling pressure?

Reprinted from panewslab

01/14/2025·27days agoAuthor: jk, Odaily Planet Daily

After FTX’s collapse in 2022, the exchange’s story shifted from glory to complex repayments and liquidations. Two years later, FTX’s compensation plan gradually became clear, but it brought huge selling pressure to some currencies.

In this article, Odaily Planet Daily will take readers to review FTX's progress in repaying debt, the tokens that have been under selling pressure, and how the featured products that once attracted the market's attention will affect the future of the encryption industry.

FTX’s Repayment Plan and Timeline

In May 2024, the Associated Press reported that clear compensation data was provided in court documents submitted by FTX at that time. According to the court filing, FTX owes creditors approximately $11.2 billion, and the exchange estimates that it can distribute between $14.5 billion and $16.3 billion to creditors.

The plan also provides for additional interest payments to creditors after claims are paid in full, as long as funds remain outstanding, the document states. The interest rate for most creditors is 9%.

However, these compensations will all be settled in U.S. dollars at the price of the cryptocurrency at the time of FTX's collapse. To be precise, when FTX filed for bankruptcy protection in November 2022, the price of Bitcoin was $16,080. This is a good thing and a bad thing - The bad thing is that investors owned digital currency at the time and now receive compensation in U.S. dollars. If the investor had held 1 Bitcoin at that time, the income would have been approximately 6 times that of today. These incomes were not included in the compensation. The investor could only receive compensation of US$16,080 + two-year interest rate.

The good thing is that without the crypto bull market of the past two years, FTX may not have had so much money in its treasury to be able to pay out to all customers - it is a very comforting thing to be able to get back the money at that time.

Under the plan filed with the U.S. Bankruptcy Court in Delaware, customers and creditors with claims of $50,000 or less will receive about 118% of their compensation. This group accounts for 98% of FTX customers.

In August 24, there was a small update on this incident: Odaily previously reported that FTX and the U.S. Commodity Futures Trading Commission (CFTC) had agreed to a $12.7 billion settlement agreement. The CFTC agreed that it would not collect any compensation as long as FTX complied with the restructuring plan. As a result, FTX will pay up to $12.7 billion to creditors, depending on available funds. This is equivalent to putting the government's seal on the compensation agreement, ensuring that the government's lawsuit against FTX will not reduce the funds available to customers. Based on estimates of the amount of funds at the time, FTX could still complete the full compensation, or even have some leftover.

Odaily previously reported that a judge approved FTX’s sale of its stake in the $1 billion AI startup Anthropic and its plan to pay the IRS $200 million in priority taxes and $685 million in subordinate tax claims that FTX argued it owed The amount is far less than the $24 billion claimed by the IRS. These are all part of FTX's road to compensation.

So, how is FTX’s compensation going now? FTX compensation requires selling coins. What is the selling pressure caused by this part? Will some tokens face huge selling pressure? Let's take a look.

What’s in FTX’s current wallet?

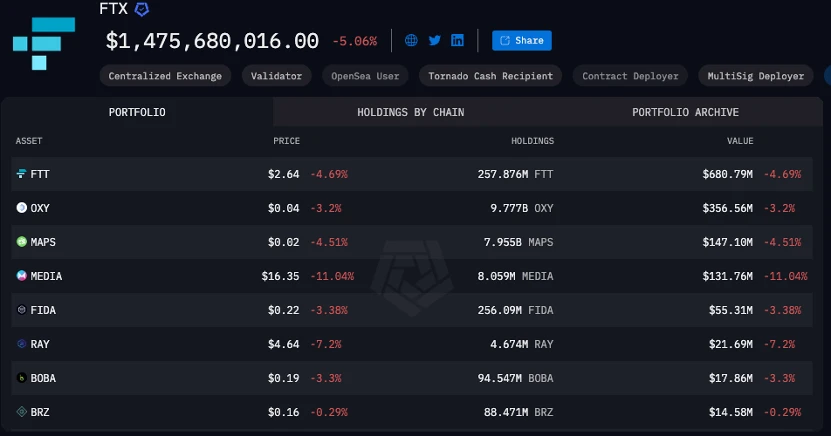

FTX's current wallet and currency holdings are publicly available on Arkham. As of the time of writing this article, FTX's on-chain address still has total assets of US$1.475 billion, and the largest holding currency is FTT, worth approximately US$680 million.

Including FTT, there are the following 20 other currencies with current holdings of more than one million US dollars:

-

FTT: $680.79M

-

OXY: $356.56M

-

MAPS: $147.10M

-

MEDIA: $131.76M

-

FIDA: $55.31M

-

RAY: $21.69M

-

BOBA: $17.86M

-

BRZ: $14.58M

-

DRIFT: $10.15M

-

JUP: $6.66M

-

JTO: $6.25M

-

USDC: $3.31M

-

SOL: $3.14M

-

RENDER: $2.77M

-

ASD: $2.76M

-

SRM: $2.72M

-

KMNO: $2.67M

-

MPLX: $2.65M

-

AMPL: $1.67M

-

STG: $1.18M

So, which currencies require extra attention to selling pressure? According to Coingecko data, Odaily has compiled the following tokens for you:

-

FTT: The current fully diluted valuation of FDV is only US$870 million, the 24-hour circulation is US$18 million, and the holdings of FTX have reached US$680 million. Even if there are market makers to take over the pressure, it is difficult for buyers to support the current price.

-

OXY: The current 24-hour trading volume is only $3,000, while FDV is about $365 million. FTX’s holdings reached $356 million, and it can be seen that the token has little trading volume due to the prospect of selling pressure. However, this token is only listed on Kraken in addition to DEX, so it has little relevance to most traders.

-

MAPS: The current FDV is US$185 million, FTX holdings reach US$147 million, and the 24-hour trading volume is also bleak, only US$130,000.

-

MEDIA: The current FDV on Coingecko is US$14.23 million, and FTX holdings have reached US$131 million.

-

FIDA: FDV is currently $216 million, and FTX holdings are $55.31 million. If done correctly, the bears may have room to work. The current 24-hour trading volume is 15.51 million.

-

BOBA: FDV currently has a market value of 94.67 million, with a market capitalization of 81.05 million, while FTX’s holdings have reached US$17.86 million. The 24-hour trading volume was $1.62 million.

-

SRM: The market capitalization is currently US$11.37 million, the 24-hour trading volume is US$490,000, and the FTX holdings are US$2.72 million.

-

MPLX: The market capitalization is currently US$185 million, the 24-hour trading volume is US$1.36 million, and FTX holdings are US$2.65 million.

-

AMPL: The market value is currently US$150 million, the 24-hour trading volume is US$830,000, and the FTX holdings are US$1.67 million.

Currencies with less impact:

-

RAY: Raydium's current market capitalization is US$1.3 billion, its 24-hour trading volume is US$94.83 million, and its FTX holdings are 21.69 million. If market makers aim for steady selling and do it properly, no big drops are expected.

-

DRIFT: The current market value is US$310 million, the 24-hour trading volume is 29.01 million US dollars, and the FTX holdings are US$10.15 million. It is fully capable of undertaking it.

-

ASD: The current market value is US$32.02 million, the 24-hour trading volume is US$1.24 million, and the FTX holdings are US$2.76 million.

-

KMNO: The current market value is US$146 million, the 24-hour trading volume is 19.92 million, and the FTX holdings are US$2.67 million.

-

Other coins, such as Solana with high circulation (24-hour trading volume reaches 4 billion US dollars, FTX currently holds only 3.14 million US dollars), Jupiter, Jito, Render, Stargate and fully supported stablecoins USDC and BRZ Wait, there is no need to worry at all.

FTX holds the currency. Source: Arkham

As of the time of publication, FTX is still continuing to sell coins. It can be seen on Arkham that the FTX clearing address is transferring the tokens it holds to Binance and Gate several times a day, and the amount of each transfer is The amount is not too large, ranging from US$50,000 to US$5 million each time, depending on whether the currency is held in large amounts. It is unclear whether there is a market maker behind the currency selling behavior, but this time, FTX did not sell all the coins it held at once, causing the price to plummet, like the German government did.

FTX Featured Products

Back then, FTX was the preferred exchange for traders and institutions, and it goes without saying that it supported high-frequency trading. This part has also produced a considerable degree of technological spillover effect, and FTX has also developed many special trading products for retail investors. After the collapse of FTX, some of these products were absorbed by other exchanges, while some have not yet been followed up.

For example, the leveraged tokens that were all the rage on FTX back then were extremely friendly to retail investors:

Leveraged tokens can provide investors with double-leveraged assets without the need for complex operations or direct liquidation risks of leveraged transactions. Contract trading/leverage trading that most investors are familiar with requires investors to pledge assets in the form of margin and monitor market fluctuations to avoid forced liquidation. The leveraged tokens launched by FTX, such as 3x long Bitcoin and 3x short Ethereum, greatly simplify this process. Users can buy and sell leveraged tokens just like normal spot tokens without opening a separate margin account or paying a margin. In addition, leveraged tokens lock the risk of market fluctuations within the daily range through the daily rebalancing mechanism, helping users avoid the risk of liquidation that may result from large market fluctuations.

For retail investors, the emergence of leveraged tokens has lowered the threshold for participating in leveraged trading. They could obtain multiple market returns with relatively small capital costs, and were quite popular in the FTX market at that time. Now, this product is absorbed by exchanges such as KuCoin and has been implemented on popular coins such as Bitcoin.

Triple short Bitcoin product on KuCoin. Source: KuCoin

As for FTX's other product, the tokenized US stock product, so far there is no large-scale product that can provide similar services. At that time, FTX provided tokenized products for many U.S. stock companies, including Alibaba and Coinbase. The launch of these tokenized U.S. stock products allowed global investors to easily participate in U.S. stock market investments without opening a U.S. securities account. FTX works with regulated partners and custodians to circulate these stock assets as tokens on the blockchain. These tokens are linked to the underlying stocks on a 1:1 basis, and investors can directly trade tokenized U.S. stocks through the FTX platform.

This product solves multiple pain points of the traditional stock market. For example, investors are no longer subject to regional or regulatory restrictions and do not need to open cumbersome securities accounts; at the same time, tokenized products support 24/7 trading, unlike traditional stock markets that have fixed opening and closing times.

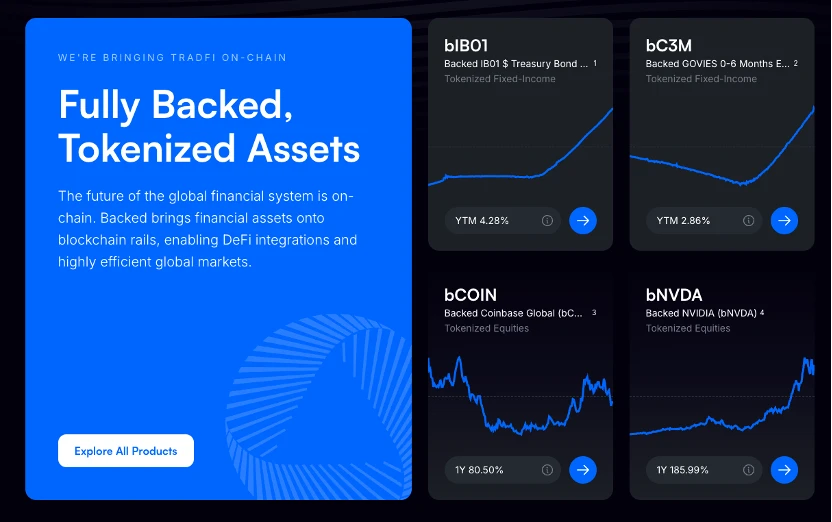

So far, protocols like Backed can provide non-U.S. users with tokenized U.S. stock products, including stocks such as Nvidia, which became popular some time ago. However, U.S. users still don’t have a platform where they can buy tokenized U.S. stocks.

Tokenized US stocks provided by Backed. Source: Backed official website

Odaily previously reported that Base developer Jesse Pollak said in a post on the X platform that Coinbase is considering offering tokenized shares of its stocks to U.S. users of Base, its Ethereum layer 2 network. Pollak said that non-U.S. users can already obtain tokenized COIN shares through protocols such as Backed, a tokenized RWA platform, and implementing COIN on Base is "something we will look into in the new year," adding that eventually "Every asset in the world will be implemented on Base." Jesse Pollak added that Coinbase “has no concrete plans yet.”

chaincatcher

chaincatcher