Golden Web3.0 Daily | Musk officially releases AI model Grok 3

Reprinted from jinse

02/18/2025·2MDeFi data

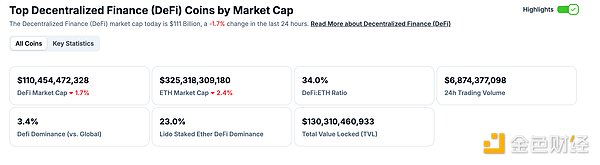

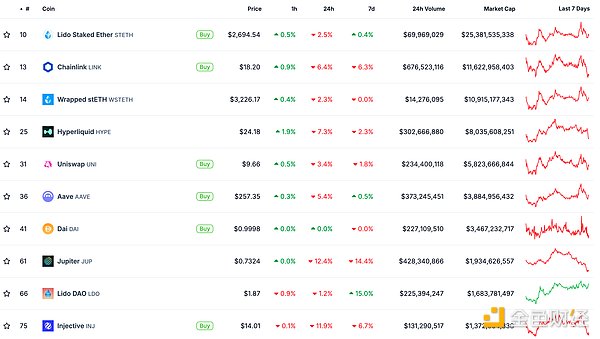

1. Total market value of DeFi tokens: US$110.454 billion

DeFi total market value data source: coingecko

2. The trading volume of decentralized exchanges in the past 24 hours was US$6.874 billion

Source of transaction volume data from decentralized exchanges in the past 24 hours: coingecko

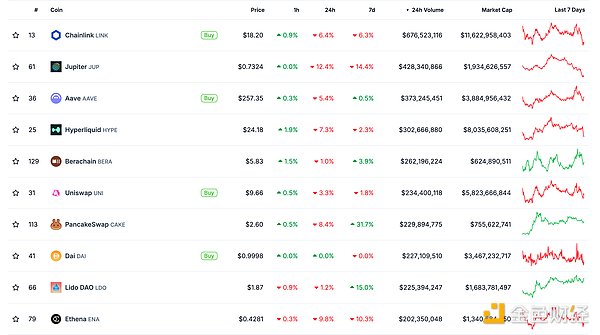

3.DeFi中锁定资产:1079.28 亿美元

DeFi project locked assets ranking and locked positions data source: defilama

NFT data

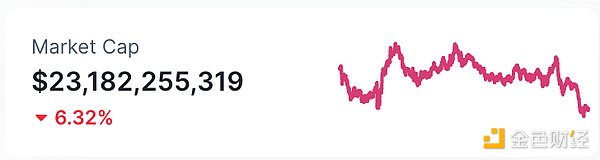

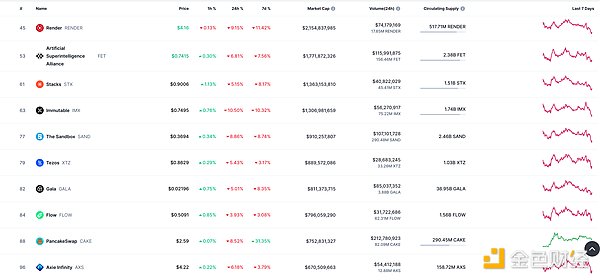

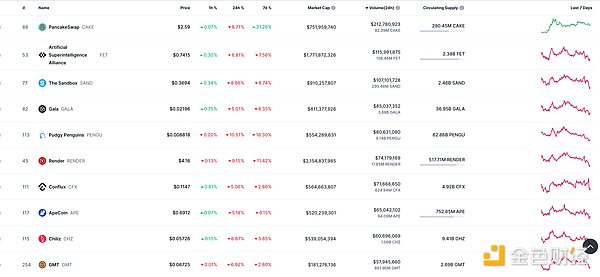

1.NFT total market value: US$23.182 billion

The top ten NFT projects ranked in total market value and market value data source: Coinmarketcap

2.24-hour NFT trading volume: US$ 2.289 billion

The top ten NFT projects ranked in total market value and market value data source: Coinmarketcap

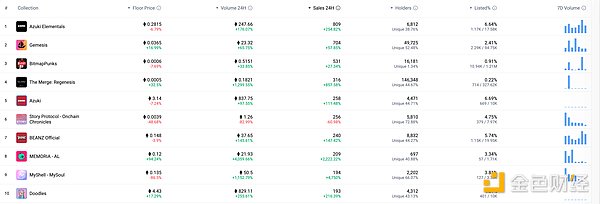

Top NFTs within 3.24 hours

NFTs with the top ten sales gains within 24 hours Source: NFTGO

Headlines

Musk officially releases AI model Grok 3

Musk's artificial intelligence startup xAI officially released the new generation of chatbot Grok 3. Previously, Musk called it "the smartest artificial intelligence on earth."

MEME hot spots

1. Suspected Galaxy Digital address has built positions in PNUT, ai16z and arc in the past three months, with a floating loss of nearly 8.5 million US dollars

Golden Finance reported that on February 18, according to Ai Aunt Monitor, the address suspected to belong to Galaxy Digital invested US$16.41 million in the past three months to deploy three Meme coins, PNUT, ai16z and arc. Currently, it has accumulated a total of 3 projects. Loss of 8.493 million US dollars. Specific holdings show: Holding 21.46 million PNUT, cost price 0.3743 USD, floating loss of USD 4.935 million; holding 7.53 million ai16z, cost price 0.7446 USD, floating loss of USD 3.133 million; arc currencies have all been transferred to Gate transactions The cost price is USD 0.2913 and a confirmed loss of USD 425,000.

2. Users who made $7.32 million in TRUMP recently lost $1.76 million in LIBRA

Golden Finance reported that according to Lookonchain monitoring, MELANIA, which had made a profit of US$7.32 million on TRUMP, lost US$617,000. Recently, the user lost a total of US$1.76 million on LIBRA, specifically: 3 days ago, the user spent 1.7 million. The dollar bought LIBRA and sold it for $136,000, losing $1.56 million; after President Javier Milei retweeted a post about how to buy LIBRA, he spent $300,000 to buy LIBRA again, losing $200,000.

3. The whale/entity that once made more than $96.87 million in TRUMP earned $2.15 million through LIBRA

According to the on-link analyst Ember Monitor, Argentine President @JMilei forwarded a tweet about how to buy LIBRA 11 hours ago. However, LIBRA is still rising because of this tweet, and goofyahh.sol also earned $500,000 through this tweet: He spent US$5 million to buy 10.4 million LIBRA after Javier Milei retweeting, and sold it in an hour to exchange it for 5.5 million USDC. Add to the $1.65 million he earned after buying after LIBRA deployment a few days ago, he/she earned $2.15 million on LIBRA. The whale/institution to which goofyahh.sol previously earned more than $96.87 million on TRUMP: after the TRUMP is deployed through 6QS...tXv address, it immediately purchased 5.971 million TRUMP using USDC of 1.096 million USD, with a price of only $0.18 . Then it was distributed to 11 addresses including goofyahh.sol and sold one after another, with a total profit of more than US$96.87 million (88x)

DeFi hotspots

1. Viewpoint: FTX repayment can be seen as a positive signal of the recovery of the crypto industry

FTX Digital Markets, a Bahamas subsidiary of the bankrupt cryptocurrency exchange FTX, will repay debts to its first creditors on February 18, a repayment that will bring about $1.2 billion worth of this repayment, according to Cointelegraph. funds. Alvin Kan, chief operating officer of BitgetWallet, said FTX repayments were seen as a positive signal of the recovery of the crypto industry, and he believes a large portion of the $1.2 billion repayments could be reinvested into cryptocurrencies, which could affect market liquidity and prices.

2. The new generation of Ethereum layer 2 network OpenZK has received early investment in Animoca

February 18th news, recently, the new generation of Ethereum layer two-layer network OpenZK has received early investment from Animoca, committed to promoting the expansion and sustainable development of the Ethereum ecosystem. OpenZK adopts the ZK architecture as the main body of L2, and innovatively integrates ETH native staking, re-staking, and RWA stablecoin staking on its L2 network, aiming to provide users with innovative solutions with one-click staking and multiple benefits. OpenZK is actively exploring the dual-currency Gas fee mechanism, and it is expected to use ETH and native tokens as network Gas fee in the future. It is reported that the OpenZK main network and airdrop points event will start this weekend.

3.QCP Capital: Options market layout Ethereum Pectra upgrade, altcoins weakness and other factors may curb upward momentum

February 18 news, QCP Capital's latest analysis pointed out that the maturity structure of the options market has been significantly distorted near the March expiration date, especially on Ethereum options, which may reflect that the market is currently in the beta stage and is expected to be 4. Ethereum Pectra, which was launched at the beginning of the month, was upgraded to be laid out. Looking back at past upgrades, the merger upgrade in September 2022 followed the typical "buy expectations and sell facts" model - ETH rose more than 100% from its June low and then fell after the upgrade. In contrast, Shanghai upgraded to enable the pledge withdrawal function in April 2023 has encountered pessimism due to market concerns about oversupply. However, once the market found that the selling pressure did not appear as expected, ETH rose 30% in the following months. As escalation expectations heat up, traders may be laying out for another volatility event, with options volatility after March 28 leaning towards call options – which could be the next theme for the crypto markets to follow the Trump tariff storm Lay the foundation. One inhibitor is the general weakness in the altcoin market—the LIBRA collapse, the SOL and ETH retreat to pre-election levels, and the share of Bitcoin’s market capitalization is close to an all-time high. In addition to market catalysts, altcoins may need substantial progress in practical applications and network development to achieve a sustained recovery, rather than relying solely on speculative capital flows.

4.Starknet: Cairo v2.10.0 has been released

Golden Finance reported that according to the Ethereum L2 network Starknet, Cairo v2.10.0 has been released, and this version is associated with Starknet 0.13.4. The new version optimization points include changing the priority of output diagnostics, using the correct type on snapshot mismatch, Add const, etc. to the Starknet type.

5. Ethereum Beam Chain will be renamed due to trademark issues

According to Golden Finance, Ethereum core developer Justin Drake published an article revealing that Beam Chain's first community meeting made important progress, but the project name needs to be changed due to trademark issues. The meeting showed that 14 consensus-level teams have participated, covering all continents except Antarctica, and the development languages include Zig, C, C++, C#, etc. The meeting introduced the joining of 8 new teams, the support of 6 mainnet consensus layer teams, and 2 newly joined Ethereum Foundation coordinators. Drake said the project is a multi-year plan to completely upgrade the Ethereum L1 infrastructure, and the second community meeting will be held at 14:00 UTC on February 28 to focus on technological advances such as post-quantum signatures.

Disclaimer: As a blockchain information platform, the content of the articles published by Golden Finance is for information reference only and is not used as actual investment advice. Please establish the correct investment philosophy and be sure to improve your risk awareness.

chaincatcher

chaincatcher

panewslab

panewslab