Golden Web3.0 Daily | OpenSea will launch NFT transactions on Solana

Reprinted from jinse

04/15/2025·7DDeFi data

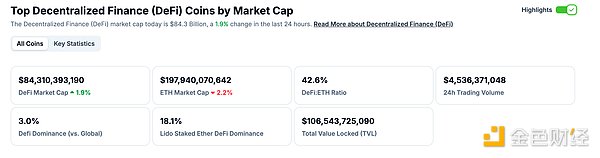

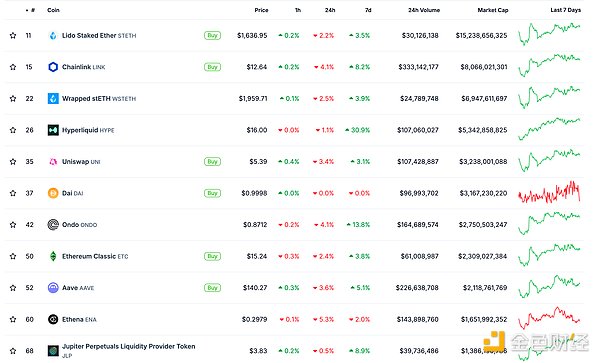

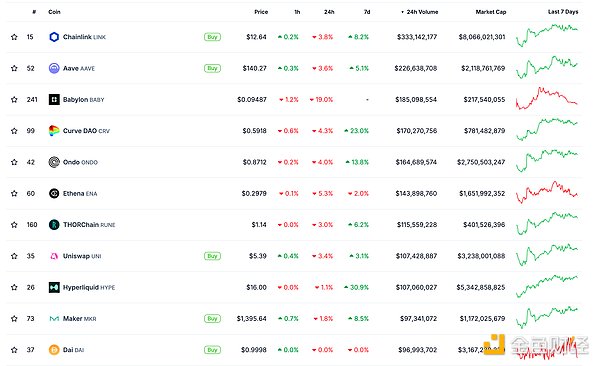

1. Total market value of DeFi tokens: US$84.31 billion

DeFi total market value data source: coingecko

2. The trading volume of decentralized exchanges in the past 24 hours was US$4.536 billion

Source of transaction volume data from decentralized exchanges in the past 24 hours: coingecko

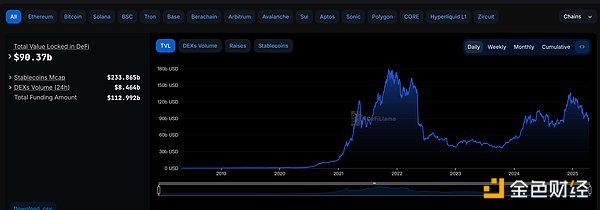

3. Locked assets in DeFi: US$90.37 billion

DeFi project locked assets ranking and locked positions data source: defilama

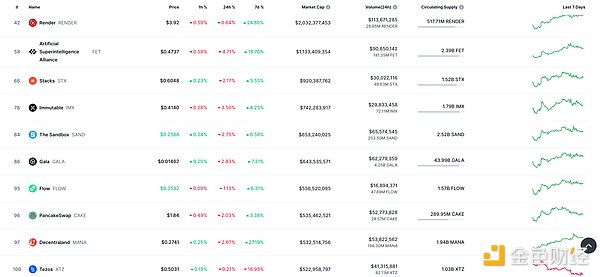

NFT data

1.NFT total market value: US$16.317 billion

The top ten NFT projects ranked in total market value and market value data source: Coinmarketcap

2.24-hour NFT trading volume: US$ 1.864 billion

****

****

The top ten NFT projects ranked in total market value and market value data source: Coinmarketcap

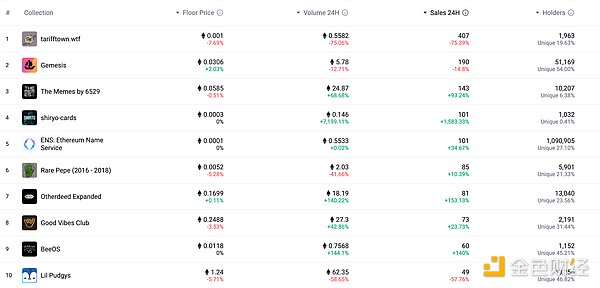

Top NFTs within 3.24 hours

NFTs with the top ten sales gains within 24 hours Source: NFTGO

Headlines

OpenSea Announces to Launch Solana On-Chain NFT Trading

According to official news, OpenSea announced that Solana token trading has now been launched for some closed-beta users on OS2 and will be gradually launched to more users in the next few weeks. Tokens are currently available, and NFT transactions will be launched later.

MEME hot spots

1. Bloomberg: Phantom is sued for theft of Wiener Doge Meme coins

According to a lawsuit filed on Monday, Phantom was sued for theft of Wiener Doge Meme coins, according to a lawsuit filed on Monday. Meme coin developer Thomas Liam Murphy and other victims said a malicious attacker stole and cashed out more than $500,000 in Wiener Doge digital assets from Murphy's Phantom wallet on January 20 this year. Murphy 13 of his relatives and friends have filed lawsuits in the Federal District Court of the Southern District of New York. According to the indictment, Murphy’s friends and family also purchased the Wiener Doge cryptocurrency. They accused Phantom Technologies Inc. of failing to provide adequate security protection, leaving users exposed to the risk of malware and cryptocurrency wallet theft.

DeFi hotspots

1. Galaxy Report: Tether, Galaxy and Ledn account for nearly 90% of CeFi outstanding loans

According to CoinDesk, Galaxy Research reported that the crypto lending market size was US$36.5 billion in the fourth quarter of 2024, down 43% from the peak of the 2021 bull market. Tether, Galaxy and Ledn hold nearly 90% of the outstanding loans of CeFi centralized lenders $11.2 billion, and CeFi loans fell 68% from the peak of $34.8 billion at the beginning of 2022.

2. Analyst: XRP spot ETF may be easier to obtain US SEC approval than other assets

According to The Block, Kaiko analysts believe that the improvement in market dynamics and the launch of leveraged products last week put XRP ahead of other assets in obtaining SEC spot ETF approval, and May 22 is the next important date to pay attention to, as the SEC must respond to the Grayscale spot XRP ETF application by that date.

3.MANTRA Lianchuang: Will release OM fluctuation event analysis report, OM repurchase and OM supply destruction plan

April 15th news, MANTRA JP Mullin published an article saying that it will release a post-event analysis report within the next 24 hours, detailing the events that have occurred since the early morning of Monday (Asia-Pacific) and will be verified in on-chain and off-chain data. After the report on this matter is released, it will share more information about the OM token repurchase program and the OM supply destruction program to rebuild market trust and demonstrate its long-term commitment to OM /MANTRA.

4.Mind Network releases 2025 roadmap: It will deploy AgentLaunch, launch AI native blockchain, etc.

On April 15, Mind Network announced the development roadmap for the rest of 2025, focusing on launching more TFHE-compatible SDKs, connecting the Web2 framework to the encryption proxy network, deploying AgentLaunch, AgentEnroll and AgentTrain, supporting cross-chain synchronization, and implementing encrypted AI inference through decentralized computing and inference. In addition, the FHE SDK that supports Pillar and ultimately Ethereum integration will be launched, the advanced AI logic layer for private smart proxying will be released, $FHE governance will be conducted through MindDAO, an ecosystem with self-governance rules will be launched, and MindChain will be extended to non-EVM and RWA. The plan also includes the launch of AI-native blockchains and networks powered by a zero-trust architecture, as well as the launch of the AgenticWorld ecosystem to drive Web2 expansion and digital sovereignty.

5. The community questioned that HashKey token HSK was not repurchased and destroyed according to the white paper regulations

On April 15, according to community users' feedback, the HashKey token HSK token repurchase and destruction has never disclosed the records publicly. According to the HSK white paper, HashKey adopts a destruction mechanism to ensure the intrinsic value of HSK. HashKey will regularly repurchase HSK in circulation using 20% of the group's net profit and permanently remove it from circulation. In the page of Hashkey Group on HSK information, the HSK destruction information shows that "HashKey will have the right to withdraw 20% of the net profit generated by the designated platform business as funds for repurchasing HSK, and permanently destroy the repurchased part." After inquiry, the "repurchasing/destructing" data in the HSK page of HashKey Group is 0. The Hashkey trading platform said it will announce the destruction results on the 11th day of each quarter. HSK is launched in November 2024. On April 11 this year, HashKey issued an announcement stating that the HSK token destruction plan will be regularly evaluated and announced to the public when applicable. The community understands that HSK has not repurchased or destroyed at present. Some people say that the reason why HSK did not repurchase or destroy is that HashKey Group did not generate net profit in Q1 2025, so it is a reasonable phenomenon that no repurchase is.

Disclaimer: As a blockchain information platform, the content of the articles published by Golden Finance is for information reference only and is not used as actual investment advice. Please establish the correct investment philosophy and be sure to improve your risk awareness.

chaincatcher

chaincatcher

panewslab

panewslab