Golden Web3.0 Daily | Renzo announces the launch of re-staking token bzSOL

Reprinted from jinse

01/13/2025·0MDeFi data

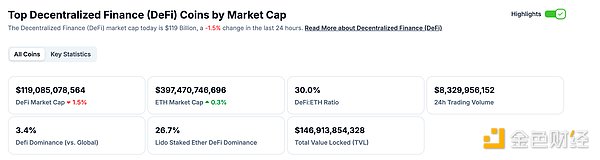

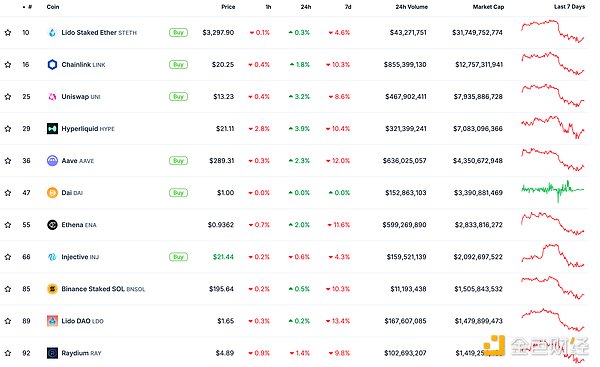

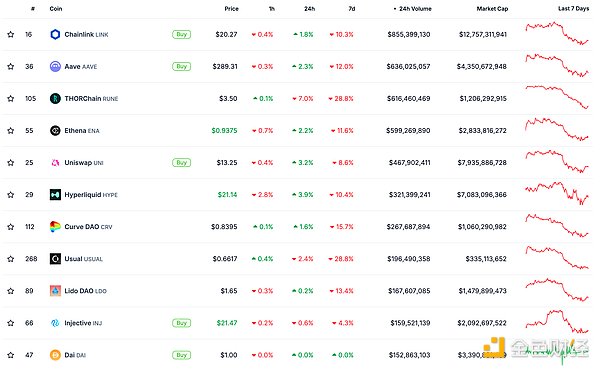

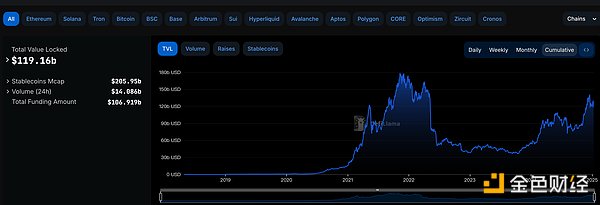

1. Total market value of DeFi tokens: US$119.085 billion

DeFi total market capitalization data source: coincko

2. The trading volume of decentralized exchanges in the past 24 hours was $8.329 billion

Trading volume data of decentralized exchanges in the past 24 hours Source: coingecko

3. Assets locked in DeFi: $119.16 billion

Data source of the top ten locked assets of DeFi projects and locked positions: defillama

NFT data

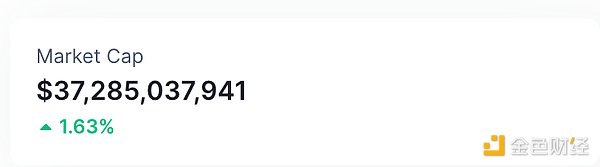

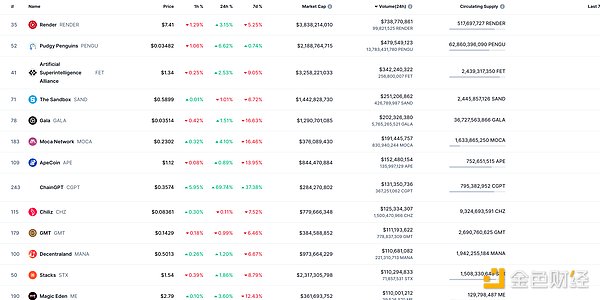

1.NFT total market value: US$37.285 billion

NFT total market value and market capitalization top ten project data source: Coinmarketcap

2.24-hour NFT trading volume: US$ 5.377 billion

NFT total market value and market capitalization top ten project data source: Coinmarketcap

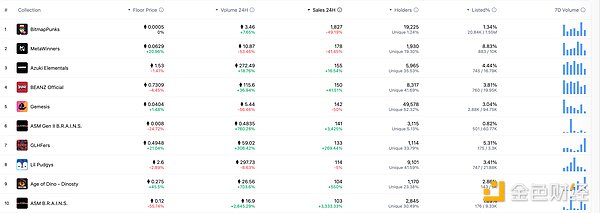

3. Top NFTs in 24 hours

Top 10 NFT sales within 24 hours Data source: NFTGO

headlines

Renzo announces the launch of re-staking token bzSOL

Renzo Protocol announces the launch of bzSOL (Binance Staked SOL) token. Users can exclusively cast bzSOL within 24 hours starting from 8:30 a.m. ET on January 14th, and support casting with SOL or BNSOL.

DeFi Hotspot

1.Pyth Network announced that it has supported USD0++/USD price feeding service

According to news on January 10, Pyth Network announced that it has supported the USD0++/USD price feed service and is currently the only oracle project that supports the USD0++ price feed service. USD0++ is the liquid pledged token of USD0, which is a stablecoin issued by the decentralized stablecoin protocol Usual. As an oracle solution, Pyth Network supports 78+ blockchains and provides over 500 real-time price data feeds. Previously, Pyth also launched an upgraded version of oracle security staking Oracle Integrity Staking (OIS), aiming to further improve the reliability of data sources and the security of the DeFi ecosystem, and provide strong support for dApp developers.

2.Synthetix stops being deployed on Arbitrum

Golden Finance reported that Synthetix announced that it is shifting the focus of its perpetual contract market operations to the Base network. Its perpetual contract market on Arbitrum will be closed and is currently set to liquidation-only mode. Users cannot open new positions or add cash. There is a position. USDx on Arbitrum needs to be exited along with the Arbitrum perpetual contract product, Synthetix Treasury purchased USDx from the open market and funded a wrapper that supports converting USDx to USDe.

3.PeckShield: There will be more than 300 hacker attacks in the encryption industry in 2024, with DeFi protocols as the main target

Golden Finance reported that on January 10, according to the PeckShield report, there were more than 300 cryptocurrency hacking incidents in 2024, with total losses reaching US$2.15 billion, an increase of 30% compared with 2023 (US$1.51 billion). May was the peak of the year, with 28 attacks causing losses of US$574.6 million. Hackers still target DeFi protocols as their main targets, but the proportion of attacks against individuals and organizations has increased to 46% (33% in 2023), mainly exploiting weak private key management and insufficient security practices. Ethereum became the most commonly attacked blockchain, accounting for 34.8% of the total number of incidents and 47.3% of losses, followed by Bitcoin, partly due to rising prices. The gaming industry suffered serious losses, totaling US$502 million, of which the PlayDapp vulnerability caused US$290 million in losses.

4. Fidelity: Solana is a “noteworthy contender,” but Ethereum is better for long-term investing

Golden Finance reported that according to The Block, Fidelity Digital Assets stated in its 2025 outlook report that although Solana has performed well in the short term, Ethereum has stronger fundamentals and is more suitable for long-term investment. The report also predicts that Bitcoin will maintain its value in various economic environments, stablecoins and DeFi will continue to innovate, and the growth of tokenized assets will continue. Fidelity believes that it is not too late to enter the cryptocurrency market and expects to enter a new era of digital assets in the next few years.

5. Stacks Network has completed an upgrade to increase network bandwidth by 500%

According to news on January 10, Stacks co-founder Muneeb Ali said that the Stacks network has completed an upgrade to increase network bandwidth by 500%, and the tenure-extend function in the Nakamoto protocol is now online on the mainnet. The core development team plans to carry out multiple optimizations in 2025, but the early launch of this feature is considered important progress.

Disclaimer: As a blockchain information platform, Golden Finance publishes articles for information reference only and not as actual investment advice. Please establish a correct investment philosophy and be sure to increase your risk awareness.