Grayscale: 2024 Crypto Market Milestones and Big Events of the Month

Reprinted from jinse

01/07/2025·2MSource: Grayscale; Compiler: Deng Tong, Golden Finance

summary

-

Cryptocurrency valuations fell in December after rising at the beginning of the year. The pullback may reflect a more hawkish signal from the Fed. The last two Bitcoin bull runs have seen declines of similar magnitude.

-

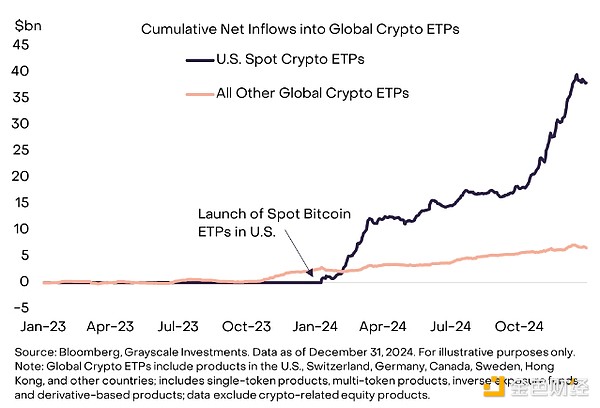

Spot Bitcoin and Ethereum exchange-traded products (ETPs) launch in the US market in 2024. Cumulative inflows have now reached $38 billion. [1] Bitcoin and Ethereum fell 3% and 10% respectively that month. [2]

-

The financial cryptocurrency sector had a stellar performance in December. Grayscale Research believes this segment may benefit from regulatory changes and/or new legislation from the incoming U.S. government and lists several companies related to decentralized finance (DeFi) in its updated Top 20 list related assets. The Top 20 also lists assets related to decentralized AI technology, which continues to be a focus of market attention.

-

In early January, the Senate will consider President-elect Trump’s nominees for Secretary of the Treasury, Secretary of Commerce, SEC Chairman, and CFTC Chairman.

In December 2024, the cryptocurrency market took a breather, with major stock indexes retreating and bond yields rising. Grayscale Research attributes many of the market changes to the more hawkish signals from the Federal Reserve at its mid-December meeting. Despite last month's setback, Bitcoin ended 2024 up 121%. [3]

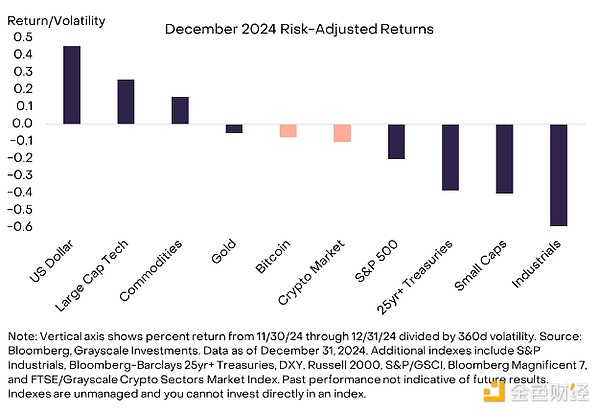

The performance of traditional markets at the end of the year was mixed (Figure 1). The dollar rallied in December and interest rates rose across the yield curve. The Federal Reserve 's guidance that it will slow the pace of interest rate cuts in 2025 may have fueled moves in currency and bond markets. Large-cap stock indexes fell, led by cyclical market sectors. Large-cap technology stocks (represented by the Bloomberg Seven Index) were the exception, rising in December and posting strong returns for the year. Bitcoin is down slightly, with risk-adjusted (i.e., taking into account the volatility of each asset) returns in the mid-range. The FTSE/Grayscale Cryptocurrency Industry Market Index (CSMI) fell 6% in December, giving up about 15% of its gains since November 2024.

Figure 1: Cryptocurrency returns are middling, risk-adjusted

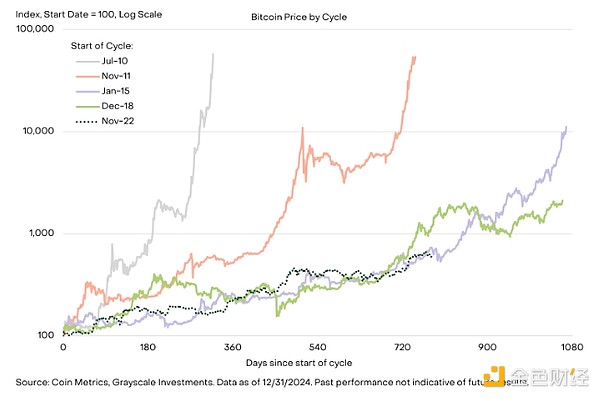

Short-term declines are a common feature of cryptocurrency bull markets. For example, during the latest appreciation phase of the cryptocurrency market cycle (from December 2018 to November 2021), the price of Bitcoin increased approximately 21 times. However, during this period, the price of Bitcoin fell by at least 10% a total of 11 times, including two major declines of approximately 50%. During the previous appreciation phase of the cryptocurrency market cycle (from January 2015 to December 2017), Bitcoin's price fell by at least 20% a total of 11 times. [4] We continue to believe that we are in the middle of the current Bitcoin bull market, with the potential for further upside in 2025 and beyond as long as the market remains supported by fundamentals (Chart 2).

Figure 2: Bitcoin price trend before two bull markets

In December, spot Bitcoin exchange-traded products (ETPs) listed in the United States once again became an important source of new demand, with net inflows totaling $4.7 billion for the month. Including the spot Ethereum ETP launched in July, the cumulative net inflow of U.S.-listed spot cryptocurrency ETPs has now reached $38 billion. [5] While cryptocurrency ETPs in other jurisdictions have also seen increased investor demand, cumulative inflows have been lower and more stable month over month (Figure 3).

Figure 3: US-listed spot cryptocurrency ETPs surge in demand

Another important source of demand for Bitcoin in the U.S. market is MicroStrategy , a publicly traded company that holds Bitcoin on its balance sheet and operates primarily as a Bitcoin investment vehicle. [6] MicroStrategy was included in the Nasdaq 100 Index in December. [7] In the fourth quarter of 2024, MicroStrategy purchased 194,180 Bitcoins, with a market capitalization of $18.2 billion at the end of the year. [8] Therefore, the micro-strategy’s purchases of Bitcoin in Q4 were comparable to the net inflows into spot Bitcoin ETPs in Q4. [9] MicroStrategy issues equity and debt instruments to fund its purchases of Bitcoin and has announced plans to continue buying Bitcoin over the next 3 years. [10] Given the quantitative importance of this source of Bitcoin demand, cryptocurrency investors should consider monitoring the micro-strategy’s financial performance metrics, including the difference between the company’s market capitalization and the value of its Bitcoin holdings. Generally speaking, if a company's stock trades above the value of its Bitcoin, it may be incentivized to issue stock and buy more Bitcoin.

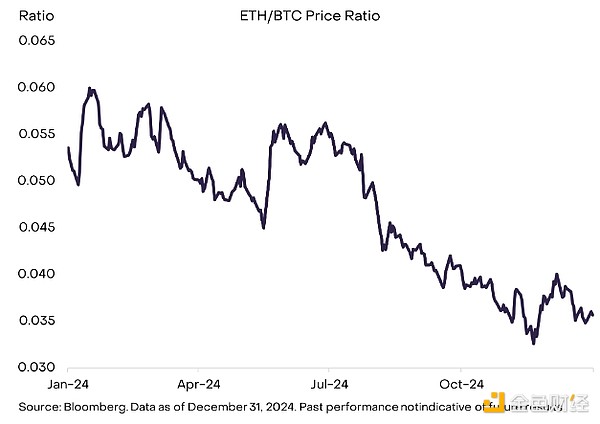

Ethereum (ETH) underperformed Bitcoin (BTC) in December, with the ETH/BTC price ratio trading sideways over the past two months (Figure 4). Ethereum is the leading smart contract platform blockchain by market capitalization, but it faces increasing competition from other projects. [11] In 2024, Ethereum underperformed Solana, the second largest asset by market capitalization, [12] and investors became increasingly focused on alternative layer 1 networks such as Sui and The Open Network (TON). When creating infrastructure for application developers, architects of smart contract blockchains face various design choices that can impact technical characteristics such as block times, transaction throughput, and average transaction fees. Regardless of specific design choices, all smart contract platforms compete for network fee revenue, which Grayscale Research believes is an important determinant of value accumulation.

Figure 4: Ethereum lags behind Bitcoin in December and throughout 2024

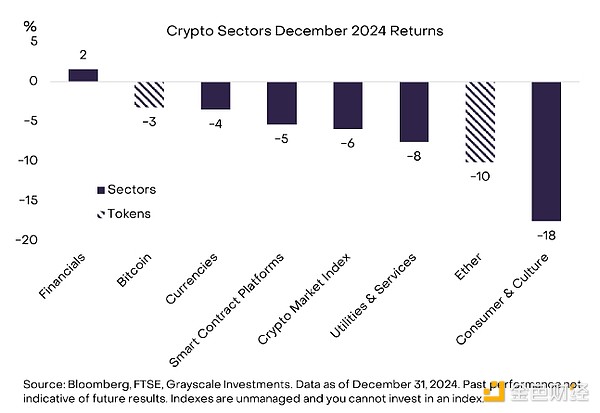

The Grayscale Cryptocurrency Industry Framework shows that digital asset valuations generally fell back in December (Chart 5). The worst-performing market segment was the consumer and cultural cryptocurrency sector, largely due to a decline in the price of Dogecoin, the largest meme coin by market capitalization. [13] One exception to the broader market decline was the financial cryptocurrency industry, which was mainly supported by gains in Binance Coin (BNB), which is associated with the Binance exchange and the Binance Smart Chain smart contract platform Tokens. Grayscale Research believes that regulatory changes and new legislation under the new U.S. administration may be particularly supportive of blockchain-based financial applications. Therefore, we have introduced several decentralized finance (DeFi)-related assets in our latest Top 20 list.

Figure 5: Financial crypto industry performs well

New innovations related to decentralized artificial intelligence technology are the dominant theme in the crypto market in 2024, and may become a dominant theme again in the new year. Much of the attention remains on developments related to artificial intelligence “agents” – software that can act independently to pursue a complex set of goals. These artificial intelligence agents are revolutionizing the way we interact with blockchain technology, as Luna demonstrated on the Virtuals protocol. Luna is a female anime-style chatbot with the specific goal of attracting 100,000 followers on . This integration with blockchain technology is particularly important as it enables AI agents like Luna to directly access and allocate financial resources, going beyond previous use cases for task-based agent AI.

Since the emergence of AI proxy tokens in late October 2024, the industry’s leading projects by market capitalization have made extraordinary gains, with Virtual soaring 49,000% and Ai16z rising 8,700%[14]. It is worth noting that ai16z, a project named after the investment company a16z, built the No. 1 AI agent framework [15] on GitHub in December and announced a partnership with Stanford University. [16]

Ultimately, 2024 is a landmark year for the digital asset market: New spot Bitcoin and Ethereum ETPs bring more investors to the crypto ecosystem, and the Bitcoin network undergoes its fourth halving event, researchers Cryptocurrencies featured prominently in the U.S. election amid breakthroughs in new blockchain applications. Although some specific themes will change, we expect 2025 to remain exciting for cryptocurrency investors.

In early January, the U.S. Senate will begin considering President-elect Trump’s nominees to lead the Cabinet and various government agencies. For the cryptocurrency market, we believe the most important confirmations may be from the Secretary of the Treasury (Scott Bessent), Secretary of Commerce (Howard Lutnick), Chairman of the Securities and Exchange Commission (SEC) (Paul Atkins), and Chairman of the Commodity Futures Trading Commission (CFTC) (who wrote this article Candidates have not yet been announced). White House AI and Cryptocurrency Czar David Sacks’ new role does not require Senate confirmation. Although Grayscale Research expects the next Congress to pass cryptocurrency-related legislation, this may not happen until lawmakers address taxation and certain other issues. Outside the United States, the EU's MiCA regulations, which come into full effect on December 30, 2024, impose stricter regulations on stablecoins, resulting in Tether's unlicensed USDT being delisted by exchanges starting in 2025 in favor of Compliant alternatives such as Circle’s USDC. [17]

Political factors aside, the cryptocurrency market seems likely to be driven by its usual fundamentals: global adoption of Bitcoin as an alternative monetary medium, demand for next-generation decentralized web applications, and macro market factors such as those affecting all asset valuations changes in central bank monetary policy. Despite the uncertain outlook, we believe many industry trends are looking favorable as the new year begins.

Index definition:

The Bloomberg Seven Total Return Index (BM7T) is an equally dollar-weighted index that tracks seven of the most widely traded companies in the United States. The S&P 500 Industrials Index includes companies in the S&P 500 Index that are classified as members of the GICS Industrials sector. The Bloomberg- Barclays 25+ Year Treasury Index measures the total return of nominal U.S. Treasury securities with remaining maturities of more than 25 years. The U.S. Dollar Index (DXY) tracks the strength of the U.S. dollar against a basket of major currencies. The Russell 2000 Index consists of the smallest 2,000 companies in the Russell 3000 Index, accounting for approximately 8% of the Russell 3000's total market capitalization. The S&P Goldman Sachs Commodity Index (S&P/GSCI) is a composite index of commodity sector returns and represents unlevered, long-only investments in commodity futures that are broadly diversified across commodities. The FTSE/Grayscale Cryptocurrency Sector Index Series measures the price returns of digital assets listed on major global exchanges. The Nasdaq 100 Index is a stock index of the 100 largest companies traded on the Nasdaq exchange, measured by revised market capitalization.

References:

[1] Source: Bloomberg, Grayscale Investments. Data as of December 31, 2024.

[2] Source: Artemis. Data as of December 31, 2024.

[3] Source: Coin Metrics. Data as of December 31, 2024.

[4] Source: Coin Metrics. Grayscale Investments. Data as of December 31, 2024. Past performance is not indicative of future results.

[5] Source: Bloomberg, Grayscale Investments. Data as of December 31, 2024.

[6] Investopedia, data as of December 23, 2024. Michael Saylor “calls MicroStrategy a Bitcoin funding company.”

[7] Markets.com

[8] Source: Bitcointreasuries.net, Bloomberg, Grayscale Investments. Data as of December 31, 2024.

[9] Spot Bitcoin ETP had a net inflow of $16.5 billion in the fourth quarter, calculated based on the value at the time of inflow. ETP's Bitcoin holdings increased by $18.6 billion at year-end prices in the fourth quarter. Source: Bloomberg, Grayscale Investments. Data as of December 31, 2024.

[10] Microstrategy, as of January 3, 2025.

[11] Artemis, FTSE, Grayscale. As of January 6, 2025.

[12] Artemis, FTSE, Grayscale. As of January 6, 2025.

[13] Artemis, FTSE, Grayscale. As of January 6, 2025.

[14] Dexscreener. As of January 2, 2025

[15] Chain Catcher

[16] Blockworks

[17] Ernst & Young, "Monetary Analysis"

panewslab

panewslab