HashKey Eco Labs CEO Kay announces HashKey Chain brand upgrade: building the preferred public chain for finance and RWA

Reprinted from panewslab

04/06/2025·23DOn April 6, 2025, the third Web3 Festival, co-organized by Wanxiang Blockchain Laboratory and HashKey Group, opened at the Hong Kong Convention and Exhibition Center. As one of the most influential events in the Asia Web3 field, Web3 Festival attracted more than 300 global experts and more than 50,000 participants to discuss how decentralized technology can reshape the financial system and asset form.

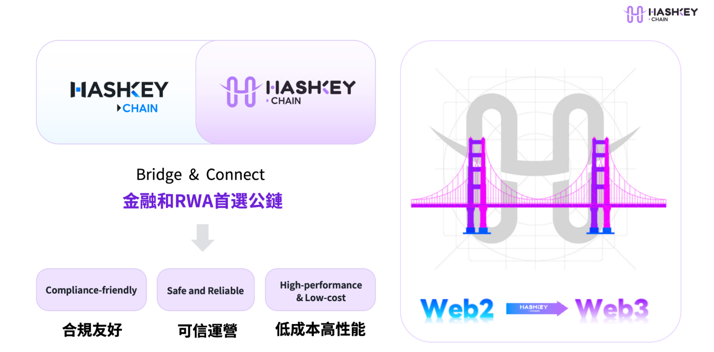

In the main venue of this grand event, Kay, CEO of HashKey Eco Labs, brought a wonderful theme sharing under the title "HashKey Chain: Bridge Tradition and Innovation, Reshape the NEW RWA Ecosystem". She pointed out that the global financial market is at a critical juncture of digital change, and the rise of RWA and Onchain Finance is becoming the core driving force of this change. While revealing this historic trend, Kay officially announced the brand strategy upgrade of HashKey Chain, positioning it as the "first public chain of choice for finance and RWA". This value evolution is destined to become an important coordinate in the digital transformation process of financial history.

**Historic Opportunities under the Wave of Global Financial

Digitalization**

Kay pointed out in the opening ceremony that traditional finance has evolved over thousands of years, from barter to modern securitization systems, and is now facing a value revolution brought by blockchain technology. Kay said, "The current global financial market size exceeds US$400 trillion, while the cryptocurrency market is only about US$1 trillion. The gap in this is the historic opportunity for the tokenization of RWA assets."

According to research data from Chainlink, the RWA tokenization market size is expected to exceed US$16.1 trillion in 2030, and has achieved exponential growth of more than US$10 billion in 2024.

Behind this trend are the efficiency bottlenecks and inclusive challenges that need to be solved by the traditional financial system. Although RWA is generally regarded as the next trillion-level track, the actual implementation of asset chains still faces multiple challenges. Kay used a metaphor of "how to put an elephant into a refrigerator" to sharply point out the pain points of the industry: "Most projects currently focus on how to choose refrigerators of different brands (choose ecology) and design 'faster refrigerators' (underground technology), but ignore the most critical issue - how to truly put elephants (real assets) in compliance and efficient manner on the chain."

For financial assets, going on the chain needs to solve technical and legal issues such as on-chain identity verification, compliance framework adaptation, and income rights division; non-financial assets involve more complex property rights registration, cross-regional supervision and value assessment systems. Kay said: "RWA is not a simple data link, but requires reconstructing a trust mechanism that collaborates on-chain and off-chain."

**HashKey Chain Strategic Positioning: Building the preferred public

chain for finance and RWA**

In this regard, HashKey Chain gave his own answer - "Technology is based, compliance is bridge, and ecology is flywheel." Kay pointed out: "As an Ethereum Layer 2 solution, HashKey Chain inherits Ethereum's decentralized security and broad global consensus, while also improving transaction efficiency through higher performance and greatly reducing issuer operating costs." At present, HashKey Chain can compress a single transaction cost to below US$0.001 and shorten the settlement time to 0.01 seconds, which is enough to support the large-scale deployment of institutional-level RWA. More importantly, through on-chain AML system, multi-layer security certification and "life-saving capsule" emergency mechanism, HashKey Chain provides a basic framework for various assets that meet regional regulatory requirements.

"We work closely with regulatory agencies such as the Hong Kong Securities Regulatory Commission and took several years to polish compliance solutions." Kay mentioned that the US dollar money market fund deployed by China Pacific Insurance in HashKey Chain had a subscription scale of US$100 million on the first day of operation; Bose Fund launched the world's first tokenized Money Market ETF, and obtained the Hong Kong Securities Regulatory Commission's approval for issuance on HashKey Chain. These cooperation not only demonstrates the recognition of HashKey Chain technology and ecological construction by regulatory entities and institutions, but also provides a strong endorsement for the tokenization of RWA assets. ”

**HashKey Chain 's brand upgrade: from "On-chain Wall Street" to "Global

Value Network"**

While revealing the progress of the ecosystem, Kay also announced a comprehensive upgrade of HashKey Chain's brand. This brand upgrade is not only a visual renewal, but also marks the in-depth evolution of HashKey Chain's strategic thinking. In the past, the narrative of public chains often revolved around technical parameters; now, HashKey Chain is turning its focus to the essence of value creation. "We are no longer just a public chain that processes transactions, but a value network connecting two financial worlds," Kay explained.

Behind this upgrade is the comprehensive empowerment of the HashKey Group ecosystem. As the only Web3 institution in Asia with exchanges, custody, asset management and compliance licenses, HashKey can provide RWA projects with one-stop services from asset issuance, liquidity support to cross-border settlement. Based on the comprehensive incentives of HashKey Chain itself, through the $50 million "Atlas Grant Ecological Incentive Plan", HashKey Chain focuses on supporting RWA, MMF, PayFi and stablecoin tracks; its on-chain ecosystem can superimpose traditional asset returns and on-chain liquidity incentives, significantly improving investor returns.

Market data confirms the effectiveness of this strategy: just 4 months after it was launched, HashKey Chain has attracted nearly 1 million active addresses, completed 25 million zero-risk transactions, and deployed more than 50 ecological projects. Cooperation with leading agreements such as Chainlink oracle and Orbiter cross-chain bridge has further opened up the interoperability of on-chain assets and off-chain values.

Future Roadmap: Defining the Global Standards for RWA

In 2025, Kay simultaneously unveiled the "2025 HashKey Chain Product Roadmap" in his speech - with OnChain Finance's overall asset architecture as the core and AI MCP Framework-driven smart contracts as a breakthrough, integrating key modules such as RWA Bridge, MMF Stablecoin, and MMF Yield Hub to provide RWA full-stack support for asset mapping, value stability and management, expanding RWA's application scenarios on-chain, and improving asset efficiency and liquidity.

The framework forms in-depth synergy with HashKey Chain’s three core plans:

- The underlying asset expansion: build an RWA issuance platform, stablecoin innovation center and Bitcoin ecological application, and release the on-chain value of trillion-dollar real assets;

- On-chain finance productization: launch the MMF financial management platform in Q2, MMF stablecoin; create RWA Layer to achieve ecological empowerment in Q3; launch a full-function chain finance platform to realize OnChain Finance's on-chain closed-loop and sustainable development;

- Global standards co-construction: Release the "Global RWA Practice White Paper", jointly with regulators and partners, define the path of asset opening and ecological closed loop after opening, and provide important guidance on compliance frameworks and business models for global RWA participants in the RWA field.

"Our ultimate goal is to become the main hub of traditional finance and Web3 innovation," Kay concluded. "This road cannot be walked alone. Only by co-built with developers, institutions and users, and in the early stages where the industry is still full of possibilities, can we reach the other side of the trillion-dollar market."

Conclusion: A revolution about trust and efficiency

Kay's speech is not only an in-depth discussion on the synergy between RWA and the public chain, but also a return to the essence of finance - whether it is the millennium evolution of traditional finance or the decade-long innovation of Web3, its core is always to reduce trust costs and improve resource allocation efficiency. The outbreak of RWA is the key turning point in the revolution from virtual to reality.

When trillions of real assets pour into the chain through the "bridge" of HashKey Chain, a more open, more efficient and inclusive global financial network is emerging. Perhaps as Kay said: "We are not subverting traditions, but writing the next chapter in financial history."

While gathering global wisdom and innovation in 2025 Hong Kong Web3 Festival also presents a new digital financial ecosystem for the industry. From the stability of traditional finance to the disruptive innovation of blockchain technology, HashKey Chain has shown a practical and feasible development path to the world with its leading technological advantages, security and compliance system guarantees, full-service collaborative ecological construction and clear development strategy.

About HashKey Chain

HashKey Chain is the first choice public chain for financial institutions and RWA assets, and is committed to promoting the compliance and scale development of Onchain Finance. As a compliant blockchain infrastructure, HashKey Chain provides institutions with a secure and transparent on-chain environment.

With a secure and trusted technical architecture, HashKey Chain inherits the decentralized security of Ethereum and improves transaction efficiency through high-performance optimization to ensure the stability and traceability of on-chain assets. In addition, HashKey Chain adopts high-performance and low-cost solutions to provide extremely low gas fees and high throughput, enabling financial assets such as MMF, bonds, funds, and stablecoins to efficiently flow and reduce the operating costs of institutions on the blockchain.

HashKey Chain is in-depth cooperation with world-leading financial institutions and compliant Web3 projects to provide optimal solutions for institutional-level DeFi, RWA tokenization, stablecoin settlement and other application scenarios, and accelerate the digitalization and intelligent upgrade of the financial system.

chaincatcher

chaincatcher