Having publicly expressed dissatisfaction many times, can Trump really "fire" Fed Chairman Powell?

Reprinted from panewslab

04/18/2025·11DThis article is compiled from Time, original author Nik Popli

The Fed has long been proud of its independence. But this tradition of “independence” is under new pressure as U.S. President Donald Trump intensifies attacks on Fed Chairman Jerome Powell for his refusal to cut interest rates.

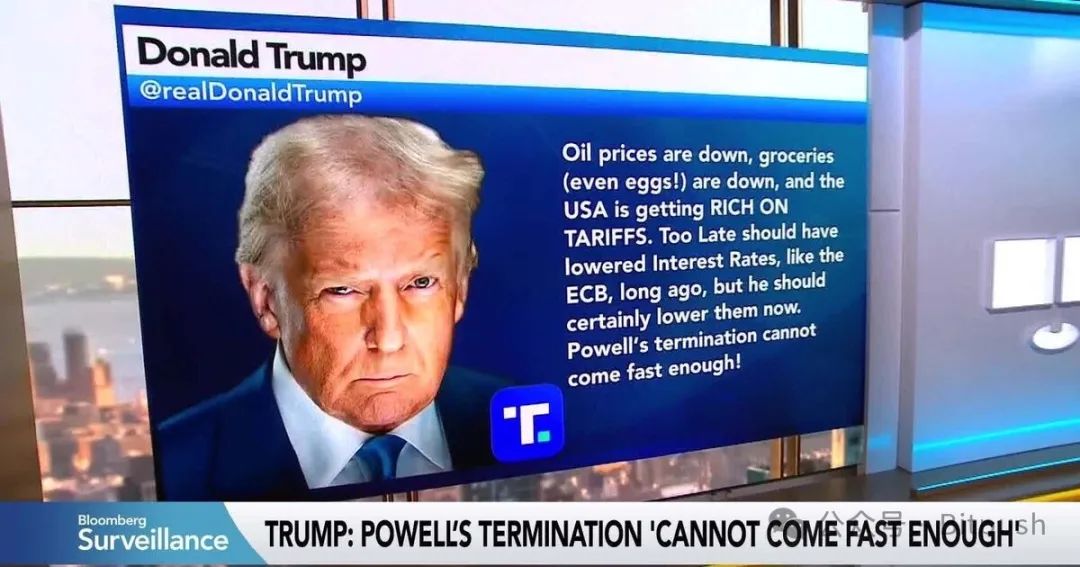

"If I want him to leave, believe me, he will leave soon," Trump told reporters in the Oval Office on Thursday.

On his social media platform Truth Social, Trump reiterated: “Let Powell leave, you can’t be faster!”

The remarks are one of Trump's most sharp actions to date, aiming to undermine the Fed's political independence — a key institution traditionally independent of the White House and responsible for maintaining economic stability.

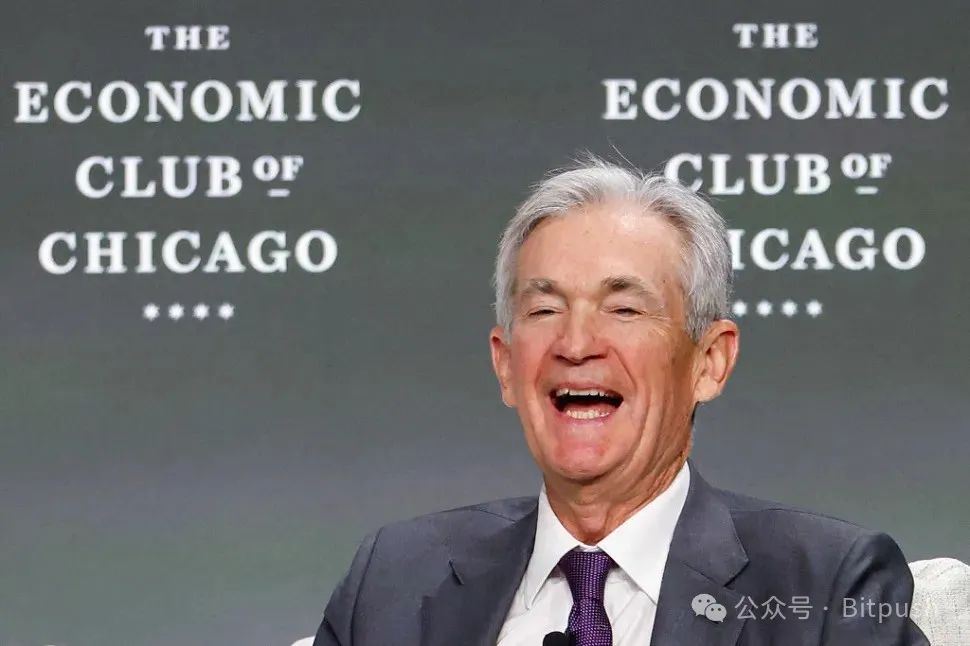

Speaking at the Chicago Economic Club the day before, Powell refuted the political intervention and said the Fed would make decisions based solely on the factors that are most favorable to the American people.

"This is the only thing we will do...We will never be affected by any political pressure...Our independence is a legal issue," Powell said in his speech.

Powell added that the Fed's directors "can't be removed unless there is a reason," and that "our term is long and seems to be endless."

Still, that didn't stop Trump from trying to fire the Fed chairman. “I don’t think he did a good job,” the president said Thursday, claiming that Powell cut interest rates “too late”.

Powell was initially nominated by Trump in 2017 and was nominated again by Joe Biden in 2022. His current term as chairman will last until May 2026.

Although successive presidents have previously expressed dissatisfaction with the Fed's interest rate decision clashing with its policy goals, Trump's remarks have sparked new concerns about political interference in monetary policy, a development that could scare the market and damage the credibility of the central bank.

Trump's aggressiveness has even raised concerns among some of Powell's critics, including veteran Democratic Senator Elizabeth Warren, who earlier warned that undermining the Fed's independence could cause disaster to the U.S. market.

"The Fed needs public confidence," said Sarah Binder, a senior fellow at the Brookings Institution and a Fed expert. "But if the president tries to oust Powell, it will only increase uncertainty that the market is not happy to see."

Here is what needs to be known about the U.S. president’s restrictions on the Federal Reserve’s power and what this means for the economy.

Can Trump fire Powell?

Legally, the answer is complex and untested. No Fed chairman has been removed from office by the president.

The Federal Reserve Act allows for the dismissal of members of the Council, including the Chairman, "for reasons." But this has been historically interpreted as misconduct or loss of capacity to perform duties rather than policy differences. "Courts generally don't treat discrimination on interest rate settings as 'misconduct'," Sarah Binder said.

Although Trump and his allies have proposed the possibility of firing Powell since his first term, they did not do so, most likely due to unclear legal prospects and possible negative effects.

Powell himself also made it clear that he would not take the initiative to speak out. When asked last November whether he would quit if Trump asked him to quit, he simply replied: "No."

Nevertheless, the Trump administration appears to be preparing for a potential confrontation. Treasury Secretary Scott Bessent recently told Bloomberg that he is expected to start interviewing Powell's possible alternative candidate in the fall.

Trump's push to remove Powell comes as the U.S. Supreme Court is currently hearing a case involving the president's dismissal of senior officials of independent agencies.

Although the case involves the National Labor Relations Board and the Merit Systems Protection Board, its impact may be more extensive. If the court supports the Trump administration, this could be interpreted as a signal of how it will resolve the legal conflict surrounding Trump’s hope to remove Powell, although the Fed said it does not believe the challenge applies to it.

At the heart of this debate is a legal precedent for nearly a century: the Supreme Court decision in 1935, Humphrey's Executor v. United States, which restricted the power of the U.S. president to remove leaders of independent institutions without reason. The ruling has long protected the Fed's chairman from political dismissals, but may soon be tested by the conservative Supreme Court.

Interests to the economy

Trump accused Powell of failing to take positive enough action to support economic growth, saying the Fed chairman “played with politics” by keeping interest rates unchanged.

But U.S. central bank officials — and many economists — take the opposite view: an independent Fed is essential to managing inflation and guiding the economy, and giving in to political demands can damage the economy and global trust in U.S. institutions.

Powell insists that the Fed's decision is "only based on the factors that are most favorable to all Americans."

In his speech Wednesday, he warned that Trump's wide range of tariffs could push the U.S. economy into a "challenging situation" of rising inflation and slowing growth -- a situation that complicates the Fed's dual mission of stabilizing prices and maximizing employment. Trump's tariffs have increased the cost of many imported goods, squeezed household budgets and raised concerns about policy slowdowns while inflation remains above the Fed's 2% target.

Meanwhile, Trump demanded an immediate rate cut, noting that the ECB had cut interest rates on Thursday.

Yale University's Budget Laboratory estimates that the inflationary effect of Trump's tariffs is equivalent to an increase of $4,900 in actual tax burden per American household. Meanwhile, long-term interest rates have soared, making borrowing costs higher for home buyers, businesses and consumers.

Jerome Powell's experience

Powell, 71, is currently serving as the second term as chairman of the Federal Reserve, the most powerful economic decision-maker in the United States. A Republican and former investment banker, he was initially appointed to the Fed's Board of Directors by Obama in 2012 and promoted to chairman by Trump in 2017. Biden later appointed him again, showing that both parties have broad trust in his ability to take charge of the central bank.

During Powell's tenure, the Fed responded to a series of economic shocks, from a recession triggered by the pandemic to the worst inflation surge in four decades. Under his leadership, the U.S. central bank lowered interest rates to near zero in 2020 to stabilize the economy amid COVID-19, and then began hikes in 2022 to curb inflation that has soared to more than 9%.

Although inflation cooled down in March, reaching a six-month low, the process was bumpy, and Powell was criticized by both parties for whether the Fed was acting too slowly or excessively.

"The level of support for Powell may have dropped significantly than (Trump) in his first term, and the economy did perform very well at the time. Many people might say that the Fed was too late to curb inflation in 22-23 and made a major policy mistake. So the question now is, who will stand up to support the Fed in this situation?"

jinse

jinse