Hayes: Why is it said that BTC may fall to $70,000 and then rise to $250,000

Reprinted from jinse

02/05/2025·2MOriginal title:[The ugly](https://cryptohayes.medium.com/the-ugly- dfba4f46ebd4)

Author: Arthur Hayes, founder of bitmex; compilation: Deng Tong, Golden Finance

" The Ugly" is the first of the three articles. "The Good" will pay attention to the rise of politics. "The Bad" will discuss the risk of being deceived by the Trump administration in terms of cryptocurrency supervision policies.

Disclaimer: I am an investor and consultant of Ethena. Ethena is the parent company of $ USDE stable currency I mentioned many times in this article.

"Stop -keep a distance of 30 meters on this hillside", a few weeks ago, when we ski on a dormant volcano, my guide suddenly slowed down, which was my instructions. Before that, climbing up the hillside was always cold. However, the situation changed at a place at an altitude of 1600 meters.

When we stopped on the ridge line together, my guide said, "The last section of the road makes my stomach roll. The risk of the avalanche is too high, so we start skiing from here." When the change, I feel different. That's why I always ski with a certified guide. A seemingly harmless terrain may be sealed in the frozen grave. People never know whether skiing can cause avalanche on a certain terrain. However, if the probability of perception exceeds people's comfort zone, then the wise approach is to stop, re -evaluate, and change the route.

At least in the first quarter, in my first article this year, I showed my optimistic attitude to the world. But with the end of January, my excitement disappeared. The relationship between central bank's balance sheet level, bank credit expansion speed, 10 -year Treasury/stock/Bitcoin prices, and crazy changes between the price trend of the crazy $ Trump Memecoin make me feel annoyed. This feeling is similar to the feeling of me in the end of 2021 (just before the cryptocurrency market falls to the bottom).

History will not repeat it, but always rhyme. I don 't believe that the bull market cycle has ended; however, from a forward -looking probability, I think we are more likely to fall to $ 70,000 to $ 75,000, and then rose to $ 250,000 before the end of 2025 instead of no no no in no. Continue to rise without substantial callback. Therefore, Maelstrom has increased the pledge of Ethena $ USDE it held to a record level and continues to profit at several cottage. We are still clean, but if I feel correct, then we will prepare a lot of funds to buy it at the low and many high -quality cottage coins at Bitcoin.

With the current bullish sentiment so high, such a magnitude pullback would be unpleasant. Trump continues to say the right thing through executive orders, improves emotions by pardoning Ross Ubricht and inspires crypto spirits with his recently launched memecoin. But in addition to Memecoin's launch, most of these things are expected. The rest of this article will discuss charts and monetary policy announcements that cause me to reduce the holdings of Maelstrom cryptocurrencies.

US monetary policy

There are two firm views that have affected my views on US monetary policy:

-The 10 -year Treasury yield will rise to between 5% and 6%, and it will trigger a small financial crisis.

-The US Federal Reserve Commissioner hates Trump, but it will take necessary measures to protect the financial system under the United States.

Let me explain the interaction between these two views.

10 -year national debt

The US dollar is the world's reserve currency, and U.S. Treasury bonds are reserve assets. This means that if you have extra US dollars, buying government bonds is the safest place to store them and gain benefits. Accountants believe that government bonds are risky, so financial institutions are allowed to use almost infinite leverage borrowing funds and assets. Finally, if the value of government bonds falls rapidly, accounting fairy tales will evolve into economic nightmares, and system importance financial participants will go bankrupt.

10 -year Treasury bonds are the benchmark for pricing for most medium and long -term fixed income tools (such as mortgage or car loan). It is the most important asset price in the dirty legal system, which is why the 10 -year yield is so important.

In view of the every financial crisis since the establishment of the Fed in 1913 (the date of the Federal Reserve) was "solved" by printing the US dollar, the leverage has accumulated for more than a century in the system. As a result, the implementation yield of large financial institutions will gradually decrease when bankruptcy. When 10-year Treasury bonds briefly broke this level, former U.S. Treasury Secretary Bad Gurl Yellen launched a policy to issue more and more T-bills as a secret way to print money Essence The direct result is that the 10 -year Treasury yield drops to 3.60%, which is a local low in this cycle.

If 5% is this level, why does the yield rose from about 4.6% to more than 5%? To answer this question, we need to understand who is the border buyer of the Treasury bond.

As we all know, the United States is issuing debt at the unparalleled speed in the history of the empire. At present, the total debt has reached US $ 3.622 trillion, higher than $ 1.6.70 trillion at the end of 2019. Who is buying these garbage?

Let's take a look at common buyers.

Fed - The Federal Reserve implemented a money printing trick called quantitative easing (QE) from 2008 to 2022. It bought trillions of dollars in U.S. Treasury bonds. However, starting in 2022, it shut down the money printing machine, which is called quantitative tightening (QT).

Commercial Banks – They have suffered a heavy blow to buy U.S. Treasury bonds at their highest prices before being hit by temporary inflation and the Fed’s fastest rate hike in 40 years. Worse, in order to comply with the annoying capital adequacy rules set by Basel III, they cannot buy U.S. Treasuries unless they pledge more expensive equity. As a result, their balance sheets have been fully utilized and they cannot buy more U.S. Treasuries.

Major foreign surplus countries - I am talking about oil exporters such as Saudi Arabia and commodity exporters such as China and Japan. As the dollar they earn from global trade surges, they have not purchased U.S. Treasury bonds. For example, as of November 2024, China's trade surplus was US$962 billion. During the same period, China's Treasury bonds held by China reduced by about $ 14 billion.

Given that the United States has stuffed Treasury bonds into the throat of the world's financial system, there has been no debt crisis yet.

Let's applaud Relative Value (RV) hedge funds. These funds are registered in the British, Cayman Islands, Luxembourg and other places for tax reasons. They are marginal buyers of government bonds. How do I know? The recent quarterly refinancing announcement (QRA) of the Ministry of Finance stated clearly that they are marginal buyers who restrict yields. In addition, if you carefully read the monthly TIC report released by the Ministry of Finance, you will find that the above areas have accumulated a lot of holdings.

The working principle of the transaction is as follows. As long as the transaction price of cash government bonds is lower than its corresponding listing futures contract, hedge funds can be arbitrage through the basis. [1] The foundation difference is very small, so the only way to make money is to trade billions of US dollars. Hedge funds do not have so many idle cash, so they need to use the banking system to provide leverage. Hedge funds buy bonds with cash, but before delivery of cash, a repurchase agreement (REPO) needs to be reached with a large bank. Hedge funds deliver bonds and receive cash. This cash is then used to pay for bond purchase fees. Look, hedge funds bought bonds with other people's money. The only money paid by hedge funds is the deposit of bond futures exchanges such as Chicago Commodity Exchange.

Theoretically, the RV hedge fund can buy countless treasures, provided that the following situations are established:

-The bank has sufficient balance sheet capacity to promote repurchase.

- The buyback rate of return is affordable. If the yield is too high, the basic transactions will be unprofitable, and hedge funds will not buy government bonds.

-Bond deposit requirements are still very low. If hedge funds must pay more margin to use futures contracts to hedge their bond purchases, it will purchase less bonds. The capital of hedge funds is limited; if most of the capital is occupied by the exchange, their transaction volume will be reduced.

Due to the above factors, RV hedge fund buyers are in danger.

Banking balance sheet/repurchase yield:

According to the Basel Agreement III, the balance sheet is a limited resource. The supply and demand relationship determines that the closer the supply is, the higher the price of the balance sheet space. Therefore, with the issuance of more debts issued by the Treasury, RV hedge funds have more basic transactions, which requires more repurchases. Using more balance sheets, at some point, the price of repurchase overnight will soar. Once this happens, the purchase will suddenly stop, and the national treasury market will begin to collapse.

Exchange margin requirements:

It is simple, the greater the asset volatility, the higher the deposit requirements. When bond prices fall, volatility rises. If the price of bonds falls/rising yields, volatility (see the MOVE index) will soar. When this happens, the margin requirements for bond futures will increase, and the purchase volume of bonds of RV hedge funds will be reduced rapidly.

These two factors are interacted in the way of reverse. Then the question becomes the problem. Is there a way to use monetary policy to cut off Gordon's knot and let the RV hebility fund continue to raise funds for the treasury?

Of course, our currency masters can always implement accounting tricks to resolve financial crises. In this case, the Federal Reserve can suspend the replenishment of leverage (SLR). The SLR that is suspended from the Treasury holding and related repurchase allows banks to use unlimited leverage.

After the SLR exemption, the following situations will occur:

-Bard can buy any amount of government bonds without mortgage to release the space on the balance sheet.

-With an unlimited balance sheet, banks can promote repurchase at a tolerable price.

The Ministry of Finance has obtained two marginal buyers: commercial banks and RV hedge funds. Bond prices rose, yields decreased, and margin requirements were reduced. Prosperity, happy day.

If the Fed is really generous, it can stop Qt and restore QE. This has three marginal buyers.

What I wrote is not news to the Fed or the Treasury Department. Over the years, the banking industry has been begging for exemption like the SLR exemption they obtained during the 2020 influenza crisis. The latest TABCO report of the Fiscal Department's Loan Consultation Committee clearly states that they need SLR exemptions, and the Fed needs to start the quantitative easing policy to restore the national bond market. The only thing missing is the Fed's political will, so I hold a second view.

Federal Reserve Policy

The remarks of the former Federal Reserve and the current Federal Reserve and the Fed's actions during President Bayeng made me believe that the Fed will be able to defeat Trump's agenda. However, the obstruction of the Federal Reserve is limited. If the bankruptcy of large financial institutions or the solvency of the empire itself requires changes in bank regulations, lowering the currency price or printing money, the Fed will take action without hesitation.

What did they say to Trump?

Here are two introductions. The first is from former Federal Reserve Director William Dudley (who served as the chairman of the New York Fed from 2009 to 2018), and the second is from Powell:

The trade war between President Donald Trump and China has continuously weakened the confidence of enterprises and consumers and worsen the economic prospects. This artificially manufactured disaster caused the Federal Reserve to fall into a dilemma: should it reduce losses by providing offset sexual stimuli, or refuse to cooperate? …Officers can make it clear that the central bank will not bail out a government that keeps making wrong choices in trade policy, which clearly shows that Trump will bear the consequences for his actions… Some even believe that the election itself belongs to the Federal Reserve. Scope of power. After all, Trump’s re-election can be arguably threatened the U.S. and global economy, the independence of the Federal Reserve and its ability to achieve employment and inflation goals.

– The Fed should not condone Donald Trump, William Dudley

Asked at a press conference on the policy meeting how the Fed views Trump’s recent victory, Powell said, “Some people have indeed taken a very preliminary step toward integrating highly conditional estimates of the economic impact of policy into In their predictions. " It's interesting. Before the election, one set of economic estimates was used to lower interest rates and help Harris, but another set of estimates is now being considered due to Trump's victory. In fact, the Fed should have used the same estimate in the months leading up to the election. But what do I know? I'm just a cryptocurrency fool.

What did they do for Biden?

In the beginning, inflation was temporary. Remember? Powell claims seriously that the inflation rate directly issued in the shortest time in American history has soared that the inflation rate is soaring in a flash, and it will soon disappear. Four years have passed, and the inflation rate has always been higher than their own, stupid, and dishonest inflation indicators. They used this sophistry to prevent unavoidable interest rate hike until 2022, because they knew that it might lead to a financial crisis or economic recession. They are not wrong; the Fed is directly responsible for the 2023 regional banking crisis.

Then, the Fed was stupid. Yellen began issuing more Treasury bills to exhaust the reverse repurchase program (RRP) from September 2022, thus completely offsetting their monetary tightening campaign. At least, the Fed can oppose the Treasury Department because they are allegedly independent of the federal government.

The Fed suspended interest rate hikes in September 2023, when inflation remained above target. In September 2024, they cheered for the printing of money by launching a interest rate cut cycle. Is inflation below their target? not yet.

The Fed talks about curbing inflation, but when keeping government funds flowing at affordable prices and stimulating the financial asset market becomes political need, the Fed takes action. This became a political need because the Biden administration was screwed up from the very beginning. In hindsight, the claim that Biden is a liar may also be correct. In any case, in order to prevent the Republicans from retaking the House and Senate and to prevent Trump from winning reelection in 2024, the Fed will do anything to prevent financial and economic crises.

What did they do for the system?

In some cases, the Fed goes beyond its responsibilities to help the Democrats. For example, in order to cope with the regional banking crisis in early 2023, the Fed has established the Bank's Term financing Plan (BTFP). The interest rate hike system and subsequent bond plunges led to a financial disaster, with banks losing money on Treasury bonds purchased at all-time highs between 2020 and 2021. The Fed noticed this corruption, which essentially $4 trillion on the balance sheet of the U.S. bank, after shutting down three crypto-friendly banks to appease Pocahontas (U.S. Sen. Elizabeth Warren). Treasury bonds and mortgage-backed securities provide support.

It seems that BTFP may be a bit overkill. However, the Fed hopes that the market has no doubt that if the financial system under the United States is facing a huge threat, it will first develop a person and go all out to launch a banknote printing machine.

Traitor Powell

Powell is a traitor because he was appointed by Trump in 2018. This is not surprising, because all the strength of Trumpism was weakened by a group of unfaithful deputy during his first term. No matter whether you think this is good or bad; the key is that the relationship between Trump and Powell is toxic on this node. After Trump recently defeated Biden, Powell immediately calmed down any doubts about resigning; he intends to have a term of office until May 2026.

Trump often believes that the Federal Reserve must reduce interest rates to make the United States great again. Powell responded in his way that the Federal Reserve was "data dependence", which means that they will do whatever they want and tell the basement intern to make some economic nonsense to prove that their decisions are correct. Remember the equivalent price of DSGE, IS/LM, and Li Jiatu? Unless you work in the Marriner Eccls building, all these are nonsense.

How do Trump let the Fed stand on him? He allows a small financial crisis. The following is a possible solution:

Continue to appear huge deficits, which requires a large amount of debt of the Ministry of Finance. Trump chooses Elon Musk to lead a de facto department without actual power, which can explain the problem. Without the government to provide billions of dollars to Tesla in the form of subsidies and tax cuts, Musk would not be as rich as him. The government efficiency department (Doge) is not a federal department, because the creation of a department requires the approval of Congress. This is a glorious consultant, reporting to Trump. Musk 's power is purely the cause. The cause is very powerful, but they will not reduce medical benefits and national defense expenses; only the direct actions of legislators can complete these difficult tasks. Why do politicians do this endanger their reelection opportunities in 2026?

He immediately fought on the debt limit. The predetermined Minister of Finance Bason has many tools to prevent the government from closing the door. Yellen used these tools when fighting the upper limit of debt in the summer of 2023. The withdrawal of the State Treasury General Account (TGA) provides financial stimuli for the market and has sufficient government funds for several months; this has delayed the time point for politicians to reach compromise to allow the Ministry of Finance to borrow again. Bason can stand by, without spending TGA money. The national bond market will be paused, and intense traders will sell government bonds because they are worried about breach of contract.

This flammable cocktail formula will quickly push the 10 -year government bond yield to more than 5%. If Barst confirms the date of debt limit and his department will not cut TGA to maintain government operation for several months, then this may happen within a few days.

As the yield of government bonds soared, the stock market will plummet, and some large financial institutions in the United States or overseas will face tremendous pressure. The Fed will fall into a political dilemma. In order to save the system, they will take the following parts or all measures:

-Sely provide SLR exemption for national debt

-Re large interest rate cut

- Stop quantitative easing

-A resumption of quantitative loose

Trump will then praise the Fed's commitment to the United States, and the financial market will be active.

The problem I described above may evolve into a crisis that is now or later caused by the uncertainty of the debt limit; the choice of timing depends on Trump. The longer the crisis began during Trump's administration, the more likely he and his Republican Party would be accused of being the culprit of the crisis, and this crisis was largely due to the leverage accumulated during the Bayeng government. In terms of transaction terms, Trump must completely solve it. Voters must blame Biden and Democratic Party, instead of the Trump and the Republican Party -otherwise Trump and the United States will become another American political movement in another birth. In the year, the Democratic Party re -controlled power in the mid -2026 election.

The spray of banknote printing will come, but only when the Fed and the Trump team are standing together. The Fed isn't the only game in town; is the banking system creating credit?

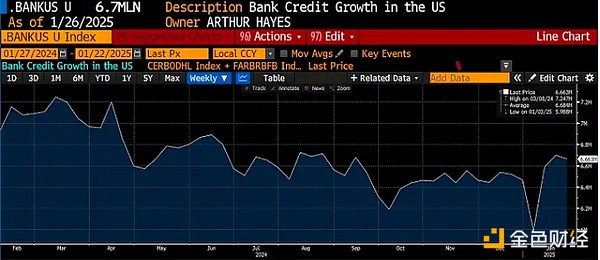

No, as you see from my custom bank credit index, it is the sum of the bank reserves and other deposits and liabilities held by the Federal Reserve.

Credit must flow. If the speed of credit creation is disappointing, the market will give up on Trump's shock. Let’s discuss China next.

China's economic stimulus measures

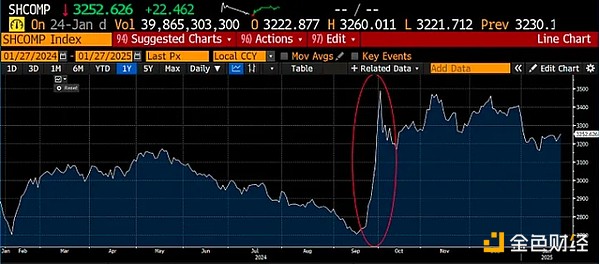

In the third quarter of last year, the People's Bank of China (PBOC) announced a series of measures to stimulate the economy. They cut off the requirements of bank deposit reserve, began to purchase Chinese government bonds (CGB), and helped local governments to reintegrate their debt burden. This was just several measures. This caused a crazy rebound in the A -share market.

If you brush Tiktok's brain every day, you don't know when the People's Bank of China and the Central Government announced that the currency and re -expanding policy will be made. The above is the Shanghai Comprehensive Index.

I have pointed out that if necessary, the Chinese government is preparing to depreciate the RMB, which is the result of the RMB credit expansion plan.

The US dollar against RMB is allowed to appreciate, which means that the US dollar will strengthen and the yuan will weaken. Everything is performed as planned, but in early January, the Chinese government changed the route.

On January 9, the People's Bank of China announced that it would end its bond purchase plan. It can be seen from the figure above that the People's Bank of China intervenes in the market and has begun to manipulate RMB strengthening. On the one hand, the central bank cannot use the RMB at home to alleviate financial conditions, and on the other hand, it can destroy the RMB to strengthen the currency.

Japan's interest rate policy

The Bank of Japan (BOJ) fulfilled its commitment to continue hikes. At a recent meeting, they raised the policy rate by 0.25% to 0.50%. The consequence of the interest rate normalization plan is the stagnation of the central bank's balance sheet growth.

As policy rates rise, Japan's government bonds (JGB) yields also reached their lowest level in nearly 15 years.

The growth rate of currency is much slower than that of modern times, but its price is rising rapidly. This is not an appropriate time for the price increase of legal pricing financial assets.

The dollar against the yen is touched. I believe that in the next 3 to 5 years, the dollar will reach 100 yuan against the dollar (the dollar is weakened and the yen will strengthen). As I have written widely, the strengthening of the Japanese yen has led Japanese companies to return trillions of dollars in capital. Anyone who borrowed the Japanese yen must sell assets because their holding costs soared. The main concern of the legal financial market is how this selling on how to sell a negative impact on the price of national debt. This is the long -term structural backwind that BESSENT must cope. It will eventually use a printing US dollar issued through a certain exchange quota tool to deal with it, but before that, it must feel pain to provide political cover to provide the required currency support. Corrosion correlation

I have explained why the legal liquidity status of the US dollar, RMB and yen is not conducive to the appreciation of the price of legal financial assets. Now, let me explain how this impact on the Bitcoin and encrypted capital markets.

Bond investor worry

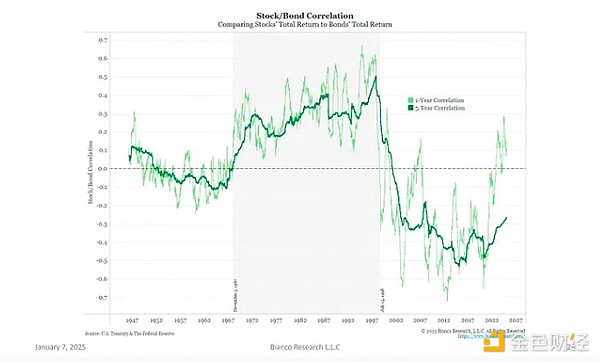

We need to discuss what bond investors worry about in peace under the United States. I will spend some time from a outstanding chart made from Bianco Research to draw conclusions, which shows the price correlation between 1 -year and 5 -year stocks and bonds.

Inflation was a nightmare for American investors from the 1970s to the early 21st century. Therefore, the price of stocks and bonds is interrelated. With inflation raging and negative impact on the economy, investors sell bonds and stocks at the same time. After China joined the World Trade Organization in 2001, the situation changed. American capitalists can outsource U.S. manufacturing bases to China in exchange for better domestic corporate profits, while growth rather than inflation has become a major concern. In this case, the decline in bond prices means that growth is accelerating, so stocks should perform well. Stocks and bonds have become irrelevant.

As you can see, the one-year correlation rose sharply in 2021, when inflation reappeared during the flu 19 crisis and hit its highest level in 40 years. In the early days of the Federal Reserve's interest rate hike cycle in early 2022, bond prices fell simultaneously with stocks. The relationship between stocks and bonds returned from the 1970s to the 1970s. Inflation is the biggest concern.

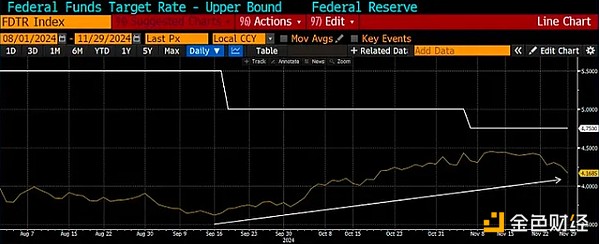

This was clearly demonstrated by the performance of the 10-year Treasury bond when the Fed suspended interest rate hikes in September 2023 and began cutting rates in September 2024, when inflation was still above the 2% target.

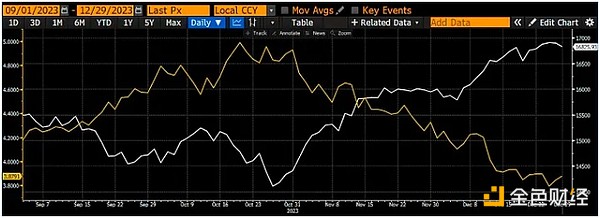

The following three charts: Federal fund interest rate limit (white) and 10 -year Treasury yield (yellow)

As you can see, the market is worried about inflation because although the Fed is relaxing the currency conditions, the yield is still rising.

Compare the first two charts with the previous interest rate reduction cycle. The last interest rate reduction cycle began at the end of 2018 and ended in March 2020. As you can see, the Federal Reserve has a decline in yields when paying interest rates.

No matter what others say, currency prices will always affect legal assets. Technology stocks are very sensitive to interest rates. You can see them as a bond with unlimited periods or duration. Simple mathematics tells you that when you increase the discount rate of unlimited cash flow, its current value will decrease. When the yield of financial dysfunction reaches the execution price, these mathematics will surface.

The picture above shows the comparison of the Nasdaq 100 index (white) and 10 -year US Treasury yield (yellow). At a level of about 5%, as the yield rose, the stock market fell, and the stock market rebounded sharply when the yield decreased. This is part of the financial system focusing on inflation rather than growth.

Let's put these together. The US dollar, RMB and yen can be swapped in the global financial market. They all entered large American technology stocks in some form. You may not like it, but this is true. I just explained step by step why, at least in the short term, the United States, China and Japan have not accelerated the creation of fiat currencies and, in some cases, have also increased the currency price. As the world economy is decoupled, the inflation rate is still high, and it may rise further in the near future. This is why I expect that the 10 -year yield will rise. If the stock market rises because of people's concerns about inflation and the rapid increase in US debt, and cannot see the border buyers, what will the stock market do? The stock market will plummet.

In the long run, Bitcoin is not related to stock prices, but the correlation may be high in the short term. This is the 30 -day correlation between Bitcoin and the Nasdaq 100 index. The correlation is high, and it is still rising. If stocks fall from 10 -year yields, this is not good for short -term prices.

Another belief in mine is that Bitcoin is the only global free market that exists. It is extremely sensitive to the global statutory liquidity; therefore, if the legal liquidity tightening is coming, its price will fall at the stock price and become a leading indicator of financial pressure. If this is a leading indicator, Bitcoin will bottom out before the stock, thereby predicting that the legal currency printing leader will be reopened.

If financial pressure occurs due to the collapse of the bond market, the author's answer will be printed. First of all, the Fed will stand with the Trump team and fulfill their patriotic obligations ... Press the Dat USD BRRR button. Then, China can expand the currency with the Federal Reserve without being weak in currency. Remember, everything is relative, if the Fed creates more dollars, the People's Bank of China can create more yuan, and the dollar- to-yuan exchange rate will remain unchanged. The biggest shareholding of Japanese companies is US dollar financial assets. Therefore, if the above -mentioned asset prices fall, the Bank of Japan will suspend interest rate hike plans to relieve the financial status of the yen.

In short, a small financial crisis in the United States will provide cryptocurrency's desire. This is also a politicians for Trump. Overall, this makes my confidence interval of the above -mentioned scenes in the first or early second quarters reached 60%.

Transaction probability and expected value

As mentioned in the preface, the increase in the risk of avalanche makes us unable to continue skiing. The key is not to make trouble, don't discover it. Extending this metaphor to cryptocurrencies, Maelstrom will hedge yourself through insufficient investment in the market. This is about expected value, not whether I am correct.

How do I know I was wrong? You never know, but in my opinion, if Bitcoin trading volume is strong, trading volume exceeds $110,000 (the level reached during the peak of $TRUMP memecoin fanaticism), and the position continues to expand, then I will give in and take a higher Risk buy back. More precisely, $ Trump Memecoin rose to a complete diluted value of nearly 100 billion US dollars in 24 hours, which is really crazy. I bought it a few hours after it was launched and sold it midway through the weekend spa vacation. My travel costs are paid multiple times, just click on a smartphone a few times. Trading should not be so easy, but this is indeed the same in the mania. In my opinion, $ TRUMP is a top signal, just like FTX purchased the US professional baseball referee logo in 2021 in the 2021 bull market.

Transactions are not about right or wrong, but about the probability of transaction perception and maximizing the expected value. Let me explain my thought process. Obviously, these are the probability of perception that can never be objectively understood, but investment games involve making decisions under incomplete information.

Why do I believe Bitcoin has 30%correction? I have traded in this market for more than ten years and experienced three bull market cycles. Considering the volatility of Bitcoin, this type of callback often occurs in the entire bull market. More importantly, after Trump won re -election in early November 2024, the market exceeded the historical highest point in March 2024. Many people, including me, have written extensively about how Trumpism predicts an acceleration in the printing of money in the United States and how other countries will use their money printing plans to boost their domestic economy. I think we will fall to the highest historical point before and talk back to Trump 's entire increase.

The probability of 30% recovery of Bitcoin is 60%

The possibility of the bull market continued and the Bitcoin repurchase increased by 10% is 40%

(60% * -30%) + (40% * 10%) = -14% expected value

Mathematics tells me that my way to reduce risks is correct. I reduce risks by selling Bitcoin for a long time and holding more funds as pledged USDE. At present, the annual yield of USDE is about 10% to 20%. If Bitcoin plummets, the field of cottage will face the end of the world, and this is where I really want to play. As mentioned at the beginning, due to various early investment and consulting allocation, Maelstrom has many flowing cottage coins. We sell most of them. If Bitcoin falls 30%, the best quality things will sell more than 50%. Bitcoin's last super liquidation candle will tell me when to reverse to buy an encrypted cottage.

Let me repeat; if I'm wrong, my disadvantage is that we make profits in advance and sell some of the bitcoins we bought with the profits of the previous altcoins investment. But if I am right, then we have cash to quickly double or turn the funds on the high -quality cottage coins that we generally sell in the encryption market.

Finally, when this article was delivered to my editor on Monday, January 27, 2025, the market was in a state of total panic because investors reevaluated their qualities due to the launch of DeepSeek NVIDIA and US tech exceptionalism bullish reasons. Nasdaq Futures is falling, and cryptocurrencies have fallen. DeepSeek is an AI model developed by a Chinese team that reportedly reduced training costs by 95%, but outperforms OpenAI and Anthropic's latest and best models. The problem of the bubble is that when investors begin to question a core principle of their bullish, they will begin to question all principles. What I worry about is that they think interest rates are not important. Western investors’ panic about DeepSeek may be a catalyst for their panic about the current poor legal liquidity situation and the long-term rise in 10-year Treasury yields. Isn’t this interesting that China is embracing the open source movement while capitalist America sticks to the walled garden? Competition is a wonderful thing.

panewslab

panewslab

chaincatcher

chaincatcher