How does the correlation between BTC and traditional asset classes evolve?

Reprinted from jinse

02/07/2025·16DAuthor: Ben Strack, Blockworks; compiled by: Wuzhu, Golden Finance

Digital assets are not exactly the same as other assets. This is part of what attracts many people—but can also cause confusion.

As more investors seek diversification and hedging opportunities, it is becoming increasingly common to try to quantify the relationship between BTC and other asset classes.

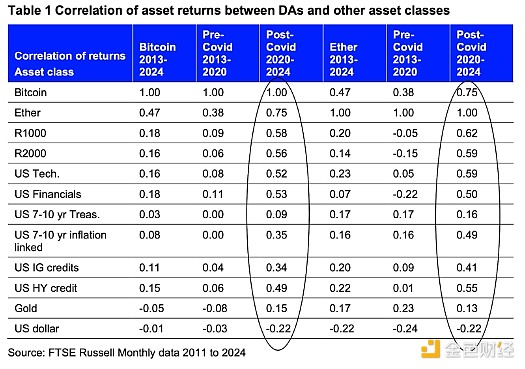

There is a clear finding in a recent report by FTSE Russell: Since 2020, the rolling correlation between Bitcoin and Ethereum returns and risky assets has risen sharply.

If we focus on BTC in particular, the Russell 1000 index, composed of large- cap U.S. stocks, has a correlation of 0.58 to that asset. BTC is almost as strongly correlated with U.S. financial stocks and U.S. technology stocks, at 0.53 and 0.52, respectively.

Since the pandemic, the correlation between BTC and U.S. high-yield credit (the most "risk" fixed-income asset class) has been 0.49.

All of these correlations were closer to zero before the pandemic broke out (stimulating inflation and currency tightening).

The correlation between 7-10-year U.S. Treasury bonds has not significantly improved with BTC after the COVID-19 pandemic, which is quite unique. And the US dollar is the only asset in recent years that has been negatively associated with BTC and ETH.

Although Bitcoin is often compared to gold, the post-pandemic BTC-gold correlation is only 0.15.

The report notes that the high volatility of BTC (and the different importance of hedging and value preservation characteristics in financial markets) may mask the “real correlation” between these asset returns.

It added: “But the real correlation may be just low, reflecting that Bitcoin and ETH are primarily risky assets, while gold has a long trading history as 'help-haven' assets, even if they do share some common preservation characteristics. ”

panewslab

panewslab

chaincatcher

chaincatcher