How to influence the encrypted market of DEEPSEEK

Reprinted from panewslab

02/02/2025·2MOriginal: Cointelegraph

Compilation: ODAILY Planet Daily Moni

On the eve of the Chinese New Year, the artificial intelligence model Deepseek brought great shock to the global market. The cost of this model was extremely low, but the effect was comparable to the AI products of American companies such as Openai.

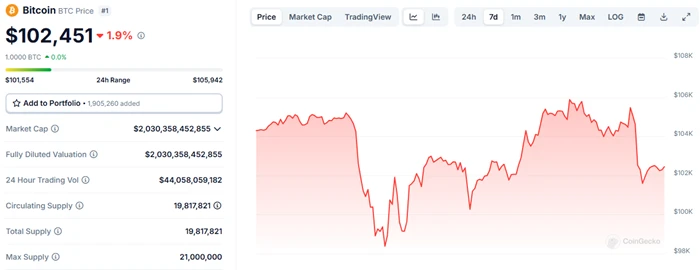

One stone stirred up thousands of waves, and American technology stocks were immediately hit hard. 17%. The cryptocurrency market was not spared, and Bitcoin and Ethereum also fell 6%and 7%respectively. The loss of some cottage coins reached double digits. This seems to once again indicate that cryptocurrencies are indeed a risk asset, and they will. Affected by market forces similar to traditional finance.

DeepSeek shocked technology stocks, Bitcoin, and a wider cryptocurrency

market

A16Z founder Marc Andreessen made DEEPSEEK a "Sptnick Moment" in the AI field. One of the main reasons was that DeepSeek surprised the global market. After all, the mainstream narrative in the field of artificial intelligence was regarded as industry leaders. (Note: At the moment of Sptnik, it means that people must be threatened and challenged.

Jean Rausis, the founder of the decentralized exchanges, said that although it seems to have nothing to do with DeepSeek, the stock price of cryptocurrencies and cryptocargy related companies such as Microslate. One of the victims. EXODUS CEO JP Richardson explained that cryptocurrencies are a "risk preference" asset. When there is any fluctuation or panic in the stock market, such as unexpected artificial intelligence models, they will see a decline, and the stock market and cryptocurrencies will be as cryptocurrencies. There is correlation with Bitcoin, which then causes the price to fall simultaneously.

Cryptocurrencies Wintermute analysts believe that although cryptocurrencies lack short -term narratives, the correlation with the stock market is promoting the flow of funds, and de -risk has been marked.

In other words, if cryptocurrency investors are frightened by the stock market, they will choose to sell.

As digital assets have been widely used and accepted in the traditional financial market, the correlation between Bitcoin and stock prices has been studied. Bitmex pointed out in its investor report that the correlation between cryptocurrencies and stocks is likely to last a long time. According to Dow Jones market data, the six -month rolling correlation indicators of Bitcoin and Nasdaq touched 0.5 on Monday, the highest level since March 2, 2023.

Fortunately, the recovery of cryptocurrencies is relatively fast. After a short -term shock, Bitcoin has risen to top to $ 100,000 this weekend.

Andre Dragosch, the head of asset management company Bitwise European research, pointed out: While the Nasdaq index continues to decline, Bitcoin has stabilized, which is extremely optimistic. Even for more wide market fluctuations, many people are optimistic and believe that cheaper artificial intelligence models like Deepseek will bring long -term benefits.

DeepSeek has made the cost of artificial intelligence lower, and in the

long run, it has little effect on the price of Bitcoin

Technical experts and market observers quickly noticed that DeepSeek was open source, which means that other artificial intelligence developers can use some advantages of DeepSeek to build and improve their models. Standard Chartered Bank analyst Geoff Kendrick analyzed: "The artificial intelligence market positioning will be clearer. In any case, if the AI tools with lower costs (in the margin) reduce inflation, then risk assets that are not related to AI, such as Bitcoin, should be, should, should be, should be Bitcoin. Will benefit. "

As risks temporarily fade, the momentum of Bitcoin seems to be increasing again. Geoff Kendrick predicts that Bitcoin may be only a few days before the next historical high, and it seems that it will exceed the record of about $ 109,000 next week. From February to March, its price may be as high as $ 130,000.

Paul Howard Paul Howard further analyzed that "Deepseek will accelerate the development of artificial intelligence in the United States and overseas, deny artificial intelligence hegemony, and the potential impact on cryptocurrencies is actually very small. The model cannot be provided, and its low cost has little effect on the interaction between institutional participants and the cryptocurrency market, because the cryptocurrency market is one end of the risk amplification in the stock market. "

On the other hand, there are also some good news from Bitcoin and more extensive cryptocurrency markets in the macro level.

According to the British "Financial Times", if the plan proposed by the Czech Central Bank Governor Aleš Michl was approved, the Czech Central Bank may eventually exchanged 5%of its 140 billion euro foreign exchange reserves to Bitcoin Essence Geoff Kendrick calculated: "According to the current price, the Czech Central Bank will hold 69,000 Bitcoin. The country that is currently known to hold Bitcoin is Salvador, and the country holds 6049." In addition, the Swiss central bank seems to be in In the direction of embracing Bitcoin, the Swiss Federal Government has officially begun to review the national referendum proposal entitled "Switzerland (Bitcoin Initiative), which has strong financial and responsible financial and responsible. The signature stage aims to include Bitcoin into the Swiss national financial system through amendments to the constitutional amendment. Although it may take some time, this move is of great significance, because Swiss foreign exchange reserves are six times that of the Czech Republic.

The cryptocurrency community predicts that the establishment of Bitcoin reserves in the United States will trigger the establishment of its own Bitcoin reserves in other countries, thereby significantly pushing the price of Bitcoin. Although Trump has not taken actions, his order has indeed made room for the establishment of "reserves", which means that the United States may retain the 207,000 Bitcoin that has already held. At the same time, the US Securities and Exchange Commission has canceled the employee accounting announcement No. 121 (SAB 121), which will also boost the demand for digital assets.

Overall, as a powerful artificial intelligence model, the development and application of DeepSeek will more or less affect the traditional finance and crypto markets. After all, a "brief collapse of the Bitcoin and cryptocurrency market has recently triggered a Bitcoin and cryptocurrency market. "But in the long run, it seems that it will not have a greater impact on the price, so you may wish to think of DeepSeek as a better, cheaper, faster, open and free AI gift.

chaincatcher

chaincatcher