In-depth analysis Orbiter Finance: How to build a competitive advantage in the cross-chain bridge market?

Reprinted from panewslab

03/15/2025·1MCore Summary

- Although cross-chain bridges can achieve cross-chain transfer of assets, they always face security threats. Orbiter Finance has been operating stably since 2021, and has won the trust of users.

- With the rise of new public chains and the expansion of DeFi territory, the cross-chain bridge market is experiencing explosive growth, and the annual cross-chain scale of assets is expected to reach US$510.7 billion in 2027. Fast access capability, technical stability and low rates will become the core elements of seizing the market.

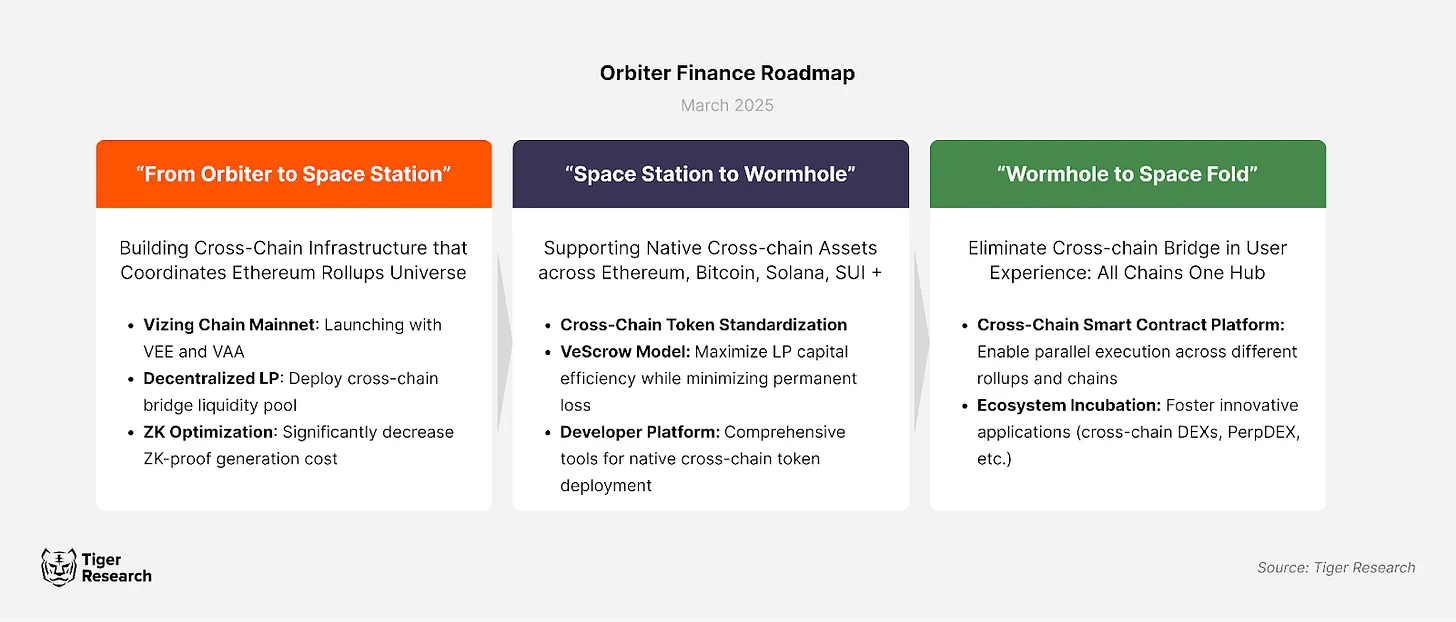

- Relying on a solid product foundation, Orbiter Finance is breaking through the boundaries of traditional cross-chain bridges through the "Vizing" plan, aiming to build a full-chain infrastructure and completely revolutionize the cross-chain transmission methods of assets and data.

1. Cross-chain bridge market structure

The cryptocurrency market has experienced ups and downs, and the cross-chain bridge field is no exception. As a key component of the ecosystem, the cross-chain bridge undertakes the basic functions of connecting different blockchain networks and realizing cross-chain transfer of assets.

The cross-chain bridge is essentially a dedicated protocol that connects two independent blockchains through the triple dimensions of economy, technology and concept. The value of analogy to physical bridges is not only simple connections, but also the rapid and efficient transfer of assets between networks. With the continuous emergence of Layer2 (L2) solutions, cross-chain bridges have become an essential tool for integrating fragmented ecosystems.

However, in sharp contrast to its importance, cross-chain bridges are frequently exposed to major security risks. A typical case is the hacked incident of Wormhole Bridge: the attacker used a wormhole Solana smart contract vulnerability to forge signatures and illegally cast 120,000 wETH, then exchanged for real wETH on the Ethereum network, and then exchanged for real ETH on the Ethereum network , causing huge losses. Just as the collapse of physical bridges will affect two interconnected cities, the breached cross-chain bridge will also affect multiple networks.

There are three reasons why cross-chain bridges have become the key target of hackers: First, huge amounts of funds are accumulated; second, trust mechanisms relying on smart contract coding; third, potential vulnerabilities brought about by the coordination of different blockchain rules. Even in a decentralized environment designed to minimize trust dependence, the risk of key theft and artificial regulatory vulnerabilities brought by limited verification nodes are still major security risks.

Despite the risks, cross-chain bridges are an indispensable part of the crypto market. In this context, screening projects with continuous stability is crucial to maintaining healthy ecological development. Taking Orbiter Finance as an example, its cross-chain bridge service has been in operation since 2021

- this is rare in the Web3 field. The platform has achieved steady growth with its operational resilience and has gradually established a barrier to user trust.

Orbiter Finance was early on supported by top investment institutions such as Ethereum co-founder Vitalik Buterin and OKX Ventures. This report will provide an in-depth analysis of how Orbiter Finance builds competitive advantages in the cross-chain bridge market and looks forward to its future development prospects.

2. The core driving force of cross-chain bridge market growth

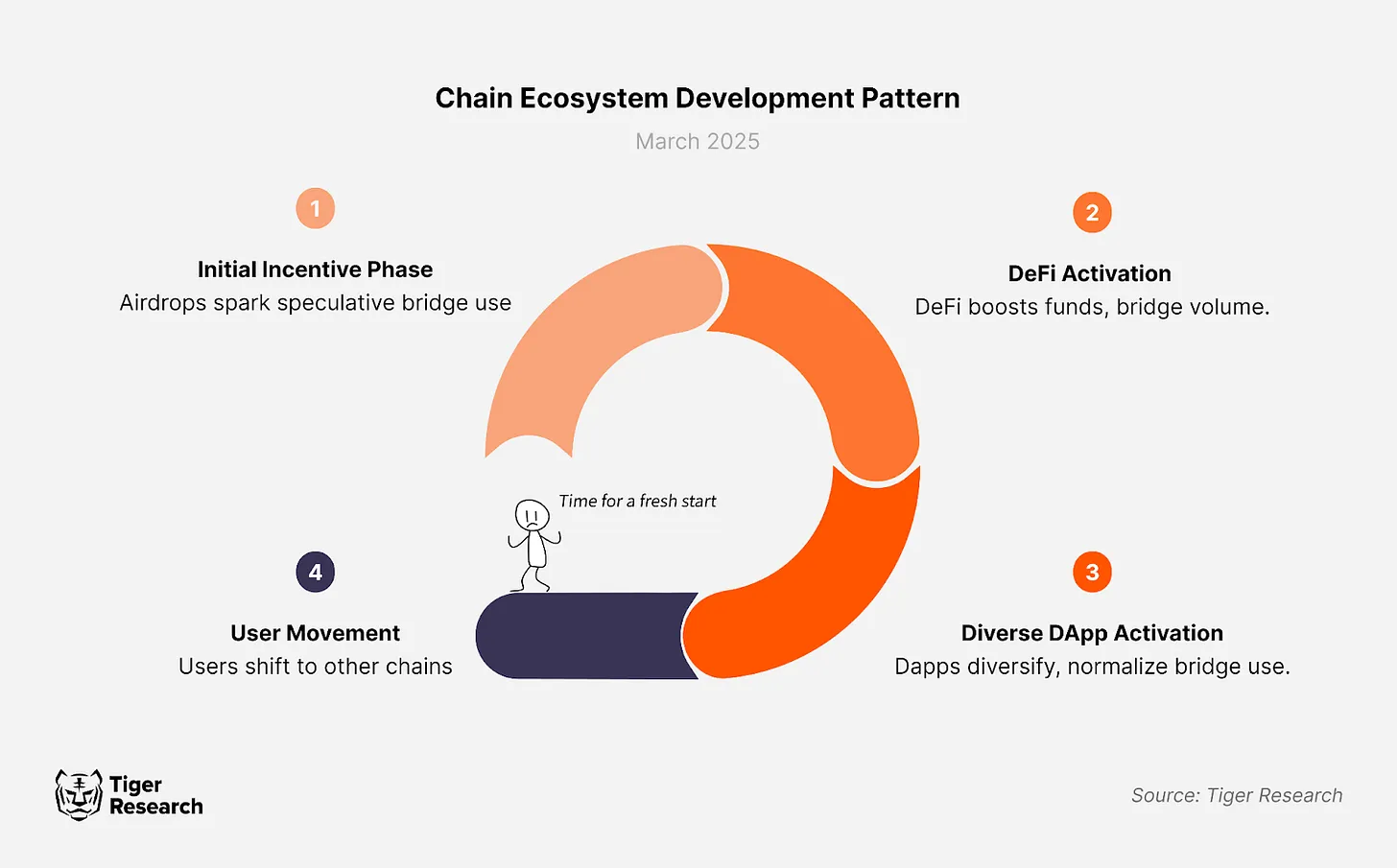

The blockchain ecosystem continues to expand, and new public chains continue to emerge. In this process, the cross-chain bridge market is benefiting from the sustainability of the development of the chain ecosystem:

1. Initial motivation stage

When the new chain is launched, incentives such as airdrops attract investors' attention. Reward expectations drive investors to transfer assets to new chains through cross-chain bridge protocols, opening up the cross-chain bridge usage cycle.

2. DeFi activation phase

Beyond airdrop participation, DeFi services in the chain have begun to make efforts. Early capital inflows realize multiple functions such as lending, pledge and liquidity supply in various DeFi protocols, attracting incremental funds to enter the market. As cross-chain asset flow intensifies, cross-chain bridge transaction volume has increased significantly.

3. The prosperity stage of diversified DApps

With the development of the ecosystem, new DApps such as game platforms and NFT markets have emerged, promoting the continuous inflow of funds. At this stage, the use of cross-chain bridges has become a conventional component of the ecological system.

It is worth noting that when new chains continue to emerge, market attention will continue to shift to emerging ecosystems, and cross-chain demand will rebound cyclically. In short, the market size of the cross-chain bridge has shown a spiral growth with the birth of new chains and the maturity of the ecosystem.

This process is like the migration of merchants from mature commercial areas to emerging development areas: when the old areas tend to be saturated and the profit margin narrows, the new areas attract early entrants with low rental costs, first-mover advantages and long-term value-added potential, and give them future opportunities such as franchising. Driven by compound incentives, retail industry migration forms a continuous cycle - this is the micromap of capital flows between blockchain ecology.

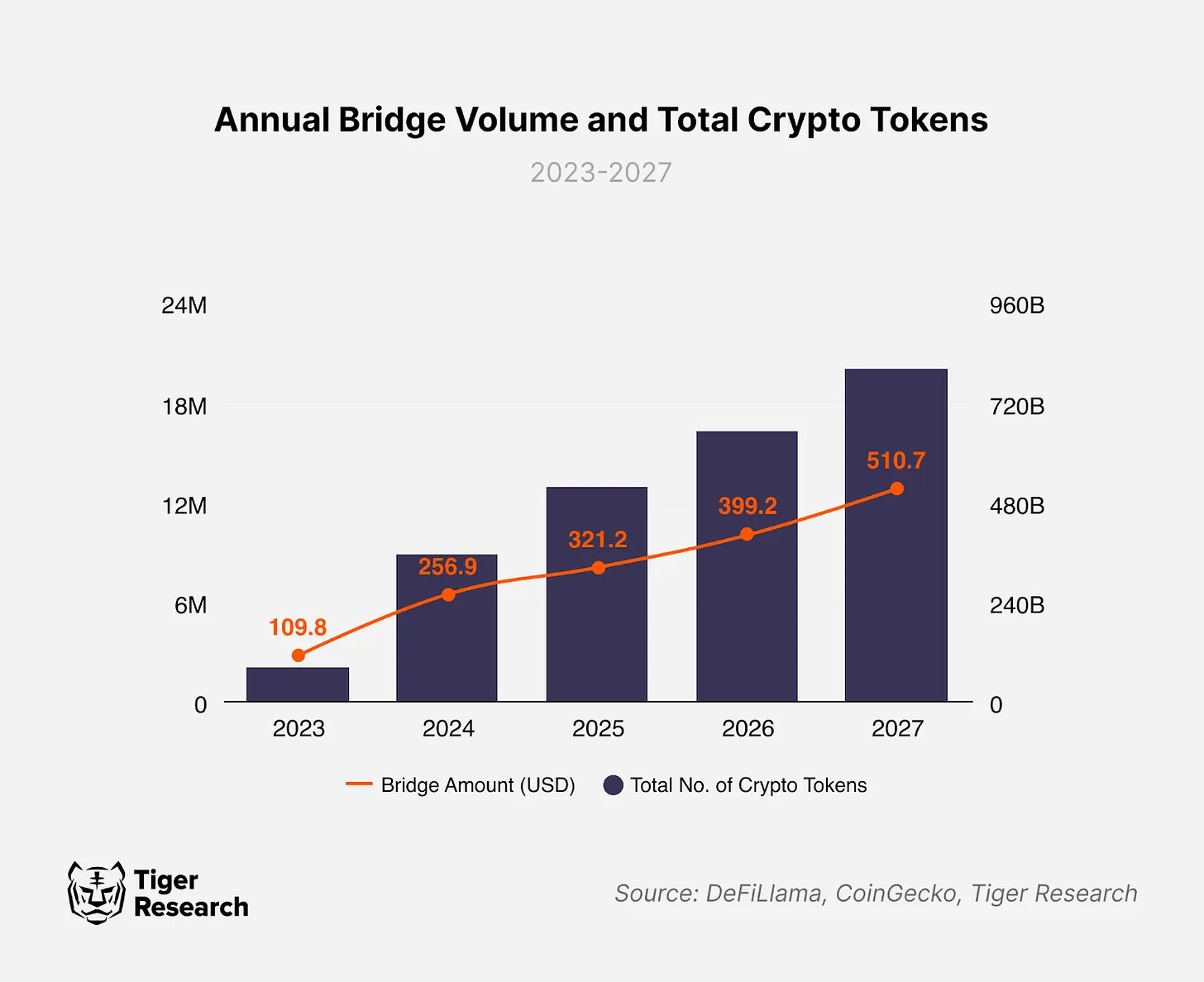

According to DeFiLlama data, the cross-chain scale of assets in 2024 has reached US$256.9 billion, doubled compared with 2023 (Note: This data does not cover all cross-chain activities on the chain, and the actual scale may be higher).

With the expansion of market size, the industry is undergoing profound changes: the blockchain ecosystem is becoming more mature, the regulatory framework is accelerating and perfecting, and the Meme coin launch board has driven a surge in token projects (although the proportion of high-quality projects is still relatively limited). Against this background, it is conservatively estimated that by 2027, the annual cross-chain asset scale will reach US$510.7 billion.

In this continuously expanding market, obtaining stable fee returns and strong market position depends on three key factors:

-

Quickly establish connection capabilities with emerging links

-

Ensure robust and safe service

-

Provide competitive transaction speed and low fees

Source: Orbiter Finance

In this market environment, Orbiter Finance is unique in positioning with its decentralized cross-chain bridge and supports asset flows between multiple networks. Its rapid access capabilities for mainstream projects such as Solana and emerging projects such as Abstract and Story are complemented by 10-20 seconds of fast transfer and low fees, which constitute the key factor in the continuous influx of users.

With its excellent technology and scalability, Orbiter Finance has successfully simplified the transfer of blockchain assets to the daily network transaction level, perfectly assumed the role of "Web2 and Web3 bridge", further consolidating its unique position in the rapid evolution of the blockchain market.

2.1 New link connection trends in Orbiter Finance

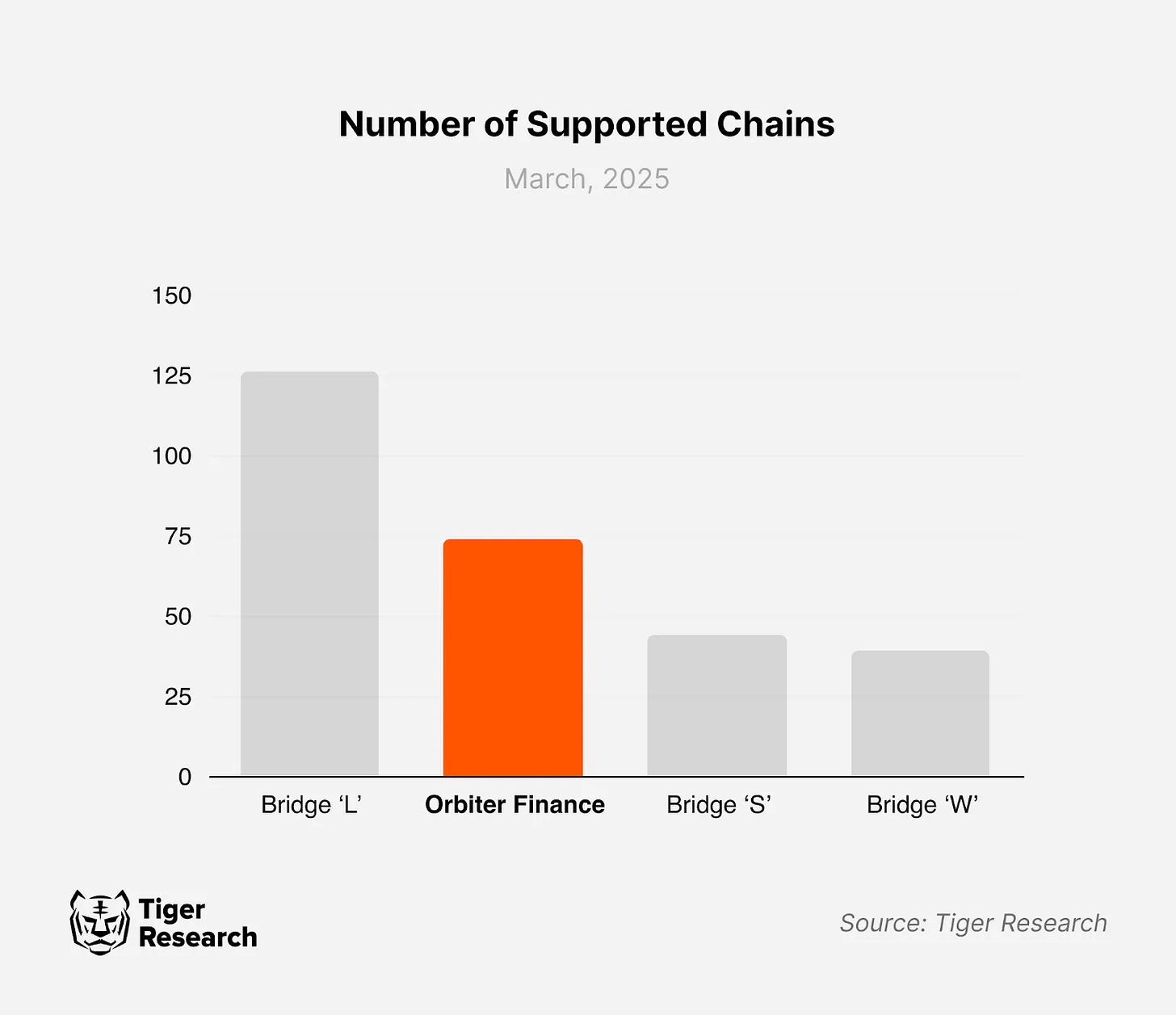

Orbiter Finance has supported more than 70 blockchains and continues to expand its coverage through the integration of new high-scaling chains. Its most significant advantage is the ability to adapt to the latest Ethereum L2 solutions quickly. Among the many L2 expansion solutions designed to solve the Ethereum scalability problem, Orbiter Finance is particularly active in integrating the zero-knowledge proof (ZK) technology department Rollup.

By integrating ZK-based public chains such as ZKFair, zkLink Nova and Proof of Play Apex, Orbiter Finance continues to strengthen its layout in the ZK ecosystem. At the same time, it expands the Ethereum ecosystem through its independently developed ZK-based L2 network Vizing, and supports diversified L2 solutions such as Arbitrum and Optimism to achieve seamless interoperability between Ethereum-based L2 networks.

Another differentiation advantage lies in the early support for Bitcoin Layer2 solution. When most cross-chain bridge services are not yet compatible with Bitcoin-based public chains, Orbiter Finance has taken the lead in integrating networks such as BEVM, Bitlayer and B² Network. This move shows its strategic ambition to break through the boundaries of the Ethereum ecosystem and reach veteran ecosystems such as Bitcoin, and provide users with more flexible asset transfer options.

These strategies allow Orbiter Finance to grasp the dividends of the rapid expansion of the Ethereum L2 ecosystem, while maintaining flexible interoperability between multiple Layer1 (L1) blockchains. With the accelerated adoption rate of Ethereum L2, Orbiter Finance is expected to play a more important role in the field of cross-chain connections.

2.2 The cornerstone of technically reliable service

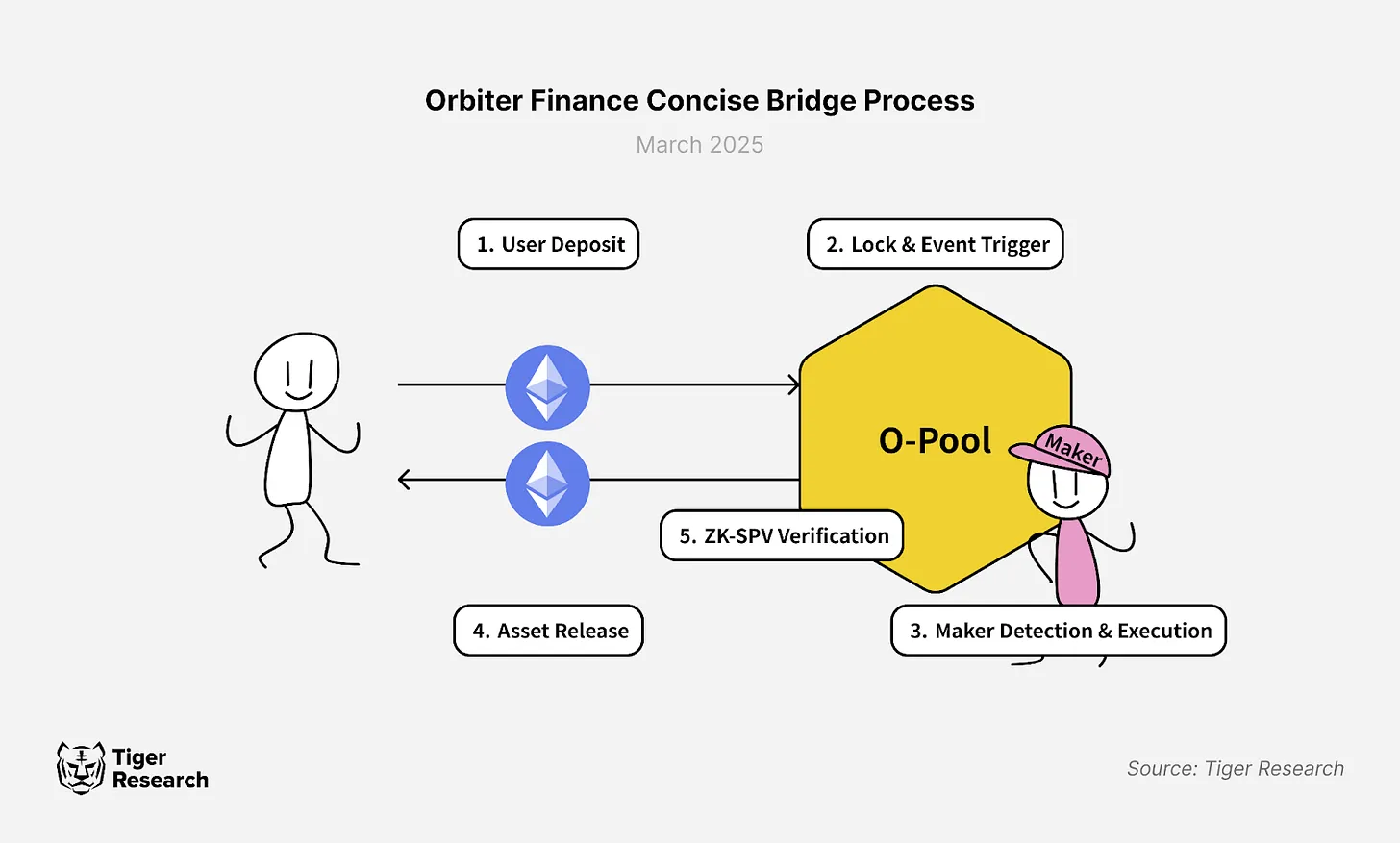

Since 2021, Orbiter Finance has always maintained a record of zero safety accidents in cross-chain bridge services. As a cross-chain bridge combining decentralized market maker network and smart contract liquidity pool, it achieves dual security and efficiency guarantees through ZK-SPV technology and O-Pool system.

The Orbiter Finance operating mechanism is concise and efficient: When a user deposits cross-chain assets into the source chain O-Pool contract, the market maker node will detect transactions and perform equal asset transfers on the target chain. In this process, market makers obtain fee returns, while ZK-SPV technology verifies transaction legality through cryptography, ensuring safe and minimizing cross-chain transfers of trust.

The system operates a similar multinational banking network: when a user deposits funds in a bank in one country (source chain), the bank representative (market maker) will notify another country (target chain) branches to provide equal funds. All transactions are reinforced by non-forgery certificates (ZK proofs) to ensure safety and trustworthiness.

At the technical level, Orbiter Finance integrates two core components:

-

O-Pool system : manages liquidity through smart contracts deployed on multiple chains. Users deposit assets into O-Pool through the source chain, market maker nodes detect and perform target chain withdrawals

-

ZK-SPV technology : Use zero-knowledge proof to achieve mathematical verification of cross-chain transactions, and can complete instant verification without a long wait, overcoming the delay pain points of Optimistic Verification

This model marks a significant advancement in cross-chain infrastructure. Orbiter Finance abandons centralized mechanisms (such as encapsulated token issuance or multi-sign verification), adopts a decentralized market maker model that does not rely on complex encapsulation processes, combines ZK-SPV technology to enhance security, and establishes a cross-blockchain asset transfer framework that minimizes trust and is scalable.

2.3 Competitiveness between speed and rate

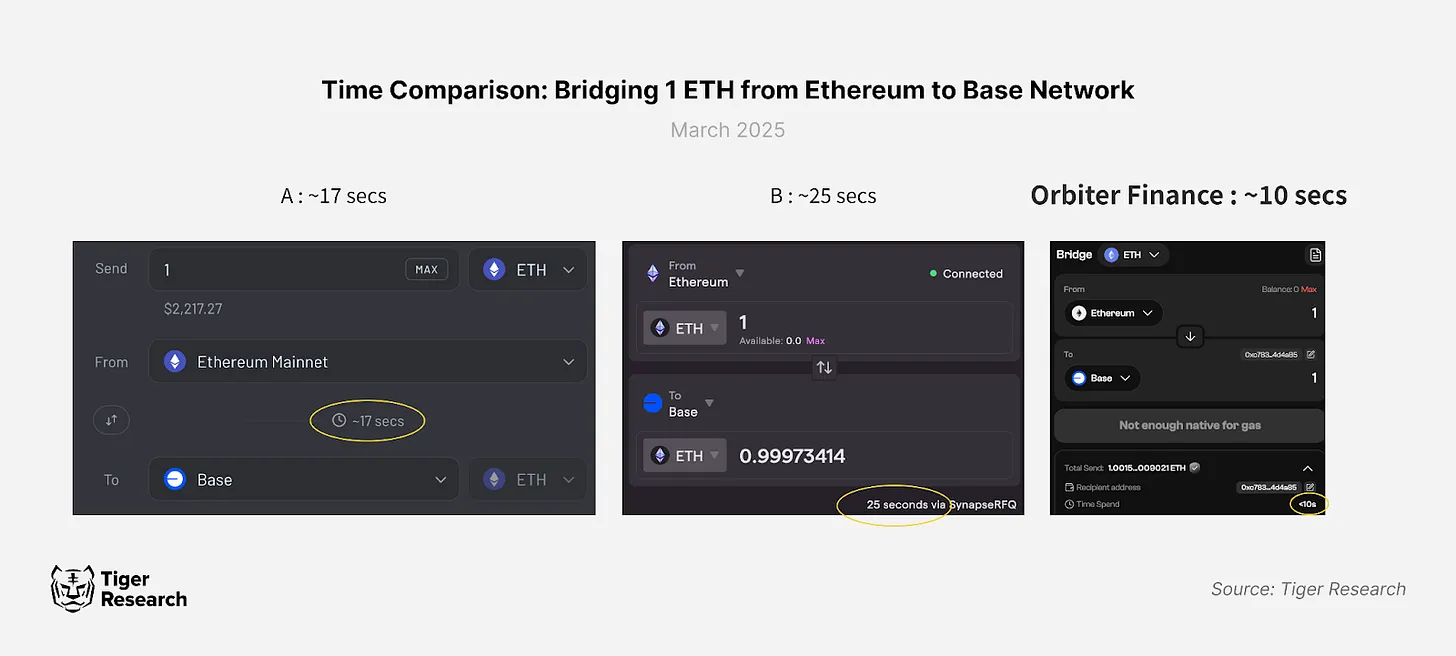

Orbiter Finance provides industry-leading transaction speeds, and cross-chain transfers are usually completed in 10-20 seconds - with significant advantages over other cross-chain bridges. This speed advantage mainly comes from ZK-SPV technology and streamlined transmission mechanism to minimize block confirmation needs.

In addition to speed, Orbiter Finance shows a strong fee advantage in the L2 transfer scenario. By minimizing smart contract calls, its ETH cross-chain gas consumption dropped to about 21,000 gas, significantly lower than the competitors' 120,000-450,000 gas. However, it should be noted that Orbiter Finance does not maintain a fee advantage in all transfer paths, and its fee rate may be higher than that of competitors under specific market conditions and transfer paths.

3. Orbiter Finance’s Star Vision—Vizing

Source: Vizing

Orbiter Finance’s vision goes beyond basic cross-chain bridge services and is committed to extending interoperability in an L2-dominated environment. Traditional cross-chain solutions focus on asset transfer, but with the evolution of the blockchain ecosystem, the market's demand for cross-chain messaging and data transmission is increasing day by day.

This transformation is like the development trajectory of urban infrastructure

- expanding from road construction to communication networks and public facilities systems. For example, a DeFi application on a chain may need to call another chain price oracle, or execute transactions based on specific cross-chain events. However, existing cross-bridge systems have obvious limitations in efficiently handling such data interactions.

To this end, Orbiter Finance has developed Vizing: ZK-based Ethereum L2 network designed to support on-chain messaging and cross-chain data transmission. Through zero-knowledge proof (ZKPs), Vizing can achieve rapid and efficient cross-chain flow of assets and data.

Vizing has two core advantages: Vizing Account Abstraction (VAA) : allows users to manage multiple L2 networks through a single account, greatly improving the convenience of use. Vizing Environment Layer (VEL) : Provides a unified execution environment across L2, allowing developers to achieve multi-chain application coverage through a single deployment.

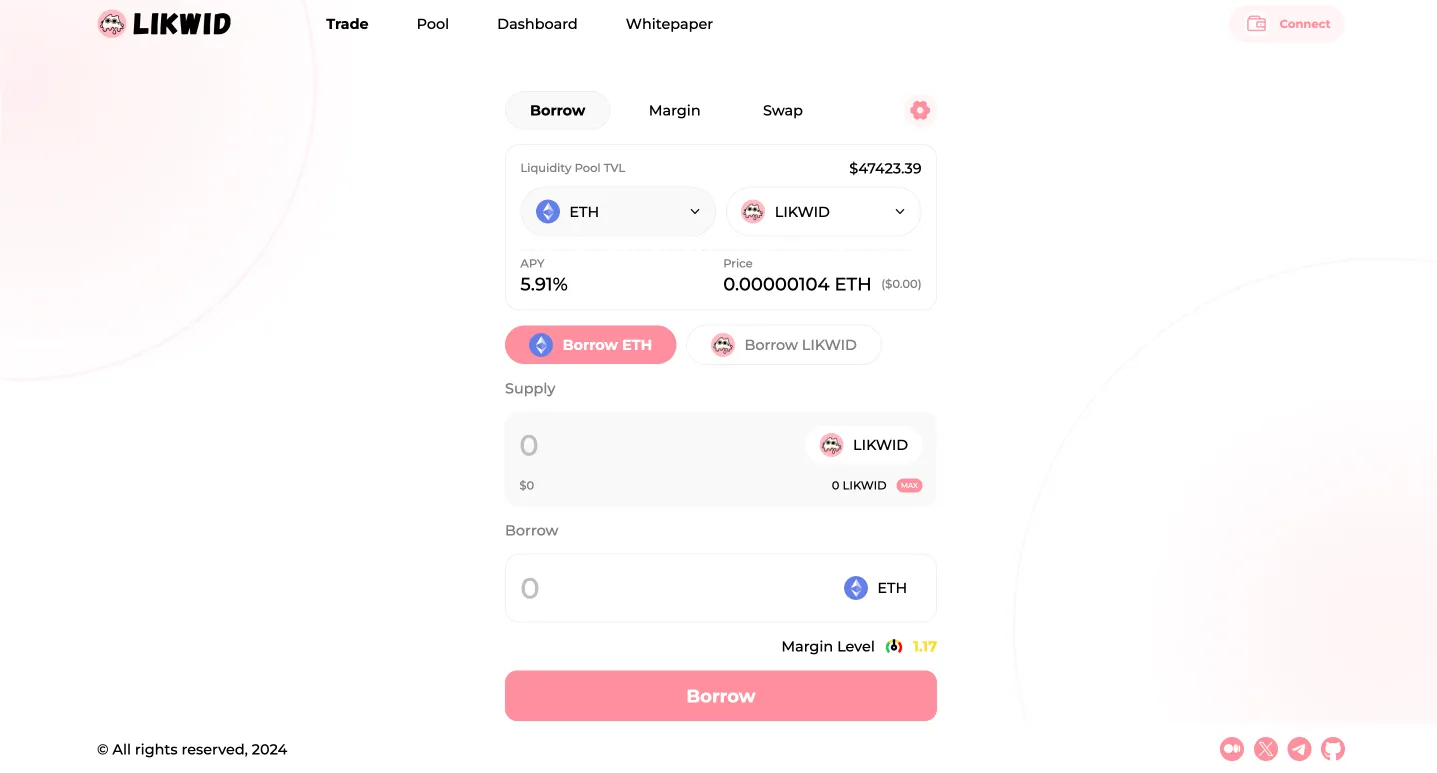

Source: Likwid

Vizing currently focuses on solving key challenges in L2 interoperability. To support ecological construction, Vizing launched the funding program last year and took the first step to implement it.

Typical cases include the AMM service Likwid based on Vizing technology. The platform realizes completely decentralized derivative transactions without relying on centralized intermediaries or oracles. It was named the DeFi innovation champion by Uniswap, creating a new paradigm for derivative transactions without competitors.

By achieving cross-chain communication and data sharing beyond simple asset transfer, Vizing effectively solves the problem of L2 ecological fragmentation, improves the efficiency and availability of blockchain infrastructure, and lays the foundation for wider real-world applications.

4. Orbiter Finance: Build a faster and more powerful ecosystem

The challenges facing Ethereum are far more than liquidity fragmentation. Although L2 solutions continue to increase, the scalability and performance improvement of the Ethereum base layer are progressing slowly. The processing capacity of network transactions is still limited, which has created the need for auxiliary network construction, but these efforts have not yet brought about a fundamental increase in throughput.

For example, when Base chain user A transfers 1 ETH to Arbitrum chain user B, the current Ethereum L2 environment still needs to read data from L1 and update the Ethereum status in the Beacon Chain. As the core ledger of Ethereum 2.0, the beacon chain manages the final records and verification of all transactions. This architecture restricts L2 scalability to L1 performance, forming a systematic bottleneck.

This situation is like sending money from Seoul to Busan needs to be processed by the central bank: even if the number of local banks (L2) increases, if the central bank (L1) processes slowly, the entire system will still be limited.

To overcome these limitations, Orbiter Finance is developing infrastructure that supports direct communication between Rollups. This full-chain infrastructure (Omnichain Infrastructure) breaks down barriers between blockchain networks, promotes seamless transmission of assets and data, and reduces dependence on Ethereum L1. By realizing L2 liquidity sharing, Orbiter Finance aims to improve the overall efficiency of the Ethereum ecosystem.

The infrastructure contains four core components:

-

Full-chain wallet system : a unified account system similar to a general bank account, minimizing L1 data access requirements. No matter which local bank (L2) the user interacts with, he can access funds through a single account.

-

Relay protocol : supports cross-shash communication protocol with direct interaction of Rollup, evading L1 transaction routing. Similar to the direct connection between local banks, the realization of Busan and Daegu banks can be traded without the need to pass the Seoul Central Bank

-

Liquidity aggregation layer : a cross-chain asset pool management system. Similar to local banks, they share liquidity pools, ensure dynamic allocation of different online funds on demand, and improve capital efficiency

-

Parallel execution contract : a full-chain smart contract system, similar to Vizing Dapp to realize automatic deployment across Rollup. This model does not require the development of financial products separately for each bank, and achieves seamless deployment across the entire network

By implementing this model, Ethereum L1 can focus on security maintenance, while L2 assumes execution and transaction functions, eliminating bottlenecks while maintaining decentralization. This transformation is similar to the reform of the financial system: the central bank focuses on policy stability, and local banks independently manage daily transactions.

Orbiter Finance's full-chain infrastructure does not replace L1 (central bank), but alleviates existing bottlenecks by realizing direct connection between L2. Finally, an efficient financial network is formed: local banks (L2) handle transactions independently, and central banks (L1) intervene only when necessary. This model promotes collaboration among Rollups and guides the industry from TVL competition to a more decentralized and scalable ecosystem.

5. A future blueprint based on solid foundation

Orbiter Finance has established a solid foundation in its core business: through fast and differentiated chain connection capabilities, stable technological infrastructure and cost-effective transactions, it provides real users with reliable cross-chain services and builds a moat for active users.

At the same time, it demonstrates a rational and solid vision for the future. With the expansion of the L2 ecosystem, Orbiter Finance accurately identifies key scalability challenges and systematically develops solutions.

Different from competitors who talk about their vision, Orbiter Finance relies on actual operational services and active user groups to expand its business territory step by step. This strategy not only helps it gain a stable share in the growing cross-chain bridge market, but also creates incremental profit opportunities in emerging markets.

With the maturity of the L2 ecosystem and the expansion of DeFi services, the role of cross-chain bridges and full-chain infrastructure will become increasingly critical. Users will more frequently combine Arbitrum high-yield lending services with Optimism for efficient transactions, or use Base chain pledged assets for Scroll chain derivative transactions. Just as traditional finance has evolved through complex financial products and strategies, cross-chain asset flow and multi-layer DeFi strategies will become the norm. In the process of accelerated trends, cross-chain bridge services such as Orbiter Finance and full-chain infrastructure will become an indispensable part of the blockchain ecosystem.

However, we need to continue to pay attention to the stability of Vizing ecological services. Although Likwid is online, it is still in its early stages and requires more cases to prove its potential. In addition, there is always a gap between vision and execution, and it is crucial to keep track of the progress of roadmap implementation.

chaincatcher

chaincatcher