In-depth analysis report of Trump Coin $TRUMP on-chain trading strategy

Reprinted from jinse

01/21/2025·3M

How did $TRUMP become a top player in the crypto community overnight? At 22:00 on January 17, 2025 (Taiwan time zone ), $TRUMP began to be minted on the Solana chain, and the official liquidity address injected 10% of the total amount of tokens. All 20% liquidity injection was completed at 9 a.m. on January 18. At 10:44 on the same day, as the incoming US President Trump’s social media post was confirmed, the price of $TRUMP surged significantly. From 19:00 to 23:00 that day, the first wave of exchanges intensively launched perpetual contracts, and the next day the second wave of exchanges intensively launched spot transactions. The price started to rise from 10u to 80u, and the full circulation market value FDV reached a maximum of about Reaching 80 billion u. This research report will provide an in-depth analysis of the key events that promoted this token release and the on-chain transaction flow data.

1. Basic project analysis

1.1 Basic information

-

Token name: OFFICIAL TRUMP (TRUMP)

-

Distribution chain: Solana

-

Token address: 6p6xgHyF7AeE6TZkSmFsko444wqoP15icUSqi2jfGiPN

-

Issuance method: Multi-signature wallet casting

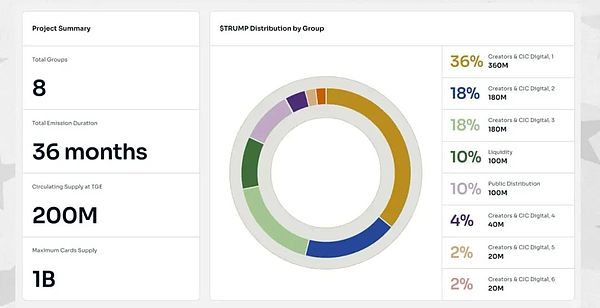

1.2 Token Economic Model

-

Maximum supply: 1B (1 billion)

-

Circulation supply: 200M (200 million)

-

Release cycle: 36 months

-

TGE unlocking ratio: 20% (liquidity pool + public allocation)

2. Token distribution structure analysis

2.1 Detailed explanation of distribution ratio

- Core allocation (72%)

-

Creators & CIC Digital 1: 36% (360M)

-

Creators & CIC Digital 2: 18% (180M)

-

Creators & CIC Digital 3: 18% (180M)

-

Market operations (20%)

-

Liquidity pool: 10% (100M)

-

Public allocation: 10% (100M)

-

-

Other allocations (8%)

-

Creators & CIC Digital 4: 4% (40M)

-

Creators & CIC Digital 5: 2% (20M)

-

Creators & CIC Digital 6: 2% (20M)

-

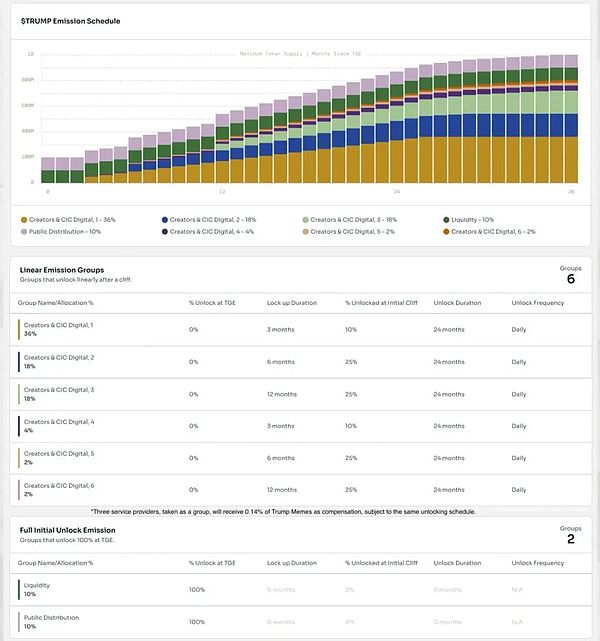

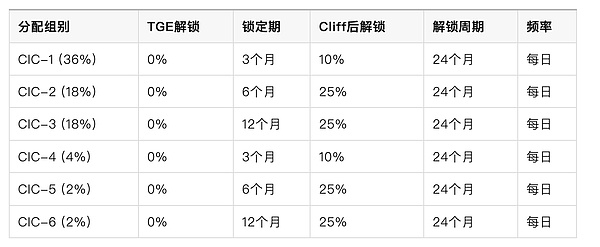

2.2 Analysis of unlocking mechanism

2.2.1 Linear unlocking group (80% of total amount)

2.2.2 Instant unlock group (20% of total amount)

* Liquidity pool (10%): TGE is unlocked immediately

* Public allocation (10%): TGE is unlocked immediately

3. Market behavior analysis

3.1 Analysis of key time nodes

Summary of major events:

Taiwan time zone on January 17

22:01 - Trump Token Minted on Solana Network

22:27 - The official liquidity address begins to inject liquidity, injecting 100,000,000 TRUMP (accounting for 10% of the total token ratio)

22:58:36 - https://gettrumpmemes.com/ official website is online (reference basis)

Taiwan time zone on January 18

09:01 - Liquidity injection completed

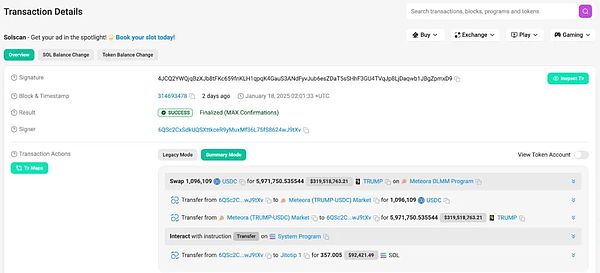

10:01 - The first large transaction ($1,096,109) occurs

10:44 - Trump’s social media post

19:00-23:00 - The first wave of exchanges intensively launch perpetual contracts (Gate.io, Hyperliquid, Bitget, HTX, Binance, Bybit)

Taiwan time zone on January 19

3:30-15:20 - The second wave of exchanges intensively launches spot trading (Kraken, OKX, Binance, Bybit, Coinbase)

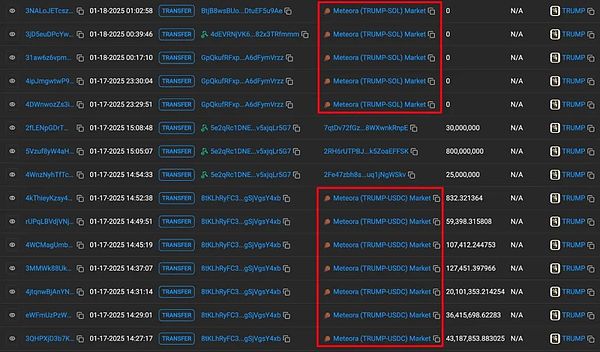

3.2 Liquidity deployment analysis (initial liquidity in Meteora)

Initial liquidity configuration (Meteora Pool):

* TRUMP/USDC Pool: 100,000,000 TRUMP / 0 USDC

* TRUMP/SOL Pool: 0 TRUMP / 50 SOL

Features:

-

Adopt a dual-pool strategy

-

Conservative initial pricing

-

Reserve space for price discovery

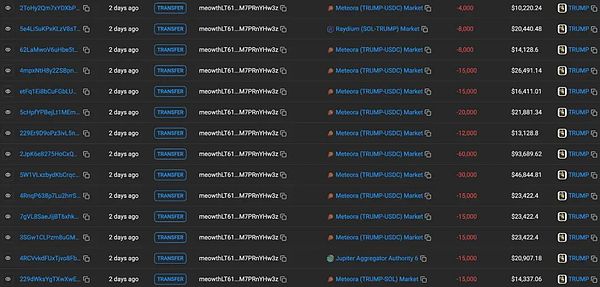

3.3 Analysis of suspicious transaction behavior

- time characteristics

-

Fund deployment: 4 hours before opening

-

Timing to open a position: Enter the market in the first minute

-

Profitable operations: carried out in batches

-

Operating techniques

- Initial position opening: USD 1 million

-

Dispersion strategy: split into 10 sub-addresses

-

EPKrfFVt2CoaUnCo8eMauH3PEsK3rwyPQefxGd1zEi8m

-

2311zgVvwvWkGnG8ZjiKCzE9ASSpf4peoUxEsXuVEJ9A

-

H2ikJvq8or5MyjvFowD7CDY6fG3Sc2yi4mxTnfovXy3K

-

2RssnB7hcrnBEx55hXMKT1E7gN27g9ecQFbbCc5Zjajq

-

AETvgbNUjrjqQCr6TbDk8wNvvSDYmUUaJAu1vVXfsMSa

-

5YHnbqDfPonA7PbuY282kigRVBU4Db62DC62z3C61qXG

-

cGxeYN6F7T9aELwjLPeL3hnJNscGU7EHg5CEsP4B3Hz

-

8zgKeSDpjHmDtD666y6fSZMWekvA6rQTMGynTcUaQGdr

-

5QiXtr1GSJcadW9WoAXn9LtZ4Zx5W9BfSWgPKkN5grkh

-

meowthLT61GwsPZCfdRcNXwSDPp1p6bNRM7PRnYHw3z

-

-

Profit scale: More than US$20 million has been cashed out

3. Transaction information

-

transaction history

-

Transaction address: 6QSc2CxSdkUQSXttkceR9yMuxMf36L75fS8624wJ9tXv

4. Exchange listing strategy analysis

4.1 Online time distribution

January 18

(The announcements made by each exchange are used as the launch timeline (Taiwan time zone))

- Gate.io

Spot online at 10:58:56 on January 18

-

Hyperliquid Perpetual Contract January 18, 13:25

-

Bybit pre-market trading January 18, 14:51

-

BYBIT Spot Online Announcement January 18, 17:24

-

Binance Perpetual Contract January 18, 18:43

-

Gate.io

Perpetual contract goes online at 19:23 on January 18

-

Bitget Perpetual Contract January 18, 20:05

-

Bybit Perpetual Contract January 18, 21:27

-

HTX Perpetual Contract Online Announcement (January 18) January 18, 22:56

January 19

-

Kraken spot will be online at 3:33 on January 19th

-

OKX spot trading January 19th 11:00

-

OKX Perpetual Contract January 19th 11:40

-

Coinbase spot will be online at 11:50 on January 19th

-

Binance spot will be online at 12:05 on January 19th - Online announcement (16:30 on January 19th)

January 20

- Robinhood spot will be online at 13:16 on January 20

4.2 Online features

- Choose from variety:

-

spot trading

-

Perpetual contract

-

Leverage trading

-

Time rhythm:

-

Quickly cover mainstream exchanges

-

Intensive listing of all major exchanges within 48 hours

-

Perpetual contracts will be launched online prior to spot

-

5. Risk analysis

5.1 Token Economic Risks

- concentration risk

-

80% of tokens are controlled by the core team

-

Longer unlocking period (36 months)

-

The average daily unlock volume will be large in the future

-

Liquidity risk

-

Unbalanced initial liquidity allocation

-

Large holding addresses are concentrated

-

5.2 Market operation risk

- Insider trading risk

-

Deploy funds in advance

-

Large buy operation

-

Decentralized profit

-

Price fluctuation risk

-

Short-term exchanges are intensively launched

-

Speculative sentiment is strong

-

Pressure to unlock continues

-

panewslab

panewslab