Is the Bitcoin bull market over? Analysts say indicators are not pointing to market peak

Reprinted from jinse

01/10/2025·1MAuthor: Biraajmaan Tamuly, CoinTelegraph; Compiler: Wu Baht, Golden Finance

BTC’s daily chart has been bearish for three consecutive days, as the largest crypto asset fell to nearly $92,000 on January 9. On January 9, the U.S. Department of Justice (DOJ) approved the sale of 69,000 BTC worth more than $6.5 billion. Spot Bitcoin ETFs experienced the second-highest net outflow, reaching $569.1 million, and overall investor sentiment was further suppressed.

As questions like “Is the Bitcoin bull run over?” begin to pop up on X, one analyst says bullish optimism for BTC should remain intact.

News-induced volatility plagues Bitcoin price

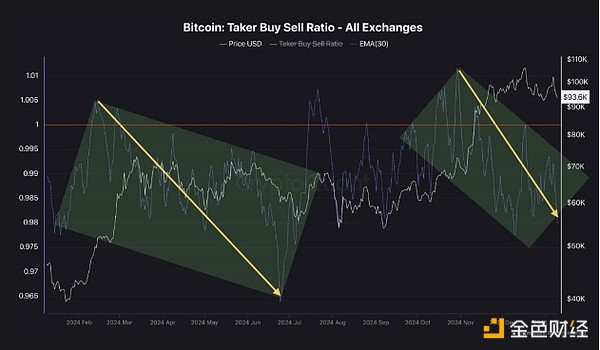

Bitcoin's recent decline has been driven largely by uncertainty over a rate cut by the Federal Reserve and investors taking a cautious approach ahead of President-elect Trump's inauguration. On-chain data clearly highlights this sentiment, as the 30-day moving average of the taker buy/sell ratio indicates seller dominance for the first time since March 2024, when BTC peaked at around $74,000.

Bitcoin taker buy/sell ratio. Source: CryptoQuant

Bitcoin’s Short-term Spending Output Profit Ratio (SOPR) also fell below 1, which means short-term investors are selling at a low price. However, anonymous cryptocurrency analyst Avocado onchain said that these changes are part of BTC’s short-term fluctuations, caused by market speculation rather than changes in market structure. The trader added,

" Investors should remain strategic, avoid reacting to short-term noise, and focus on the broader bullish trajectory,"

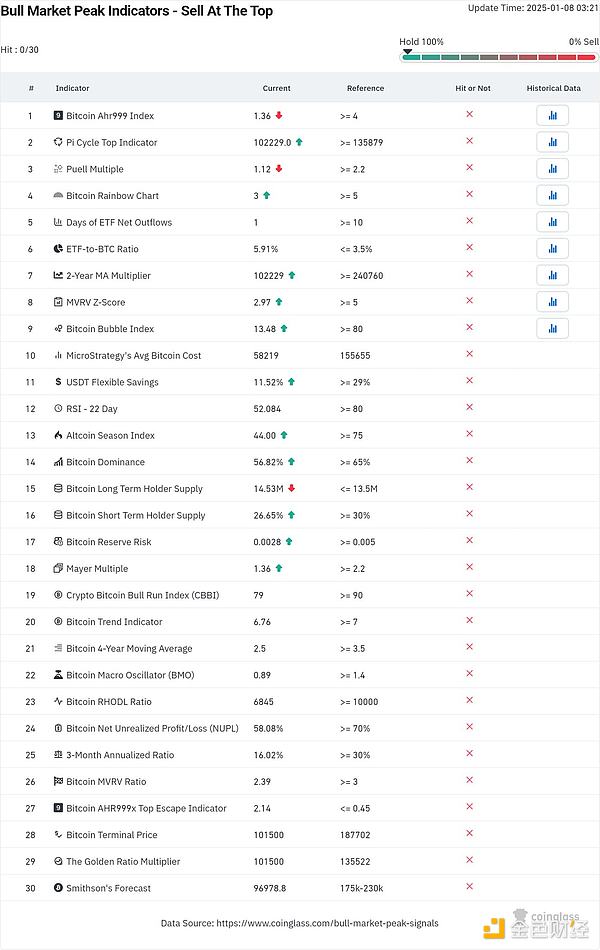

Likewise, cryptocurrency trader Mikybull pointed to a list of key Bitcoin top signals for the current bull cycle. Of the 30 possible market peak indicators, including Puell Multiple, RSI-22 Day, Bitcoin Dominance, and MVRV Ratio, not a single signal has been touched during the current cycle. The trader said,

" Every dip is an opportunity to prepare for a massive rally to come."

List of Bitcoin bull market peak indicators. Source: CoinGlass

Cryptocurrency analyst Alex Kruger also dismissed the long-term bearish dilemma, saying “people are too pessimistic right now.”

The economist explained that while "easy mode" has ended in the future, the liquidity that will be injected into traditional finance in 2025 has not yet been taken into account.

chaincatcher

chaincatcher

panewslab

panewslab