Let’s briefly talk about the “truth” and “lies” in the cryptocurrency narrative in 2025. Which narratives deserve attention?

Reprinted from panewslab

01/11/2025·1MAuthor: Techub Selected Compilation

Written by: Ignas, DeFi Research

Compiled by: Glendon, Techub News

“By 2025, Bitcoin (BTC) will reach $250,000 and Ethereum (ETH) will reach $12,000.”

This is a prediction I just made up that may or may not come true.

In fact, this is true for most predictions. While some predictions are based on some data, VanEck, for example, offers predictions that make sense, while Cathie Wood (CEO of ARK Invest) is known for making bold predictions with eye-popping numbers. She predicts Bitcoin will reach $500,000 by 2026 and $1 million by 2030. As for Michael Saylor, he even predicted that the price of Bitcoin will reach $13 million by 2045.

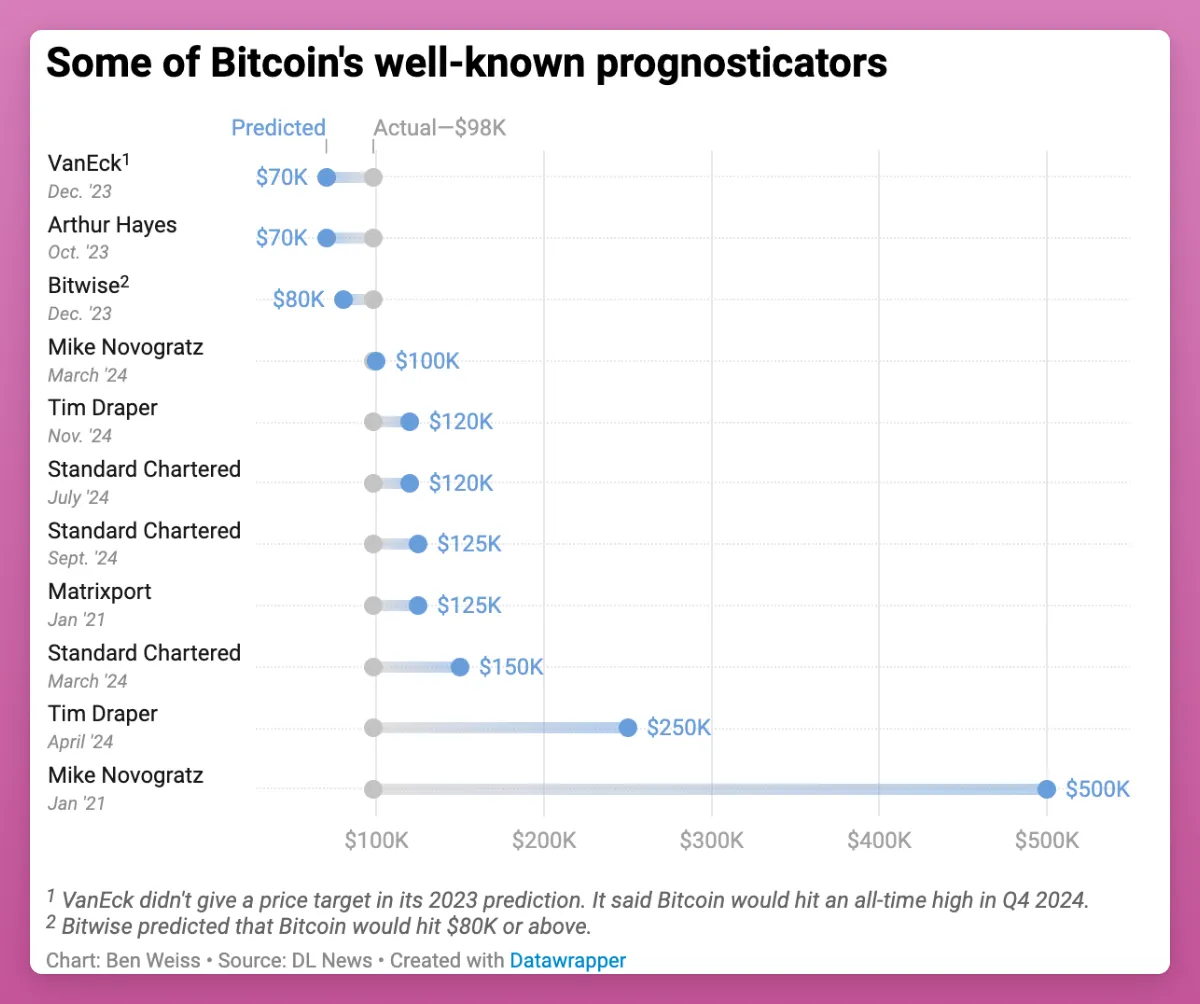

Here’s a summary of DLNews’ 2024 forecasts:

But how helpful can price predictions really be? In fact, apart from strengthening your belief in holding a position and continuing to hold it (HODL), it does not provide you with much actionable insights.

I propose a different thinking framework that may make you a better investor, not only in 2025 but also in the future.

“What important truths few people agree with you?” This is a challenging question posed by Peter Thiel, because it is often easier for us to conform to the status quo than to think for ourselves. .

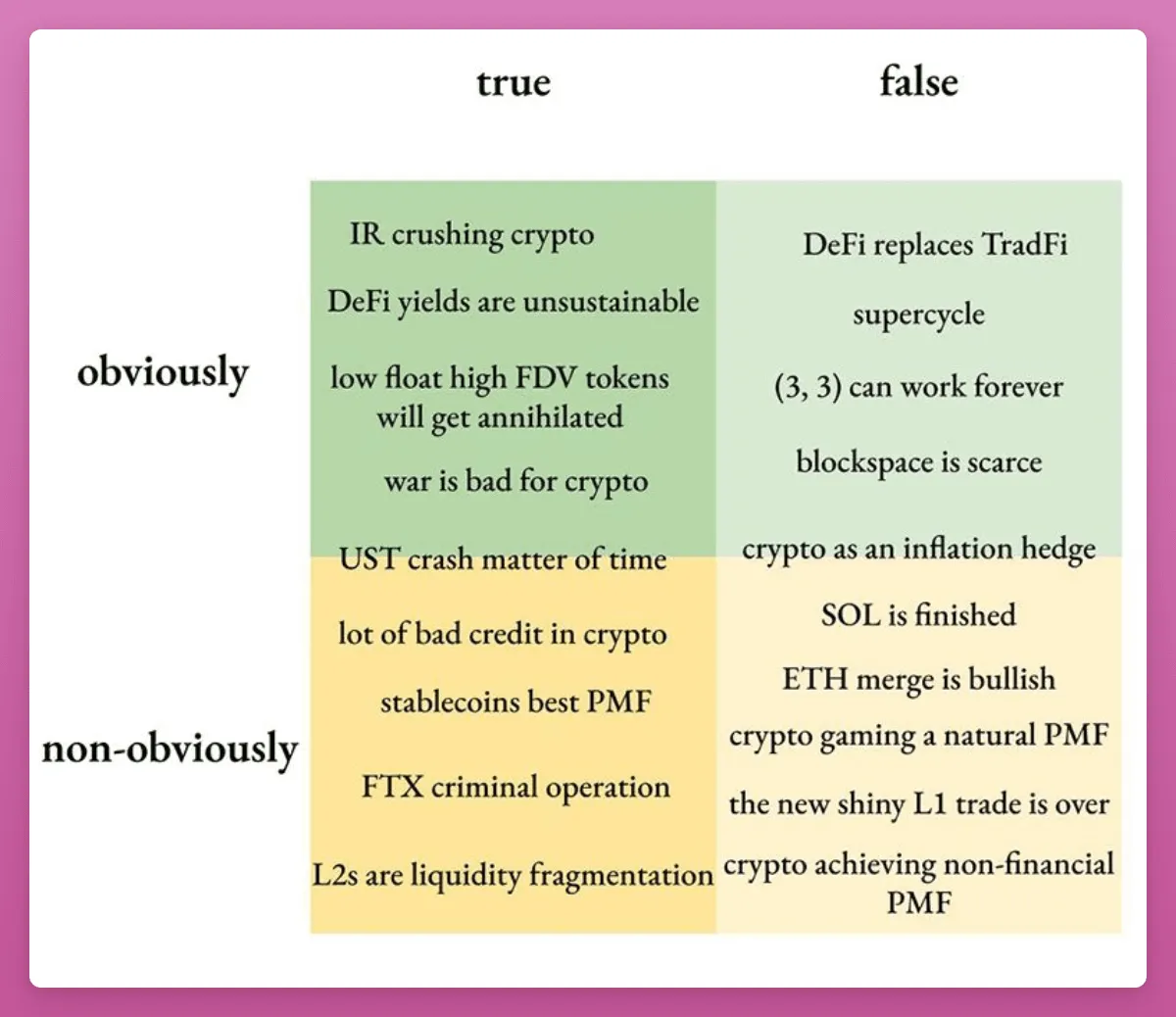

Matti once introduced a framework of questions when evaluating investments in Zee Prime Capital: "If you listen to the current discussion and narrative, what do you think is the obvious truth, what are the obvious lies? And what are the unobvious truths? And unobvious lies?"

In the last cycle, examples of obvious truths include:

-

Higher interest rates are bad for cryptocurrencies

-

War is not good for cryptocurrencies

There are also some obvious lies:

-

Cryptocurrency Super Cycle

-

Bitcoin is an inflation hedge

-

(3,3) Cooperation is sustainable and can exist for a long time

Obvious truth narratives are easy to identify, Matti explains: “The distinction between the obvious and the unobvious can be redefined as popular vs. unpopular, or knowable vs. unknowable based on existing data. Discover the Unobvious Truth narratives require unique insights, while obvious truths are visible at a glance, but still not 100% certain, because nothing is absolute, and the line between them is not necessarily binary, but perhaps more scalar. .

As he puts it, non-obvious truth and lie narratives are harder to identify, but they provide insight into what is to come, especially when these narratives become obvious and the crowds flock to them, FOMO (fear of missing out) start to appear.

And we hope to be at the starting point of FOMO.

Some less obvious truth narratives from the last cycle:

-

It’s only a matter of time before UST collapses

-

FTX is a criminal organization

-

L2s leads to liquidity fragmentation

and non-obvious lying narratives:

-

SOL is dead

-

Gaming is a natural product market fit (PMF) for cryptocurrencies

-

The new L1 transaction has ended

Here are some examples from Matti's blog post:

To outperform the market, you have to find “ideas and narratives that already exist but are little known, or not viewed favorably by many.”

I identify RWA, DeFi options, Soulbound Tokens (SBTs), and Instadapp (INST) as potential counter-narrative trading opportunities. While DeFi options and SBTs have not made much progress, RWA and INST have performed quite well.

The key here is still timing. It took INST a year and a half to post significant gains.

In hindsight, it is easy to identify these truths and lies, but it is difficult to predict the future.

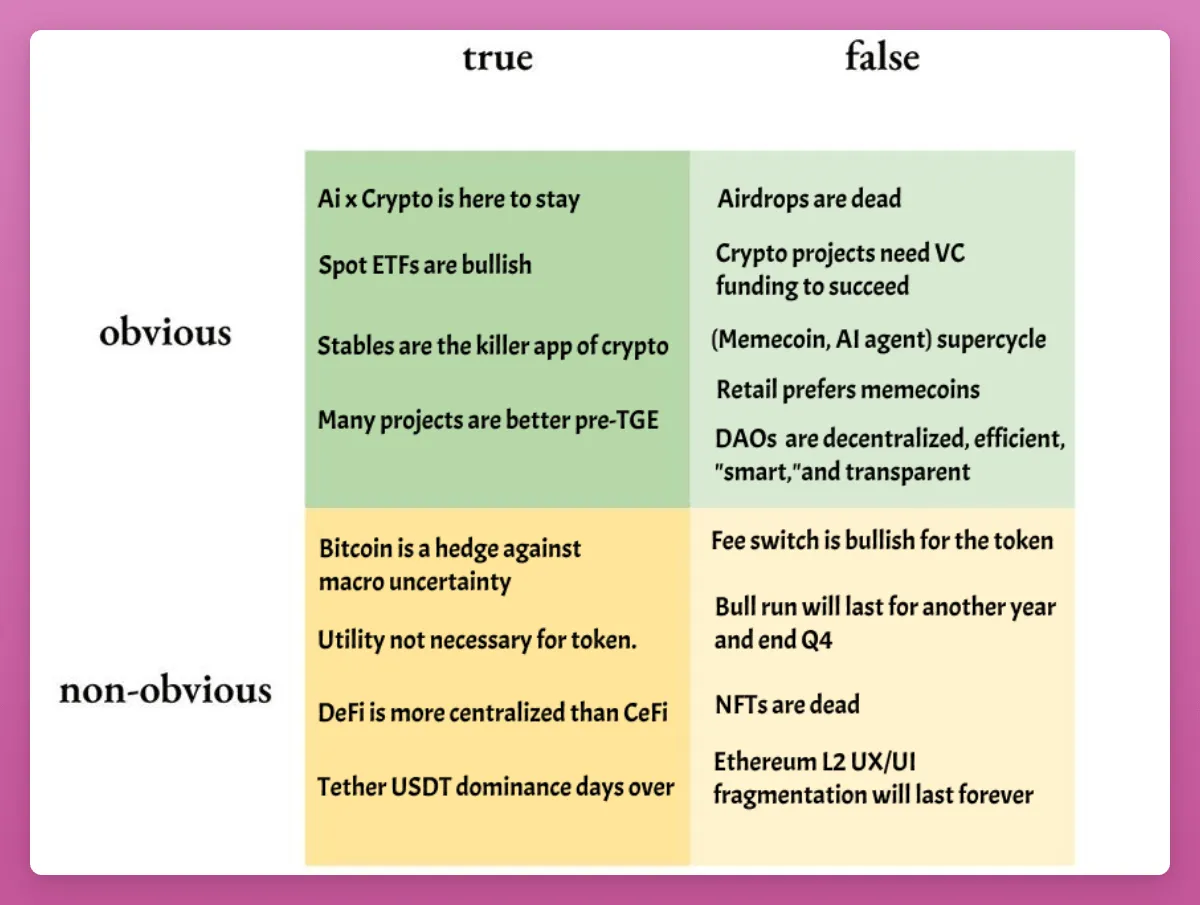

Next, I will share some truths and lies narratives about the current cycle.

First, start with the parts that I think are obvious, and then move on to the challenging non-obvious parts. To gain more insights, I also asked some people in the cryptocurrency industry for their opinions.

Below is a brief framework for 2025.

apparent truth narrative

A fact or result that is widely accepted and based on observable evidence.

AI x Crypto is here to stay

Artificial intelligence has dominated the crypto community (CT) over the past year and may continue into 2025.

Cryptocurrency enthusiasts are eager to acquire AI tokens, but there are not many to choose from, with TAO being the top choice.

But with the proliferation of AI agents, that all changes. We now have a number of crypto-native AI agents that publish content on X or trade on platforms like Polymarket, as well as tools to help launch these AI agents.

Therefore, I believe that AI and Crypto will coexist for a long time. This is an obvious truth.

But this does not mean that AI agent tokens will continue to soar. Current AI agents are simple (for example, AIXBT just scans data and other people's opinions to re-express). And 2025 will be the AI agent super cycle, which is also an obvious lie.

However, bubbles eventually incentivize innovation, and just as DeFi continues to mature after the DeFi bubble bursts, AI agents are here to stay.

Spot ETFs bullish

I'm still surprised that so many people think ETFs are bearish. Some people believe that "BTC in ETFs is part of the packaging of traditional finance (TradFi), and it is also a 'Trojan horse' that will destroy Bitcoin from the inside."

For Ethereum, the ETF may provide stronger bullish momentum than all the ETH locked in L2, as TradFi allocates a portion of its cryptocurrency portfolio to Bitcoin and Ethereum.

The numbers will continue to rise.

Stablecoins are cryptocurrency’s killer app/product-market fit

This is Stacy Muur 's insight carried over from the last cycle.

During this cycle, stablecoins may eventually expand beyond cryptocurrency trading into the fintech space.

PayPal has launched a stablecoin PYUSD, Revolut is launching its own stablecoin, and even Visa may launch a stablecoin, although this may have an impact on its profit margins.

Many projects perform better before TGE

This point was also made by Stacy Muur .

“At this point, my thought is that 90% of protocols have better overall metrics before issuing a token (HYPE and F tokens are exceptions). Therefore, before the token is launched, the product is better than after TGE.” popular'."

DeFi Made Here agrees with this , as he said: "9/10 chains/projects are garbage, have no organic use, and only have false TVL supported by private transactions."

I share this perspective as a reminder that we are in a very niche industry. Just like venture capital (VC), we cannot expect all investments to generate huge returns.

The truth is, most coins don’t survive for long and tend to trend downward. Our mission is to find great tokens that are game-changing.

Obvious Lie Narrative

Airdrops are dead

Low-float, high-FDV (fully diluted valuation) token issuances do huge damage, making it not worth investing in protocols that are inherently good.

But I am still optimistic about airdrops in 2025, because people's expectations have returned to reality and the airdrop craze has become outdated.

It is foreseeable that Hyperliquid may not be the last large-scale airdrop in this cycle. And, now is not the time to stop clicking buttons.

Crypto projects need VC backing to succeed

This is another lesson we learned from low-circulation, high-FDV token offerings. The “moat” of venture capital is shrinking year by year. With the rise of public and private equity platforms like Echo and Legion, projects can now raise funds from a diverse pool of crypto-native investors.

Be aware that many VC firms offer little to no help other than providing funding and putting a company logo on a presentation. Conversely, engaging crypto-native investors will give them a stronger stake in the success of their investments.

Of course, some lesser-known projects will still rely on venture capital funding. But finding “100 times the chance of success” is no longer the exclusive right of VCs.

Bullish.

Memecoin, AI agent and other super cycles

There's a word that should always keep you on your toes: "super cycle."

The Memecoin super cycle was all the rage until ancient coins including some “dead” coins like XRP and Litecoin made a comeback.

AI agents are a hot topic right now. But this narrative will eventually lose its appeal relative to newer narratives that have not yet captured everyone’s attention. Attention will then shift to the new narrative…

Retail investors like Memecoin the most

This perspective comes from CryptoKoryo , who specializes in tracking narrative price performance and rotations. His conclusion is simple: "The rotation always happens after everyone is in." In short, every time someone says "project x, y, z (like SOL, TAO, HYPE, etc.) will dominate this cycle ”, it’s probably a lie.

Plus, retail investors are no longer so stupid now: they can use Phantom wallets and find new narratives on Reddit, TikTok, and everywhere else.

In fact, a less obvious truth is that crypto-native users may end up buying tokens from TikTok rather than the crypto community.

DAO is decentralized, efficient, “intelligent” and transparent

In 2024, I started a new journey: becoming a representative of multiple DAOs, including Aave, Lido, Instadapp, Arbitrum, Paraswap and Uniswap.

The turning point was during the Compound DAO attack, where the attackers managed to pass a vote that distributed $24 million worth of COMP tokens.

The problem is that the DAO is too indifferent and token holders have no idea about the vote. It's really sad.

Talking to Doo from Stablelabs gave me some insights, and his insights confirmed what many people are questioning:

-

DAO is not truly decentralized, efficient, and transparent, nor is it run by “smart money”; (Techub News notes, “smart money” refers to those with foresight and quick response capabilities in the field of financial investment. )

-

DAO funds are limited and may go bankrupt;

-

Most DAOs are usually still led by founders or a core team and are based on interpersonal relationships;

-

DAOs can be protectionist or have protectionist tendencies.

Take Uniswap DAO as an example, it has no idea that Unichain is being developed.

Why is this important? We cannot continue to deceive ourselves and the community; the current DAO model is unsustainable and needs to be completely disrupted. Whoever can fundamentally improve the DAO model will be able to create a new successful business.

Unobvious truth narrative

Insights that are not readily apparent or widely recognized require deeper understanding or unique analysis.

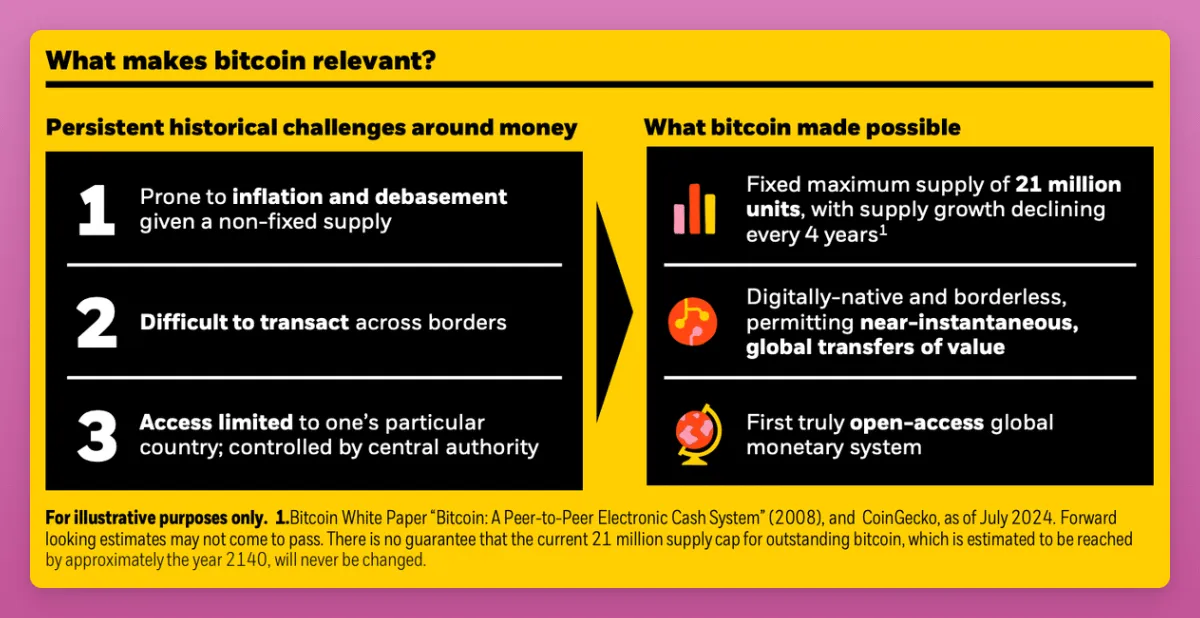

Bitcoin is a hedge against macroeconomic uncertainty

BlackRock’s head of crypto doesn’t endorse crypto commentators/researchers who “firmly believe Bitcoin is a risk asset and trade based on unemployment, non-farm payrolls or ISM manufacturing index data” personnel.

Because Bitcoin cannot be digital gold and a high-risk asset at the same time.

BlackRock claimed in its 2024 study that Bitcoin is a unique diversified asset with the following characteristics:

-

Bitcoin's high volatility makes it a "risk asset." However, most of the risks and potential reward drivers faced by Bitcoin are fundamentally different from traditional "risk assets," making it unfit for most traditional financial frameworks - including the "risk appetite" adopted by some macro commentators ( risk-on) and “risk-off” frameworks;

-

Bitcoin’s status as a scarce, non-sovereign, decentralized global asset has led some investors to view it as a safe-haven option during times of panic or when certain geopolitical turbulent events occur.

-

Over the long term, Bitcoin’s adoption trajectory is likely to be affected by the level of concerns about global monetary stability, geopolitical stability, U.S. fiscal sustainability, and U.S. political stability. This is in contrast to traditional "risk assets" which typically have an inverse relationship with these factors.

Bitcoin sometimes sells off at the start of major macro events. However, chaos, turmoil, and potential currency printing are good for Bitcoin.

The danger is that commentators continue to paint Bitcoin as a high-risk asset, which confuses those in the traditional finance industry who view Bitcoin as digital gold.

Token utility is not required

Almost every cryptocurrency project will issue tokens at some point.

Think about it: Which DeFi protocol cannot function without a token?

Uniswap runs perfectly without UNI, Aave, Maker, Fluid, Ethena... all these protocols can run without tokens.

However, they all have tokens, why? Is it for governance? Community? Or fundraising...

I actually answered this question in a 2022 post.

A few years ago, issuing a token did require some proof of utility, but that is no longer the case.

Memecoins have changed this perception to the greatest extent, and the ARKM token launched by Arkham also played a key role.

If analytics platforms can launch tokens, so can any crypto project: wallets, extensions, marketing agencies…

This trend is continuing with future token offerings from Nansen and Kaito, but 2025 is sure to be even crazier. Anything that attracts attention can be tokenized. Utility isn't important, it's attention, community, and users that matter.

In fact, this is an insight Aylo shared with me, which is that attention and price are related.

My advice to DeFi protocols therefore echoes this: click the button, sign up for any analytical tools that are gaining traction, share your recommendations, and avoid the “why you need a token” discussion.

It requires a token because that makes us (early users and founders) rich.

DeFi is more centralized than CeFi

This is a poignant point made by Defi Made Here.

Centralization here does not mean blockchain decentralization or self-hosting.

As DMH puts it, “Few protocols own the majority of the TVL, few risk providers work on the same project and have a vested interest in each project, etc.”

The following are unedited quotes:

-

JPMorgan Chase's market share in the United States is about 12%, while Aave has a market share of 50%-70%;

-

L2s is an unregulated multi-signature wallet at billions of scale;

-

Tether is a multi-signature wallet with a scale of hundreds of billions;

-

Chainlink controls almost all value in DeFi;

-

Different agreements pay salaries to the same risk assessment team, and there is a clear conflict of interest between them.

Therefore, the view is that business and TVL concentration is higher in DeFi compared to CeFi. As the USDC collapse illustrates, reliance on a few players can be damaging to DeFi.

Having said that, I am still optimistic about DeFi. As the market matures, more players will enter the industry and risks will decrease over time.

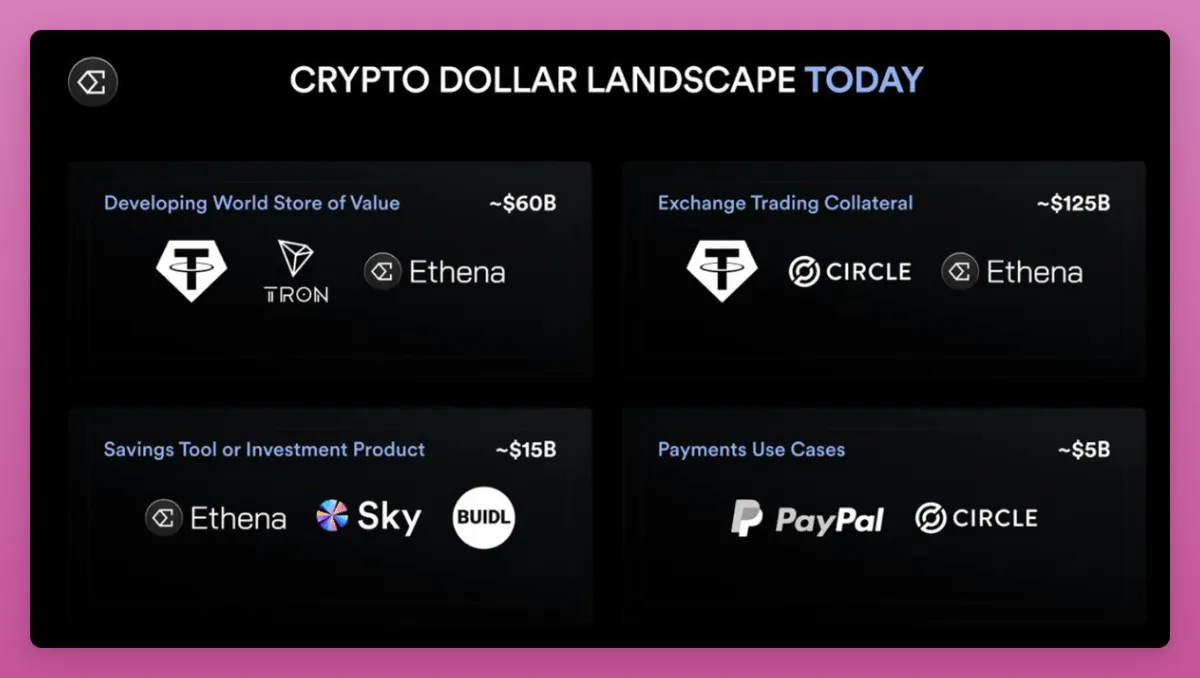

Tether USDT’s dominance is coming to an end

The landscape of the cryptocurrency stablecoin market is changing as new players and use cases emerge, and USDT’s dominance within it is coming to an end. Currently, Tether leads the way in terms of trading and collateral.

However, future trends will focus on two fast-growing areas: savings products and payments.

TradFi is entering the on-chain savings market, while fintech and Web2 incumbents are moving into cryptocurrency payments (Visa will become a major player if it launches a stablecoin).

While these categories are relatively small today, they could drive more than $50 billion in new capital inflows over the next two years (according to Ethena's forecasts). Ethena and Sky are already leaders in the savings space, and sUSDe will also benefit from the integration of traditional finance.

When it comes to payments, the TON ecosystem is leveraging Telegram’s network to build seamless crypto-native solutions.

It can be seen that the battle for stablecoins is shifting from transactions and stores of value (SoV) dominance to innovations in savings and payments, marking the beginning of a new era of cryptocurrency.

On top of that, cryptocurrency regulations like MiCA are driving Tether out of the EU and other markets.

non-obvious lying narrative

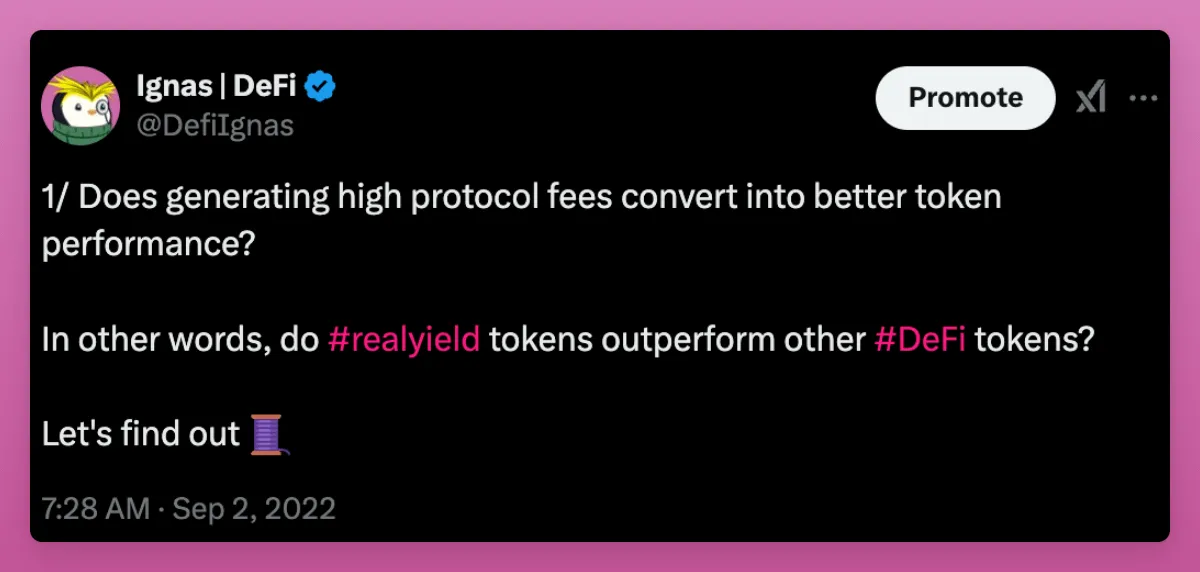

Fee switching is good for token prices

Token fee switching is often the first request from token holders. However, revenue sharing is not a panacea to the coin’s price issues; it is simply one of the bullish narratives for the coin.

Remember the “realyield” narrative from two years ago?

In fact, due to the unusually high revenue/market cap ratio of cryptocurrencies, most protocols do not generate enough revenue to significantly increase the token price.

I don’t think the fee conversion affects the token’s growth; but it sets a floor for the minimum trading price of the token. If the revenue sharing is effective and the revenue is substantial, then at some point the token will become worth buying.

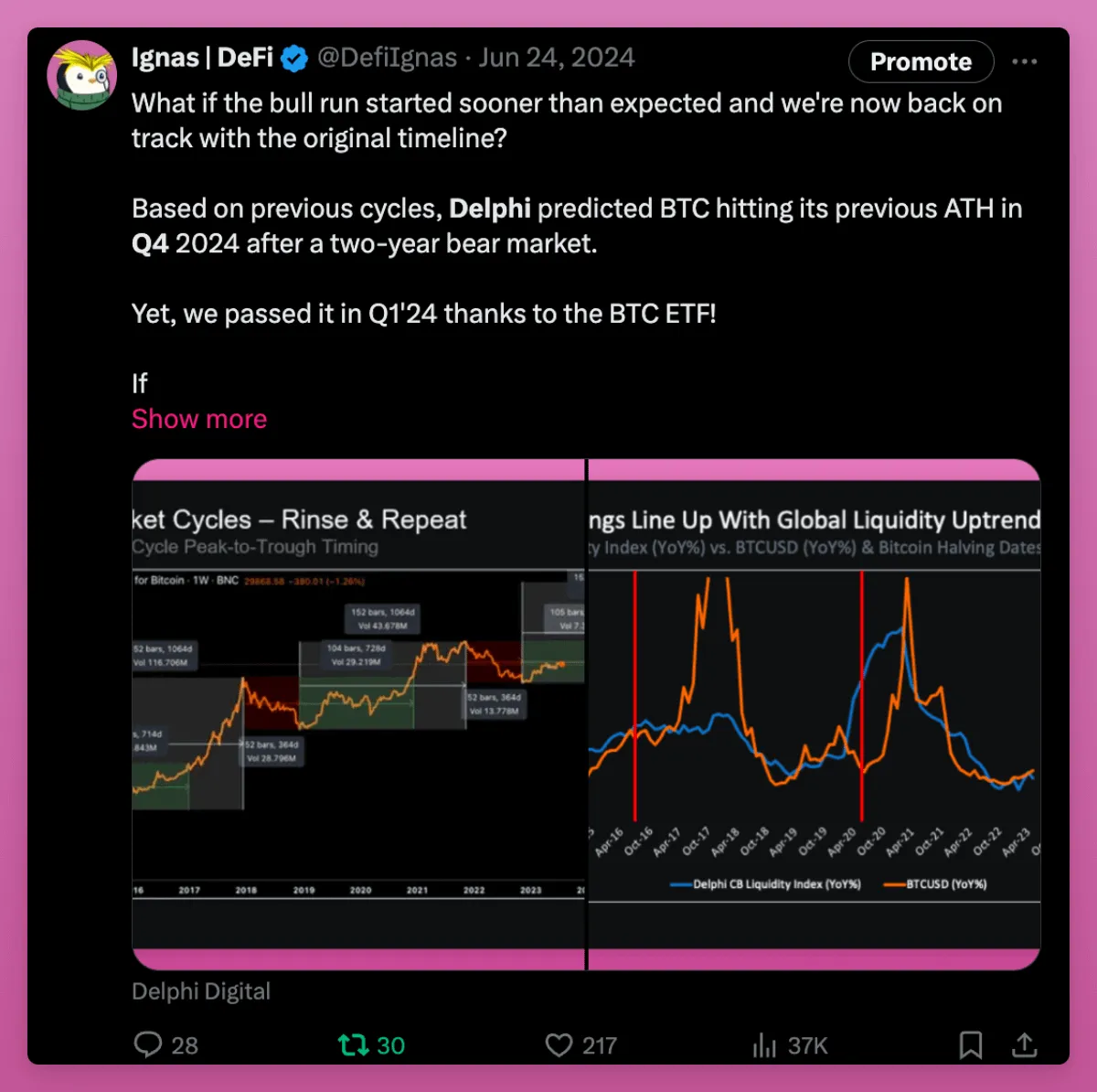

**The bull market will last a year and is expected to end in the fourth

quarter**

I agree with this view. But this one is more of a prediction than a fact/lie.

The reason I mention this is because the crypto community generally believes that 2025 will be the year to sell, most likely early in the fourth quarter.

But can it really be that simple?

Note that in 2023, the general consensus is that Ethereum will outperform Bitcoin in 2024 and Solana will die.

But that's not the case. Therefore, as with most consensus trades, I believe there will be factors that disrupt the bull cycle, possibly delaying or prolonging it.

Ethereum L2 user experience/interface fragmentation will persist

I believe that Ethereum's underperformance is largely due to the fact that its user experience is not as good as Solana's. The problem is obvious.

-

Ethereum is slower and more expensive than Solana

-

The increase in the number of L2 leads to fragmentation of liquidity and user experience

-

Unlike building on unified Solana, developers must choose a specific L2 for their application to succeed

This poor user experience is very obvious if you use Metamask. Fortunately, user experience/interface (UX/UI) is improving day by day.

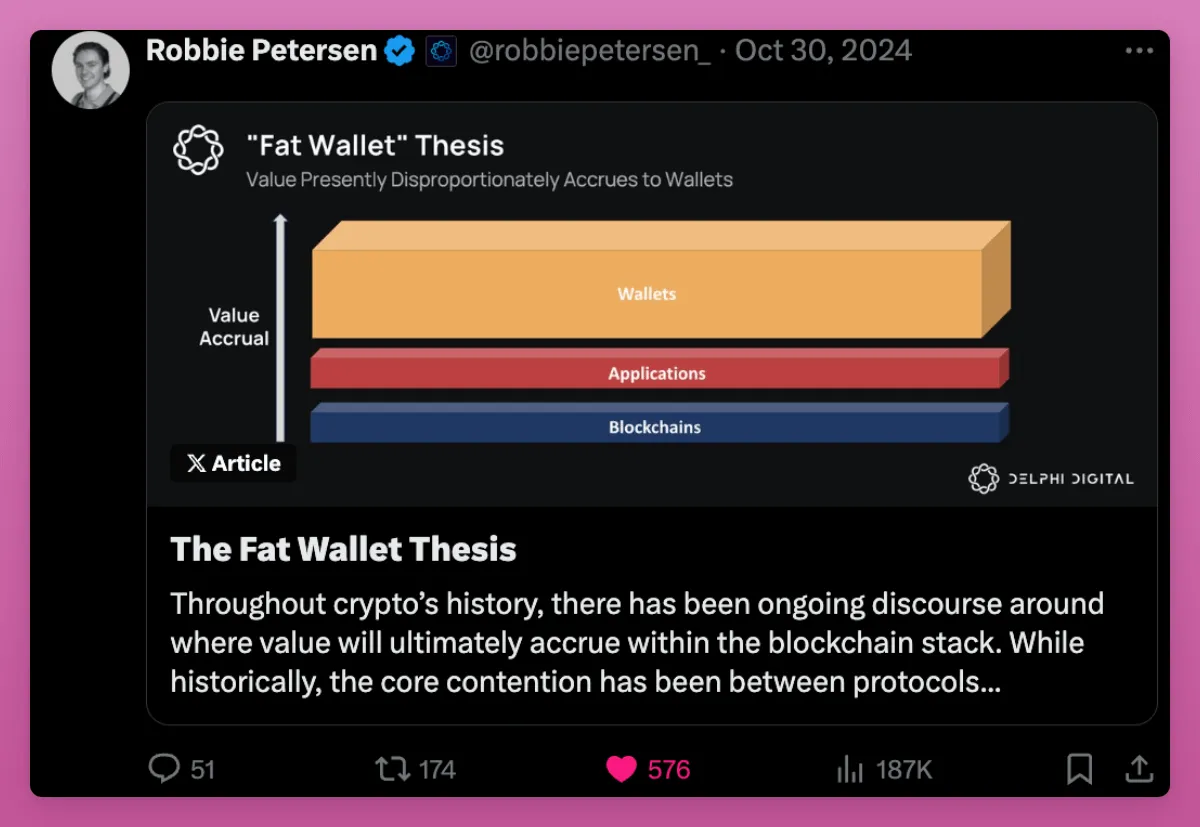

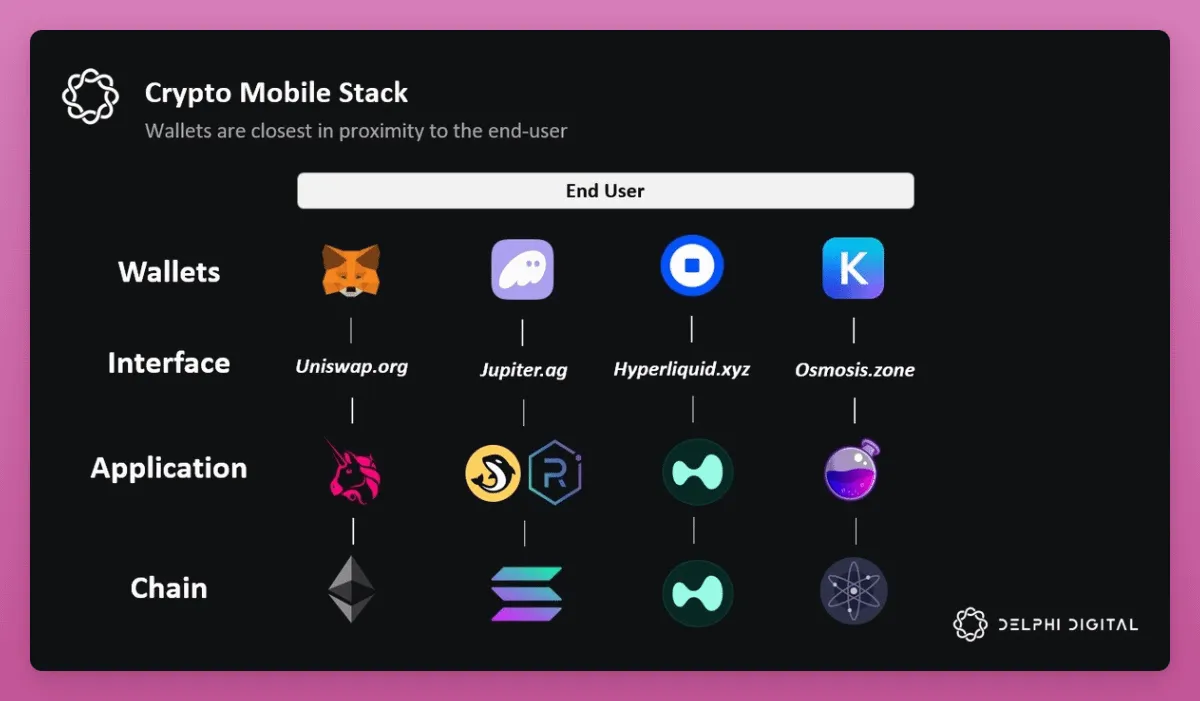

OP Superchain and similar alliances such as Polygon and zkSync are improving the back-end user experience. In addition, if Delphi Digital’s predictions about the “Fat Wallet” theory hold true, the user experience problem may be solved as early as 2025.

The "Fat Wallet" theory solves the user experience problem of Ethereum L2 by positioning the wallet as the key to solving the problem of inefficiency.

As protocols and applications become slimmer, wallets become front-end aggregators and can simplify interactions such as cross-chain and liquidity management through chain abstractions.

By integrating Payments for Order Flow (PFOF) and providing Distribution as a Service (DaaS), wallets can also simplify access to DApps, reduce friction, and improve transaction execution.

In addition, wallets leverage their strong connection with users to create a more intuitive and seamless experience, address high switching costs, and establish a smoother L2 onboarding process, ultimately driving user adoption.

Currently, with the rise of AI agents, user experience is improved as agents can perform all necessary cross-chain operations for humans.

NFTs are dead

This is an interesting point. Some feel it is patently wrong, while others feel it is correct. That's why I put it in the "unobvious lie" category.

Currently, “NFT is dead” seems to be an obvious lie due to the PENGU airdrop and its significant impact on the entire NFT field. But we must be clear that, with a few exceptions, NFTs have been losing money over the past year.

However, I am looking ahead to the next big thing in NFTs.

In my opinion, 2024 is the year when Bitcoin Ordinals and PENGU will rise at the same time. I expect NFT to go beyond avatars and cultural icons.

Perhaps NFTs can continue to evolve in the AI era, providing indisputable evidence that a photo is original and not created or modified by AI.

To be sure, NFTs have a feeling of being stagnant, but that’s not the case.

We need to build something revolutionary.

What do you think are the non-obvious truths and lies?

You may disagree with me, and that's fine! This means you have the opportunity to make money from narratives that are not yet consensus, but will soon be.

Builders need to look beyond the “obvious” to the less obvious truths to build lasting and meaningful projects. Buzzwords and popular narratives (such as “hot topics” in the crypto space) often lead to superficial efforts from builders without real innovation.

Matti gives great advice in his blog post.

For founders:

-

Combine hard work with genuine curiosity and first-principles thinking.

-

Avoid basing projects solely on popular trends or narratives.

For most investors:

-

Evaluate whether the founder’s vision is based on an apparent truth narrative or on a deeper, unique insight.

-

Breakthrough products and companies are more likely to emerge based on less obvious truth narratives.

Taken together, having the ability to distinguish between obvious/non-obvious truths and lies will allow investors to back ideas that have real potential rather than just follow the hype.