Leviathan eroded by capital barnacles: Deconstructing the dilemma of decentralization of Ethereum

Reprinted from jinse

02/06/2025·2MAuthor: Revc, Golden Finance

**1. The Dusk of Idealism: How to VC barnacles empty and decentralize the

foundation**

1.1 L2 colonization: an alienated expansion revolution

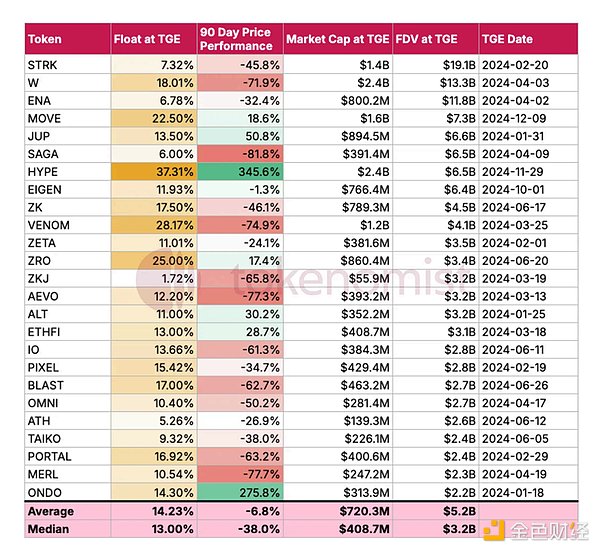

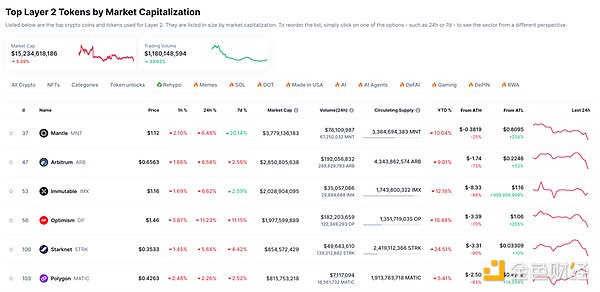

- Data erosion : The current market value of L2 tokens is US$15.2 billion, and the scale of ununlocked tokens reaches US$30 billion. From a liquidity perspective, it is equivalent to forming a 4% hidden inflation pressure on the Ethereum ecosystem. Moreover, the average decline of the related tokens at a high of nearly 50%, and the actual impact may be higher. These L2 tokens generally have nearly 60% tokens to be unlocked, that is, there is at least US$30 billion in funds that need to be taken over by Ethereum ecological investors.

-

The power transfer trap : VC institutions account for 67% of the Optimism Governance Committee, and the veto rate of Arbitrum DAO's early proposals exceeded 80%, revealing that the decentralized governance is in name only.

-

Liquidity siphon effect : The locked position of EigenLayer re-pled agreement exceeded US$18 billion, but 90% of the profit generated went to institutional pledgers.

1.2 Reprivate Prisoner Dilemma

-

Economic model distortion : Lido, EigenLayer and other protocols solidify ETH annualized returns at 3-5%, forcing the project party to design an inflation token model to maintain incentives.

-

Empirical evidence of death spiral : the circulation of a certain head L2 token increased by 300% in the past six months, and the price fell by 72%, forming a vicious cycle of "additional issuance-depreciation-renewal issuance".

-

Pledge oligopoly : The top 10 giant whale addresses control 43% of EigenLayer's voting rights, while the top 10 Bitcoin addresses only account for 5% of the circulation.

**2. Anatomical capital parasitism: From technical utopia to financial

alchemy**

2.1 VC ' s Colonial Trilogy

-

Cognitive Colonization : Through the developer-funded program, 83% of the investment of a top VC has been directed to the infrastructure level.

-

Governance colonization : "gold power politics" in DAO governance, the positive correlation between the Aave community proposal approval rate and the amount of coin held by the proposer reached 0.91.

-

Economic colonization : Establish a "protocol tax" system, with an actual annualized rate of return of a certain DEX agreement of 15%, of which 11% flows to VC-related liquidity providers.

2.2 The alienation of the developer class

-

Technical feudal system : 62% of Ethereum core developers serve VC-funded projects full-time.

-

Innovation attenuation : In 2023, the number of new independent protocols added to the Ethereum ecosystem fell by 37% year-on-year, while the Solana ecosystem grew by 209%.

-

Value split : Gitcoin donation data reveals that only 23% of Ethereum developers agree with the development concept of "application first".

3. Ecological Darwinism: Solana 's counterattack apocalypse

3.1 Evolutionary Advantages of Commercial Genes

-

Demand-oriented mutation : The average life cycle of Solana Ecological MEME coins is 3.2 times that of similar projects in Ethereum.

-

Organizational model innovation : Jupiter adopts the "developer is user" model and allocates 50% of tokens to community test participants.

-

Regulatory adaptability : By cooperating with traditional institutions such as Visa to establish compliance channels, the proportion of illegal transactions handled is only 0.3%.

3.2 Comparison of cultural genes

-

Developer portrait : Ethereum developers account for 68% of economics/cryptography backgrounds, and Solana developers account for 55%.

-

Differences in user behavior : Solana users have an average daily transaction number of 17 times, while Ethereum users have only 2.3 times.

-

Capital efficiency ratio : Under the same market value scale, the handling fee income generated by the Solana ecosystem is 4.7 times that of the Ethereum L2 system.

4. Rebirth equation: From technical giant whales to ecological oceans

4.1 Surgery plan

-

L2 Debauge Plan: Native Rollups or L1 are actually the process of Ethereum’s acquisition of rights. Since the industry still recognizes that Ethereum is the largest decentralized platform, it cannot allow VCs to use their political correctness to continue to build infrastructure unlimitedly, We can try to build a boundary for Ethereum that is supported by the developer community, and then evolve with one boundary, because decentralization also requires an entity to implement its will and enable commercial interests to feed back to the ecosystem.

-

Support Base and hyperliquid: Base has actually become the largest "fairy king" in the Ethereum ecosystem, and is often compared with Solana in terms of AI innovation and capital inflows during the bull market. Although it has not yet been “military grouped” (i.e. issuing tokens), this transformation can happen at any time, but in the Mass Adoption process, Base is expected to attract more users and developers for Ethereum. Base is indeed more capable than other L2s.

-

Reform of the pledge system : introducing dynamic pledge weights based on contribution degree to reduce the voting efficiency coefficient of VC addresses to 1/10 of ordinary users.

-

Economic firewall : L2 requires at least 30% of its revenue to be used to repurchase and destroy ETH to establish a symbiotic economic model.

4.2 Genetic transformation engineering

-

Developer Revitalization Plan : Establish an application layer innovation fund, and at least 50% of the funds flow to independent developers without VC background.

-

Governance of GMOs : Using AI-powered governance oracles, automatically identifying and filtering governance proposals with VC characteristics.

-

Ecological re-wildness : Establish a "dark forest" arena on the test network, allowing only fully decentralized protocols to participate in the liquidity competition.

**5. From concept to reality: Rethinking the significance of Ethereum

decentralization**

-

The breaker of class leap: social class solidification and capital barriers hinder fair competition. Decentralization lowers the threshold, DeFi and DAO allow ordinary people to participate in the market fairly, breaking the traditional rules of wealth flow.

-

Competing against capital monopoly: financial capital monopolizes market rules, decentralization replaces intermediaries with smart contracts, improves transparency, protects individual assets control, and maintains economic vitality.

-

The terminator of Internet oligopolies: technology giants monopolize data, decentralized technology allows users to master data sovereignty, Web3 guarantees the free flow of information, and weakens corporate exploitation of data.

-

Accelerator of innovation and transparency: centralized systems suppress innovation, decentralization improves transparency, and open agreements incentivize innovation.

Conclusion: Leviathan 's Awakening Moment

As Ethereum's block time continues to flow forward, this crypto blue whale is facing a key choice for species evolution: should it continue to slowly sink as the ideal host of VC barnacles, or should it be reborn through painful genetic mutations?

Historical experience shows that truly revolutionary agreements must complete the leap from technical standards to ecological civilization . Perhaps just as humpback whales in the ocean will actively impact the hull and throw barnacles, what Ethereum needs is not a gradual reform, but a complete leap in economic model. This includes increasing constraints on L2, strengthening boundaries and evolving in a more business-oriented way.

When the L2 parasitic token is abandoned by the market, it may witness the rise of Ethereum, which adheres to the decentralization concept.

panewslab

panewslab