Local fanaticism or full recovery? Data analysis Solana chain MEME giant whale trends and market differentiation

Reprinted from panewslab

04/16/2025·5DAuthor: Frank, PANews

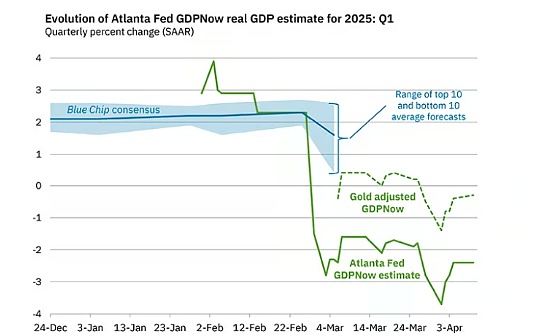

The MEME market seems to be getting hot again. Starting in mid-March, Fartcoin began to bottom out and rebound, rising about 349% in about a month, with an overall market value of nearly $985 million. At the same time, the actions of the on-chain MEME giant whales have also attracted attention. Some giant whales spent millions of US dollars to invest in MEME coins such as Fartcoin and RFC, which triggered a rapid increase in the market value of related tokens.

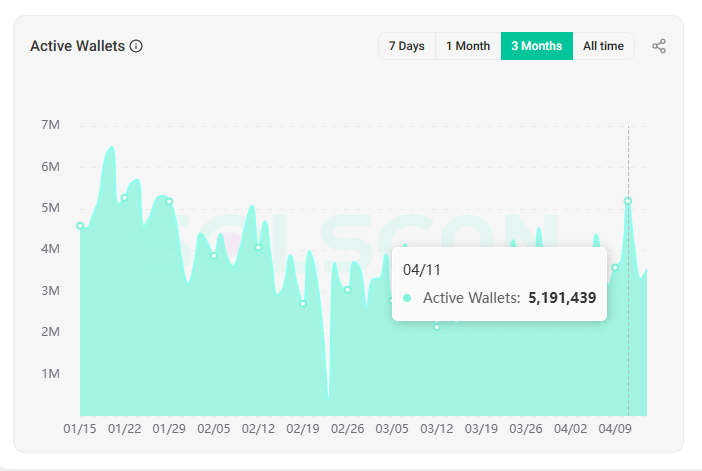

Behind these abnormal movements, on April 11, the number of active addresses on the Solana chain once again exceeded 5.1 million, close to the peak level in January.

This round of MEME market is the return of the MEME bull market or the return of hot money under the boring market? PANews conducted data analysis on several MEME currency major accounts with significant recent gains, hoping to find clues.

Fartcoin analysis: Giant whale enters the market in mid-March, with an

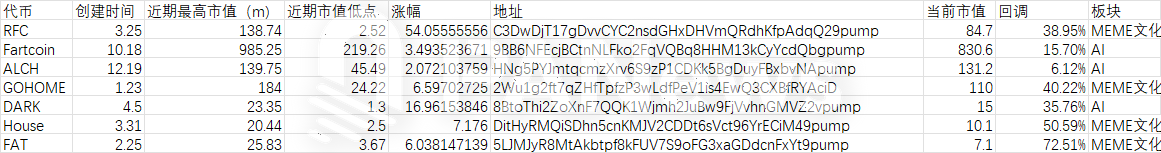

average cost of about US$0.62

First, after observing multiple tokens with higher market capitalization, PANews found that this round of MEME boom is not universal, but is concentrated in several specific tokens. Most MEMEs with market value of over 100 million (such as Trump, BONK, WIF, POPCAT) with previous market value is still in a downward or bottom fluctuation stage. Among the several tokens counted by PANews, except for Fartcoin, the other tokens are either new coins that were born within the past 1 to 2 months, or they are tokens that have been lukewarm after the issuance. The following are several tokens observed by PANews: RFC, Fartcoin, ALCH, GOHOME, DARK, House, FAT.

The token screening rules are tokens with a market value of more than US$10 million and more, and have seen a significant increase or rebound in the market in the past month to three months. Among them, the most popular RFC has increased the most recently, with the largest increase in the past month reaching 54 times.

The leading token for this round is Fartcoin. Since it fell to the bottom on March 10, Fartcoin has begun a new round of upward trend. The market value once reached US$948 million, becoming the leader of MEME again.

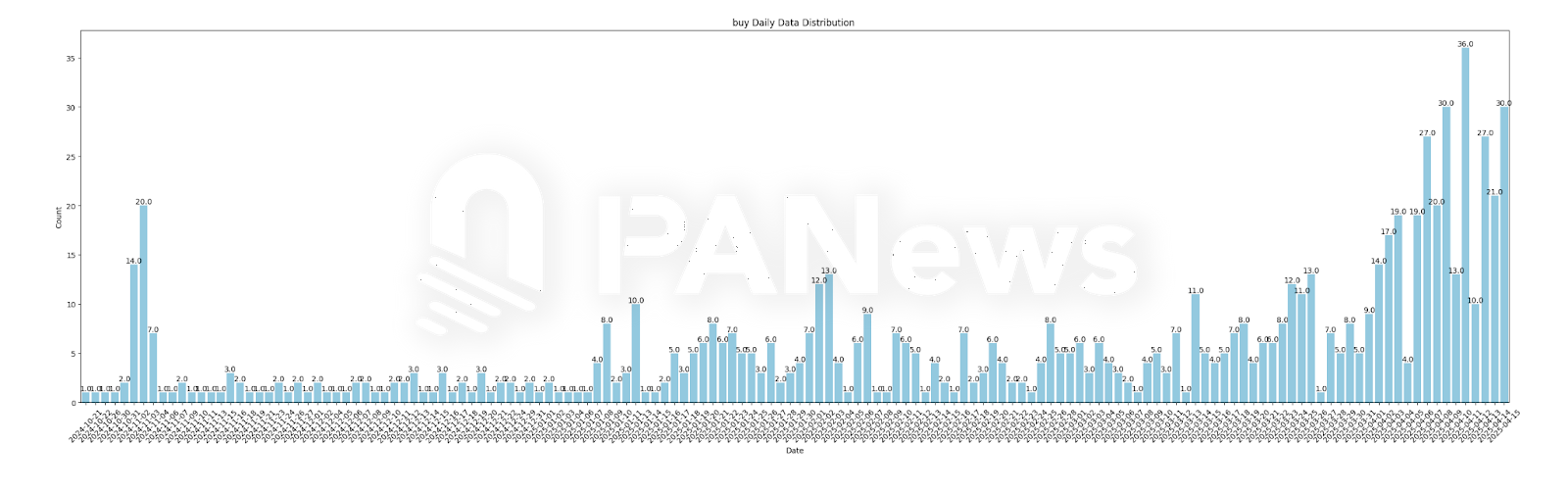

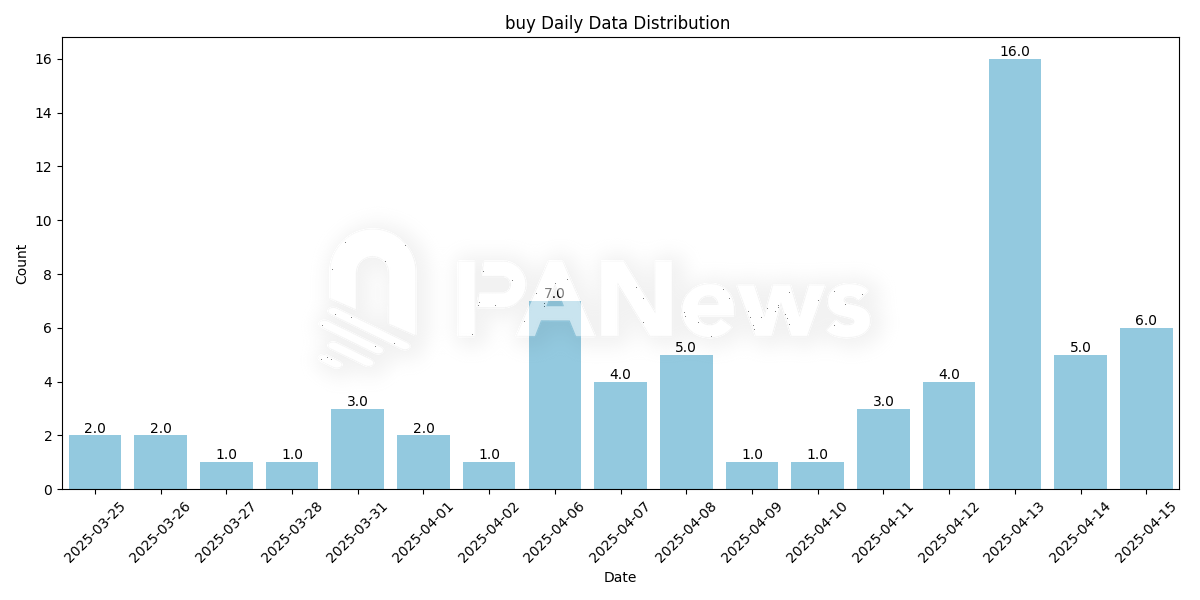

From the analysis of the first purchase time of large players, it can be found

that the collective entry time of large players in this round starts to buy in

mid-March. It continued until April 10, and the entry of large players

continued to rise.

Distribution of entry time for Fartcoin large players

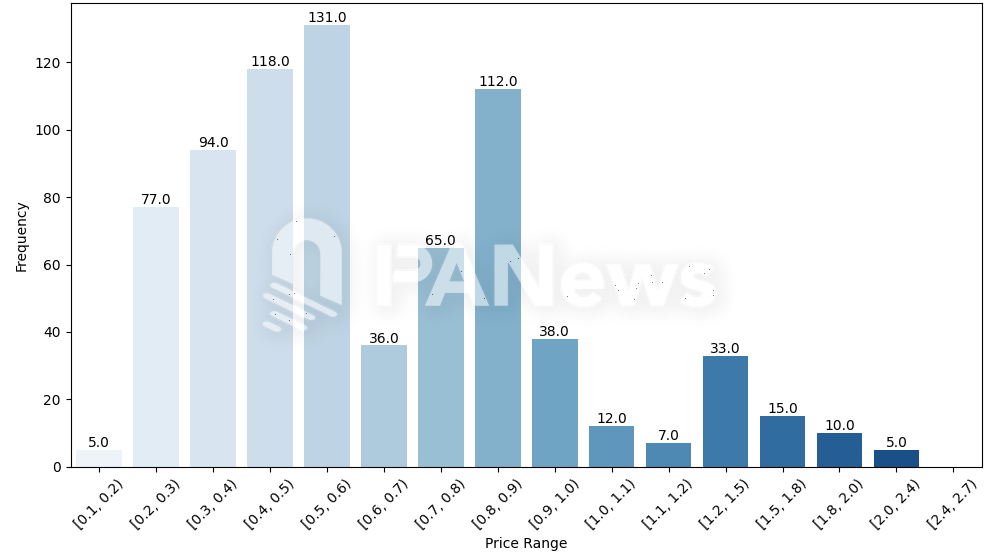

In terms of cost, the first purchase costs of the top 1,000 large players are basically concentrated between US$0.2 and US$0.6 and US$0.6 and US$0.9. According to Fartcoin's chart, the proportion of large players who are still trapped in excess of USD is small. According to comprehensive analysis, the current large holdings basically start entering the market after the price low on March 12.

Distribution of holding costs for large Fartcoin investors

Overall, the cost of Fartcoin's large players' initial purchase position is about US$0.62. Based on the current price of $0.844, these new big players have an average profit margin of about 36%.

23% of the addresses cross-holding, DARK and RFC come out of the

repetitive script

Overall, by comparing the top 1,000 large investors in these tokens, it was found that 23% of the large investors had at least two types of tokens. Among them, the token held by the big investors the most is DARK, which was created the shortest time, but 116 big investors repeatedly held this token.

Secondly, RFC has the most repetitions, reaching 110 times. Fartcoin has received high market attention recently, and its market value is also the highest tokens analyzed, but it only has 76 recurrences. However, according to PANews analysis, the reason for this may be that Fartcoin's market value has risen to a higher level, and many large investors with positions have withdrawn or replaced cars. Since we cannot trace the historical information of major players at a specific time, we cannot draw a clear answer at present.

However, from the analysis of RFC and DARK, these two tokens seem to have relatively similar scripts.

First of all, in terms of the K-line trends of the two, except for the different creation time, other trends, including the pullback patterns, tend to be similar.

In addition, the data held by these two token investors are relatively close, both of which are more than 110. In a more detailed analysis, PANews saw that 75 addresses hold DARK and RFC at the same time, which is the largest number of large investors holding combinations. The second is the combination of Fartcoin and House, with 35 addresses holding these two tokens at the same time.

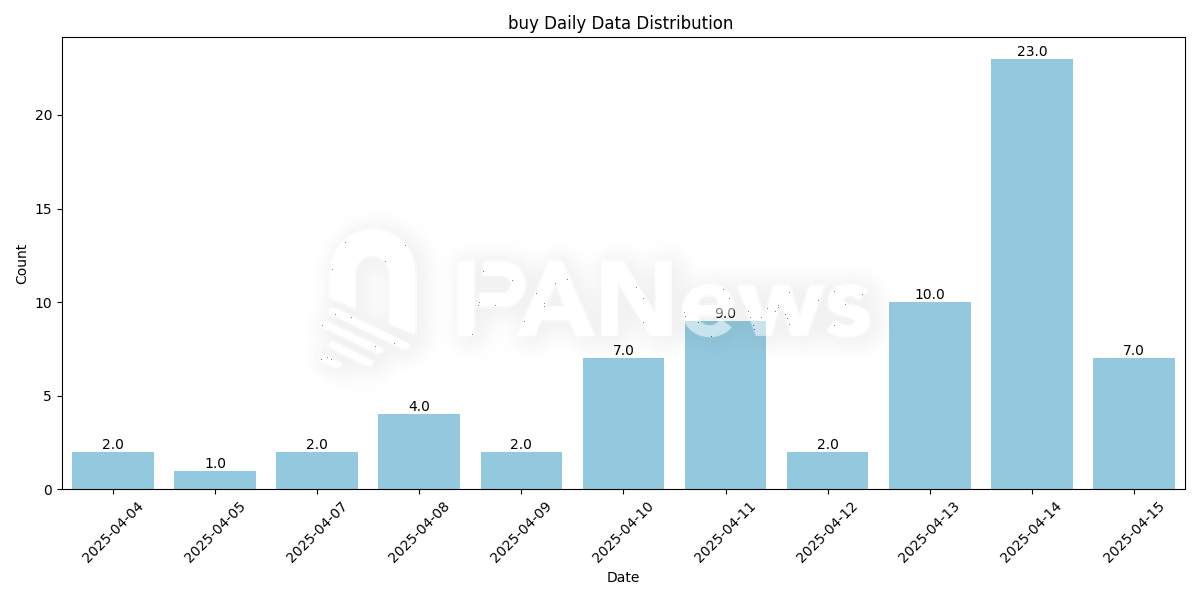

According to further analyzing the buying opportunities of these addresses that hold RFC and DARK, the first time most large-scale addresses buy these two tokens is April 13 and April 14 respectively.

Judging from the K-line trend, April 13 is the date when RFC is rising rapidly, with an increase of 65% on the same day and an amplitude of 107%. On April 14, DARK ushered in a similar market, with an increase of 80% on the same day and an amplitude of 218%. This sharp increase in front and back feet looks like the main force's car change and pull up action.

RFC's main first buy distribution date

DARK's main first buy distribution date

Of course, it should be noted that RFC's market value reaches a maximum of US$138 million, while DARK's maximum market value is only US$23 million. It seems that the big players behind this stock are not the absolute dominant force in the market, or the main force has different expectations for these two tokens. Therefore, it cannot be considered that DARK can replicate the market value scale of RFC.

In addition, token combinations such as Fartcoin, House, DARK, House, etc. appear many times in the holdings of large investors.

"Artificial cows" love MEME culture and AI

In the overall data, the total holdings of these major investors with repeated holdings in these seven tokens is about US$100 million (excluding the holdings of several major exchanges such as Gate, Bitget, and Raydium), accounting for 8.47% of the market value of these tokens.

As of the early morning of April 16, these tokens generally ushered in a certain pullback. Among them, FAT pulled back from its high point by 72.51% month, House pullback reached 50%, and the overall average pullback was 37.12%. Among them, only ALCH has a smaller callback amplitude, and this project is the only AI-related token with practical applications in terms of nature. However, from a cyclical perspective, ALCH may just be in the stage of market rotation and rising, and has not yet entered the selling cycle.

Behind this MEME rotation rise, there seem to be some traces of artificial MEME bull market. KOL@MasonCanoe said on Twitter that the address of the giant whale that has risen in RFC is related to the previous addresses of TRUMP, VIRTUAL, LIBRA and other tokens that have market-making behavior, and at the same time they are associated with several addresses that have been ambushed on the RFC very early. Based on this, @MasonCanoe believes that the push up by RFC is by no means accidental, and may be a signal of the careful layout of the large funds behind it.

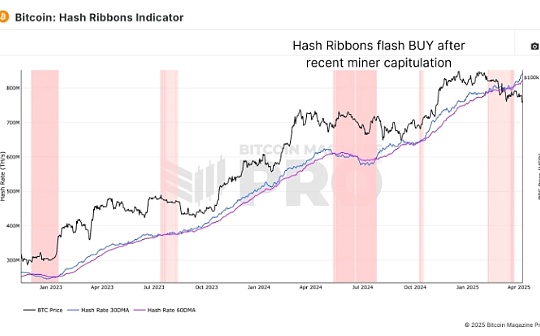

Judging from the performance of the data, the MEME on the Solana chain seems to be starting to attract market attention again under the promotion of some giant whales. However, since this pulling effect cannot benefit all MEME tokens, it can only be judged by tracking the real-time dynamics of these main funds. In addition, judging from the classification of several tokens, tokens with cat, dog, and frog themes seem to have not been able to gain a foothold in the recent rise, and tokens mainly in AI and MEME culture have performed outstandingly.

Overall, the recent MEME boom on Solana’s chain has not blossomed in full swing, but is highly concentrated on a few specific tokens. Fartcoin, as the leader, has attracted a large number of new big players who entered the market after mid-March. What is more noteworthy is that behind the two tokens with highly similar trends, RFC and DARK, there are a large number of overlapping large-scale account addresses, and their main buying time is April 13 and 14, when the two feet have sharply increased, which strongly implies the possible coordinated operation or main rotation behavior. This round of rise does not seem to be a purely spontaneous market behavior, with traces of an "artificial bull market", and whether this "artificial rainfall" can evolve into a natural influx of funds remains to be seen.

jinse

jinse