Messari Analyst: Is it possible for XRP’s market value to surpass ETH?

Reprinted from panewslab

01/18/2025·3MBy Sam Ruskin, Messari Analyst

Compiled by: Luffy, Foresight News

I want to make a few points first:

- I'm definitely not the first person to make this point, but a few days ago, I became convinced that XRP surpassing ETH is entirely possible.

- I don't think either XRP or ETH are reasonably valued at current prices, but I'm not here to discuss how I think they should be valued.

XRP experienced significant gains in the months following the US election. Since then, the price of XRP has increased by more than 460%, and its market value has surpassed BNB, USDT and SOL. On a fully diluted valuation (FDV) basis, XRP is valued at twice that of Solana and about two-thirds that of Ethereum.

Data source: Messari

It’s safe to say that no cryptocurrency has benefited as much from this election as XRP.

Data source: Messari

But I am not here to discuss BNB, SOL or USDT, which have been surpassed by XRP. Ethereum (with the exception of Bitcoin, which I hope will never have to write an article about a similar situation with Bitcoin) is the last one that has yet to be surpassed.

Quantitative analysis of ETH and XRP

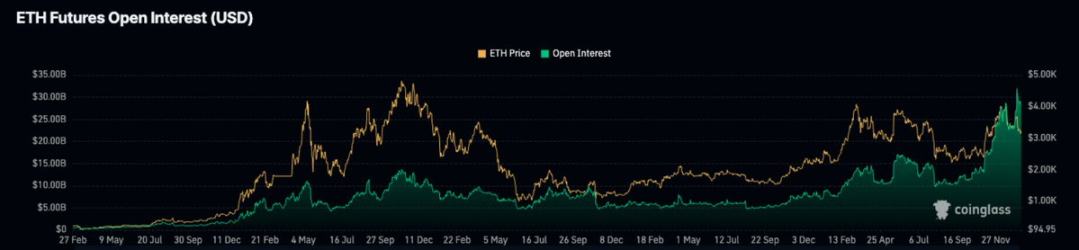

Data source: Coinglass

By all metrics, Ethereum appears to be overvalued. Open interest is at an all-time high, while ETH price is still down 30% from its all-time high of $4,800.

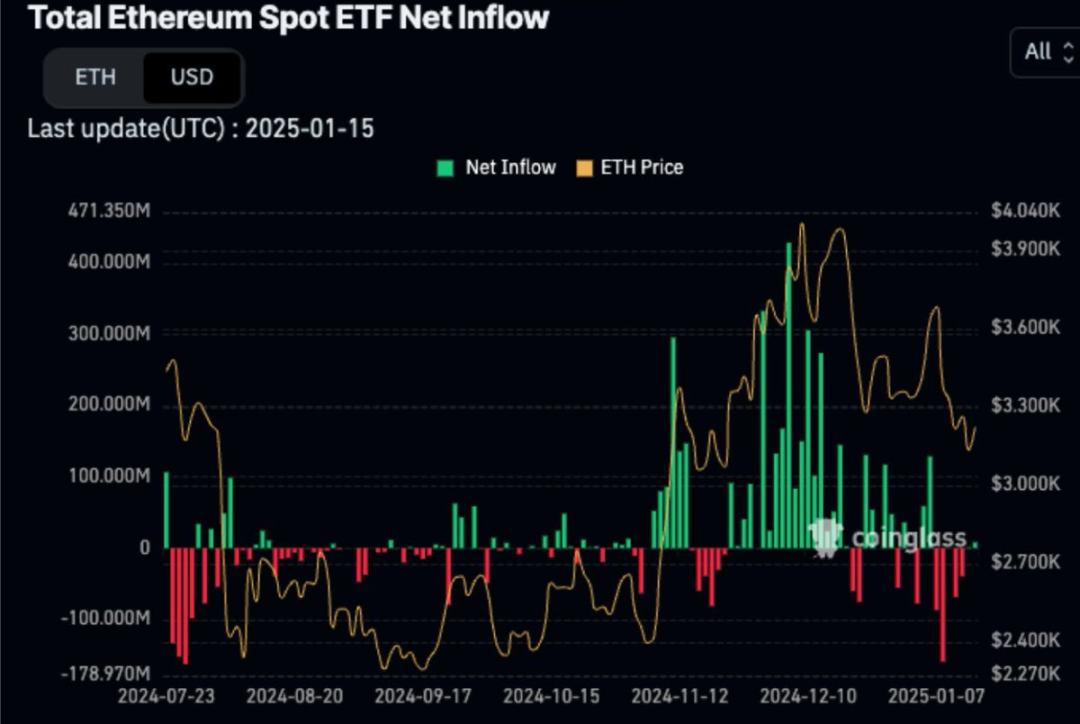

Data source: Coinglass

XRP’s open interest, on the other hand, is much healthier and more correlated with price action.

Due to the complexity of options, open interest in the cryptocurrency market is typically more correlated with crypto-native investors than with regular retail investors. This shows that Ethereum’s on-chain demand is relatively saturated.

Data source: Coinglass

The market value of the Ethereum ETF accounts for 3% of the total market value of Ethereum, while the market value of the Bitcoin ETF accounts for nearly 10% of the total market value of Bitcoin. Retail investors are not as enthusiastic about Ethereum as they are about Bitcoin, so on-chain morale suffers.

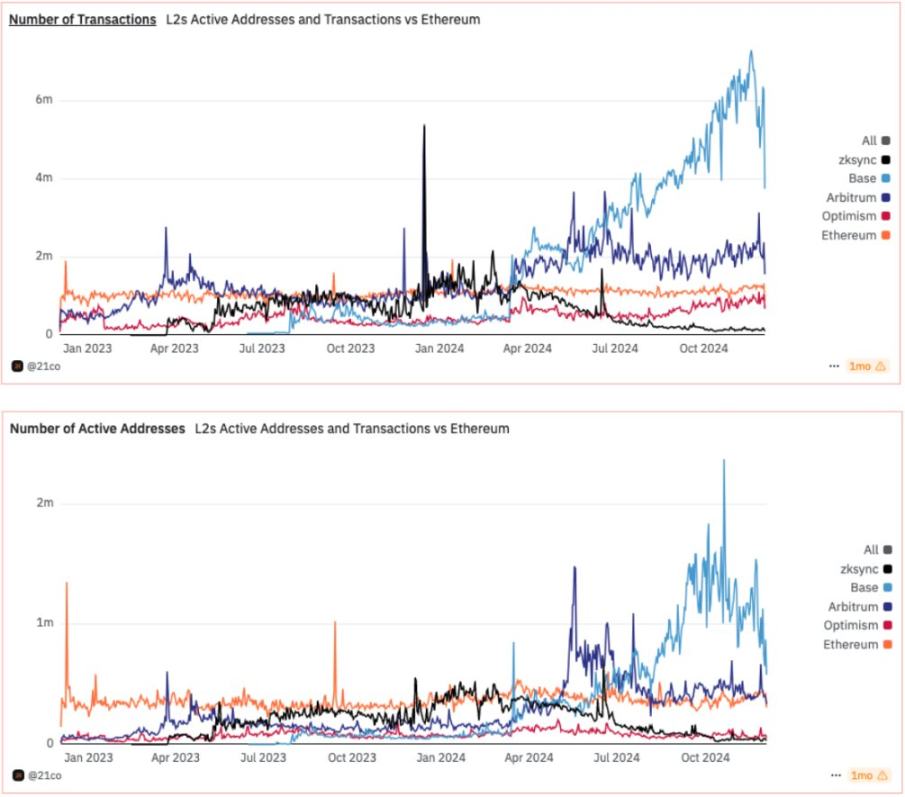

Data source: Artemis

Ethereum L1 has faced many challenges in the past few years, with competitors including Solana, Sui, and even its own L2 solutions such as Base. The Ethereum community remains divided over whether L2 is essentially parasitic or essential to L1's economic growth. Regardless of which perspective is correct, these outflows are a worrying trend for ETH.

Looking at the price action of XRP and Ethereum over the past year, it's hard to find a reason to buy Ethereum. As @mikeykremer said in his thoughtfully written article: “Buy when strength is confirmed and sell when weakness is confirmed.” Market indicators indicate that there is currently more interest in XRP than in ETH.

Over the past 6-12 months, there has been a noticeable decline in sentiment towards ETH on cryptocurrency Twitter. After the failed Blast airdrop, it became clear that the Ethereum ecosystem was oversaturated with L2, and that the Ethereum community's funding and development efforts were misallocated.

Data source: Dune (21co)

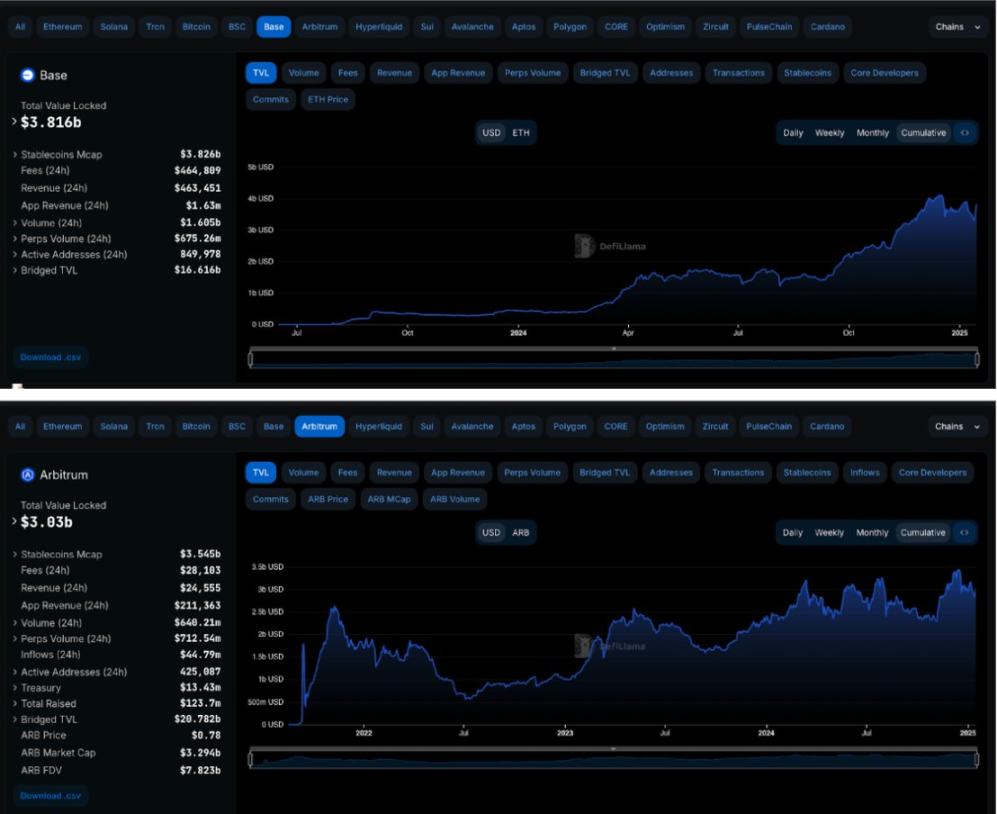

When comparing the number of active addresses and transactions, Base leads by a wide margin, becoming Ethereum’s most popular L2.

When comparing the top two L2s in terms of total locked value (TVL), Base has a TVL of nearly $4 billion after one and a half years, while Arbitrum has a TVL of $3 billion after three and a half years. By almost every metric, Base is the leading L2 on Ethereum.

Qualitative analysis of ETH and XRP

The L2 scaling roadmap (modular blockchain design) aims to be as decentralized as possible by using multiple Rollups and L2 to increase throughput. Overreliance on a single chain goes against Ethereum’s core purpose, but Base is also Ethereum’s last hope for ensuring on-chain activity. This is a negative feedback loop and I currently see no way out (unless Base becomes the sole representative of Ethereum).

XRP, on the other hand, has few similar internal contradictions when it comes to the protocol’s roadmap. Instead, its community is united by its belief that XRP will play a central role in the future of finance. Until this belief is disproven or validated (which could drive XRP prices higher), its core supporters are unlikely to waver.

Additionally, I believe there are four potential factors that could drive XRP prices higher in the coming weeks:

- Trump Inauguration: Trump's Inauguration looks more like a buy event given the bullish momentum generated by recent macro signals. With Trump participating in the crypto party, figures like Garlinghouse may also be in attendance, which could bring more attention to XRP.

- ETF Application: XRP has not yet applied for an ETF. Considering the price spikes of ETH, SOL, and BTC when the ETF application announcement was made, a similar effect may occur if XRP applies for an ETF.

- Capital Gains Tax Policy: Proposed cryptocurrency policies, such as the elimination of capital gains taxes for U.S. companies, could create tax-driven demand for XRP. As a U.S. project, XRP may attract capital reallocation due to potential tax advantages.

- "Senior Investors" Currency Rotation: Currencies such as XRP, HBAR, XLM and ADA saw sharp price increases shortly after Trump was elected. Similar trends may emerge around the time of the inauguration, as this may attract buyers with similar interests and preferences.

risk

Long story short, I’m not trying to encourage XRP bears:

- People are waking up and realizing that XRP is overvalued, it is. Fortunately, the entire cryptocurrency market is overvalued, so XRP doesn’t stand out in this regard.

- Garlinghouse has been less active in the White House than some expected. He did vote for Kamala, but XRP is still considered the "Trump coin," which speaks volumes about how easily investors forget.

- An alternative banking solution replaces XRP, whether it’s a cryptocurrency-based stablecoin or something entirely new.

time window

I look at short-term trading opportunities, probably a month or so after the inauguration. We are seeing a lot of front-running of this price action right now, but I expect XRP to overtake ETH may happen after Trump is inaugurated.

Assuming ETH prices rise more slowly than XRP, I expect XRP to gain another 35-50% from now.

chaincatcher

chaincatcher