Messari: Learn about the DeFAI protocol Orbit in one article

Reprinted from jinse

01/14/2025·24days agoAuthor: Sam Ruskin, Messari Research Analyst; Translation: Golden Finance xiaozou

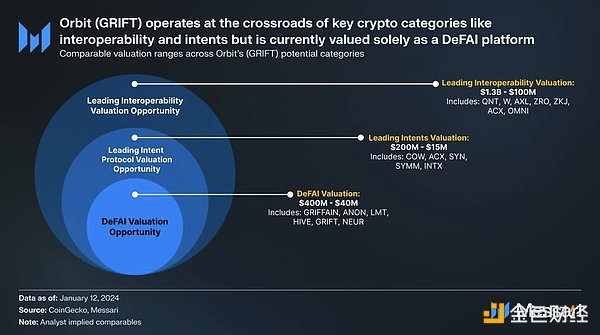

The DeFAI protocol Orbit (GRIFT) connects key cryptographic areas such as interoperability and intent (intent), but is still only regarded as a DeFAI platform. Its agent-solver (agent-solver) network is developed by SphereOne and may become important. Competitive moat.

Currently, Orbit is valued at $70 million, up 63% this week. Orbit meets the needs of the DeFAI, intent, and interoperability fields, but it seems that people only regard it as a DeFAI platform.

Sphere Labs is the design company behind Orbit (GRIFT), which has been on fire recently with the DeFAI trend, but they have been working on developing intended DeFAI infrastructure for over a year.

Intent allows users to conduct transactions without smart contracts, such as swap transactions, staking or managing liquidity, which solvers compete to perform. The intent is to abstract on-chain operations and bridge complexity across chains such as Solana and Ethereum.

Intents can power DeFi in a world of chain abstractions, but there are some risks:

-

Order Flow: Exclusive control over Ethereum’s order flow centralizes power, allowing censorship, rent-seeking, and MEV attacks to take advantage, compromising decentralization and fairness.

-

Trust: Reliance on intermediaries sets a high barrier to entry for new intent architectures, limiting the innovation and competition needed to improve execution quality.

-

Opacity: Intent architecture often requires users to relinquish control of their on-chain assets, and permissioned mempools add a layer of opacity. The risk is to create a system where user expectations are unclear and potential threats to the ecosystem are ignored.

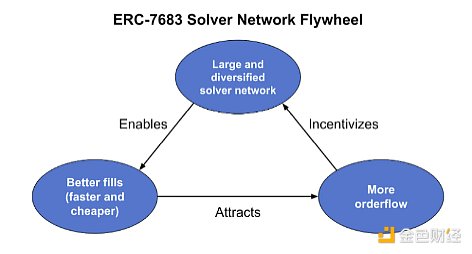

SphereOne came along at the right time: they created a multi-agent solver network that has all the features of a typical solver network, but with much less baggage.

Surrogate solvers typically have the following characteristics:

-Near infinite expansion

-Can be automated seamlessly

-Not inclined to engage in MEV

-Ability to balance token liquidity more optimally and transparently

-More cost-effective and resource-efficient

Intent is probably the most practical use case for DeFAI.

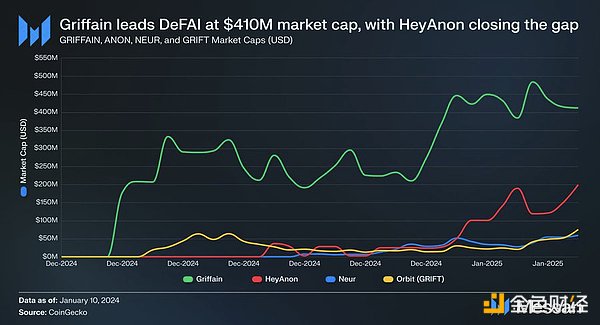

First-mover advantage is crucial to DeFAI. We have seen griffain and Hey Anon maintain their lead over other coins. Apart from basic natural language interface products, DeFAI has little innovation and seems to be ready to face the fate of being subverted.

With major tech/AI companies like OpenAI, Google, and Amazon pursuing their own agent explorations, I don't think any natural language interface/chatbot is a viable moat. Choosing a successful DeFAI protocol requires a deeper dive into specific tools, deep DeFi integration, and developer speed.

Agent solver networks are not without risks, such as:

- Low initial latency and poor reasoning ability.

-Given the opacity of general intentions, a certain level of trust is still required.

-If malicious actors flood the network with false intentions, there are security risks.

These risks (low latency, poor reasoning capabilities, trust requirements, security risks, etc.) are common to most AI projects. So, I hope that some projects that provide solutions for mainstream frameworks will have a trickle- down effect on smaller platforms like Orbit.

Orbit and SphereOne aim to cover the entire intent and transaction stack, integrating cross-role agency frameworks such as CoW DAO, Across, and solver networks (e.g., 1inch, Fractal, Rizzolver).

As more and more agents begin to manage funds and on-chain transactions in a year or two, deeper DeFi integration and more robust on-chain infrastructure will be critical. Orbit is a leader in both aspects, and is almost unbeatable in terms of on-chain infrastructure.

panewslab

panewslab

chaincatcher

chaincatcher