Messari technical director: Don’t be obsessed, the market is always right

Reprinted from panewslab

01/13/2025·28days agoAuthor: Tulip King, Technical Director at Messari

Compiled by: Luffy, Foresight News

Alpha priority:

- Let the market tell you which cryptocurrencies are good and which are not. Buy strong tokens and sell weak ones. You don’t have to be first, just not last.

- Put in the effort. Find cryptocurrencies that are moving against your views and try to understand why.

- Maverick. If you rely on copy trading, the results will not be good.

The market is right and you are wrong

Indeed, it is possible to make the most money when you invest and trade against the market. In an ideal world, we would all be able to buy the bottom and escape the top. However, this is unrealistic. If people can follow the market trend more calmly, enter when the cryptocurrency rises 40% in a day, and sell when it closes down more than 10% for many consecutive days, then a lot of troubles can be avoided.

- Markets are never wrong: Markets are never wrong, only human opinions are. This means that no matter what you think should happen, the movement of the market is ultimately reality.

- Profit verification correctness: Whether it is correct or not is not about predicting market trends, but about whether you can make a profit. Traders who are theoretically correct about market direction may still lose money due to poor execution or poor timing. The true measure of "right" is profitable trades, not correct predictions.

You\'ll notice that Saylor not only buys at highs, but he buys in huge amounts

Rather than trying to predict reversals, successful traders learn to identify and follow strong areas in the market. This means: be willing to buy assets that have risen significantly, cut losses quickly when market sentiment changes, and avoid the temptation to cover losing positions at a high cost.

The most successful traders focus not on being right but on managing risk effectively. When there is a profit, be safe in your pocket, do not hold on to a sharp retracement, and be willing to re-enter after leaving the market.

Price action is the only truth in the market. When your position moves against you, the market is sending a signal that your view may be wrong. The prudent approach is to accept small losses rather than allowing them to turn into large losses.

When there is a major correction in your position, you need to step away temporarily and ask yourself why. Is this a trend across the broader market? Has the narrative focus shifted to other cryptocurrencies? What am I missing? Most importantly, you should ask yourself: Do I need to ride out this decline? When the market doesn't agree with your opinion, question your own opinion. Stay humble and adapt to changing circumstances.

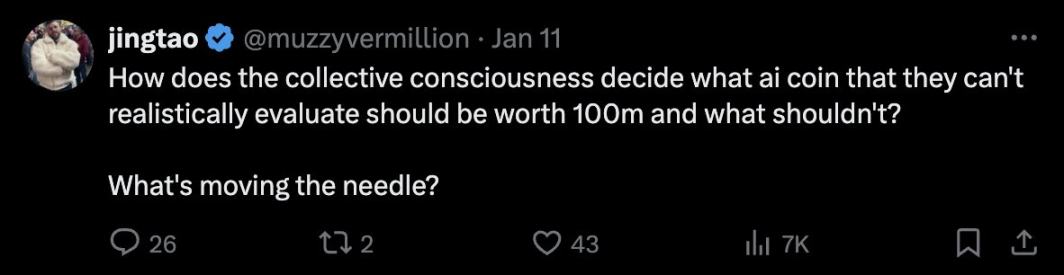

Market Signals: Aiccelerate Case Study

The current market reaction to AICC teaches us a lesson in market psychology. The key lesson is this: If you disagree with the market's interpretation of AICC, you face two possibilities, both of which require immediate attention:

- The market is right and you are wrong.

- The market sells off for other reasons you haven’t discovered yet.

In either case, bucking the trend can be dangerous. If you can't explain why prices are falling, you're unlikely to be able to tell when prices will stop falling. This is exactly what Buffett meant when he said, "You only know who is swimming naked when the tide goes out." If you don't understand the market trend, you will face invisible risks.

Be less obsessed

In the ever-changing world of cryptocurrencies, the only asset that can truly be bought and held for a long time is Bitcoin. This is not an extremist position, but rather a recognition of Bitcoin’s unique status as digital gold, underpinned by unparalleled network effects, true decentralization, and institutional adoption. As with every other asset in our world of digital assets, active management is not only recommended but necessary for survival.

Although ai16z has attracted a lot of attention, the market has been prompting you to move into the DeFAI space for a few weeks.

The cryptocurrency market requires a unique mindset: one must be both well-informed and adaptable. Successful traders must maintain what Andy Grove calls "professional paranoia", that is, a state of constant vigilance, questioning every position, challenging every opinion, and treating every profit as a Maybe it's just temporary. This is not to be pessimistic, but to be realistic in a market where narratives change as quickly as posting messages on Discord.

The most dangerous pitfall in cryptocurrency is not leverage or poor entry timing, but developing an emotional dependence on holding a position. We’ve all seen it: traders turn into Hodlers after losing money on a position, investors double down on an idea because they’ve built their identity around it when it fails, community members turn into market denialists Change extremists. This bias towards holding positions has destroyed more funds than any smart contract vulnerability.

Success in this market requires being online at all times, constantly processing information from multiple channels. But more importantly, it requires the emotional intelligence to process this information objectively, free from preexisting biases. Your belief should be strong enough to enter the position, but flexible enough to be able to exit the position when circumstances change. Think of yourself as a surfer reading the waves rather than a captain trying to master the ocean.

The best traders look to the market for guidance and admit when they need to update their trading framework

The most successful cryptocurrency traders I have observed share this trait: they hold firm views but wear them like loose clothing, and are ready to abandon those views when the market presents a different picture. They understand that in cryptocurrency, being right is not about maintaining unwavering belief, but about maintaining consistent focus and resilience.

Remember, every position other than Bitcoin requires active management, ongoing verification, and the humility to acknowledge this fact when circumstances change. In such dynamic markets, beliefs should be viewed as hypotheses to be tested rather than positions to be held.

independent power

In the echo chamber that is cryptocurrency Twitter, where every price move spawns a thousand conflicting narratives, the ability to think on your feet has become a rare and valuable skill. It’s easy to mistake information acquisition for analysis, and to confuse following opinion leaders with developing your own insights. But at the end of each trading day, your name is written on the Profit and Loss (PnL) report.

The market doesn’t care which influential accounts you follow or which so-called alphas you join. It responds only to supply and demand, fear and greed, and the collective behavior of actors acting on their own beliefs. This is why copy trading without understanding the logic behind it is so dangerous: you never know when to get out, when to add to a position, or most importantly, when the original view has become invalid.

Writing is the most powerful tool for developing real market insights. The act of writing promotes clear thinking. When you try to present your market views in writing, holes in your logic become apparent. Those vague concepts that seem convincing in your mind have to withstand harsh scrutiny when they must be articulated. That's why the most successful traders and investors, from George Soros to Howard Marks, are often prolific authors.

Consider how Messari has become an incubator for some of the sharpest minds in cryptocurrency. The habit of regular research and writing not only records ideas but also refines them. Every article, every thread, and every market analysis forces the author to stress-test his or her ideas, to go beyond the surface and delve deeper into the inner workings of market movements.

The path to market success is not about finding the right people to follow, but about forming your own opinion. Start writing, even if it’s just for yourself. Document your trades, explain your opinions, analyze your mistakes, openly question your assumptions, and participate in discussions. Be comfortable changing your mind when new information comes to light. The goal is not to be always right, but to think clearly and independently.

"Don't follow what others say, value your own opinion. Cultivate it, value it." - Rick Rubin

Remember, in a marketplace driven by narratives, those who can independently construct and analyze narratives have a significant advantage. Your writing doesn't need to be beautiful or popular, it needs to be honest and analytical. This is how partially formed market intuitions evolve into actionable trading ideas, and how market participants grow into market leaders.

chaincatcher

chaincatcher