Messari: What’s the right valuation for Symmio?

Reprinted from jinse

01/08/2025·1MKinji Steimetz, Messari Corporate Research Analyst; Translation: Golden Finance xiaozou

This article is a summary of the key points of my recently released Messari research report on Symmio.

Symmio recently issued the SYMM token through TGE, which currently has an FDV of approximately $30 million.

In our opinion, the market has misunderstood Symmio and viewed it as “another on-chain sustainability protocol.” In fact, Symmio introduces a new DeFi primitive for on-chain bilateral counterparty protocols—a unique design that enables perpetual trading on universal L1.

Let’s take a closer look:

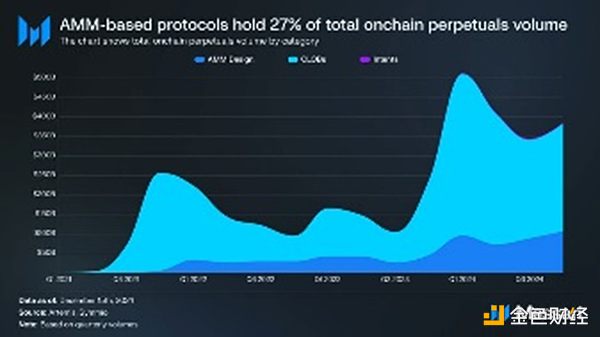

Funds are constantly flowing into the order books and AMM (automated market maker) based perpetual contract exchanges on L1 and L2. However, we believe that due to technical limitations, these models are inherently unfeasible and unlikely to be long-term winners .

The on-chain order book on general L1 faces the following problems:

-

Gas cost issue : The high fees required to set up/cancel orders harm the profitability of MM (market makers), causing the price spread for users to widen.

-

Order cancellation priority issue : General L1 cannot give priority to MM’s order cancellation, increasing the risk of adverse selection.

These restrictions increase the cost and risk of MM, and ultimately harm the interests of users.

AMM restrictions:

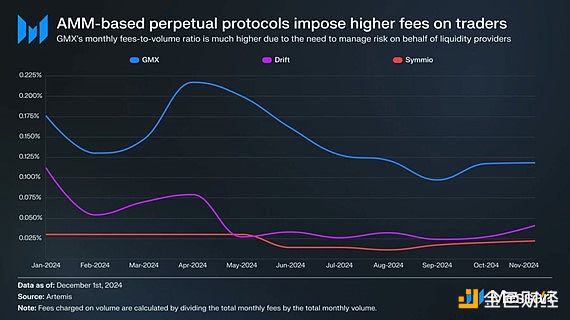

Due to its reliance on passive liquidity, perpetual trading based on AMM is difficult to achieve sustainability. Liquidity pools act as counterparties, requiring long and short positions to be balanced to avoid market risk. Once there is an imbalance, such as being overly long, the capital pool will face losses if the price moves in the opposite direction.

In order to rebalance and manage the risk of LPs (liquidity providers), the protocol adjusts fees or funding rates. This means that the protocol must charge traders higher fees to prevent further imbalances and incentivize counter-trading to gradually restore balance.

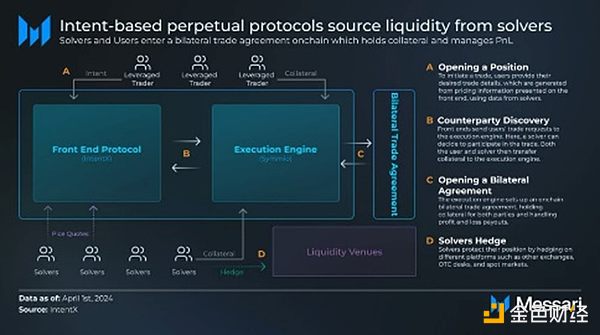

The ideal solution requires market makers to manage risk while giving them priority to cancel trades and minimizing costs. This can be achieved by creating an application-specific chain, such as Hyperliquid, which prioritizes market makers, or by using an intent-based system, such as Symmio. Symmio relies on solvers (primarily market makers) as user counterparties, thereby eliminating the protocol’s need for passive LP risk management, as well as the need for gas payments when creating and canceling limit orders.

Other benefits:

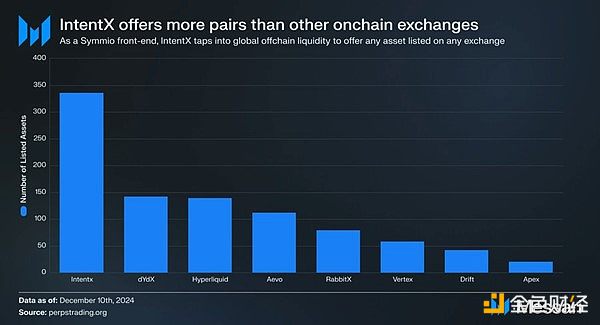

Symmio offers a host of additional benefits through its intent-based system, including deeper liquidity, stable funding rates, and access to more assets. By aggregating liquidity from on-chain and off-chain markets, it supports 336 trading pairs, compared to 142 on dYdX and 139 on Hyperliquid.

A new primitive:

We believe that the protocol is unfairly categorized as merely a perpetual exchange, which ignores its potential as a groundbreaking new DeFi primitive. The broader impact of the protocol is its ability to create a market for decentralized OTC trading, enabling a true peer-to-peer ecosystem that goes well beyond perpetual trading.

For the first time, DeFi has a platform dedicated to experimenting with peer-to-peer counterparty discovery . Symmio opens the door to entirely new DeFi use cases by providing an infrastructure that simplifies the creation of decentralized protocols.

But is this really a new product that has never been seen before ? So what about protocols like CoW Swap or Across that also pair users with solvers?

Symmio takes a different approach: instead of optimizing transaction paths, it facilitates bilateral agreements with isolated risks.

This unlocks use cases that were previously unfeasible, such as decentralized OTC markets, synthetic assets, and custom protocols. This differs from other intent platforms that lack counterparty agreements and focus solely on competition for transaction routes.

Symmio has the potential to surpass existing AMM-based perpetual exchanges and increase the on-chain perpetual market share to around 5%. Additionally, it can serve as a platform for new use cases, such as providing leverage for any meme coin, or facilitating trading of synthetic assets with deep liquidity. If this potential materializes, it will bring a 10x growth opportunity and Symmio's FDV will grow to approximately $800 million.

panewslab

panewslab

chaincatcher

chaincatcher