New Hong Kong Investment Immigration Rules: Cryptocurrencies can be used as proof of assets, but practice is not smooth

Reprinted from panewslab

02/10/2025·13D

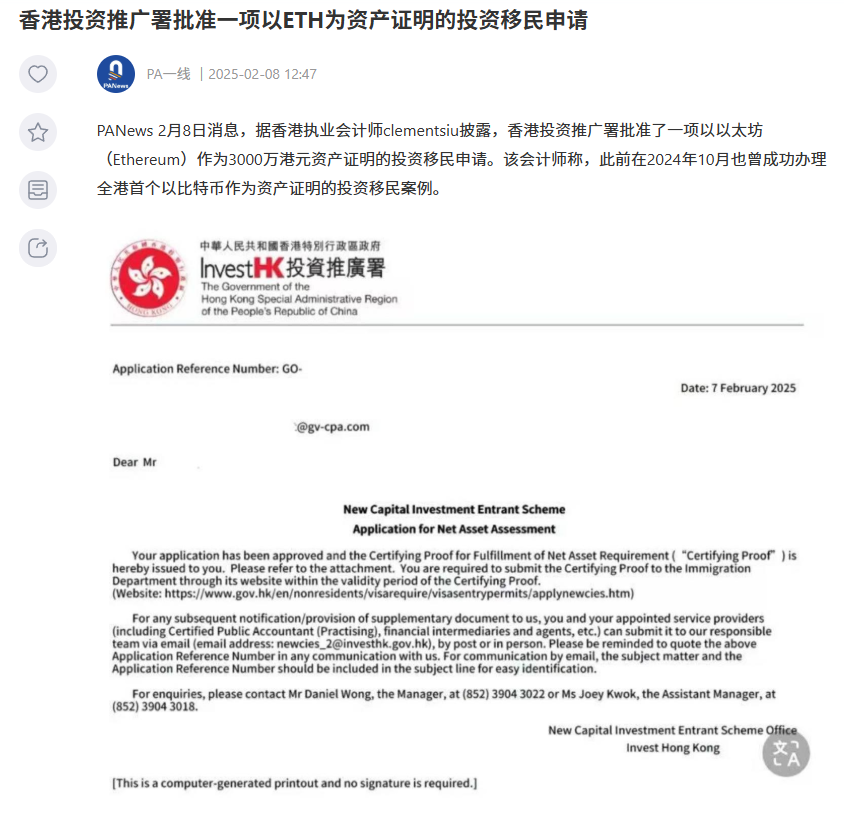

Recently, the Hong Kong Investment and Promotion Agency approved a "new thing": someone successfully applied for investment immigration with HK$30 million Ethereum (ETH) as asset proof. This is not the first time. There were cases of using Bitcoin to "clear clearance" in October last year. It sounds like cryptocurrency players have found a "shortcut", but in actual operation, many big coin holders are stuck in a key link - proof of funding source (SOF). Today we will talk about what happened.

1. Why can cryptocurrencies be used as "asset proof"?

According to Hong Kong's "New Capital Investor Entry Scheme", applicants need to prove that they have beneficially owned (or share with their spouse) at least HK$30 million in assets, including stocks, bonds, deposits, real estate, etc. When cryptocurrencies are accepted, there are two core logics:

1. The policy does not explicitly prohibit: The Hong Kong government is open to asset types. As long as the accountant can report that these assets are real and belong to the applicant, it will theoretically meet the requirements.

2. There are precedents in the market: According to the industry partners I have come into contact with, they have already had many similar cases, from Bitcoin to Ethereum, as long as the process is compliant, there is no essential difference between cryptocurrencies and stocks and real estate.

But the question is: Prove that you have money" and "prove that you have money" are two different things.

2. The biggest difficulty: SOF

There is a classic contradiction in the cryptocurrency circle - "You can take out the coins, but you can't explain the money."

- Early players had many "black history": many people got coins through mining, over-the-counter transactions or even "friend gifts" in their early years, and they could not produce bank statements or transaction records at all.

- Exchange "burst" drags on its back: platforms such as FTX and Binance have encountered compliance problems, and some users' historical data is lost or not recognized by regulators.

- Anonymity is a double-edged sword: Although blockchain is transparent, it is difficult to directly link the wallet address and real identity, and it is difficult for accountants and the Immigration Bureau to trace the source of funds.

For example: A big dealer spent 1 million Hong Kong dollars to buy Bitcoin in 2017, and now it is worth 10 million Hong Kong dollars. But the transfer records of that year have long disappeared, or they are using cash transactions. How do you prove that the 100,000 yuan is legal income? If you can't explain this, the immigration application will be disappointed.

3. Accountants’ “difficulty”: both understanding the currency and

complying with regulations

Hong Kong policy stipulates that asset proof mainly relies on the reports of certified public accountants (CPA), but accountants also have headaches:

1. The valuation standards are confusing: cryptocurrencies are fluctuating violently. Is it calculated based on the price at the time of application, or is it taken as the average value in the past six months? Different accountants may have different operations.

2. Anti-money laundering pressure: If the client’s money comes from unknown channels, the accountant may take the blame for the report.

3. High technical threshold: How to verify the ownership of the wallet address? How to distinguish between "own assets" and "temporary borrowed coins"? These all require expertise.

4. What to do? Three roads break the situation

For big coin holders, if you want to apply for immigration with cryptocurrency, you must make these preparations in advance:

-

Leave evidence from the first day : transfer records of buying coins, exchange bills, tax proofs, and even a handwritten receipt are better than nothing.

-

Find a professional team : The combination of lawyers + accountants + immigration consultants is the key, especially institutions familiar with cryptocurrencies and Hong Kong policies, which can help you design compliance paths.

-

Batch compliance: If the funding origin is vague in the early years, you can add WeChat for consultation.

Previously, Aiying also wrote a related article " Hong Kong New Capital Investor Entry Plan: Full Analysis of Virtual Asset Investment and Guide to Application for Hong Kong Virtual Asset Management License ". The following is a summary of some content:

The Hong Kong Government Policy Address announced that the minimum investment threshold for the "New Capital Investor Entry Plan" is HK$30 million, of which the applicant must invest at least HK$27 million in licensed financial assets and non-residential real estate, and invest HK$3 million in new " Capital Investors Entry Plan Portfolio” to support the development of innovation and technology and other key industries. This means that for those who want to immigrate, they can now obtain residence rights in Hong Kong by investing in these financial assets.

The scope of licensed investment assets has become a highlight. According to the published list of "licensed investment assets", the ownership of limited partnership funds (LPF) and the open-end fund company (OFC) managed by Hong Kong No. 9 company are both licensed and entitled. Recognized as an investable asset.

chaincatcher

chaincatcher