On the eve of issuing coins, the BERAChain ecological characteristics discuss and the core project list

Reprinted from panewslab

02/05/2025·24DWriting: DESPREAD

Disclaimer: The content of this report reflects the opinions of their respective authors. It is for reference only and does not constitute suggestions for purchasing or selling tokens or using agreements. Any content in this report does not constitute investment suggestions and should not be understood as investment proposals.

Quotation

Berachain is a Layer 1 network that features the consensus mechanism of POL (Proof of liquidity), so that the benefits of verificationrs, liquidity providers and agreements are consistent. At present, Berachain is conducting the second test network "Bartio Testnet" to solve the problems found in the first test network.

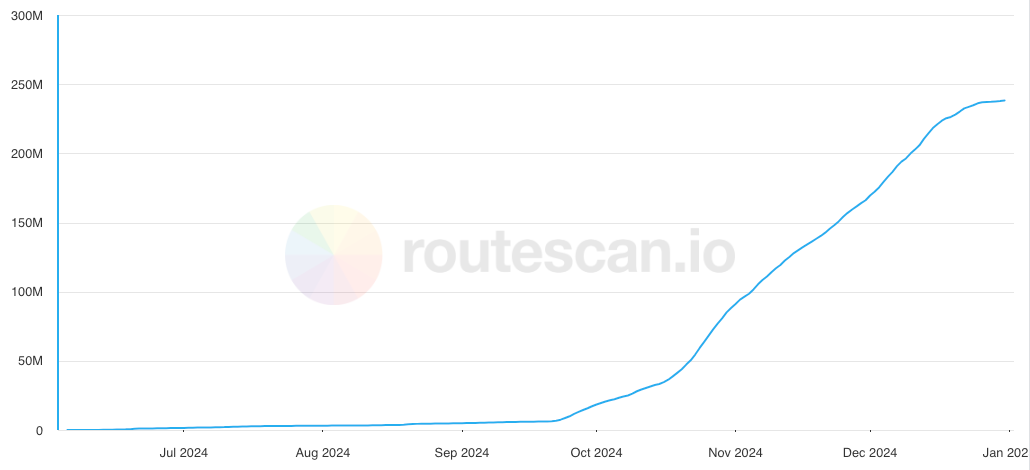

And many ecological agreements have been deployed on Bartio Testnet. As of January 2nd, according to the official website of BERACHAIN, a total of 234 protocols participated in Bartio Testnet, and the cumulative number of wallets for testing Berachain's POL mechanisms has also exceeded 2.38 million. Although only at the test network stage, these data show that the market has for BERACHAIN and BERACHAIN and. Its ecological attention is quite high.

Since the end of 2024, Smokey The Bera, the founder of BERACHAIN, who has launched the "Q5 to launch the main network", recently introduced Boyco through an X tweet, implying that "Q5 will occur before April" indicates that the launch of the main network is coming. This also attracted Berachain's new and old users to join the ecology.

However, to participate in the BERACHAIN ecosystem, they must understand their POL mechanism. Before the launch of the main network, the various complex financial products launched by the protocols to gain advantages in the POL mechanism have caused a large number of new users The entry threshold.

This article aims to discuss various areas of the Berachain ecosystem to effectively reduce the threshold for user participation. We will discuss projects that have outstanding performance in various fields and detail how each agreement uses the POL mechanism.

DEX

BERAChain has a native DX called BEX. It will be launched with BERASWAP when the main network is launched. BERASWAP will support smooth liquidity transactions in the ecology and ensure the effective operation of the POL mechanism. In view of the existence of BEX, other DEX prepared on BERACHAIN is also preparing a variety of more convenient and efficient services and strategies in order to effectively compete with BEX to attract users and mobile funds.

2.1. Kodiak

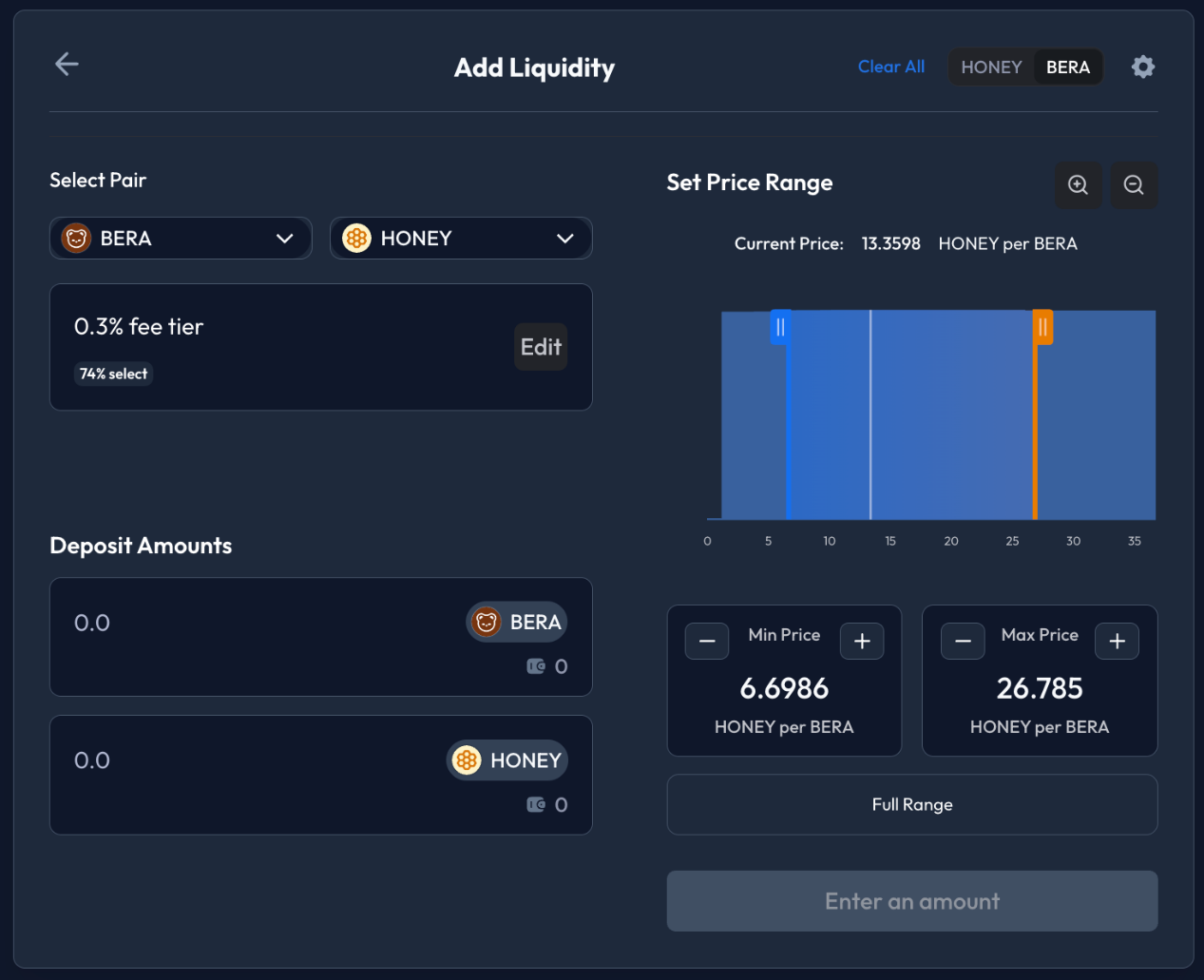

Kodiak is a DEX standing out from BeraChain's incubation project "Build A Bera". In addition to supporting the UNISWAP V2 function (the average distribution of liquidity within the entire price range), Kodiak also provides a CLAMM (concentrated liquidity automatic market business) similar to Uniswap V3, allowing liquidity providers to set Ding and concentrated liquidity.

Users can provide liquidity through the narrow range of the CLAMM pool to more effectively cultivate $ BGT. In addition, Kodiak also provides an ISLAND function to help users automatically repay and balance the CLAMM range, and reduce the trouble of management liquidity supply positions. And this function uses BEX to re -balance liquidity, so it establishes a complementary rather than competitive relationship.

Not only that, due to the customization of the range of liquidity, the tokens of the CLAMM liquidity warehouse are usually difficult to be used by other protocols, but Kodiak standardizes the user's CLAMM liquid position through the Island function, so that the LP token can also be in other protocols in other protocols. Use in China to promote more flexible and diverse ecological gameplay.

Before the launch of the main network, Kodiak had cooperated with many projects in the BERAChain ecosystem to establish its position as a core infrastructure. They also operate their own Berachain nodes as verification nodes. As of January 3, the second highest BGT authorization in Bartio TestNet has been received.

2.2. Honeypot Finance

HoneyPot Finance is a protocol that supports token life cycle. From distribution to providing liquidity and effective transactions, consisting of the following sub -protocols:

-

Henlo DEX: It provides a price limit order and BATCH-A2MM features that specialize in protecting users from MEV. It can collect user orders within a specific period and execute at the same price.

-

DreamPad: a Launchpad protocol to provide incubation and financing opportunities for projects preparing for projects launched on Berachain, while ensuring fair tokens to launch and distribute.

-

POT2PUMP: It provides a safer fan -sale platform for the sale and trading environment, which has functions such as preventing robot SNIPING and not reaching the 24 -hour fundraising target.

Like Kodiak, HoneyPot Finance also plans to operate as verified as verified as verified as a commissioned reward to users who entrust $ BGT.

In addition, HoneyPot Finance uses the accumulated $ BGT to release to the $ HPOT liquidity pool, thereby enhancing the liquidity of $ HPOT. The agreement also plans to increase the value of the token by using node operating income to purchase and combust the $ HPOT, and retain the reward value of the $ BGT client to further consolidate the liquidity of $ HPOT.

In addition to the above Kodiak and HoneyPot Finance, there are other protocols that advocate high -efficiency and convenient trading functions to prepare for the BERACHAIN main network, including to support capital efficiency transactions by collecting more than three or more low -level assets (similar to Curve Finance). Burrbear, liquid polymer Oogabooga, and cross -chain abstract trading protocol Shogun.

Liquid

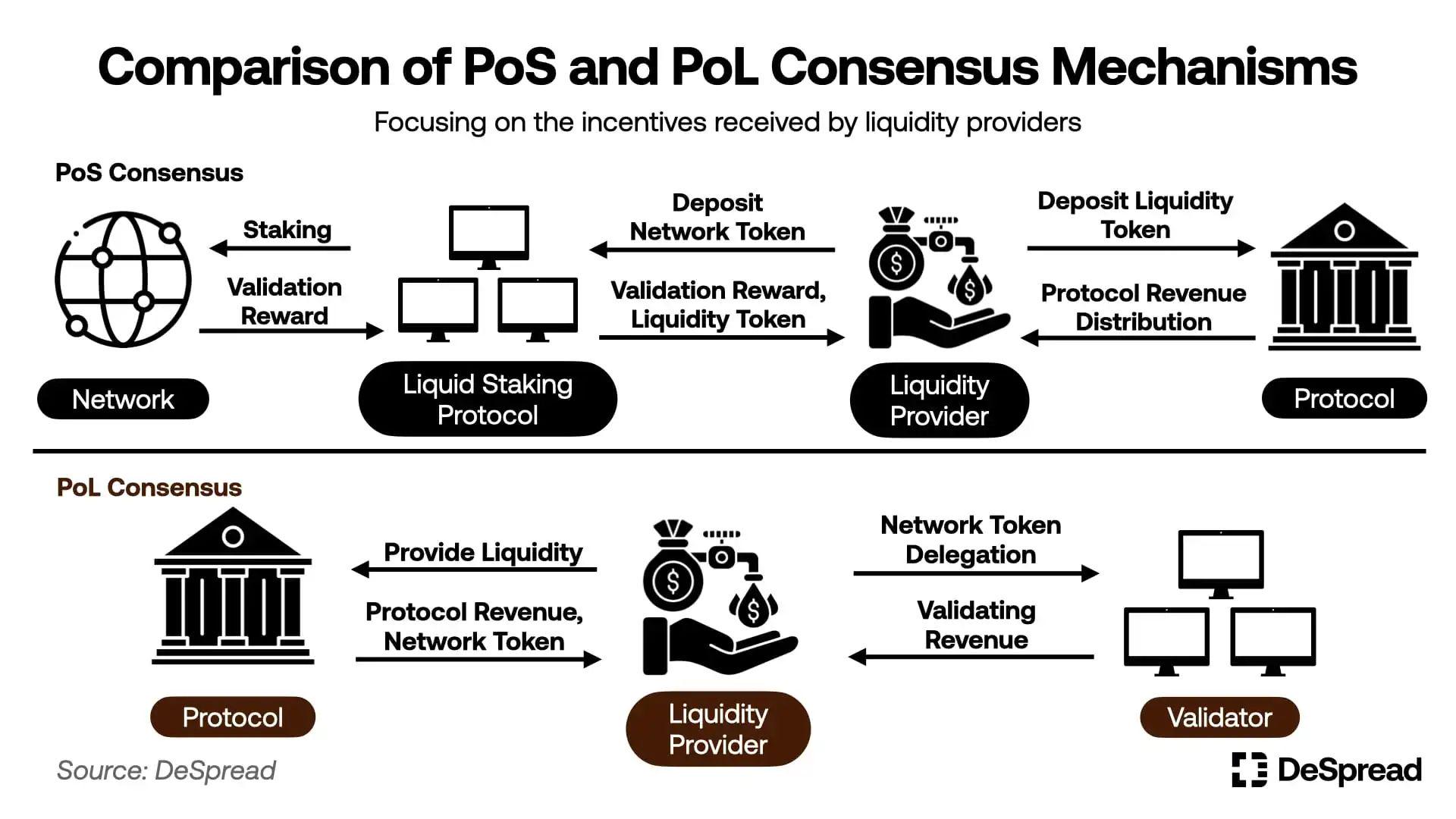

In the typical POS network, the network rewards will be distributed to the verifications holding a certain number of tokens and the operating node. Therefore, if the Internet itself does not have the authorized structure of native currencies, general users who do not operate nodes cannot get online rewards.

In order to solve this problem, the liquidity pledge agreement is distributed by receiving the pledge and commission node operation of the native token, so that ordinary users can also participate in network pledge. These protocols will also issue LP tokens to pledges as a proof of how many original currencies hold, thereby improving the mobility of the ecology. Through these functions, the liquidity pledge protocol has also become the core infrastructure of the POS network.

In contrast, although BERACHAIN's node operation requires 69,420 $ BERA, its structure is when the liquidity provider will deposit the liquidity tokens from the ecological protocol to Berachain, they will get the Internet calculated by $ BGT. Reward and liquidity provide interest. Therefore, in addition to different methods and sequences, BERACHAIN has basically been built in the network protocol.

Although BERAChain's node operation on the main network requires 250,000 $ BERA, the structure of the Berachain is distributed $ BGT rewards and interest supply providers. In the Internet protocol.

However, in BERACHAIN, the existing agreement can only provide rewards and get voting rights through cooperation with the verifications, or as Kodiak and HoneyPot Finance are displayed, they can establish their own self -sufficient flywheel model through their own nodes that operate their own nodes. Start its liquidity pool.

In this context, the BERAChain's liquidity pledge protocol will provide a $ BGT (determine the voting right of EMISSION). This allows the BERACHAIN ecological project to include the $ BGT of liquidation into its agreement mechanism, and does not need to negotiate with the verification or node. In other words, this makes it easier for the ecological agreement to adopt the structure of the POL mechanism tightly.

3.1. Infrared

Infrared is a liquid pledge protocol that jointly incubated with Kodiak through the "Build A Bera" project of BERACHAIN.

The storage library operated by Infrared can accept the LP tokens from the mobile fund pool, generate a $ BGT interest rate, and run the network node at the same time. When the user deposits the LP token in these storage libraries, Infrared uses these tokens to generate $ BGT, and the user can receive the $ IBGT (liquidated $ BGT) that is proportional to the LP tokens they deposited in.

Users can use the received $ IBGT in the following way:

-

Pure in Infrared to receive the reward generated by nodes

-

Use in other DEFI protocols

-

Sale profit

Therefore, infrared By turning $ BGT into a flowing tokens, Infrared concentrates the reward generated by the POL mechanism and distributes to less $ IBGT pledges, and at the same time help other protocols in the BERACHAIN ecosystem incorporate $ IBGT into its agreement. Make their platforms also provide higher returns for their users. In addition, Infrared also plans to launch new features, allowing them to receive and liquidate the $ BERA required for the operation and liquidation nodes while running nodes and distribution profits.

The best example of effective use of INFRARED function is Kodiak's Island Pool. We also introduce a little bit in the above DEX field. After the launch of the main network, Infrared plans to launch Kodiak's Island Pool (operated in Testnet), allowing users to use Kodiak's CLAMM for more efficient $ IBGT farming, and re -pledge the $ IBGT received in Infrared , Or restart it into Kodiak's $ IBGT/$ BERA's Island Pool for more $ IBGT breeding. Of course, users can also choose to play in other ecosystems.

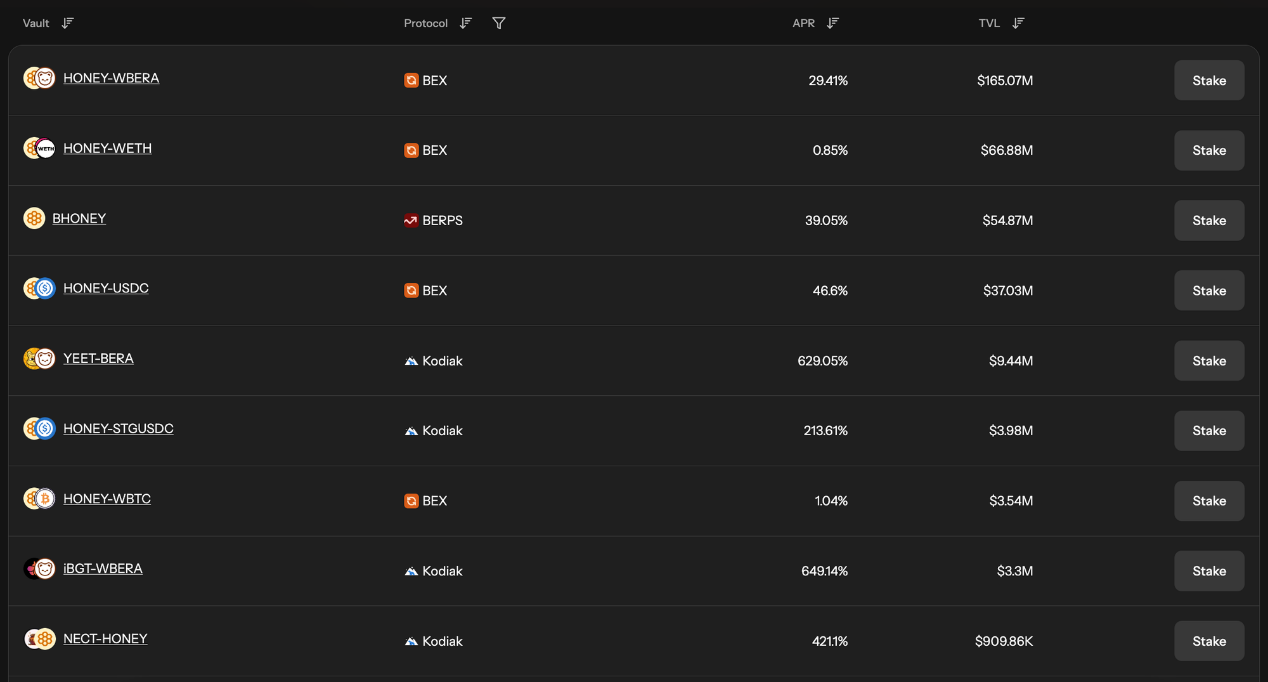

Based on the interdependence and effective ecological gameplay of the protocol, Infrared has received the attention of many users, and currently accepts up to $ BGT commissioned in Bartio Testnet. In addition, many ecological projects have also cooperated with Infrared and plans to launch various derivative products, showing that Infrared will become the most important infrastructure after the launch of the main network.

At the same time, the clear details about how Infrared will use the commissioned $ BGT to choose the Emission of $ BGT has not been made public. Therefore, it is important to pay close attention to whether Infrared will implement these processes in a decentralized manner and the voting right of $ BGT, which will provide it.

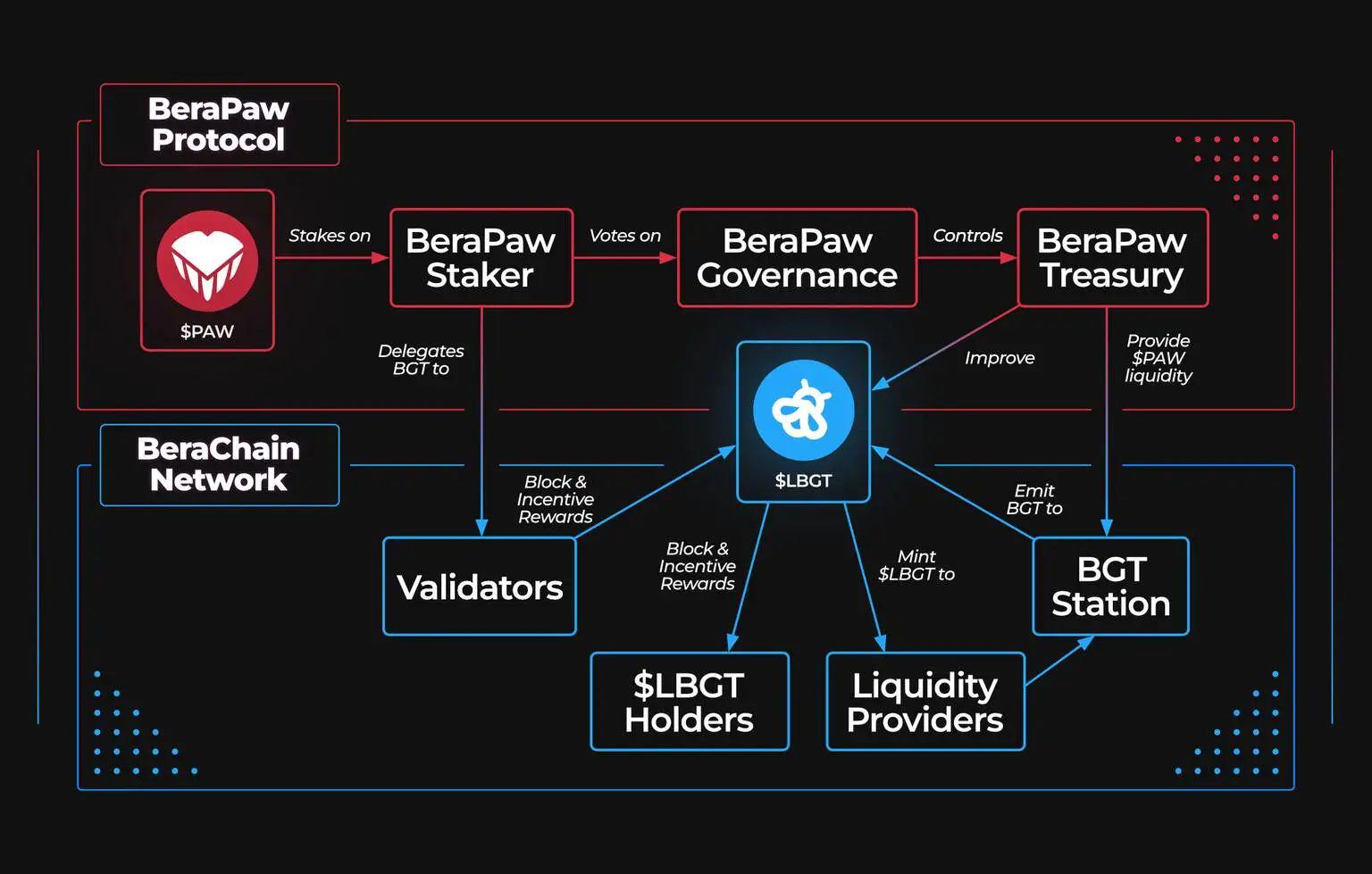

3.2. BERAPAW

BERAPAW is also a liquidity pledge protocol, but they do not run their nodes, but run the vault between different nodes and the liquidity pool registered in BERAPAW, and issue $ LBGT as a $ BGT liquidation token.

BERAPAW's governance tokens are $ PAW. Users can vote for voting to determine which liquidity pools should be obtained at $ BGT. Node operators distribute the revenue generated by pledged $ BGT to the holders of $ LBGT.

The structure adopted by BERAPAW divides the use of the $ BGT tokens into two tokens: $ LBGT and $ PAW, 1) receiving rewards and 2) vote to the $ BGT emission pool. Through this structure, users and protocols that use $ PAW tokens to vote for $ BGT EMISSION can exercise more voting rights with relatively few capital. Therefore, the agreement to seek initial liquidity in the BERACHAIN ecosystem is expected to actively use $ PAW to generate a $ BGT reward for its liquidity pool.

The above are two liquid pledge protocols that are officially launched on Berachain. Although these agreements not only make more derivative products also give users more gameplay, but also make the ecosystem more complicated. In the BERACHAIN network, the power and status of nodes will be proportional to the number of commissioned $ BGTs, and the liquid pledge protocol with the $ BGT liquidation function is expected to be adopted by many users and protocols to become the core infrastructure.

Borrow

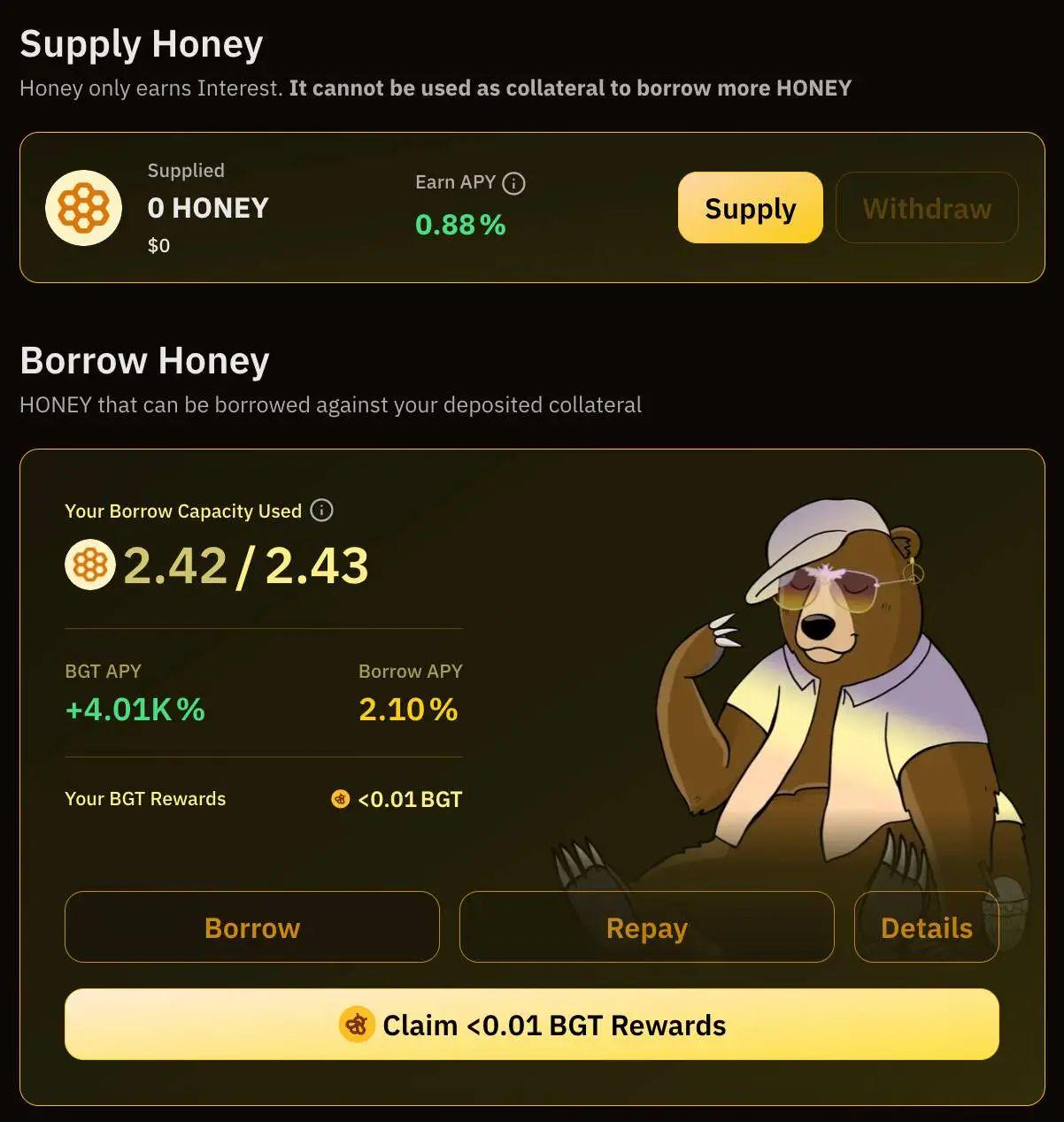

BERAChain also has a native borrowing agreement Bend to provide the following functions:

-

Use $ WBTC, $ WETH as a mortgage borrowing $ HONEY

-

Stay in $ HONEY

Unlike typical lending agreements, Bend has two remarkable features: 1) $ Honey cannot be used as a mortgage, 2) $ WBTC and $ WETH deposits does not generate interest, but the $ BGT reward will be generated when borrowing $ HONEY.

Through this structure, Bend enhances BERAChain's triple tokens economic structure, generating basic interest for $ Honey, and adding borrowing demand through $ BGT to enrich ecological liquidity. Users can also replace the borrowed $ honey back to $ WETH, $ WBTC, and store it in Bend to execute the $ BGT leverage Farming.

Next, we will discuss in detail to prepare several major lending agreements and functions provided by various platforms that are prepared on Berachain.

4.1.

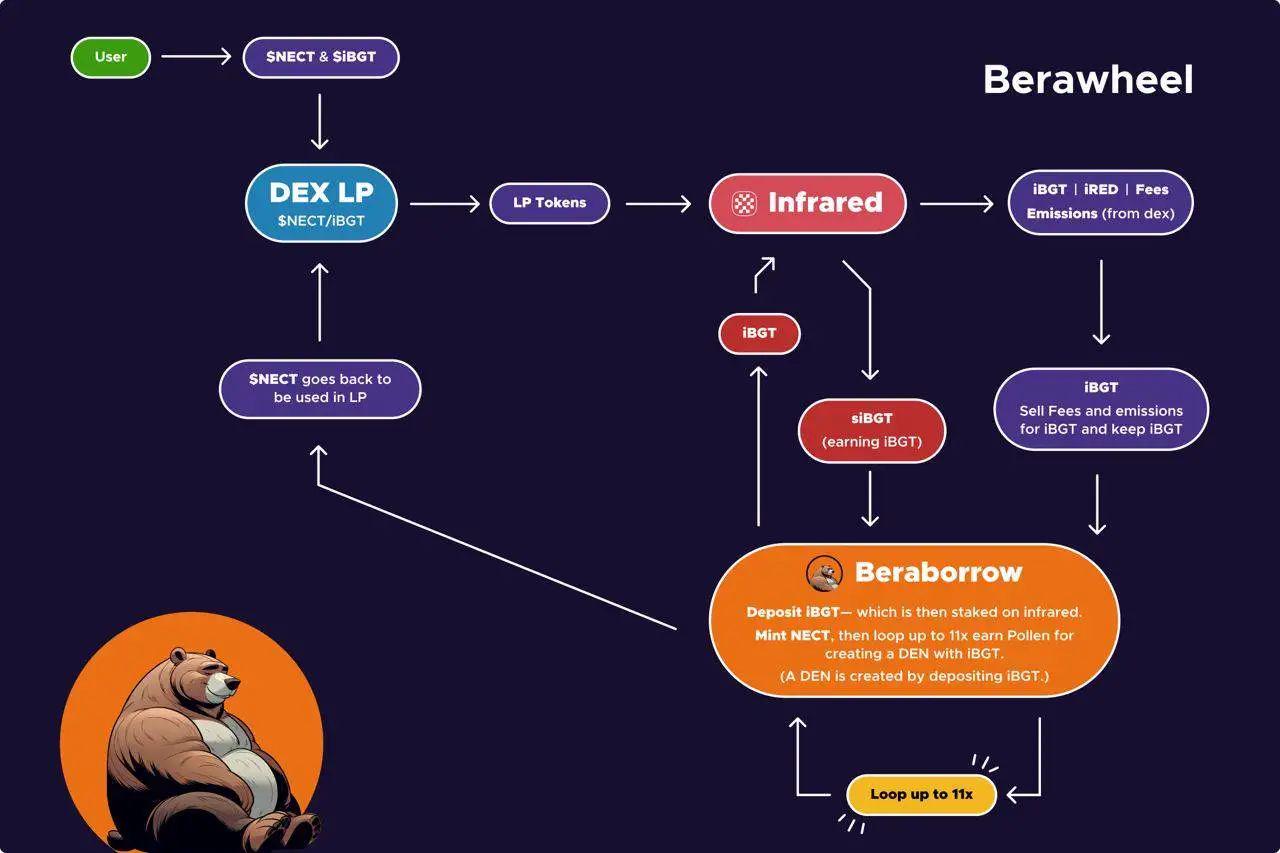

BERABOROW is an ultra -mortgaged stable currency issuance protocol, and users can cast $ NECT stablecoins. It not only allows ordinary assets such as $ BERA and $ HONEY, but also allows BEX and Berps LP tokens and Infrared's $ IBGT as mortgage assets. The $ Nect cast by mortgaged assets can be stored in the liquidity stabilization pool of BERABOROW. The depositer can charge the borrowing fee and liquidation cost from the $ Nect borrower to establish a structure that supports the basic demand of $ Nect.

In addition, BERABORROW also has a governance token $ Pollen in addition to $ Next, which can be used as an incentive token in the following aspects:

-

The liquidity pool for rewarding the $ BGT Emission

-

Encourage mortgage deposits to high $ NECT debt liquidity pool

-

As a reward distribution to the depositor who is to the liquidity stabilization pool

In addition to this basic structure, the LP token deposited in Beraborrow will automatically deposit in Infrared to generate a $ IBGT reward and automatically re -deposit into Infrared to generate recovery. Users can borrow $ Net to provide liquidity in other protocols, and reintermine the received LP token in BERABOROW to establish a leveraged position.

In addition, BERABOROW also plans to allocate $ BGT in the DEX liquidity pool for $ Net and $ IBGT transactions to enhance the demand and market liquidity of $ NECT, while providing high deposit benefits for liquidity providers.

With the support of various ways, $ Nect is expected to become the core native stablecoin with $ Honey in the Berachain ecosystem.

4.2. Gummi

Gummi is a borrowing agreement hatched through "Build A Bera". It can operate without a prophetic machine, allowing anyone to establish a loan pool unlimited. Using this architecture, Gummi plans to use any assets of Berachain to provide users with a 100 -fold leverage position.

Before the launch of the main network, Gummi had reached a cooperative relationship with core infrastructure such as Infrared and Kodiak, and plans to support the leverage farming position of various LP tokens of various LP tokens of $ IBGT and Kodiak.

It can be seen that unlike other network leverage and borrowing protocols that are mainly used in specific assets and the borrowing protocol for hedging, the BGT Emissions of the POL mechanism can magnify the POL mechanism. Therefore, as more protocols are launched on BERACHAIN and the diversification of ecology, the utility and demand of the loan agreement will also increase together to make it an important part of the ecology.

Derivative

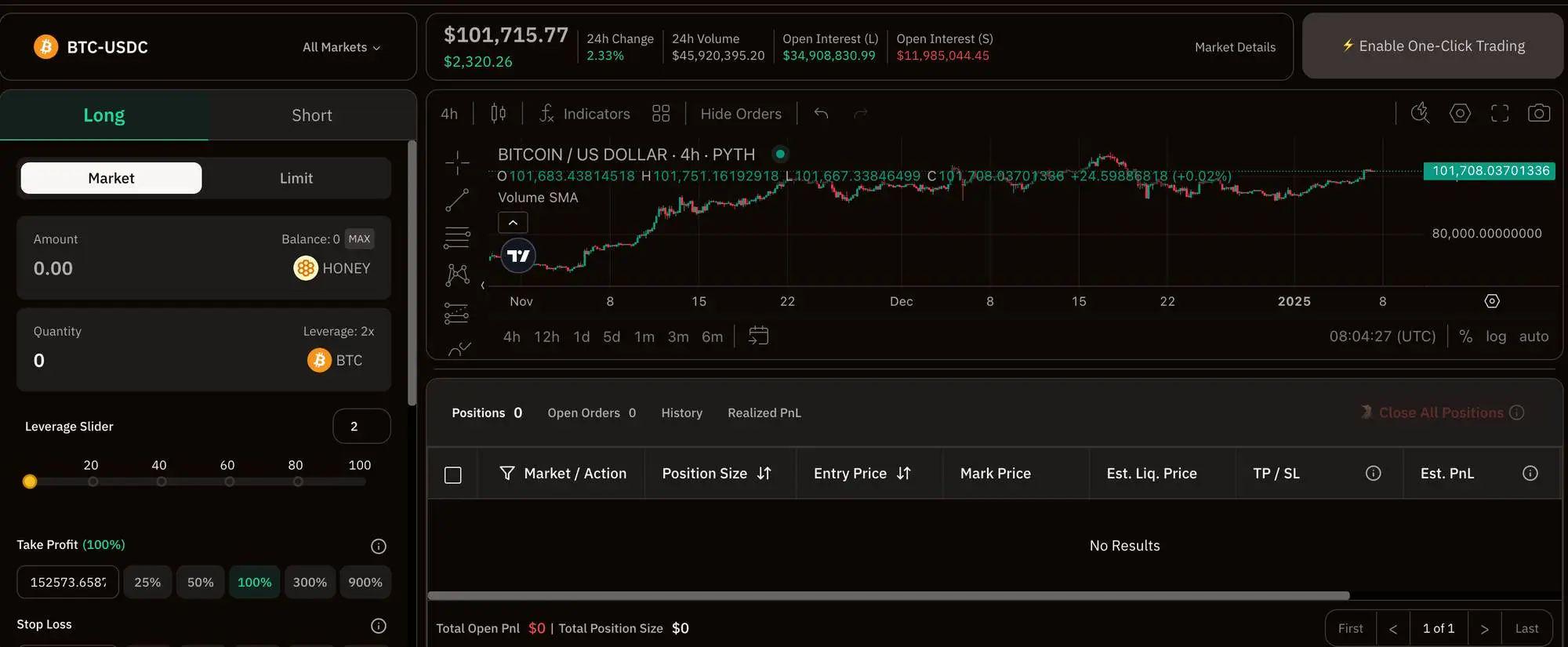

At present, the derivative protocols that use the POL mechanism in different ways are also preparing to launch when the Berachain is launched. The basic infrastructure includes BERPS, which is the native Perp Dex launched with Bex and Bend.

In BERPS, users can use $ Honey to establish a 100 -fold leverage position of various assets, or deposit $ Honey to provide the mobile funds required for the traders' positions, and charge trading fees, funds and $ BGT.

Through this structure, Berps gives $ Honey a clear use case as the basic asset of Berachain's native PERP Dex. It also provides a simple but effective $ BGT Farming entry point, making those new new and daunting new. Users can also dig for $ BGT rewards through a single token $ Honey deposit. Therefore, the agreement is expected to become the most critical agreement to support the BERACHAIN trio economy.

Next, let's take a look at some unique derivative agreements preparing to launch on Berachain.

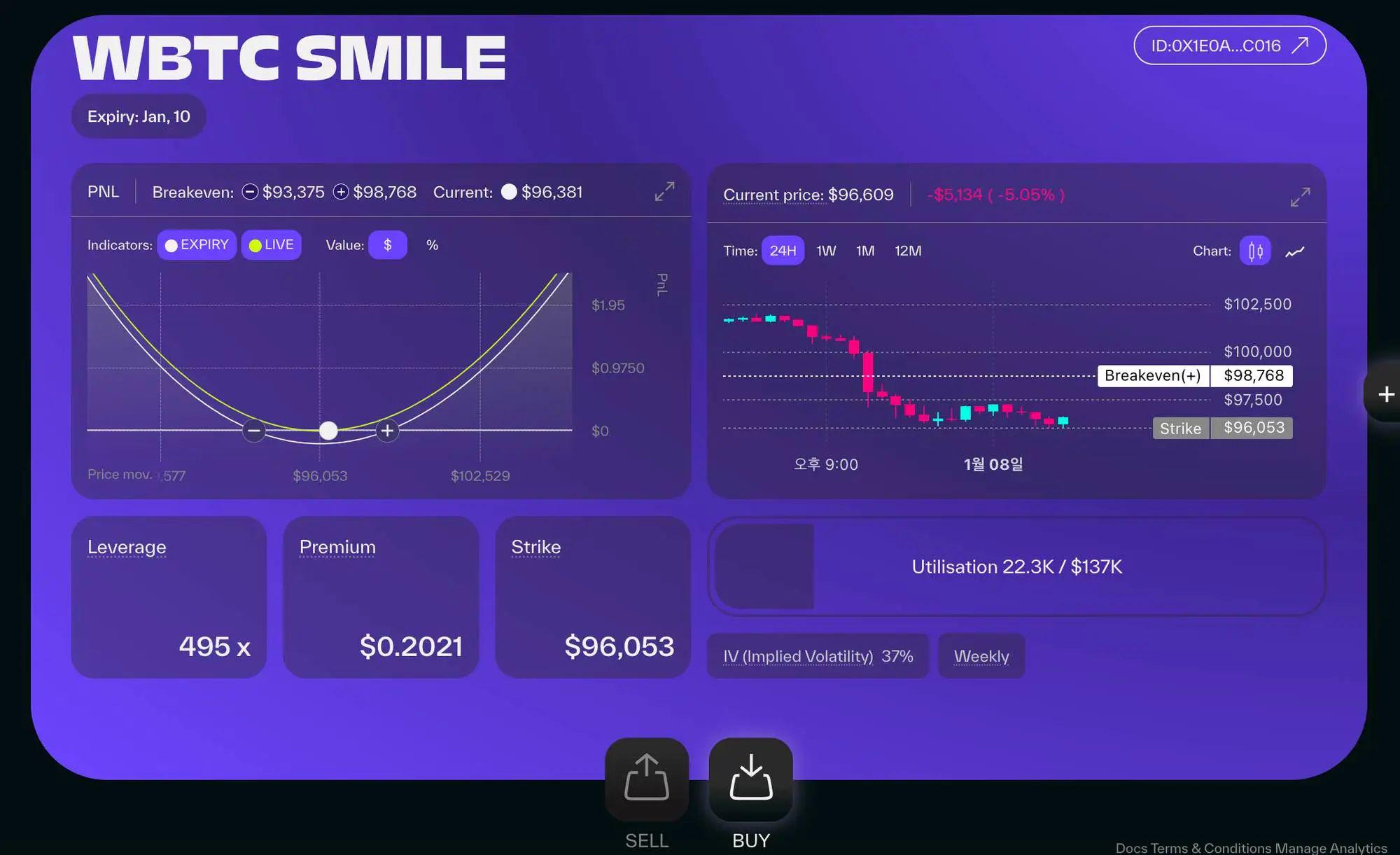

5.1. Smilee

Smilee is an option protocol that can provide a warehouse for a position for DEX liquidity. The options created in Smilee have a unique structure that can generate more profits when the price fluctuates is large, creating a loser loss (IL, that is, the liquidity provider causes greater losses when fluctuating) is completely completely).) Converse effect.

Users must pay a certain amount of options to establish a futures position in Smilee. There are three options positions to choose from:

-

Bull: The bet price rises sharply until it expires.

-

Bear: The bet price has dropped sharply until it expires.

-

Smile: The bet price fluctuates significantly up or down until it expires.

In addition to such options transactions, users can also provide liquidity for option positions established by options traders and charge option fees paid by traders. Although liquidity providers will face unpaid losses (IL) with equal profit as traders, similar to providing liquidity to DEX, SMILEE provides positions to reduce liquidity providers by re -balanced liquidity through real -time balancing of liquidity during the occurrence of options transactions. Losses for free.

The BERACHAIN network protocol is expected to create a liquidity pool on the main DEXS (including native DAPP BEX) to improve the liquidity of its tokens and generate a $ BGT reward for these pools. In this environment, we can estimate that the liquidity providers and protocols of $ BGT will be widely used as hedge tools for LP positions. In addition, if SMILEE's option positions start to get $ BGT Emission in the future, Smilee's position in the Berachain ecosystem will become more stable.

5.2. Exponents

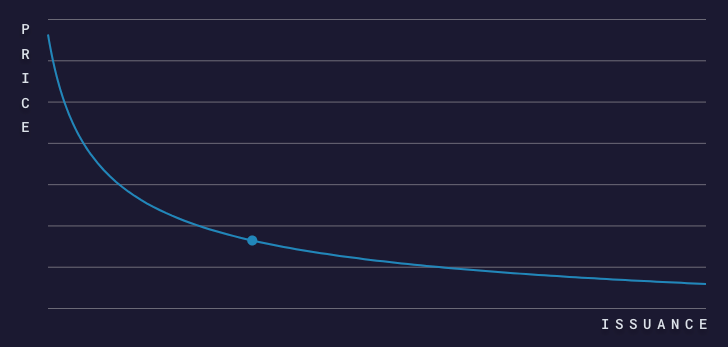

Exponents is another derivative protocol that IBC (reverse Bonding Curve), which is developed by self -developed reverse asset issuance protocols, to achieve leveraged cabin in all assets in the ecology.

IBC adopts reverse Bonding Curve, which is contrary to the concept of ordinary Bonding Curve. Bonding Curve is a recent price discovery mechanism adopted by many fascinated coins Launchpad (such as pump.fun). Traditional Bonding Curve By reducing the number of assets required and with more mortgage asset deposits into the liquidity pool, the price increases; and IBC has achieved reverse assets. As demand increases, the price will also be The decline, because more mortgage assets are deposited, the number of assets receivable will increase.

Exponents uses an IBC mechanism to realize the long and short positions of all assets. It does not need to be a prophet machine. The purpose is to adjust the IBC mechanism parameter to make the Bonding Curve curve slope steep, thereby providing a liquidated leverage position.

In addition, IBC also pledge the synthetic assets issued in the agreement and the function of the profit generated by the assignment agreement. When combined with the POL mechanism of BERACHAIN, $ BGT EMISSION can be distributed as a reward to users who issue assets through IBC. In other words, by using $ BGT as a reward, users are encouraged to establish short positions on the competitive tokens of the competitive agreement to achieve more diverse ecological gameplay.

In addition to the SMILEE and Exponents discussed above, various derivatives protocols are also preparing to launch on Berachain, including the IVX of the short-term high-leveraged position through the 0-DTE function, and Polarity, which provides a loan with options as a mortgage. Finance. Compared with the derivative tools in other Internet ecology, the form of each derivative tool is more diverse and complex. Some agreements are complementary to the POL mechanism of BERACHAIN, and some agreements use this mechanism to highlight its unique advantages.

other

So far, we have discussed several protocols (including DEX, liquidity pledge, lending and derivative agreements, etc.) in the blockchain ecosystem, and discussed how these projects highlight their unique advantages. In Berachain Use the POL mechanism.

However, in addition to the Defi track currently introduced, various types of projects are also preparing to launch on BERACHAIN. Some of these projects adopt the unique structure of Berachain, actively use the POL mechanism, and some only have a high degree of synergy with the ecology, and they do not directly use the mechanism. Features, attract users' interest and attention.

Next, we will introduce these projects that are more distinctive and will be launched on Berachain.

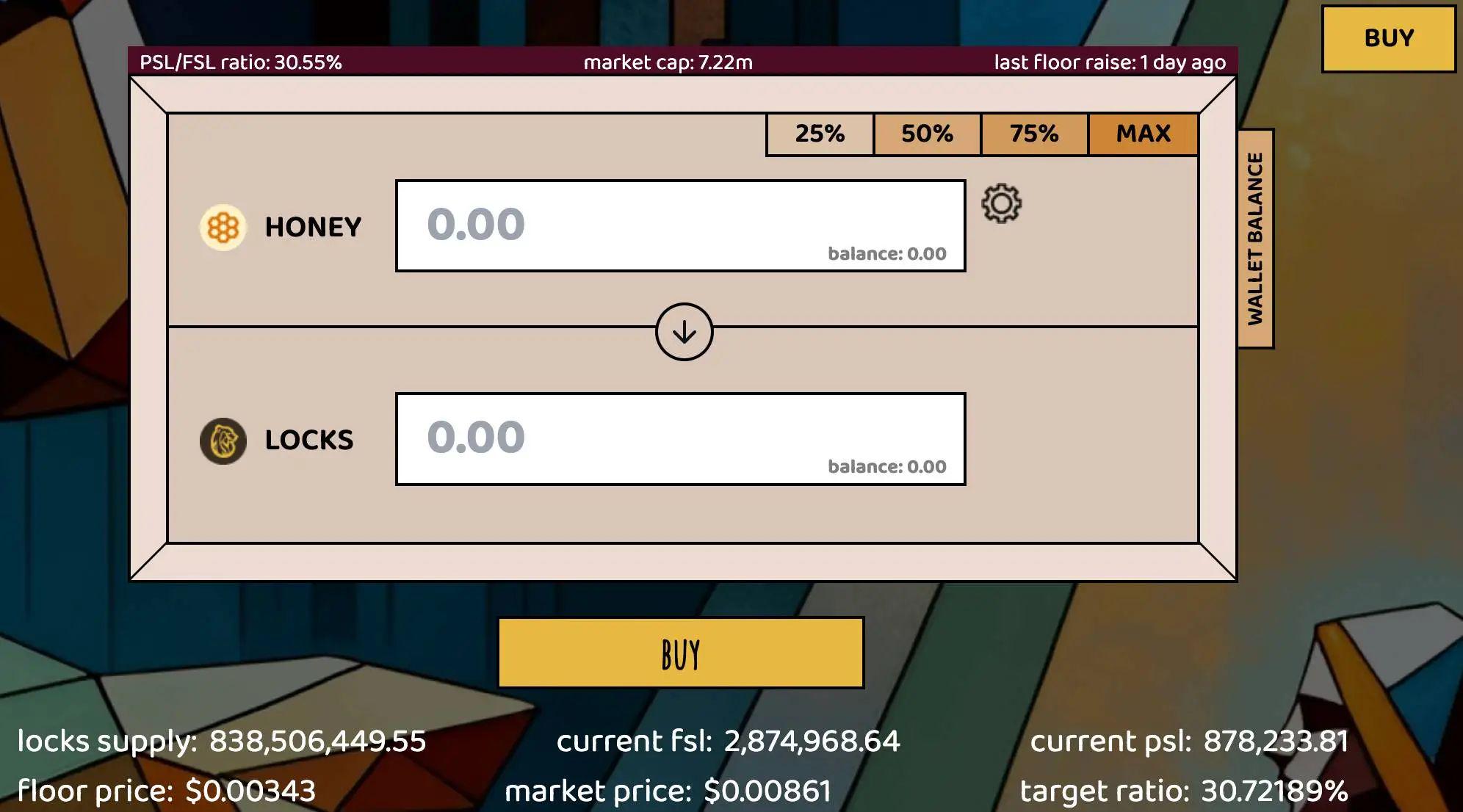

6.1. Goldilocks

Goldilocks is a DAO and platform for developing BERACHAIN exclusive DEFI infrastructure. It consists of the following sub -protocol:

- GOLDISWAP: It contains the FSL SUPPORTIDIDIDITITITITITITITITING Liquidity Pool of Goldilocks to govern the tokens and the PSL pool (Price Supporting PO PSL pool used to exchange $ Honey and $ Locks. OL). The cost generated by $ LOCKS in PSL pool continues to increase the reserve price of $ LOCKS. Users can get $ Porridge as a mortgage for $ LOCKS as a reward, and $ Porridge gives users the right to buy $ Locks at the lowest price. Users can use $ Locks as mortgage borrowing $ Honey.

-

GOLDILEND: Berachain Ecological NFT NFT mortgage borrowing agreement.

-

GOLDIVAULTS: Utilize assets that are locked in the BERAChain Ecological DEFI protocol to generate interest. The depositor will receive OT (ownership tokens) to give the right to obtain principal at the expiration, and YT (income token), and give the right to obtain interest. This allows users to trade in interest income in the future and provide PENDLE Finance similar to Ethereum. (For details on this function, see the article "Pendle Finance -Discover the Unewal Trading Market").

Therefore, Goldilocks provides BERAChain optimization services in the Berachain ecosystem, such as NFT mortgage borrowing and interest trading functions. Compared with other networks, the NFT and liquidity issued by protocol issuing more important roles. In addition, GOLDILOCKS is expected to gradually ensure more users and liquidity by increasing the platform tokens and using the borrowing service of this token.

At the same time, Pendle Finance has also become the core DEFI protocol adopted by many projects currently in the Ethereum ecosystem. The liquidity deposit is performed through the YT distribution protocol point, thereby promoting its airdrop activities. Similarly, whether Goldilocks can create various types of GOLDIVAULTS through cooperation with other projects issued by the BERACHAIN ecosystem to create a variety of types of Goldivaults, so as to get a dominant position in BERACHAIN, it will be an interesting concern.

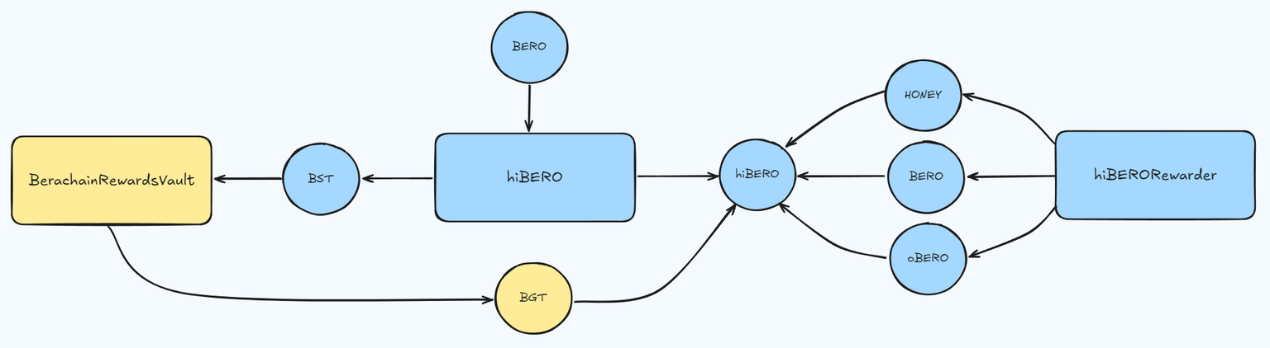

6.2. Beradrome

Beradrome is an agreement that brings together user liquidity tokens that distribute the profit generated and rewarded by other protocols to users. Beradrome uses the following three native currencies, allowing users to re -internalize the profits generated by users in Beradrome in the agreement:

-

$ OBERO: The tokens of users who deposit liquid tokens in Beradrome. By burning $ OBERO, users can obtain the voting right of $ OBERA reward emissions in the liquidity pool, or cast and obtain $ Bero in the $ Honey, which is equivalent to burning $ OBERO in the Beradrome.

-

$ Bero: Beradrome's main currency. Since the casting process is burned with $ Ober to get the $ HONEY, its value is guaranteed to remain above 1 $ Honey.

-

$ Hibero: Beradrome's governance tokens can be obtained by betting $ Bero. You can use the $ BGT held by Beradrome to vote for the liquidity pool to obtain $ Obero and the profit generated by the protocol. You can also use the pledged $ Hibero as a mortgage to borrow $ HONEY.

Therefore, BERADROME encourages the internalization of rewards generated in the agreement by using $ Obero's $ Bero coining mechanism, so that the price of $ Bero and $ Hibero is maintained above $ 1, and at the same time, it provides $ Hibero holders on the $ Bero coin process process. Surval $ Honey's Clean -free borrowing opportunity. This will continue to attract external liquidity into the agreement, encourage more agreements to develop liquidity through Beradrome, and establish a self -continuous flywheel to re -assign the rewards it provides to users.

In addition, Beradrome plans to operate its own node. By accepting external $ BGT commission, it obtains the $ BGT EMISSION voting right, is separated from its protocol operating mechanism, and assigned $ BGT to $ Hibero casting pool. If the plan is successful in the future, the $ Hibero holder will be able to obtain Beradrome's profits and $ BGT at the same time, which may attract more mobile funds for the Beradrome ecology.

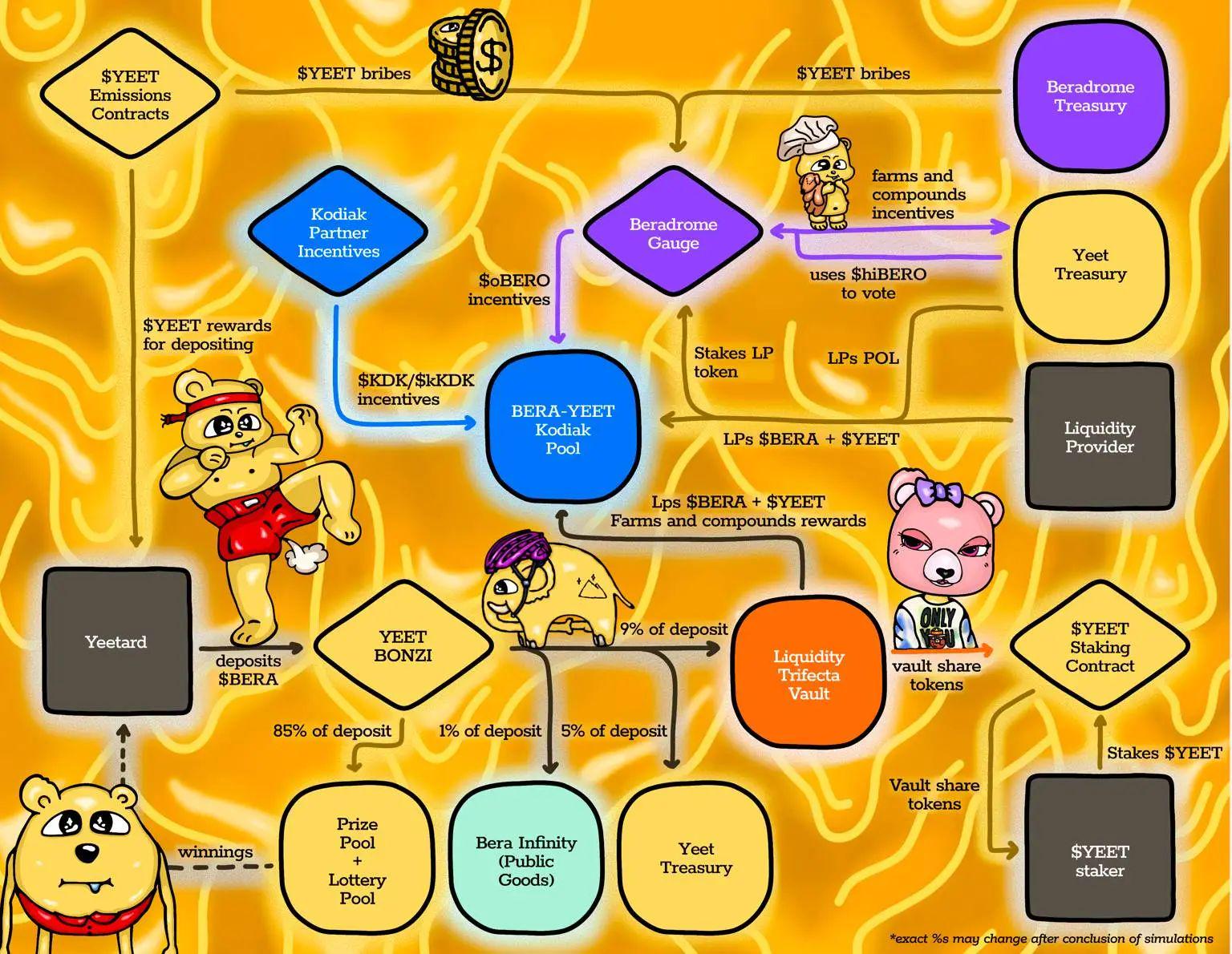

6.3. Yeet

YEET is a betting game protocol using $ bera. Anyone can participate in the game in the set game time, betting the $ BERA in the Lobar Pool of the YEET (about 0.5%higher than the $ BERA of the previous deposit), and finally the users who deposit in $ BERA take it away 80%of the total deposit of the total deposit in the liquidity pool.

Even if the user does not win the game, they can receive YEET's native currency $ YeET. As a reward that is directly proportional to their betting amount, users can bet the $ yeet to earn the liquidity trifecta vault to earn betting interest.

LIquidity Trifecta Vault will be 9%of the $ BERA and bets that the user stores in the game. The vault will use the assets deposited to provide mobile funds to Kodiak, which will re -deposit the liquid capital tokens received from Kodiak into Beradrome to maximize the interest of paying the investment.

In addition, Yeet plans to launch the YEETBOND function, allowing users to claim specific token bonds at discount prices at the due date. In BERACHAIN, there are various methods to create future value with liquidity. This function provided by Yeetbond is expected to be actively used by various protocols as a means to ensure liquidity.

Therefore, the YEET plan provides the optimization "interesting features" and "effective features" for BERAChain. From the test network stage, it has established a solid community with its unique joy and humorous fans because of the center, including $ yeet, including $ yeet. YEETARD NFT with a reward enhancement function.

6.4. Ramen

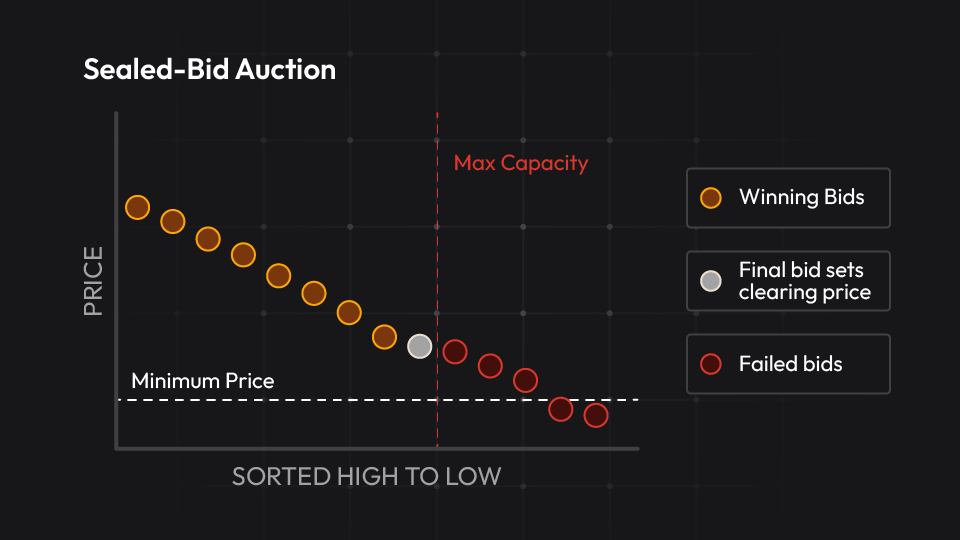

Ramen is a Launchpad protocol, similar to HoneyPot Finance DreamPad, helping to prepare for the promotion of new protocols launched on BERACHAIN, and safely raises funds through the Fair currency sales. The platform supports two Launchpad modes:

-

Fixed price model: The method of buying token in a fixed price. Users must register on the white list to participate in the issuance platform, or use the platform's native currency $ ramen as a bet to get GACHA tickets, and consume these tickets to win in the lottery.

-

Price exploration mode: Unlike a fixed price model, anyone can participate. It is hoped that users who are equivalent to the amount of deposit assets that are equivalent to the amount of albums required will be blindly bidding to determine the settlement price. The right to purchase tokens at the settlement price starts from the highest bid user.

In addition to the Launchpad function, Ramen also plans to launch the AirDrop recipes function, which can easily set and execute token air investment standards. Ramen provides all necessary functions from tokens to sales and distribution. The goal is to become the core infrastructure adopted by many new projects after being launched by the main network of Berachain.

However, in order to keep Ramen's interest in users, it is necessary to have a certain degree of agreements to be dependent on, and it is necessary to have a way to successfully operate to the tokens through Ramen and provide profits to tokens. Therefore, it is necessary to continue to observe the long -term growth of the projects sold through Ramen, and whether the potential projects choose to use the Ramen distribution platform.

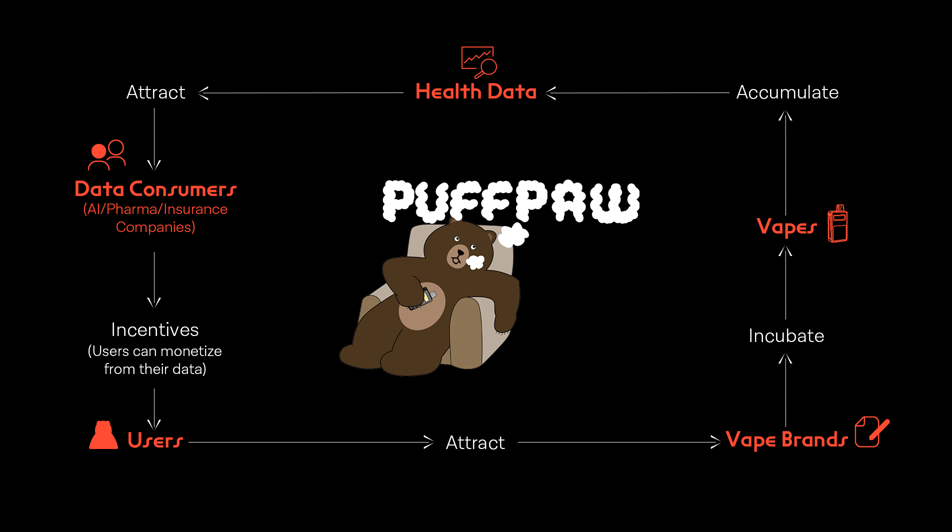

6.5. PuffPaw

PuffPaw is a Vape 2 Earn project that users can earn vocal currencies through electronic cigarettes. It measures the smoking activities of users through the self -produced smoking device and smoke box, and distributes the $ VAPE tokens with a lower cigarette liquid with low nicotine content to encourage smoking to quit.

In addition, through its Leasing-BorRowing plan, users who do not want to smoke but want to participate in the plan can also lend the device to users who cannot buy the device and share profits to create the structure of BERAChain ecological users regardless of whether smoking.

In December 2023, the Puff Pass NFT of PuffPaw was successfully sold. As a ticket for the project, it is planned to strengthen its VAPE brand image and expand its ecology through additional devices. In addition, the company also plans to create additional income by providing data used by the user equipment to AI and insurance companies. Through these income, it supports the value of the $ VAPE provided by the reward. The method of creating additional income.

After reading this, we have studied agreements on behalf of various tracks on BERACHAIN, and each agreement has its unique advantages. In addition, there are other items that can also participate in the liquidity mechanism of BERACHAIN without understanding:

-

Beratone: Life simulation, role -playing game

-

Junky Ursas: GambleFi platform

-

FABL

-

Onikuma: SocialFi platform on the chain

不仅如此,Dirac Finance、NAV、D2 等多种Vault/On-chain 基金协议也将陆续推出,通过结合Berachain 协议功能来简化了生态中各种DeFi 策略,让新用户也能轻松地参与运用,并Obtain profits through simple risk management.

And these agreements can not only encourage more users to join the Berachain ecology to increase the liquidity of the overall ecology, but also promote the use of ecology at the same time.

Community

The structure adopted by most BERAChain ecosystems is to obtain the initial liquidity by allocating high benefits to liquidity providers. By actively using the POL mechanism, and using NFT and Memes Expand these structures.

Because the POL mechanism allows users who hold more $ BGT and liquidity in the ecology to have higher negotiation permissions and more opportunities to get more incentives, there are also some project strategies to form a community with NFT and MEMES. After establishing a reputation and status of community activities, they then generate and distribute profits, and these projects do not necessarily provide specific functions in the agreement.

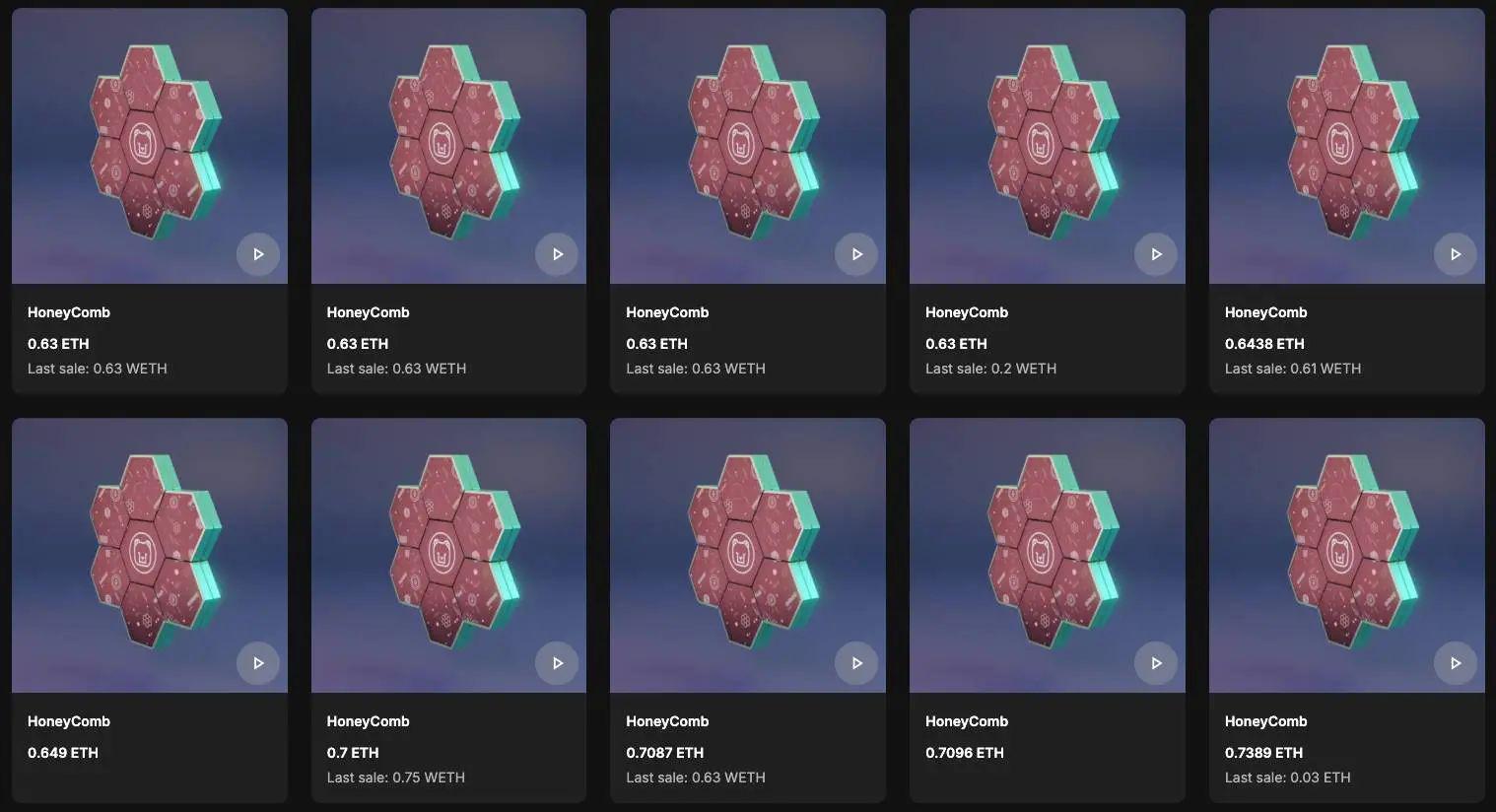

7.1. The honey jar

The Honey Jar is a community of unity through a core concept to build sticky liquidity with a community -driven flywheel, which develops around a NFT called Honeycomb in 2023.

The expansion of The Honey Jar community is similar to the growth way of Berachain. It is the holder through the distribution and distribution of Honeycomb's derivative NFT series. On the basis of the expansion of the community, it cooperates with various projects developed in the BERAChain ecology to provide the various interests of these projects to NFT holders, thereby consolidating its position.

Subsequently, The Honey Jar produced various BERACHAIN -related educational materials, and provided various useful services such as testing network FAUCET for new users who entered the Berachain ecology. In addition, The Honey Jar is also a venture capital studio in the Berachain ecosystem, which incubates the community evaluation service S & P (Standard & PAWS) that evaluates the BERACHAIN ecological project, and the platform BERA Infinity, which measures and rewards and rewards the contribution of BERACHAIN ecosystem.

According to Honey Jar's Ecosystem Explorer, as of January 11, Honey Jar has participated in or has a total of 89 projects that have directly participated or have a cooperative relationship, which has established Honey Jar's most influential core community in the current BERACHAIN ecosystem. In addition, users holding Honeycomb NFT will also receive the NFT white list and token air investment opportunities from many cooperative projects, so that Honeycomb is the NFT series of 0.6 ETH's highest reserve price in Bong Bears and Rebase NFT ecology.

In the current BARTIO Testnet, the $ BGT represented rights obtained by the node operated by Honey Jar ranked third, second only to nodes operating in Infrared and Kodiak. And we can also see that the next ranking is also a community -centric project, including BERALAND providing BERAChain -related information in Podcast, and TTT, which provides textbooks and operate nodes for Vietnamese users. Maximum projects of $ BGT represents rights.

Through these data, we can understand that in the current BERACHAIN ecosystem, the advantage of the community as the center is an effective strategy.

in conclusion

The above we discussed how the BERAChain Ecological Infrastructure Agreement (such as DEX, Moral Pure and Loan Agreement) combined with various functions to create complex financial services. Through some examples of ecological projects, we also understand how different protocols have attracted users' interests and liquidity through "high returns" and "entertainment" through the POL mechanism and unique community culture.

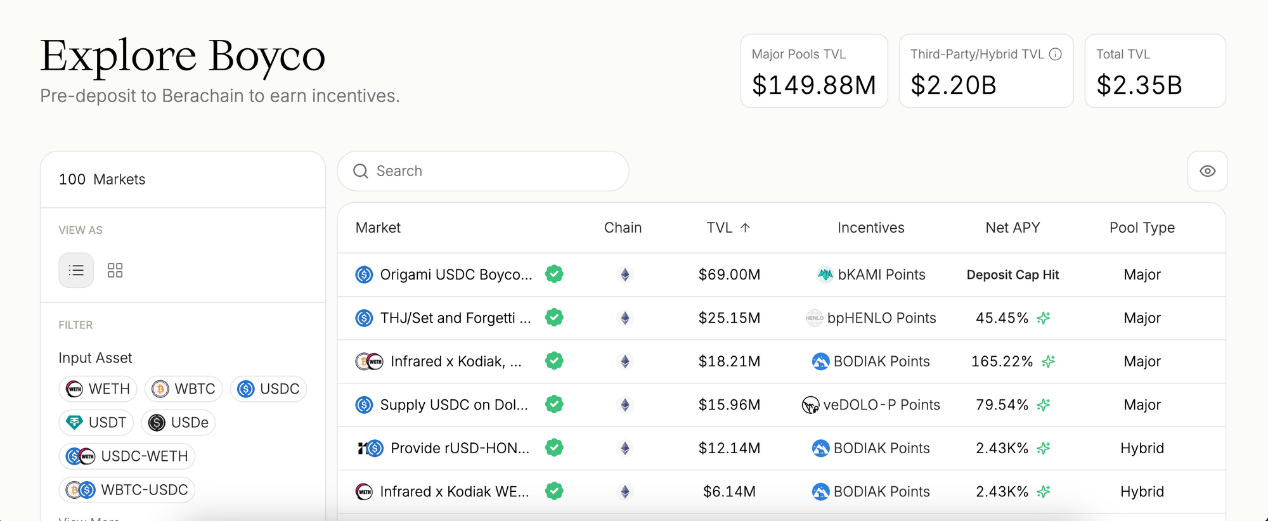

At the same time, BERACHAIN has recently announced that it will use Boyco, RFA (Request for Application) and RFC (Request for Community) to support the $ BERA token distribution and initial ecological liquidity, suggesting that the main network is about to launch.

-

Boyco: The liquidity platform before the main network allows the agreement to be planned to be upper part of the BERACHAIN, which can negotiate liquidity and future reward allocation plans in advance with liquidity providers in a transparent environment.

-

RFA (Request for Application), RFC (Request for Community): After the Berachain main web is launched, plans to allocate $ BERA tokens in projects that actively develop or build communities in the ecology. The selected RFA and RFC will continue to contribute to the ecology by using the assigned tokens to promote preliminary ecological activities and liquidity activities to distribute to ecological users.

These plans can speculate that BERAChain will show rapid growth after the main network is launched. Therefore, users who plan to participate in early ecology can pay close attention to the movement of RFA and RFC projects to formulate their strategies to participate in the ecology.

At present, the Pre-Boyco vaults operated by protocols such as Stakestone, Ether.Fi, and Ethena, and the Boyco vault launched on January 28 have obtained a 2% initial $ BERA token supply. As of January 31st, the total deposit cumulative deposits of these vaults have reached 2.35 billion U.S. dollars. If these mobile funds are directly used by ecological agreements after the main network is launched, BERACHAIN's TVL will be higher than the 8th SUI currently ranked 8th.

With the approaching date of the end of Boyco on February 3, users estimate that in the last few days, the funds will be deposited into the high -income vaults to promote the further increase in total TVL. In addition, considering the POL structure of BERACHAIN encourages flowing funds and returns the profit generated to the Internet, after the launch of the main network, we estimate that the online TVL will also increase significantly from the current number.

However, we cannot accurately say that this attempt to enhance this structure with ecological priority, and to strengthen this structure through Boyco and RFA/RFC, which can perfectly ensure the long -term sustainability of BERACHAIN. Nevertheless, the ecological and community cases that BERAChain successfully built before the main network was launched is quite rare in the blockchain industry. Therefore, for projects that will be launched in the future, it will definitely become an important reference case.

chaincatcher

chaincatcher

jinse

jinse