Overview of Global Licenses for Cryptocurrency Assets (1): Europe and the United States

Reprinted from panewslab

01/03/2025·3MIn the booming wave of global financial technology, the virtual currency asset market has increasingly become the focus. Different countries and regions have established their own unique regulatory frameworks and licensing systems based on their own financial systems, regulatory objectives and market needs.

This article will delve into the licensing situation of major countries in Europe and the United States (the United States, the United Kingdom, Canada, and Switzerland) in the regulation of virtual currency assets, and analyze in detail their regulatory systems, policies and regulations, as well as the application requirements and scope of application for various licenses, and provide relevant practitioners with Provide comprehensive and accurate information reference for , investors and those who are concerned about the supervision of virtual currency assets.

USA

(1) Overview of the U.S. virtual currency regulatory system

The U.S. virtual currency regulatory system is known for its complexity and multi-layered nature, covering multiple federal and state-level regulatory agencies. These institutions implement corresponding regulatory measures based on the different functions, properties and uses of virtual currencies. The following is a detailed review of the U.S. virtual currency regulatory framework and major institutions.

1. Federal level regulation

(1) Securities law supervision: The U.S. Securities and Exchange Commission (SEC) plays an important role in the regulation of virtual currencies and is mainly responsible for examining whether virtual currencies constitute securities. If a virtual currency meets the criteria of the Howey test (investment contract test), such as raising funds through an ICO (initial coin offering), it is considered a security and must comply with the relevant provisions of the Securities Act. In recent years, the SEC has taken enforcement actions against multiple unregistered ICOs and certain cryptocurrency trading platforms to maintain market order and investor interests.

(2) Commodity law supervision: The U.S. Commodity Futures Trading Commission (CFTC) defines mainstream virtual currencies such as Bitcoin and Ethereum as commodities and regulates their derivatives markets (such as futures and options). Although the CFTC has limited direct supervision of the spot market, it has enforcement powers for market manipulation and fraud to ensure market fairness and transparency.

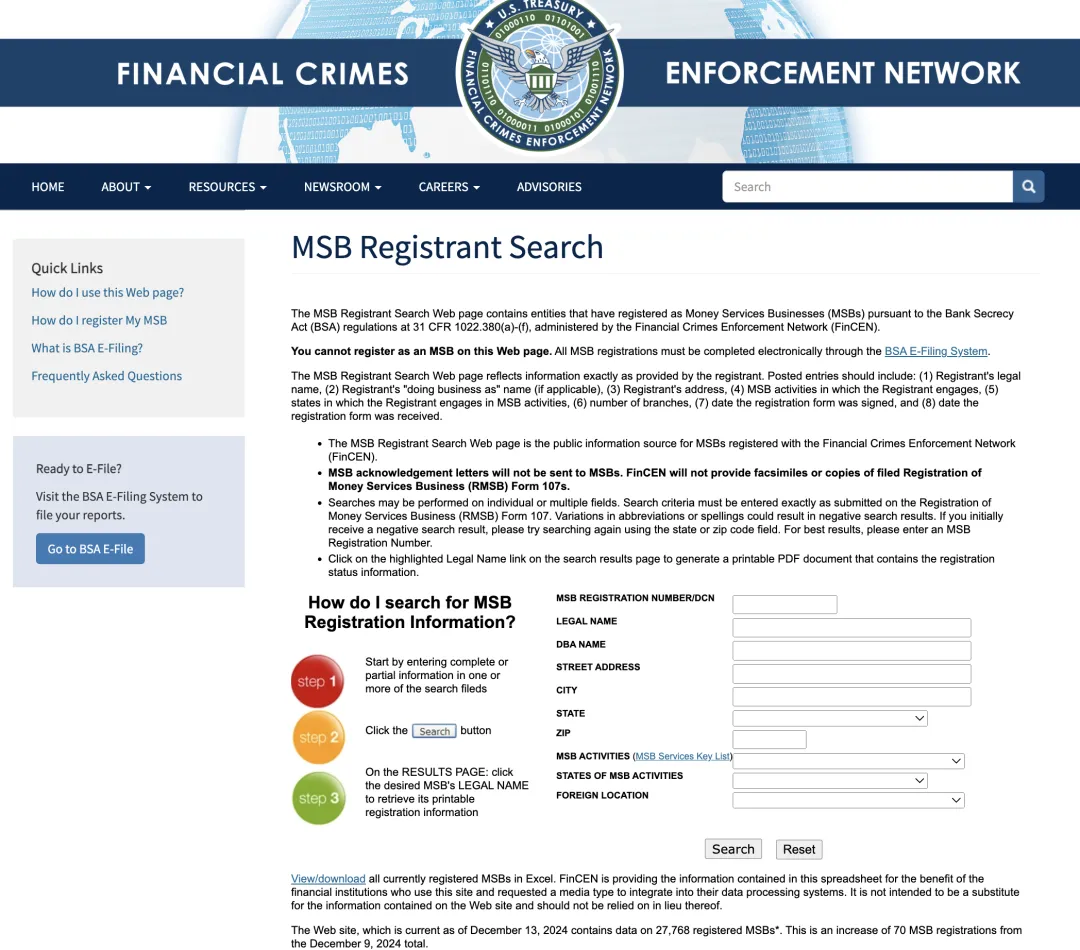

(3) Anti-money laundering and counter-terrorist financing (AML/CFT) supervision: The Financial Crimes Enforcement Network (FinCEN) is the main agency responsible for anti-money laundering and counter-terrorist financing supervision. It requires virtual currency exchanges and custody service providers to register as money services businesses (MSBs) and comply with relevant provisions of the Anti-Money Laundering Act (AML) and the Bank Secrecy Act (BSA). These businesses are required to implement customer due diligence (KYC) procedures and report suspicious transactions to prevent illicit financial flows.

(4) Tax regulation: The U.S. Internal Revenue Service (IRS) treats virtual currencies as property rather than currency and levies capital gains tax on their holdings and transactions. Additionally, using virtual currency to pay for goods or services may also create a taxable event. IRS tax supervision ensures the tax compliance of virtual currency transactions and provides the government with a stable source of tax revenue.

2. State-level regulation

There are significant differences in attitudes and regulations regarding virtual currencies across the United States. Among them, New York State’s BitLicense is one of the strictest regulatory frameworks, requiring virtual currency businesses to apply for a license and meet specific compliance requirements. Some states have adopted looser regulatory policies to attract cryptocurrency companies.

This interstate regulatory disparity poses challenges to virtual currency businesses and has prompted the U.S. government to seek to promote a unified national virtual currency regulatory framework.

(2) Important policies and legislation

1. "Digital Asset Market Structure Bill" (draft): This bill aims to clarify the regulatory boundaries of securities and commodity cryptoassets and provide legal protection for the healthy development of the virtual currency market. By clarifying regulatory scope and standards, the bill helps reduce the risk of regulatory arbitrage and cross-market manipulation.

2. Digital Tax Compliance Act (DAC8): This bill focuses on the tax transparency of virtual currency transactions and requires virtual currency exchanges and wallet providers to report transaction information to tax authorities. This will help combat tax evasion and improve tax compliance.

3. Executive Order: In 2022, the Biden administration issued the "Executive Order on the Development of Digital Assets," emphasizing promoting innovation and strengthening consumer protection. The executive order requires various regulatory agencies to strengthen coordination and cooperation to promote the healthy development of the virtual currency market and protect the legitimate rights and interests of consumers.

(3) Main licenses: MSB, BitLicense

1. Money Services Business (MSB) License

Money Service Business is a registration and regulatory requirement imposed by a government or regulatory agency for companies that provide financial services such as money transfer, payment services or currency exchange.

Regulator : Financial Crimes Enforcement Network (FinCEN), a division of the U.S. Department of the Treasury

Scope of application : (1) Money Transmission: Provides services for transferring funds from one place to another. For example, cross-border payments via banks, wire transfers, or online platforms. (2) Currency Exchange: Provides exchange services between currencies, such as converting US dollars into euros, RMB into US dollars, etc. (3) Issuance and sales of payment instruments: For example, companies that provide traveler's checks, prepaid cards or e-wallet recharge services. (4) Digital currency services: including cryptocurrency transactions, wallet services, exchange and transactions of Bitcoin or other digital currencies.

Require :

(1) Registration : Businesses must register as an MSB with FinCEN and comply with the Bank Secrecy Act (BSA) and Anti-Money Laundering (AML) regulations.

(2) Compliance plan : Develop and implement an effective AML compliance plan, including customer due diligence (KYC) and suspicious activity reporting.

(3) Reporting obligations : Submit reports to FinCEN regularly, such as large cash transaction reports and suspicious activity reports.

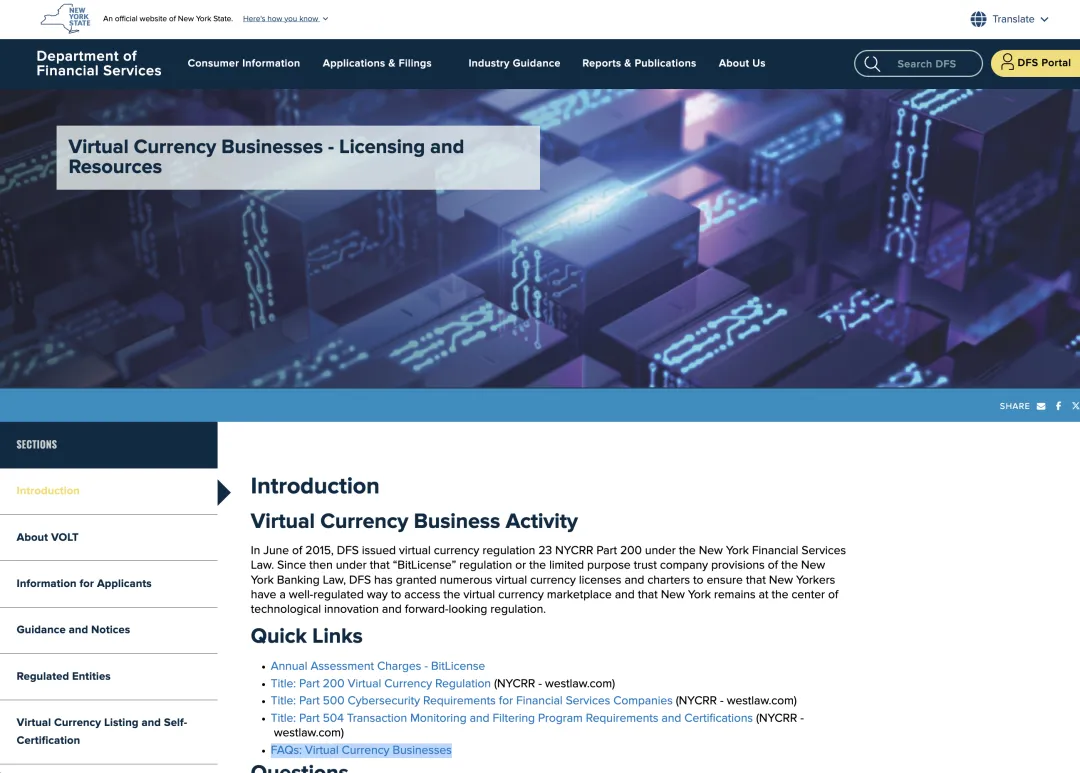

2. New York State Virtual Currency License (BitLicense)

BitLicense, "New York State Department of Financial Services Virtual Currency License ", is a regulatory framework launched by the New York State Department of Financial Services (NYDFS) in 2015, specifically used to regulate companies engaged in virtual currency- related businesses in New York State. Applications are divided into the following two types according to the specific business activities of the company:

·Virtual Currency License : License for basic virtual currency business. This type of license is suitable for businesses that do not involve the transmission of fiat currency.

·Virtual Currency and Money Transmitter License : Applicable to companies that not only make virtual currencies, but also involve converting virtual currencies into legal tender or making transfers.

Regulator : New York State Department of Financial Services (NYDFS)

Scope of application : Companies engaged in virtual currency business in New York State, the business scope includes (1) the receipt, storage and transfer of virtual currency. (2) Virtual currency exchange: Exchange virtual currency into US dollars or other currencies, or vice versa. (3) Virtual currency trading: buying and selling virtual currency transactions such as Bitcoin. (4) Payment processing: services that use virtual currency for payment.

Require :

(1) Capital requirements: Meet the minimum capital requirements stipulated by NYDFS to ensure financial soundness.

(2) Compliance plan: Establish a comprehensive compliance and risk management plan, including AML, KYC and cybersecurity measures.

(3) Reporting obligations: Regularly submit financial and compliance reports to NYDFS.

U.K.

(1) The main regulatory framework in the UK

The UK (and Switzerland below) is a non-EU member state and has its own independent legal framework for virtual assets, which is not under the MicA framework of EU member states.

1. Anti-Money Laundering (AML) and Counter-Financing of Terrorism (CFT)

Under the Anti-Money Laundering Regulations 2017 (as amended in 2020), all virtual currency businesses must register with the FCA.

Enterprises need to meet: Customer Due Diligence ( KYC ) : verify user identity and assess transaction risks. Suspicious Transaction Report (SAR) : Prompt reporting of suspicious transactions to regulatory agencies. Compliance Program : Establish internal control processes to comply with AML/CFT regulations.

2. Consumer protection

Cryptocurrencies themselves are not considered legal tender or financial instruments and therefore user funds are not protected by the Deposit Protection Scheme (FSCS). The FCA has imposed a ban on some crypto derivatives (such as contracts for difference, options, etc.) to prevent retail investors from suffering heavy losses due to high volatility.

3.Tax policy

Capital Gains Tax (CGT) : The sale of virtual currency may incur capital gains tax. Income Tax : Profiting from mining or receiving virtual currency payments may be subject to income tax. Value Added Tax (VAT) : Certain virtual currency transactions are subject to VAT, but virtual currency used for payment is generally exempt from VAT.

4. Stablecoin supervision

The UK plans to impose stricter regulations on stablecoins, especially those used as a means of payment.

· The Bank of England regards stablecoins as a potential systemic risk and proposes requirements for reserve asset transparency and operational audits.

5. Market abuse and fraud crackdown

· The FCA warns investors of the high risks of virtual currency-related investments and encourages transactions through registered service providers.

· Companies that are not registered or licensed may be placed on the FCA's warning list.

- 1. Financial Conduct Authority (FCA)

· The FCA is the core agency for virtual currency regulation in the UK.

· Regulated businesses include: cryptocurrency exchanges, custodial wallet service providers, etc.

- 2. Bank of England (BoE)

· Regulate stablecoins and payment systems.

· Pay attention to risks related to financial stability and take a leading role in future central bank digital currency (CBDC) research.

-

3. HM Revenue and Customs (HMRC)

-

Responsible for tax policies related to virtual currencies, including capital gains tax and value-added tax.

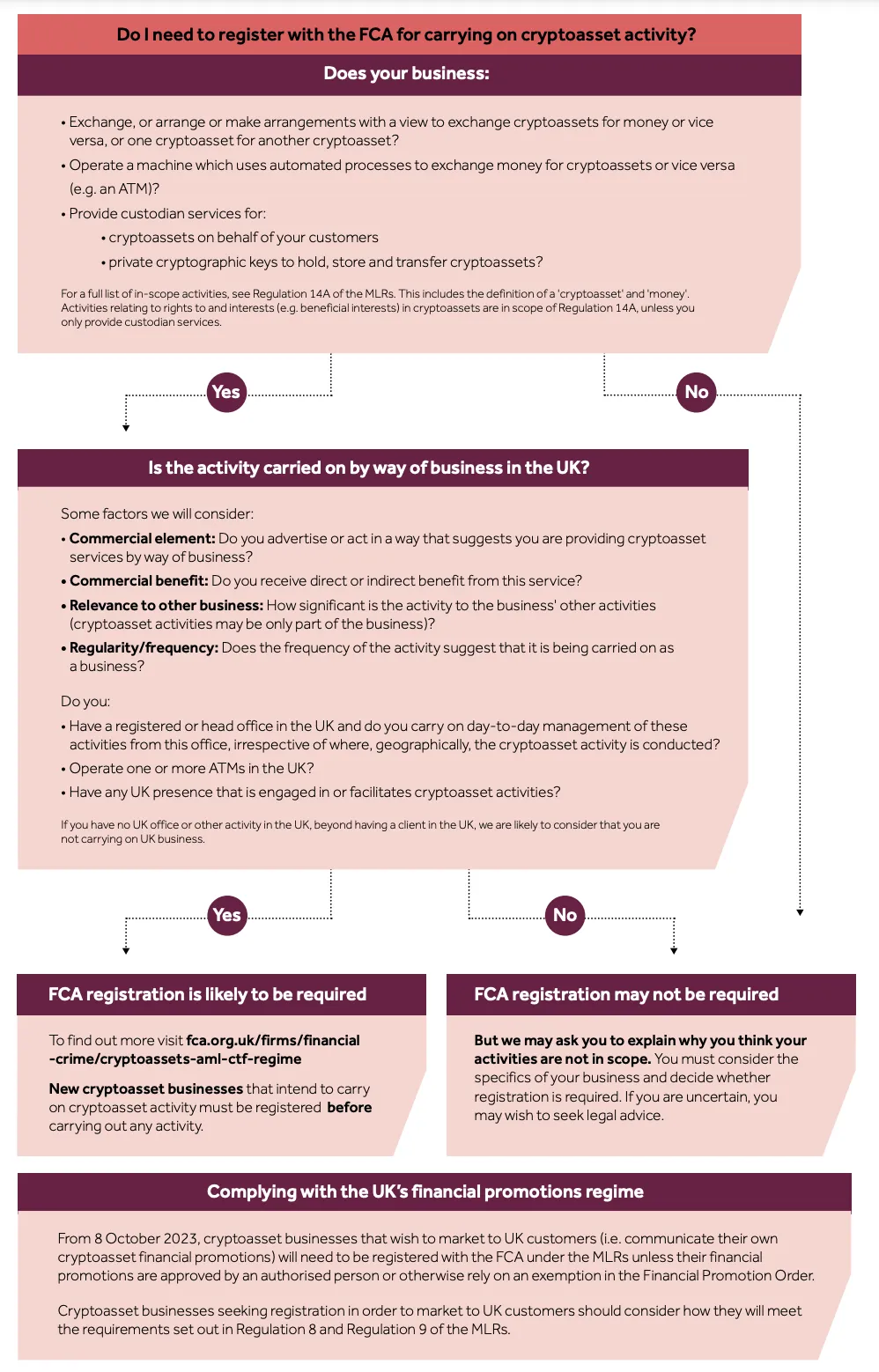

(3) Main license: Virtual asset service provider registers with FCA

The FCA's Virtual Asset Service Provider (VASP) is a license established by the British government in accordance with the Anti-Money Laundering Regulations 2017 (revised in 2020). Companies engaged in virtual asset-related businesses are required to register with the FCA (Financial Conduct Authority) and accept supervision. Its core goals are to prevent money laundering and terrorist financing while promoting transparency and compliance in the virtual asset industry.

1. Enterprises that need to apply for a VASP license include:

(1) Virtual currency exchange:

· Provide legal currency and cryptocurrency exchange services.

· Provide exchange services between cryptocurrencies (such as transactions between Bitcoin and Ethereum).

(2) Custody wallet service provider:

· Provide services for hosting virtual assets, including storing private keys and protecting the security of digital assets.

(3) Other virtual asset services:

· Involving ICO/IEO (Initial Coin Offering), token sales and other related activities.

2. When applying for a virtual asset service provider license, companies must meet the following requirements:

(1) Anti-money laundering (AML) and counter-financing of terrorism (CFT) compliance

· Companies must develop and implement a comprehensive anti-money laundering and counter-terrorist financing plan, including:

Customer Due Diligence ( KYC ) : Verify customer identity and monitor transaction activities.

Suspicious Activity Report (SAR) : unusual transactions must be reported to the FCA.

Risk Assessment : Conduct dynamic risk assessments of customer and business relationships.

Data retention : Keep transaction and KYC records for at least 5 years.

(2) Senior management team review

- The FCA will conduct a “Fit and Proper” test on the company’s management:

Managers need to have compliance experience and a strong ethics record.

A clean criminal record and financial background check results are required.

(3) Funding and resource requirements

-

Applicants must demonstrate that they have sufficient financial resources and technical capabilities to support operations.

-

A clear business model and compliant funding plan are required.

(4) Appointment of Compliance Officer

- Enterprises need to appoint a Compliance Officer (Compliance Officer), who is responsible for supervising the implementation of AML/CFT policies and reporting to the FCA.

(5) Network security and technical requirements

-

Companies need to prove that their IT systems and network security measures meet industry standards and can protect customer funds and sensitive information.

-

Conduct regular security audits and stress tests.

(6) Consumer protection

-

It is necessary to ensure that customer assets are separated from the company's operating funds.

-

Service terms and potential risks need to be clearly disclosed to customers.

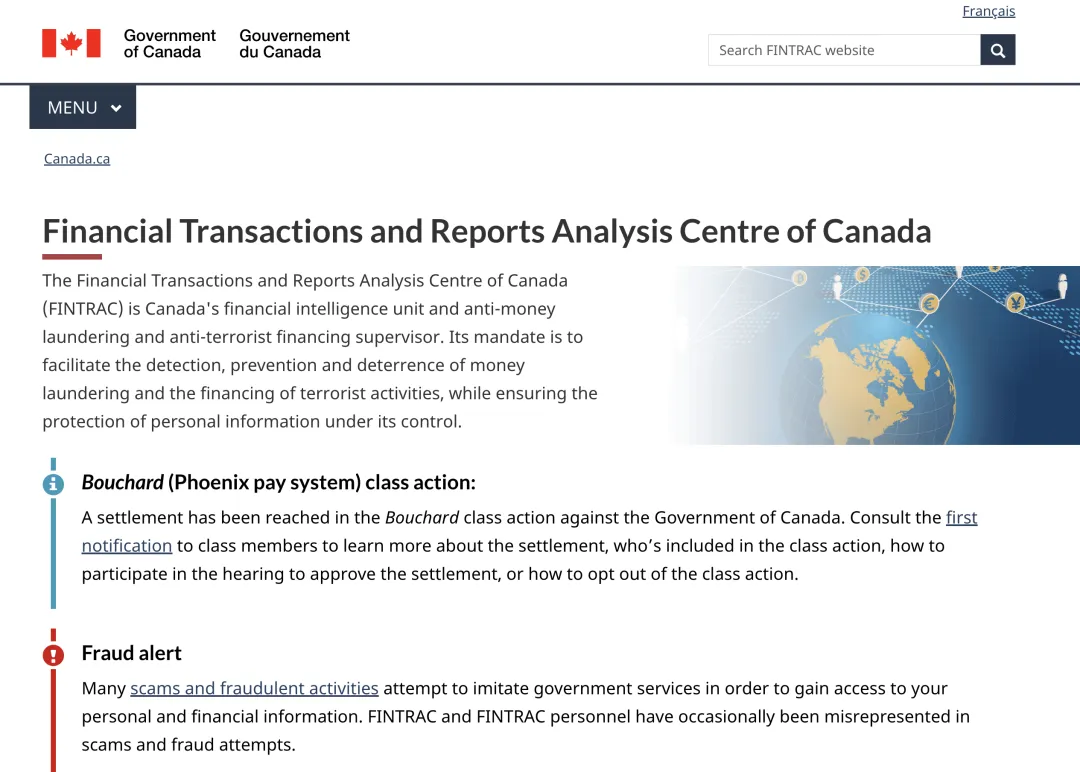

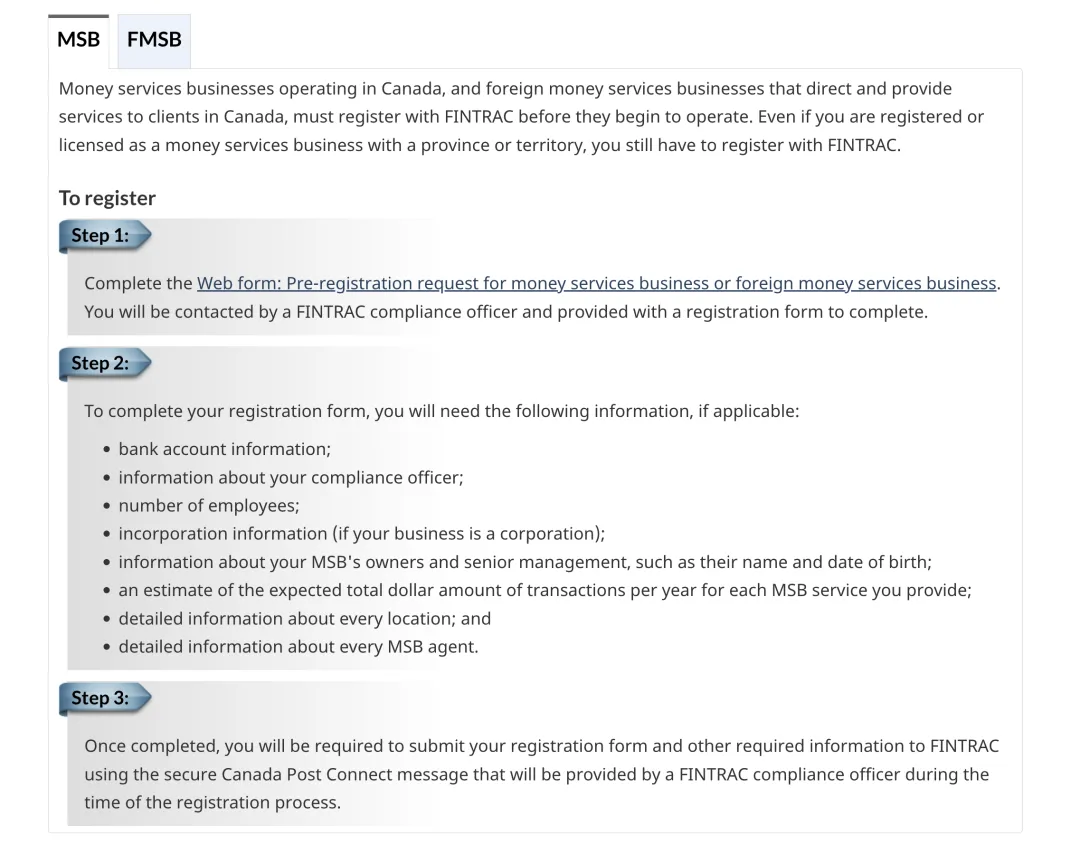

Canadian MSB license

(1) Canada’s key regulatory framework

1. Money Services Business (MSB) Registration

Effective June 1, 2020, Canada has included virtual currency service providers (VASPs) in the definition of MSB, including:

· Provide virtual currency and legal currency exchange services.

· Provide exchange services between virtual currency and virtual currency.

· Provide virtual currency transfer services.

2. Securities laws apply

Virtual currencies may be regarded as securities or derivatives, and the following businesses must comply with relevant securities regulations:

·Crypto-asset exchanges : need to register with provincial securities regulatory authorities.

·Token Issuance (ICO/IEO) : If the token has the nature of an investment contract, it must comply with securities regulations.

Investment management : Investment funds involving virtual assets require investment manager registration.

3.Tax policy

The Canada Revenue Agency (CRA) treats virtual currencies as commodities rather than legal tender, subject to the following tax requirements:

·Capital gains tax : Capital gains must be declared on the sale or exchange of virtual currencies.

·Income tax : Mining income or accepting virtual currency payments must be included in taxable income.

·Goods and Services Tax (GST)/Sales Tax (HST) : Certain virtual currency transactions may apply.

4. Consumer protection

· Canada requires virtual asset platforms to protect user funds, usually using a custody mechanism.

· Platforms must clearly disclose transaction risks and prohibit misleading publicity.

5.International cooperation

· Canada complies with the Financial Action Task Force (FATF) virtual asset regulatory standards to ensure consistency with the international AML/CFT framework.

(2) Main regulatory agencies

1. Financial Transactions and Reports Analysis Center of Canada (FINTRAC)

·Responsibilities : Responsible for the anti-money laundering and anti-terrorist financing supervision of virtual currency service providers (VASPs).

·Registration requirements : All companies engaged in the business of trading or transferring virtual currencies must register with FINTRAC as a money services business (MSB).

2. Canadian Securities Administrators (CSA)

·Responsibilities : Supervise crypto asset activities involving securities or investment contracts (such as exchanges, investment platforms, etc.).

·Scope of application : When virtual currencies are regarded as securities, they must comply with the requirements of the Securities Law.

3. Provincial financial regulatory agencies

· For example, the Ontario Securities Commission (OSC) implements direct supervision of crypto-asset platforms in the province.

(3) Main license: MSB

The Financial Transactions and Reports Analysis Center of Canada (FINTRAC) has included virtual currency-related businesses within the regulatory scope of the Money Service Business (MSB) license . Companies holding MSB licenses are required to comply with relevant regulations on anti-money laundering (AML) and counter-financing of terrorism (CFT).

1. Scope of application

The following businesses need to apply for an MSB license:

(1) Provide exchange services between virtual currency and legal currency.

(2) Provide exchange services between virtual currency and virtual currency.

(3) Provide virtual currency transfer services (such as transfer, payment, clearing).

(4) Provide any other related financial services involving virtual currencies.

2. License application requirements

To apply for an MSB license, you must meet the following conditions and requirements:

(1) Registration requirements

·Register with FINTRAC : Any company engaged in the virtual currency business needs to register as an MSB.

· Registration application needs to be completed before the company can start business.

(2) Anti-money laundering and counter-terrorist financing compliance (AML/CFT)

Businesses must develop and implement an AML/CFT compliance plan, including:

·Risk assessment : Assess the risks of money laundering and terrorist financing based on the business model.

·Customer Due Diligence ( KYC ) :

Verify customer identity (proof of identity, proof of address, etc.).

Monitor customer transactions and identify suspicious behavior.

·Record retention : Keep all transaction records and customer information for at least 5 years.

·Reporting Obligations : Suspicious Transaction Reporting (STR) : Identifies and reports unusual transactions.

Large virtual currency transaction reporting : Transactions with a single transaction amount exceeding 10,000 Canadian dollars need to be reported to FINTRAC.

·Appointment of Compliance Officer : Designate a Compliance Officer to oversee the implementation of the compliance plan.

(3) Technical and safety requirements

· Secure technical measures need to be adopted to protect customer assets and data.

· Conduct regular network security audits to ensure that technical systems comply with industry standards.

(4) Capital and financial requirements

· It is necessary to prove that the company has sufficient financial resources to support operations.

· Ensure the separation of client funds and company funds to avoid conflicts of interest.

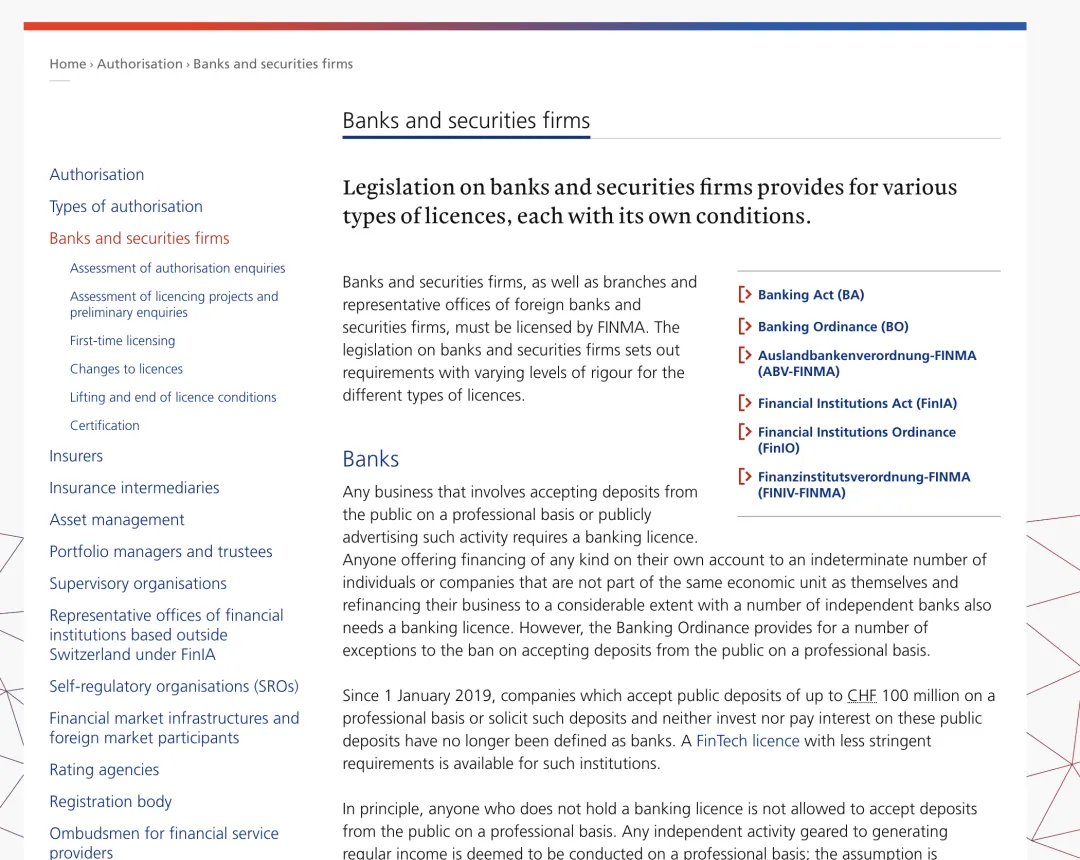

Switzerland

Switzerland is known as a “cryptocurrency and blockchain paradise” with a regulatory framework that supports innovation while focusing on financial stability and anti-money laundering (AML) requirements. Switzerland adopts the principle of technology neutrality and adjusts existing laws and regulations to cover virtual currency and blockchain-related businesses.

(1) Switzerland’s key regulatory framework

Switzerland’s regulatory framework is based on existing financial regulations and is mainly divided into the following categories:

1. Anti-money laundering and counter-terrorist financing (AML)

· All businesses involved in virtual currency exchange, trading, custody or transfer services are required to comply with AML regulations.

· Businesses must:

Register as a financial intermediary (via FINMA or a designated self-regulatory organization).

Implement customer due diligence (KYC).

Report suspicious transactions (STR).

2. Financial Markets Infrastructure Act (FMIA)

· Tokens involving securities (such as stock tokens or bond tokens) are regulated by the FMIA.

· Any enterprise that provides a trading platform or custody service must meet the requirements of securities trading or financial market infrastructure.

3. Cryptoasset classification

FINMA divides virtual assets into the following three categories:

(1) Payment tokens: mainly used for payment or transfer, such as Bitcoin and Ethereum; subject to anti-money laundering regulations, but not considered securities.

(2) Utility Tokens: Provide access to blockchain applications or services; considered securities only when used as investment tools.

(3) Asset Tokens: Represent rights to assets (such as debt, equity or real assets); subject to securities regulations.

4. Blockchain and DLT Act

·Introducing the legal status of DLT securities : giving securities issued on DLT the same legal status as traditional securities.

· Custody and bankruptcy protection : Clarify the legal responsibilities of the DLT asset custodian and provide bankruptcy protection for the crypto assets under custody.

(2) Main regulatory agencies

1.Swiss Financial Market Supervisory Authority (FINMA)

·Responsibilities : Responsible for the supervision of virtual currency businesses involving financial markets and financial services, especially enterprises involving securities, payments and banking services.

·Supervision core :

Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT).

Investor protection and market integrity.

Compliant with the Swiss Financial Markets Infrastructure Act (FMIA) and the Anti-Money Laundering Act (AMLA).

2. Swiss National Bank (SNB)

·Responsibilities : Pay attention to the potential impact of virtual currencies on monetary policy and financial stability.

3. Implementing agency of the Blockchain and Distributed Ledger Technology ( DLT ) Act

· Switzerland passed the Distributed Ledger Technology Act (DLT Act), standardizing the legal status of DLT and crypto assets.

(3) Main license: FINMA

The Swiss Financial Market Supervisory Authority (FINMA) is responsible for managing and issuing various licenses related to virtual assets and financial services.

1.Banking License

Scope of application: Providing deposit services, encrypted asset custody, and services related to legal currency exchange. Cryptocurrency exchanges or platforms generally require this license if they hold customer funds.

Main requirements:

·Minimum capital requirement : minimum capital of CHF 10 million.

·AML compliance : Implement anti-money laundering (AML) and customer due diligence (KYC) programs.

·Risk management : effective risk control system and internal audit mechanism.

·Separation of customer funds : Customer funds must be strictly separated from company funds to ensure the safety of funds.

Regulatory advantages: After obtaining a banking license, companies can legally handle customer funds and attract more institutional investors.

2. Securities Dealer License

Scope of application

· Trading platforms, brokers or token issuers involving security tokens (such as asset tokens).

· Provide clients with securities trading, matching services or sales of tokenized assets.

Main requirements

·Capital requirement : minimum CHF 1.5 million.

·Regulatory reporting : regularly submit transaction reports and financial data to FINMA.

·Transparent operations : Ensure that the platform or service complies with the transparency and fairness requirements of the Financial Market Infrastructure Act (FMIA).

·Compliance program : Establish a strong internal compliance program to manage market risks and money laundering risks.

3. FinTech License

Scope of application

· For enterprises involved in innovative financial technologies, such as providing blockchain technology, smart contract services or DLT platforms.

Businesses are allowed to accept customer deposits of up to CHF 100 million , but they cannot be used for loans or interest payments.

Main requirements

·Capital requirement : at least CHF 300,000.

·Compliance obligations : Comply with AML regulations; implement strong KYC policies.

·Customer fund protection : Provide fund custody protection and clarify the scope of fund use.

·Technical standards : Ensure the security and stability of the technology platform.

·Applicable advantages: Designed specifically for small innovative companies, lowering the high threshold for traditional bank licenses.

4. Asset Management License

Scope of application

· Aimed at companies that provide virtual assets or traditional financial asset management.

· Including fund management companies or companies that manage tokenized assets.

Main requirements

·Capital requirements : Depending on the size of assets under management, capital requirements usually range from CHF 500,000 to CHF 2 million.

·AML Compliance : Implement anti-money laundering and counter-terrorist financing policies.

·Reporting and Transparency : Regularly report asset management activities to FINMA.

·Customer fund custody : Ensure safe custody of customer funds and meet bankruptcy protection requirements.

Regulatory advantages

· Attract high-net-worth customers and institutional investors and enhance corporate credibility.

Mankiw Lawyer Summary

European and American regions show diversified characteristics in the supervision of virtual currency assets.

· The United States has established a complex multi-level regulatory system, covering the federal and state levels, and has clarified the scope of regulation through various bills. Its main licenses, such as MSB and BitLicense, are applicable to different virtual currency businesses respectively, and are very important to enterprises in terms of registration, compliance, There are strict requirements in reporting and other aspects.

· The UK, with the FCA as its core regulatory agency, supervises virtual currency companies based on various regulations such as anti-money laundering, consumer protection, tax policy, etc. Its virtual asset service providers’ registration with the FCA license requires companies to meet compliance standards in multiple dimensions. , to prevent money laundering, protect consumer rights, etc.

· Canada has included virtual currency service providers in the definition of MSB. It is supervised by FINTRAC and other agencies and has regulations on currency service business registration, application of securities laws, tax policies, etc. Its MSB license application involves registration, compliance, technology and capital, etc. Various requirements.

· Switzerland uses FINMA as the main regulatory agency to build a regulatory framework based on existing financial regulations and conduct classified supervision of virtual currencies. The banking licenses, securities brokerage licenses, financial technology licenses and asset management licenses issued by it have different scopes of application and requirements. It has special emphasis and is applicable to different types of virtual currency-related businesses, providing a variety of options for companies to conduct compliance business in Switzerland.

Generally speaking, the regulatory measures in these countries aim to balance innovation and risks in the virtual currency market, protect the rights and interests of investors, and maintain financial market stability. As the virtual currency market continues to develop, regulatory policies will continue to evolve and improve.

jinse

jinse

chaincatcher

chaincatcher