PA Daily | Binance, OKX and other mainstream exchanges are about to launch BIO; Sonic SVM and Solayer are about to issue tokens

Reprinted from panewslab

01/03/2025·3MToday’s news tips:

SWARMS broke through $0.2, rising 60.8% in 24 hours

Matrixport: Bitcoin may be strong in 2025, but may see a correction in 2026

Greeks.live: 20,000 BTC and 206,000 ETH options expire, lacking more benefits in the short term

MetaPlanet plans to exceed 10,000 Bitcoin holdings by 2025

DWF Labs invested in TAO Cat, and TAOCAT rose over 31% in a short period of time

Sonic SVM is now open for SONIC air investment qualification inquiry

OKX will launch BIO (BIO Protocol) spot trading

Regulation/Macro

Dennis Porter, co-founder and CEO of Satoshi Action Fund (SAF), posted on the X platform that at least 13 states in the United States are enacting legislation related to "strategic Bitcoin reserves." January is shaping up to be a record-breaking month for Bitcoin policy.

South Korea’s Public Security Bureau stops execution of Yoon Seok-yue’s arrest warrant

According to Yonhap News Agency, due to the ongoing confrontation, the South Korean Public Officials Crime Investigation Service stated that it would stop executing the arrest warrant at 1:30 pm local time today (January 3), which is 12:30 noon Beijing time. At present, the Public Investigation Department and police officers who executed the arrest warrant have left the presidential palace.

The court had approved FTX’s Chapter 11 reorganization plan to take effect on January 3, 2025, and set today as the record date for the first distribution. BitGo and Kraken have been designated as FTX distribution partners and will assist customers and creditors in distributing recovery funds. Users need to complete requirements including KYC verification, tax form submission, and docking with designated service providers. Claiming users are required to complete necessary steps in a timely manner to ensure a smooth distribution process. The first distribution is expected to be completed within 60 days of the effective date.

MetaPlanet plans to exceed 10,000 Bitcoin holdings by 2025

According to CoinDesk Japan, Japanese hotel development and operation company MetaPlanet plans to increase its Bitcoin holdings to more than 10,000 in 2025, aiming to become one of the top ten Bitcoin holding companies in the world. As of the end of 2024, the company held 1,762 Bitcoins, worth approximately $262 million. MetaPlanet continues to purchase Bitcoin through the issuance of stocks and bonds, positioning it as a core asset for corporate financial management. At the same time, the company plans to promote Bitcoin education and popularization through the transformation of its hotel brands into "Bitcoin Hotels" and the launch of "Bitcoin Magazine Japan".

Musk posted a picture related to crypto investment to tease the IRS about tax complications

Musk posted a photo comment in an apparent humorous dig at the complex issues surrounding cryptocurrency investing and taxes. The images depict investors experiencing high returns in different crypto projects, being "run away" and trying to claim tax deductions from the tax office, highlighting the high risks and complexities of the crypto space while also eliciting in a satirical way discussed tax issues.

Today is the 16th anniversary of the birth of the Bitcoin genesis block

The Bitcoin genesis block was dug out by Satoshi Nakamoto on the afternoon of January 3, 2009 (02:15:05 on January 4, 2009, Beijing time). The block reward is 50 BTC. As of today, it has been 16 years after its birth, the current total block height of Bitcoin reaches 877566. In the genesis block, Satoshi Nakamoto recorded the Times’ front page headline of the day in the CoinBase data of the genesis block: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks (The Chancellor is standing On the verge of a second bailout of the banking sector).”

According to Cango Inc.'s announcement, the company's Bitcoin output reached 569.9 in December 2024, an increase of 56% from 363.9 in November. At the end of the month, Bitcoin holdings increased to 933.8 coins, and no Bitcoin was sold during the period. The company's average computing power reached 30.4 EH/s, an increase of 2% month-on-month.

According to Cointelegraph, Terraform Labs co-founder Do Kwon has been charged with a new crime: money laundering conspiracy. This is a new charge in the superseding indictment unsealed on January 2 by the U.S. District Court for the Southern District of New York. The indictment states that Do Kwon conspired with others to facilitate financial transactions involving more than $10,000, knowing that the transactions involved illegal proceeds. Kwon has previously been charged with eight felonies for his role in the collapse of the Terra ecosystem in 2022, and was arrested in Montenegro in 2023 for forging travel documents. After an extradition dispute between the United States and South Korea, Kwon was handed over to the United States in December 2024. Currently, Kwon has pleaded not guilty to all charges when he appeared in court on January 2 and agreed to be detained. Whether a plea deal or a criminal trial will be reached remains uncertain. The case has similarities to that of former FTX CEO Sam Bankman-Fried, who was extradited and later sentenced to 25 years in prison.

Financing

DWF Labs invested in TAO Cat, and TAOCAT rose over 31% in a short period of time

DWF Labs announced an investment in TAO Cat as part of its $20 million AI Agent Fund, designed to support the development of the next generation of AI agents. Perhaps affected by this, TAOCAT rose 31% in the short term and is now quoted at $0.05231. It is reported that TAO Cat is jointly supported by Bittensor and Virtuals and built by Masa.

Project news

The content-driven entertainment game blockchain XPLA officially announced its 2025 roadmap, focusing on four core pillars: MXGA plans to promote ecological expansion, global player community building, cross-chain interconnection, and token economic structural adjustment. Specific measures include: The implementation of the third phase of the MXGA plan will expand the application scenarios of XPLA tokens, such as in-game purchases, NFT leasing, staking and issuance of Meme coins, etc., and plans to launch 30 DApps in the first half of 2025. In addition, XPLA GAMES will be reshaped into a new Web3 game platform in the first quarter to support large-scale Web3 games and optimize user experience. In terms of cross-chain interconnection, XPLA plans to achieve interoperability with the Ethereum and Ripple ecosystem through technologies such as zk chain and LayerZero. XPLA will reorganize the token economy, including measures such as token destruction and community pool distribution. It was previously reported that Aethir will cooperate with XPLA to launch a US$10 million game project ecosystem funding plan.

Sonic SVM is now open for SONIC air investment qualification inquiry

Sonic SVM, the SVM blockchain on Solana, announced that it will soon open the initial claim of $SONIC. Users can check whether they are eligible to receive it through SONIC Eligibility Checker. It has been previously reported that 57% of the total SONIC tokens will be distributed to the community, and TGE is scheduled for January 7, 2025.

OKX will launch BIO (BIO Protocol) spot trading

Oyi announced the upcoming launch of BIO (BIO Protocol), which is the financial layer of decentralized science (DeSci). It aims to accelerate the flow of capital and talents into on-chain science and create shared intellectual property ownership among members. The specific timetable for going online is as follows: • Deposit time: 1:30 pm on January 3, 2025 (UTC+8) • Call auction time: 5:15 to 6:15 pm on January 3, 2025 (UTC+8) • BIO/USDT spot trading opening time: 6:15 pm on January 3, 2025 (UTC+8) • Withdrawal time: January 3, 2025 10:00 pm (UTC+8).

Binance: BNSOL Super Pledge will be launched on the 4th phase of the project EOS Network (EOS)

Binance announced the launch of the fourth BNSOL super pledge project in partnership with EOS Network. From January 6 to January 20, 2025, users who hold BNSOL or pledge SOL through their Binance account and wallet to generate BNSOL can receive additional EOS APR reward airdrops. Reward details: Total reward pool: 320,656.41 EOS; Daily reward: 21,377.09 EOS.

BounceBit launches on-chain stock trading function, the first assets include MSTR and COIN

BounceBit announced the launch of the RWA trading function to support tokenized securities on its BounceClub Quanto platform. The first listed assets include $MSTR (MicroStrategy), $COIN (Coinbase) and $BB (BlackBerry). Users can use $BB tokens as collateral to trade with up to 200x leverage. The trading hours are synchronized with the U.S. stock market, from 9:30 am to 4:00 pm Eastern Time, and the market is closed on weekends and U.S. holidays. This feature is not available for US users.

The Seraph Foundation announced that it will officially launch TGE at 20:00 (UTC+8) on January 6, 2025, and launch the S1 Genesis Season simultaneously. As a AAA-level chain game that integrates blockchain and AI technology, Seraph aims to lead Web3 games into a new era. Details of its Seraph token economic model will be announced in a subsequent announcement.

According to Solayer official news, the Solayer Foundation website was officially launched and announced that it will launch the governance token LAYER. LAYER is an SPL-2020-based token designed to accelerate the expansion and protocol development of the Solana ecosystem. Token distribution will be conducted in three phases, with the first phase open to eligible participants and protocol partners, focusing on Solayer Staking (sSOL, endo and exo AVS), sUSD participants, and whitelisted ecosystem partners. The foundation will be committed to promoting the expanded research of distributed systems and targeting the hardware-driven SVM blockchain to support the efficient growth of the Solana ecosystem.

point of view

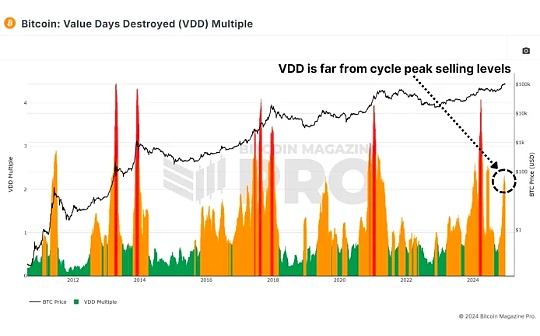

Matrixport: Bitcoin may be strong in 2025, but may see a correction in 2026

The latest weekly report released by Matrixport points out that 2025 may become a key turning year for Bitcoin. The report combines Chinese zodiac culture and Bitcoin's four-year cycle model and analyzes that the Year of the Snake (2025) symbolizes change, wisdom and hidden potential, which is consistent with Bitcoin's innovative characteristics and potential technological breakthroughs. The report mentioned that since the birth of Bitcoin in 2009, its four-year halving cycle has had a significant impact on market trends. 2025 may usher in further maturation of Bitcoin’s regulatory framework, as well as important technological advances, such as improved network scalability or energy efficiency improvements. These changes could give Bitcoin greater adaptability and long-term growth momentum while addressing some of the current market criticisms. In addition, the report predicts that Bitcoin may perform strongly in 2025, but may usher in a correction in 2026, which is consistent with the historical cycle pattern and the explanation of the Chinese zodiac. Analysts believe that 2025 may be a year full of opportunities and changes for the Bitcoin market.

Greeks.live: 20,000 BTC and 206,000 ETH options expire, lacking more benefits in the short term

According to Greeks.live analyst Adam, a total of 20,000 BTC options expired on January 3, with a Put Call Ratio of 0.69, the biggest pain point of US$97,000, and a nominal value of US$1.93 billion. At the same time, 206,000 ETH options expired, the Put Call Ratio was 0.81, the biggest pain point was US$3,400, and the nominal value was US$710 million. This delivery is the first weekly option delivery in 2025, with a total of US$2.6 billion in options expiring. As European and American users gradually return from the holidays, market enthusiasm has picked up. However, the market theme this week is still dominated by adjustments, and the hot spots are not sustainable. Later this month, the new U.S. President Trump will officially take office, and the market’s expectations for 2025 are relatively optimistic. However, the recent correction in U.S. stocks has brought uncertainty to the market. In addition, there is a high probability that the status quo will be maintained at this month's interest rate meeting, which means there is a lack of more positive news in the short term. Nonetheless, factors ranging from the in-depth integration of mainstream finance and the encryption market to the reserve of Bitcoin by the U.S. government and giant companies have brought long-term benefits to the encryption market, and 2025 may usher in more positive developments.

important data

SWARMS broke through $0.2, rising 60.8% in 24 hours

According to data from GMGN.AI, SWARMS, the AI agency project on the Solana chain, exceeded US$0.2, rose 60.8% in 24 hours, and continued to hit a record high. It is currently quoted at US$0.203, with a maximum price of US$0.2352, and its market value has exceeded US$200 million. According to previous news, Binance Alpha added swarms, TAOCAT, and degenai.

On-chain adoption rate hits record high in 2024, surpassing peak in 2021

Dune data shows that in 2024, the on-chain adoption rate will reach 2021 levels and hit new highs in terms of transfer volume and number of transactions: • Overall on-chain adoption rate: In December 2024, the Dune on-chain adoption index reached 77, second only to 2021 The peak in November was 84, and multiple weekly data have reached peak levels in 2021. • Fee decline: On-chain fees dropped from $2 billion in November 2021 to $500 million in December 2024. Reduced fees drive more transactions and adoption. • Transfer volume reaches a new high: At the end of 2024, on-chain transfer volume exceeded the record of US$730 million in January 2022, and reached US$817 million in December. The annualized transfer volume is close to US$10 trillion, which is equivalent to the scale of Visa. • The number of transactions surges: In December 2024, the number of on-chain transactions exceeded 1 billion for the first time, which was three times the peak in 2021.

BlackRock’s IBIT had a net outflow of approximately US$330.8 million yesterday

According to Tree News, daily capital outflows from BlackRock Bitcoin Trust (IBIT) were approximately US$330.8 million. Set a record for the largest single-day net outflow.

Circle issues an additional 300 million USDC and transfers them to Coinbase

According to on-chain data monitored by iChainfo, Circle has just issued an additional $300 million in USDC and transferred it to Coinbase-related addresses.

jinse

jinse

chaincatcher

chaincatcher