Panoramic analysis of Payfi industry (Part 1): rise, current situation and potential

Reprinted from panewslab

01/13/2025·29days agoAuthor: Kedar@Foresight Ventures, Alice@Foresight Ventures

In today's world, cross-border payments often take days, and businesses face billions of dollars in transaction fees. PayFi emerged as an innovative solution that combines the advantages of decentralized finance (DeFi) with the immediacy of modern payment systems, and is expected to reshape the future of transactions.

As the global financial landscape continues to evolve, PayFi has emerged at the intersection of blockchain technology and payment systems, committed to combining the efficiency of DeFi with the immediacy and convenience of modern payment solutions to revolutionize transaction methods. This article will deeply explore the reasons for the rise of PayFi, outline the current status of the industry in which it operates, list key cases, and explore its potential application scenarios.

1. The birth background and advantages of PayFi

1) Filling the gap between DeFi and payments

The traditional financial system has long-standing problems with settlement inefficiency, such as long settlement times, high transaction costs, and limited accessibility, which were exposed during the 2008 financial crisis. Although DeFi has introduced innovative financial services through decentralized platforms, there are shortcomings in real-time processing capabilities for daily transactions.

PayFi uses blockchain technology to achieve real-time settlement of transactions. Based on the time value of money (TVM) theory, that is, money currently available is more valuable than the same amount of money in the future because of its potential earning power. PayFi maximizes financial efficiency through instant, safe and low-cost transactions.

(2) PayFi’s unique advantages

Real-time settlement: Transactions are completed instantly, eliminating delays in traditional banking systems.

Safe and reliable: The non-tamperable ledger feature of the blockchain ensures safe and transparent transactions and provides protection for users.

Cost reduction: eliminate intermediate links, significantly reduce transaction costs, and save user expenses.

Global accessibility: Its decentralized platform reaches markets that are not fully covered by traditional financial services, including people without bank accounts, to achieve inclusive financial services.

Innovative products: spawning novel financial service models such as “buy now, pay never”, as well as innovative applications such as providing advanced monetization channels for creators.

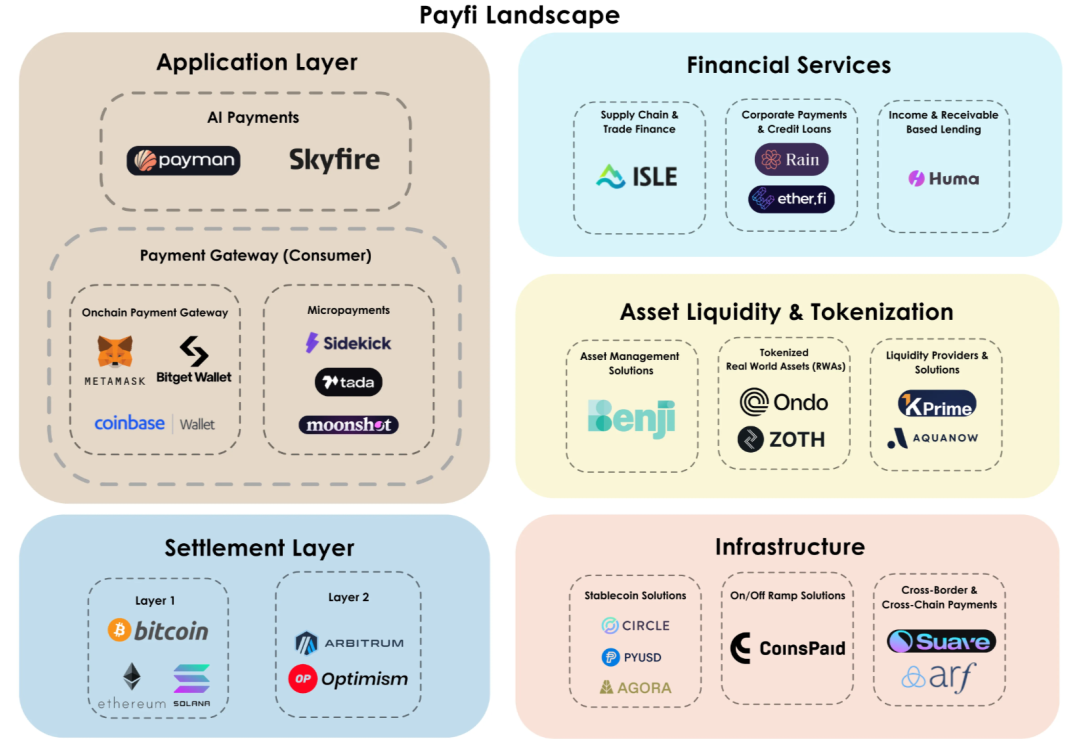

2. PayFi industry panorama and insights into subdivisions

The PayFi ecosystem is booming, and various industries are actively innovating to meet financial challenges. The following is an analysis of its key segments and examples of innovative companies in each field.

(1) Cross-chain and cross-border payment

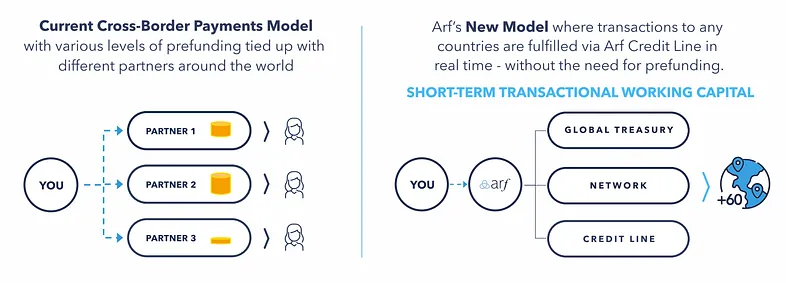

- Stubborn problems with traditional cross-border payments

Slow speed and high latency: Traditional payment channels are inefficient, settlement often takes several days, and the settlement process across time zones and banking hours is complex, exacerbating payment sluggishness.

Low capital efficiency and constraints of pre-deposited funds: Pre-deposited fund requirements require financial institutions to maintain foreign currency funds in current accounts, resulting in a global liquidity gap of US$4 trillion. The idle funds cannot generate income, becoming a hidden cost for financial institutions and passed on to the terminal. users, causing users to pay higher fees.

High transaction costs: Involving layers of fees from multiple intermediaries, including pre-deposited funds fees, currency exchange fees, etc., the average transaction cost of global cross-border remittances is as high as 6.35% (World Bank statistics).

-

Industry innovation cases

-

Arf: Build a regulated global settlement banking platform to provide on-chain liquidity solutions for financial institutions. Realize the instant and low-cost advantages of cross-border settlement with the help of stablecoins such as USDC, provide real-time liquidity for cross-border transactions on demand through the blockchain, and eliminate the dependence of current account accounts on large cash reserves; provide instant credit lines based on USDC , allowing financial institutions to temporarily borrow funds during transactions and repay them after payment is settled. Arf abandons the pre-deposited fund account model and uses USDC-based short-term liquidity solutions to effectively reduce capital requirements and settlement time, significantly reducing the operating costs of financial institutions engaged in global transactions. Pay attention to transparency and create complete traceable loan records. With the help of blockchain, all loan, repayment and receivable information can be easily traced. Adhering to the concept of strict compliance, as a member of the VQF Financial Services Standards Association, we follow international standards for anti-money laundering and financial supervision and set an example for the industry. So far, it has successfully processed more than 1.6 billion US dollars in on-chain transactions and maintained a zero-default record.

- suave.money: Create a cross-chain payment solution that enables enterprises to receive cryptocurrency payments from any blockchain network. Enterprises can seamlessly connect various token payments and flexibly choose to receive their favorite tokens according to their own needs, improving the area. Payment flexibility in the blockchain ecosystem. suave.money's platform simplifies cross-chain transactions. Enterprises do not need to manage multiple wallets or rewrite decentralized applications (DApps), so they can attract user groups from different blockchain ecosystems and broaden their customer sources. By promoting payment convenience from more than 10 blockchain networks and enhancing liquidity acquisition capabilities, it provides strong support for the expansion of DeFi and Web3 projects and expands market coverage. Simplifying the cross-chain transaction process and reducing the complexity of enterprise operations enables enterprises to attract more customers in the blockchain ecosystem without relying on professional infrastructure construction, creating more opportunities for enterprise development. With its innovative capabilities, it helps companies tap into the trillion-dollar cross-chain capital potential, occupies an important position in the rapidly developing DeFi and crypto payment fields, and provides users with unparalleled flexibility and convenience.

(2) Loans based on income and receivables

The dilemma of the traditional lending model: Traditional lending business relies on collateral, which excludes potential borrowers who lack large assets or credit records, limiting the inclusiveness and fairness of financial services.

Emergence of innovative solutions: Platforms such as Huma Finance allow users to borrow against future income or receivables, leveraging blockchain technology to make the lending process transparent and efficient.

Positive benefits brought about: This innovative model significantly improves financial inclusion, provides new ways to obtain funds for underserved markets ignored by traditional financial institutions, and promotes balanced economic development and social equity and justice.

Huma Finance’s practical case: building a decentralized lending protocol to provide businesses and individuals with lending services based on future income and receivables. Connecting borrowers with global investors through the on-chain platform creates an income-supported lending model that is different from the traditional DeFi over-collateralization model. Cooperating with Circle, Request Network, Superfluid and other platforms, the world's first on-chain factoring market was launched on Ethereum and Polygon. For the first time, users can use tokenized invoices or payment streams as collateral, broadening the scope and form of collateral. With the efficiency of blockchain, the on-chain processing time of the factoring process is shortened to less than one minute, providing users with a convenient experience. Huma Finance’s technical architecture consists of several key components. The decentralized income portfolio layer converts income sources such as invoices, payroll, and pledge income into tokenizable assets, providing a rich asset base for the lending business. The assessment agency framework is responsible for conducting accurate risk assessments of various types of lending needs to ensure that the credit quality on the chain is reliable and stable. The smart contract suite implements diverse lending use cases from invoice factoring to universal credit lines through configurable smart contracts to meet the personalized needs of different users. Huma Finance focuses on providing much-needed liquidity support to small and medium-sized enterprises and people without bank accounts. Through innovative lending models, it helps these groups break through traditional financial restrictions, obtain financial resources that are otherwise difficult to reach, promote their economic development and social integration, and build a Make positive contributions to a more equitable and inclusive financial ecosystem.

(3) Tokenization of real-world assets

Problems with traditional asset transactions: Real-world asset transactions such as real estate have cumbersome processes, high intermediate costs, and slow transaction speeds, which bring inconvenience and financial burden to buyers and sellers.

Innovative breakthroughs in tokenization: Tokenize real estate and other real-world assets. Through smart contract technology, asset ownership can be divided into multiple parts, enabling partial ownership transactions while greatly accelerating transaction speed and processes, creating an asset trading market. Inject new energy.

Significant advantages: This tokenization model significantly lowers the threshold for investors to enter the market, allowing more investors to participate in real-world asset investment, while greatly improving asset liquidity, accelerating the asset buying and selling process, and making market resources more accessible. Efficient allocation and circulation.

Ondo Finance’s successful practice: launching tokenized U.S. Treasury bonds and other income-generating products on the blockchain platform, opening up new investment channels for investors, allowing them to conveniently obtain short-term U.S. Treasury bonds through decentralized finance (DeFi) and other fixed income assets to achieve the organic integration of traditional financial markets and DeFi. Ondo Finance's innovative products provide investors with stable, profitable, liquid and safe investment options, breaking the barriers between traditional financial markets and DeFi, allowing more investors to share the dividends of the originally relatively closed capital market. , enrich investors’ asset allocation portfolios, and enhance the efficiency and vitality of the entire financial market. As of September 2024, Ondo Finance has achieved outstanding results in the field of tokenized US Treasury bond products, and its total locked value (TVL) has exceeded the US$600 million mark. Among them, the locked amount of USDY (interest-bearing stablecoin) reached US$384 million, and the locked amount of OUSG (tokenized US Treasury bonds) was US$221 million. These data fully prove the market's high recognition and widespread acceptance of its innovative products, highlighting its Leading position and strong influence in the field of real-world asset tokenization.

Zoth’s innovative contribution: building a market platform specifically for tokenized trade finance assets, providing investors with convenient access to U.S. dollar-denominated fixed income products. By tokenizing assets in traditional financial fields such as trade receivables and corporate bonds, we build a bridge between traditional finance and decentralized finance (DeFi), creating high-yield, low-risk investment opportunities for investors, and at the same time Enterprises provide new financing channels and fund management methods. Zoth's platform plays an important role in the market, not only bringing high-quality investment options to investors, helping them achieve asset appreciation and preservation, but also providing strong support for corporate development. By tokenizing trade financing assets, companies can unlock working capital more efficiently, optimize capital structure, and improve their competitiveness and risk resistance. At the same time, this will help promote the optimal allocation of global market capital, promote a more reasonable flow of financial resources to companies and projects in need, further improve the on-chain trade finance ecosystem, and make a positive contribution to the stability and development of the entire financial market.

(4) Corporate payment and credit solutions

New demands of consumers and limitations of traditional credit: In today’s consumer market, consumers require higher flexibility in payment methods and expect to enjoy a more convenient and diversified payment experience without shouldering a heavy debt burden. However, traditional credit Models often fail to meet this demand, causing inconvenience and economic pressure to consumers.

PayFi’s innovative model: In response to this market demand, PayFi innovatively introduces unique payment models such as “buy now, pay never” and cleverly uses the interest income obtained from the DeFi lending platform to offset purchase costs, providing consumers with a new , more flexible and debt-free payment solutions, greatly enhancing consumers’ purchasing power and shopping experience.

-

Industry innovation cases

-

Rain: Launched a corporate card supported by USDC, designed for the daily business payment needs of Web3 teams (such as decentralized autonomous organizations DAO and various protocol projects, etc.). With the help of this corporate card, the Web3 team can easily use its on-chain assets (such as USDC) to pay for daily business expenses such as travel expenses and office supplies purchase expenses. There is no need to perform cumbersome conversion operations between cryptocurrency and legal currency, greatly simplifying the corporate payment process and improving Financial management efficiency. As an important part of its expenditure management platform, Rain's corporate card makes full use of the advantages of blockchain technology to achieve seamless integration of digital assets and traditional payment systems. Through this innovative payment method, enterprises can manage their finances more efficiently, reduce the cost and time consumption of intermediate links, and at the same time provide more convenient and secure payment solutions for enterprises in the blockchain and encryption fields, effectively promoting the development of the Web3 industry and the popularization of applications. .

-

Ether.fi: The launch of "Ether.fi Cash" product has attracted widespread attention in the market. This is a credit card in cooperation with Visa and has unique and innovative features. After users hold the card, they can easily obtain a borrowing limit by using their crypto assets (including various assets based on Ethereum) as collateral, so that they can consume legal currency without selling crypto assets, providing users with more flexible funds. Management style and consumption experience. In addition, the "Ether.fi Cash" credit card is deeply integrated with Ethereum's Layer 2 network Scroll. This technical advantage significantly reduces transaction costs and further improves user cost-effectiveness. At the same time, the card supports point-to-point USDC transfer functions, allowing users to transfer and manage funds more conveniently, meet payment needs in different scenarios, and bypass traditional bank intermediate links, saving users additional expenses. In addition, in order to improve user enthusiasm and satisfaction, the "Ether.fi Cash" credit card also provides an attractive cashback reward mechanism, bringing tangible economic benefits to users during their consumption process, further enhancing product market competitiveness and user viscosity.

-

Bitget Card: The launched Visa card serves as an important bridge between cryptocurrency and traditional payment systems, providing users with convenient and efficient payment solutions. The card is closely connected to the multi-currency wallet. Enterprise or individual users can conveniently hold, convert and use various mainstream cryptocurrencies in the wallet, such as USDT, BTC, ETH, USDC, BGB, etc. (Currently, fund accounts are mainly in USDT Mainly recharge, with plans to gradually introduce more cryptocurrencies in the future). During the actual payment process, Bitget Card can automatically convert cryptocurrency into legal currency based on real-time exchange rates, ensuring that users can successfully complete payments when spending money at any merchant that accepts Visa cards around the world, without having to worry about cumbersome currency exchange procedures and exchange rate fluctuations. Risk, truly realize the seamless connection between cryptocurrency and legal currency payment, providing users with great convenience. The emergence of Bitget Card has had an important impact on the field of corporate payment. It not only simplifies the corporate payment process, but also allows companies to use traditional currency consumption in real time without manually performing complex cryptocurrency and legal currency conversion operations, greatly improving payment efficiency and fund use efficiency. At the same time, its strong cross-border payment capabilities make it easier for companies to expand and operate international business without having to worry about opening and managing foreign currency accounts, effectively reducing corporate operating costs and financial risks. Currently, Bitget Card has been widely accepted and recognized in more than 180 countries and regions around the world, providing strong support for the global development of enterprises. In addition, Bitget Card also has rich potential DeFi Use cases, such as supplier payment, companies can directly use the card to pay suppliers in fiat currency, avoiding the tedious process of manually converting cryptocurrencies, improving supply chain payment efficiency and stability; in terms of travel expense reimbursement, employees can rely on this card The card can easily make business-related consumption payments during cross-border travel, such as air ticket bookings, hotel accommodations, etc., without worrying about payment restrictions and handling fees, and provides a more convenient payment solution for corporate cross-border business activities; in terms of corporate reward mechanisms, companies You can also use Bitget Card The cryptocurrency payment function provided provides employees with cryptocurrency-based rewards. Employees can convert cryptocurrency into legal currency for consumption according to their own needs, or directly use it in scenarios that support cryptocurrency payment, creating an incentive and welfare system for corporate employees. Bring more innovation and flexibility, further enhance the competitiveness and attractiveness of enterprises.

(5) Supply chain and trade finance

Dilemma of traditional supply chain finance: In the traditional supply chain finance system, suppliers often face long and complex payment cycles, and large amounts of funds are locked up for a long time, which seriously restricts their operational efficiency and capital turnover capabilities, making it difficult to maintain normal production and operation activities and business expansion. . According to statistics, global enterprises have up to US$2.5 trillion in trade financing needs that cannot be effectively met every year due to the limitations of traditional financial institutions. This has become a bottleneck for global trade development and hinders the coordinated development of industrial chains and stable economic growth.

PayFi’s solution: PayFi provides innovative solutions to the invoice financing problem in supply chain finance by introducing a decentralized platform. Under this model, suppliers can use the advantages of blockchain technology to tokenize their invoices and quickly achieve financing on a decentralized platform, obtain immediate financial support, and greatly improve capital liquidity. At the same time, buyers can continue to settle according to the original payment plan without changing traditional payment habits and financial processes, achieving a balanced and coordinated development of interests between buyers and sellers, and providing a strong guarantee for the efficient operation of supply chain finance.

-

Industry innovation cases

-

Isle Finance: Deeply explores the on-chain credit market in the field of supply chain finance. The platform it builds can accurately connect high-credit buyers with liquidity providers, thereby helping companies obtain financing faster. It cleverly uses blockchain technology to greatly enhance the liquidity of the entire supply chain through rigorous verification of real-world assets (RWAs) and implementation of early payment strategies for buyers, especially those suppliers with low credit ratings. and security, laying a solid foundation for the stable development of supply chain finance. Isle Finance uses its own platform to vigorously promote the development of reverse factoring business, which not only significantly speeds up the company's payment speed, but also greatly optimizes the cash flow situation. This innovative solution based on blockchain allows companies to flexibly provide early payment discounts, creating extremely stable and considerable returns in the field of supply chain finance. It also broadens the channels for companies to obtain liquidity and provides them with sustainable Inject strong impetus into development.

(6) Stable currency payment platform

-

Example: Agora

-

Business content: The United States Digital Dollar (AUSD) has been carefully created, and its solid backing is fully backed by cash, U.S. Treasury bonds, and overnight repurchase agreements. The platform is dedicated to using blockchain technology to enable broader and more convenient circulation of U.S. dollars around the world, with a particular focus on areas underserved by the traditional financial system. It fully implements the concept of financial inclusion and opens up a path for the public. A new way to gain easier access to stable, globally recognized currencies.

-

Impact: Powerful push to democratize access to U.S. dollars, highly consistent with PayFi’s ambitious vision to expand financial inclusion. It gives full play to the technical advantages of blockchain and builds a decentralized and easy-to-access financial system, allowing individuals and enterprises to benefit from US dollar-backed financial instruments. The results are particularly significant in Argentina, Southeast Asia and other regions. It provides strong support for local economic development and financial stability.

-

Achievements: Successfully brought the stablecoin AUSD to the market, initially issued on Ethereum and later expanded to the Avalanche network. Remarkably, within just a few weeks of its release, its minting volume exceeded $20 million. Today, the platform is steadily advancing the global layout of its digital dollar, continuing to expand the international market, while always adhering to the development strategy of financial inclusion and regulatory compliance, and gradually establishing a good reputation and influence in the stablecoin field.

-

Example: PayPal

-

Business content: PayPal USD (PYUSD) was officially launched in August 2024, first launched on the Ethereum blockchain, and then successfully expanded to Solana in May 2024. The original design intention of this stablecoin is to fully integrate the advantages of the two blockchains and strive to achieve a fast and low-cost digital payment experience. Especially after expanding to Solana, with its excellent transaction speed and low fee advantages, the usability of PYUSD in various commercial and DeFi application scenarios has been greatly improved, providing users with more efficient and convenient payment options.

-

Impact: It is expected to become a powerful alternative to traditional payment systems with its fast and cost-effective characteristics, thereby significantly improving global payment efficiency. It successfully implements seamless transfer functions across different platforms (covering PayPal, Venmo, etc.), allowing users to easily hold and transfer stablecoins, and fully utilizes the technical advantages of blockchain to manage and pay transactions for users’ digital assets Bringing more convenience and innovative experience.

-

Achievements: After expanding to Solana, PYUSD's market adoption rate has shown rapid growth, and its market value has rapidly increased and successfully exceeded the US$500 million mark. This remarkable achievement fully demonstrates its deep integration and widespread recognition in centralized and decentralized platforms. It also marks a major victory for PayPal in its exploration of stablecoins, setting the stage for its future development in the field of digital payments. A solid foundation has been laid for further development.

-

Example: Bridge (acquired by Stripe)

-

Business content: Bridge, as a platform focusing on stablecoin payments, always takes simplifying cross-border digital payments as its core goal. Through convenient API interfaces, it can easily implement payment integration based on stablecoins, providing low-cost and high efficiency for global users. cross-border transaction solutions. Before being acquired by Stripe, Bridge had already achieved remarkable results in e-commerce platform integration, successfully helping merchants to seamlessly connect and efficiently process stablecoin payment services in any corner of the world, greatly expanding the use of stablecoins in the commercial field. Application scope.

-

Impact: Recently acquired by the US payment giant Stripe, this major event is undoubtedly a key milestone for the integration of stablecoins into mainstream financial services. Leveraging Stripe's powerful infrastructure and extensive market network, Bridge is able to further expand its business coverage and comprehensively improve its capabilities, committed to providing global enterprises with more convenient and efficient stablecoin payment and settlement services. This move is highly consistent with PayFi’s grand vision to promote the global adoption of digital currencies by promoting financial inclusion and seamless cross-border transactions. It is expected to leverage Stripe’s existing advantages and Bridge’s stablecoin technology expertise to accelerate blockchain-supported payments. The widespread application and deep integration of payment methods in mainstream financial channels has injected new vitality into the innovative development of the global financial payment field.

-

Achievements: In August 2024, Bridge's annualized payment volume run rate successfully exceeded US$5 billion, a remarkable achievement. During its development, Bridge has established close cooperative relationships with many industry-leading companies, such as Coinbase and SpaceX, and is still providing high-quality payment services to these companies today, and has accumulated rich practical experience and experience in the field of stable currency payment. A good market reputation has become one of the important forces driving the development of the industry.

Conclusion

Overall, PayFi is not a completely new concept. The problems it aims to solve already exist in the traditional financial system, and there are corresponding solutions. But this does not mean that PayFi is worthless, as traditional solutions are still insufficient. By solving core inefficiencies in the global payments system and harnessing the transformative potential of blockchain, PayFi has the potential to unlock unprecedented liquidity and drive financial inclusion. As more and more companies innovate in this space, the vision of a fully decentralized financial ecosystem where payments are instant, secure, and borderless is getting closer to reality. Now is the time to embrace PayFi's transformation and shape the future of global finance.

chaincatcher

chaincatcher