Penetrating the Bitcoin Lending Business: A New Paradigm Reconstruction of Trillion-Level Liquidity

Reprinted from panewslab

01/10/2025·1MWritten by: JiaYi

I have mentioned many times before that Bitcoin, worth trillions of dollars, is actually the largest and best "fund pool" in the crypto world.

Last month, Avalon Labs, the largest on-chain lending agreement in the Bitcoin ecosystem, just completed a $10 million Series A financing led by Framework Ventures. My venture capital institution GeekCartel also participated, hoping to cooperate with Avalon and more Bitcoin Together with innovative projects in the currency ecosystem, BTC will be transformed from a digital value store into a more active financial instrument.

In fact, for the Bitcoin ecosystem, starting from Babylon and Solv, BTC, as a liquid asset and a niche asset, has clearly further evolved into richer on-chain structured income scenarios, and gradually developed unique and unique It is a self-contained BTCFi ecosystem.

From a sustainable perspective, if we can revitalize the dormant BTC and build an efficient and secure liquidity network, we can completely open up the global imagination space for BTC, a trillion-dollar asset, as a DeFi niche asset.

Industry practices for liberating Bitcoin liquidity

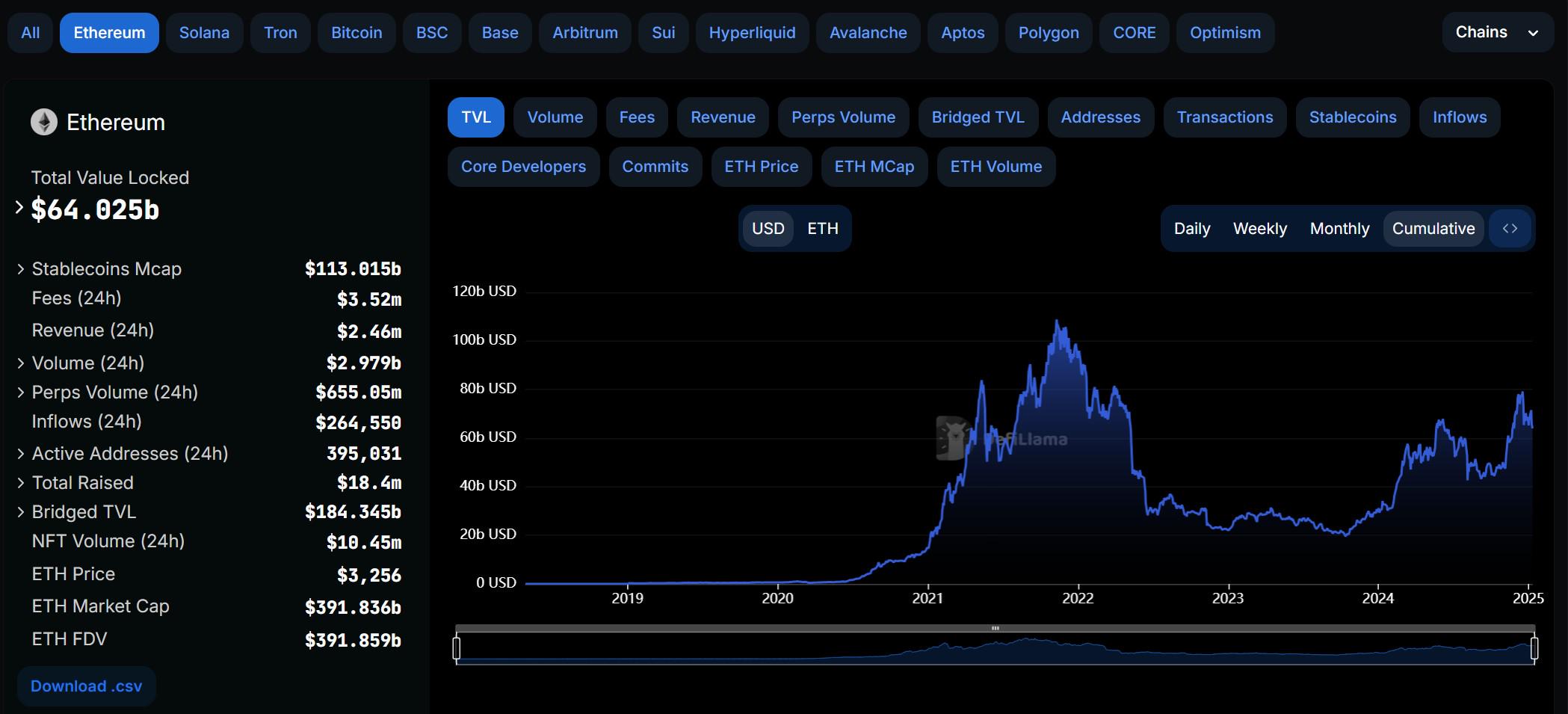

DeFiLlama data shows that as of January 9, 2025, the total locked-up value on the Ethereum chain exceeded US$64 billion, a significant increase of nearly 180% from January 2023 (US$23 billion). However, during the same period, the Ordinal wave began to gain momentum. In the Bitcoin ecosystem, even though the market value and price growth of BTC are much better than that of ETH, it has never been able to catch up with the expansion speed of the ecosystem on the Ethereum chain.

You know, if BTC liquidity is released by even 10%, it will create a market of up to 180 billion U.S. dollars. If it can reach a TVL ratio similar to ETH (on-chain TVL/total market value, currently about 16%), it will release about 180 billion U.S. dollars. $300 billion in liquidity.

This is enough to promote the explosive growth of the BTCFi ecosystem, and even has the potential to surpass the pan-EVM network and become the largest super-on-chain financial ecosystem.

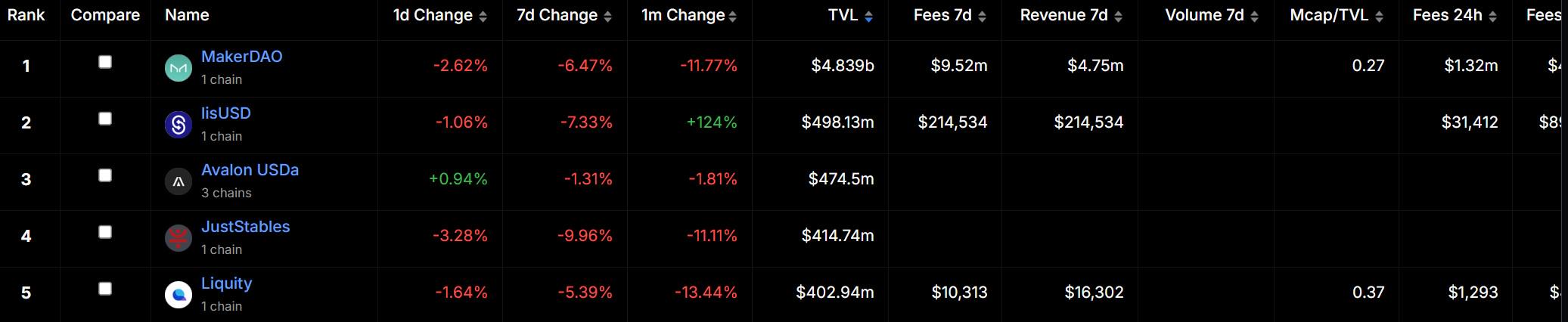

From this perspective, Avalon, a Bitcoin liquidity platform that “allows anyone to benefit from BTC lending,” has the greatest potential for imagination— it has become the largest lending agreement in the entire BTC ecosystem so far . , second only to DAI and lisUSD.

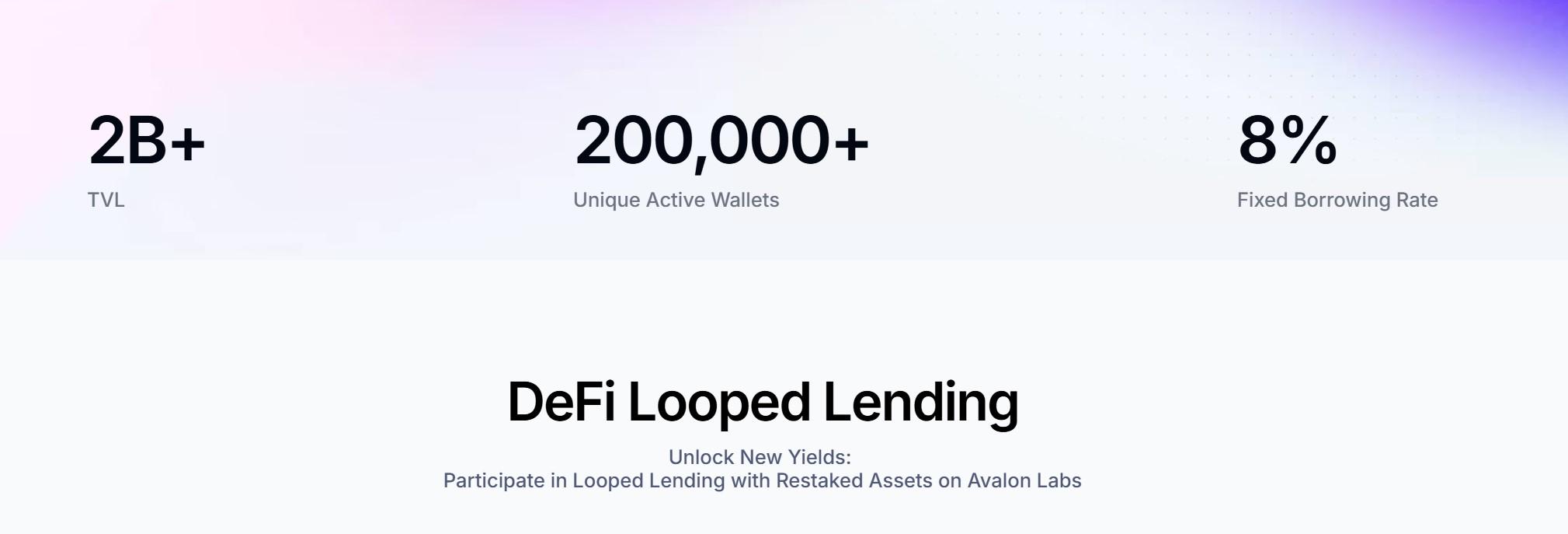

This also created a record for the fastest-growing TVL DeFi lending agreement in the history of DeFi. According to official data, Avalon Labs TVL has exceeded 2 billion US dollars, and the locked position of its Bitcoin stablecoin USDa exceeded 500 million only 1 week after its launch. Dollar.

For current BTC holders, it is absolutely necessary to make full use of the BTC assets accumulated in their hands, but at the same time, they do not want their BTC to bear too much risk of principal loss. It is best to exchange fixed assets for Mobile and convenient operation.

Therefore, the on-chain lending protocol based on Bitcoin is bound to usher in a window of opportunity, and this is where Avalon’s opportunity lies - the interest rate for project lending is fixed at 8%, and professional institutions will host the mortgaged Bitcoins and the stablecoins lent at the same time. Unlimited supply gives BTC holders more liquidity to participate in other projects within the ecosystem.

The logic of this gameplay has also been certified by the market. It is worth mentioning that the difference between Avalon official and other TVL project strategies is that their focus is on the healthy construction of retail investors in the entire ecosystem, and it is not just a game for large investors. , anyone can participate and use leverage to increase the rate of return as much as possible within a safe range.

How much is a Bitcoin stablecoin worth?

From the perspective of stablecoins, decentralized stablecoins on the chain are still dominated by Collateralized Debt Position (CDP) stablecoins -MakerDAO has the largest DAI, followed closely by liUSD, USDJ, etc.

Essentially, a CDP doesn't look like a loan - the borrower mints a CDP, a protocol oracle calculates the dollar value at a 1:1 price, and the CDP can be sold on the open market, thereby "borrowing" another asset. The lender receives the CDP.

To put it bluntly, this is an expansion of the use of stablecoins based on lending scenarios, which is equivalent to creating an additional liquidity trading pool for those assets that usually sleep. Taking Avalon as an example, its ecosystem currently has four core businesses. Sector: USDa, a revenue-based stablecoin based on Bitcoin mortgage; USDa-based lending protocol; hybrid lending platform connecting DeFi and CeFi; and decentralized lending protocol that supports BTC pledge.

This is also the reason why stablecoin protocols and lending protocols can easily penetrate each other - for example, Aave and MakerDAO, which are based on lending, are working in both directions. One is launching the native stablecoin GHO, and the other is accelerating the construction of its own lending scenario coverage.

Therefore, on the same basis, Avalon's liquidity market can build a stablecoin USDa market through liquidity design while forming a "lending" relationship with the underlying assets, and provide users with fixed income products.

In a word, Avalon has really made it possible for anyone to benefit from BTC lending, turning Bitcoin from an idle asset into a more liquid one. This not only helps the Bitcoin ecosystem solve the stablecoin problem that has been troubled for a long time, but also because of the help of LayerZero technology achieves cross-chain compatibility, and users can seamlessly operate USDa in multiple DeFi ecosystems without using a third-party cross-chain bridge. This brings the liquidity of the Bitcoin ecosystem to other chains in disguise.

You must know that BTC is mostly idle. Since it has a sufficient safety margin compared to other altcoin assets, many OG or Maxi have no motivation and are unwilling to take the risk of cross-chaining it to ecosystems such as Ethereum. This has caused most BTC to sleep for a long time. BTCFi Scale and volume have remained stagnant.

USDa is a relatively important part of this. On the one hand, USDa can be regarded as making up for the missing DeFi infrastructure (lending agreement) in the Bitcoin ecosystem. On the other hand, Avalon’s USDa takes advantage of the CeDeFi lending platform. Allow users to use USDa to obtain USDT from CeFi liquidity providers to solve the peg problem.

It also provides the Bitcoin network with a basic framework that can efficiently utilize assets and activate sleeping BTC, allowing more BTC Holders to safely participate in on-chain liquidity activities and confidently put a large amount of sleeping BTC into the DeFi liquidity pool. Redeem or earn income.

Conclusion

It is foreseeable that as Bitcoin assets gradually come out of slumber, BTCFi is very likely to become a new DeFi asset direction with a volume of hundreds of billions of dollars, becoming the key to building a prosperous ecosystem on the chain.

As an investor in Avalon, I have become the absolute leader in Lending on the BTCFi track within a few months. This also makes me firmly believe that Avalon and BTCFi will perform better in the future - building a variety of financial products with BTC as the core. The form and DeFi scenario redefine the role of BTC in the DeFi field of the entire network.

As for whether BTC's deep integration in the DeFi field can reach a critical turning point, it is worth looking forward to.

chaincatcher

chaincatcher