Phantom completed a sky-high US$150 million in financing, do I have a chance to receive an airdrop?

Reprinted from panewslab

01/17/2025·3MBy Pzai, Foresight News

On January 16, the crypto wallet Phantom announced the completion of a $150 million Series C round of financing at a valuation of $3 billion. Sequoia Capital and Paradigm led the investment, with participation from a16z crypto and Variant. The funds raised will be used to continue developing its applications. This should be the biggest financing news in the crypto space in recent times.

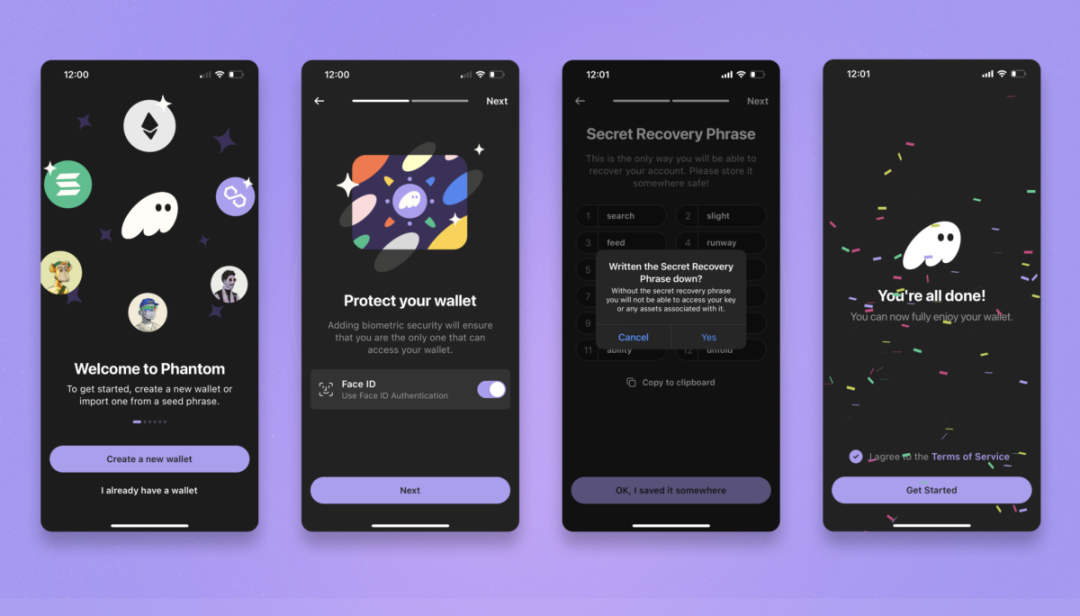

As the leader in Solana wallets, Phantom has quickly become one of the go-to tools for crypto users with its simple user interface, multi-chain support, and self-hosted security. At the same time, Phantom’s financing has also triggered market speculation about its future development path. Although many crypto projects choose to raise funds and incentivize users by issuing tokens, Phantom’s founders have repeatedly emphasized that they are focused on product and user experience rather than token economics. In its recent response, Phantom also stated that "there are no plans to issue coins for the time being." This article will discuss in depth whether Phantom will enter the era of token economy from multiple perspectives.

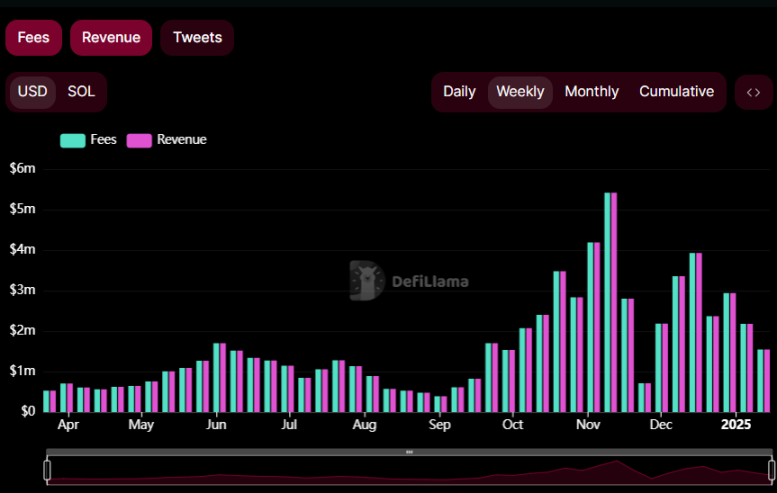

Generous cash flow

Phantom CEO Brandon Millman made it clear in an interview in 2022 that Phantom’s core goal is to provide a first-class user experience rather than making money by issuing coins. He emphasized that Phantom is positioned as a "consumer financial platform" rather than a pure encryption project. Phantom prefers to achieve long-term development through traditional financial models rather than relying on the token economy. Half a month ago, Phantom even tweeted that it had "no plans to launch a token."

From the user's perspective, it is true that the wallet is a very simple entrance, and its currency issuance will create certain value for users, including granting governance rights, income rights, etc., and enhancing user stickiness to achieve a positive flywheel. However, the volatility of the crypto market itself also creates certain uncertainties for the project, leading to certain fluctuations in project development.

From the investment style of VC, Sequoia Capital and Paradigm, the leading investors in this round of financing, are more inclined to support projects with clear business models and long-term growth potential, especially in infrastructure, such as OpenSea, Zora, etc. The invested projects all expressed doubts about the token economy to varying degrees.

As an old player in the field of venture capital, Sequoia Capital is extremely cautious about investing in the crypto field. Under the background of compliance, investing and exiting through IPO is more in line with the habits of traditional giants such as Redshirt, which adds to Phantom's own ICO expectations. Adds a layer of suspicion.

In terms of usage scale, Phantom currently has 15 million monthly active users, has $25 billion in self-custody assets, and has processed 85 billion on-chain transactions. From the perspective of income distribution, its income mainly comes from transaction fees, and during the peak period of Solana trading, the weekly trading income can reach more than 5 million US dollars, and the annual income is estimated to reach about 80 million US dollars, which is considered to be the largest in the encryption market. The stable cash flow and large user base make it very suitable for traditional IPO.

In the context of Trump’s encryption compliance, the liquidity of encrypted U.S. stocks is being more widely recognized by the market. The precedents of excellent encryption companies such as MicroStrategy and Coinbase seem to have provided Phantom with a successful example and a path forward for its IPO. bedding.

Friends' experience

In fact, in the wallet track, there are many projects that embrace the token economy. Among them, Trust Wallet, Safe, Bitget Wallet (BWB has now been merged into BGB), etc. have issued their own tokens in different ways, and the ecological niche of the wallet in the entire encryption field is released through the value of the tokens, which may include:

- Governance rights: Distribute transaction proceeds to (staking) users through tokens. For example, Tokenlon DEX under imToken distributes and repurchases transaction proceeds through LON tokens.

- Ecological project airdrop: In the ecology associated with the wallet, the project provides services to users through close cooperation with the wallet and provides users with ecological incentives. This requires the wallet to work closely with partners in the ecology, usually with a clear ecological endorsement, such as Trust Wallet and BSC, Phantom and Solana, Safe and EVM ecology, etc.

- Payment: Simplify the user experience by reducing the handling fees generated by payment.

All in all, Phantom’s sky-high financing represents the capital market’s optimism for it and is another example of crypto projects being favored by traditional VCs. But for blockchain enthusiasts who are used to being airdrop hunters, can they share Phantom’s growth dividends? It has become uncertain.

jinse

jinse

chaincatcher

chaincatcher