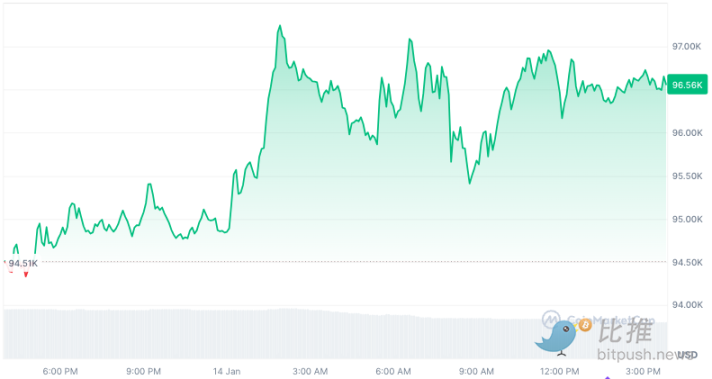

PPI data becomes "timely rain", Bitcoin strongly exceeds 97,000 US dollars

Reprinted from panewslab

01/15/2025·22days agoAfter the release of the U.S. Producer Price Index (PPI) data, Bitcoin continued to rebound to above $96,000, with an increase of 2.5% in the past 24 hours. Among mainstream altcoins, XRP and DOGE led the way with gains of 6% to 7%.

The report showed that the U.S. PPI rose only 0.2% month-on-month in December, lower than the 0.4% increase last month and also lower than the consensus estimate of 0.4% among economists. As a forward-looking indicator of the Consumer Price Index (CPI), PPI plays an important role in the overall inflation level. The cooling of PPI is a positive signal for the Federal Reserve's next move.

The day before, the Washington Post reported that sources close to the new Trump administration revealed that the president-elect will issue executive orders related to cryptocurrency after taking office. The orders are expected to address so-called “de-banking” issues and reverse the controversial SAB 121 policy, which restricted banks from servicing cryptocurrency companies.

Cryptocurrency billionaire and Galaxy Digital founder Mike Novogratz mentioned last year that SAB 121 was one of the policies of the Joe Biden era that would be quickly repealed after Trump took office.

The crypto market immediately rose after the Washington Post reported that Trump was willing to support a crypto legislative strategy early in his presidency, driven by a group of Silicon Valley tycoons, including A16Z general partner Marc Andreessen.

Derivatives market indicators show market volatility

Derivatives market data shows volatility in Bitcoin and other cryptocurrencies is expected to continue rising. The short-term implied volatility of Bitcoin options remains high. At the same time, the VIX index, which measures the volatility of the US stock market, also remains at a high level, indicating an increase in overall market uncertainty.

According to Deribit data, the first Bitcoin options expiration date this year is January 24, two days after Trump’s inauguration. The market's attitude towards this point is slightly optimistic, and call option demand is relatively high. Among them, call option contracts with a strike price of $99,000 are the most concentrated. Analysts at QCP Capital believe derivatives market data suggests market volatility will persist in January.

K33 Research had previously predicted that Inauguration Day could be a selling opportunity, but the recent decline in stocks and digital assets generally has led it to revise that view. The agency said that while the appeal of selling on Inauguration Day has weakened, the market still needs to pay close attention to price trends next week. The report states: “While our previous monthly outlook favored selling on Inauguration Day, this strategy has become significantly less attractive given the recent two-month lows for both stocks and Bitcoin. The S&P 500 filled in yesterday Post-election gap, Bitcoin also hit two-month lows. The de-risking operation will be entirely dependent on the price action next week and the impact will be short-lived as we are optimistic about Trump’s long-term impact on BTC. manner."

Cryptocurrency research firm 10x Research said in a report that "lower-than-expected inflation data could trigger a rise in Bitcoin" as the Federal Reserve considers the impact of inflation.

Geoffrey Kendrick, head of digital asset research at Standard Chartered Bank, said in a research report on January 14 that Bitcoin is currently facing pressure from macro risks, and any retracement below $90,000 represents a "mid-term" buying opportunity.

"If we do retest this level (if it falls below $90,000, I would expect a drop below $80,000), I would view this as an excellent medium-term buying opportunity," the report said. Despite the short-term risks, Standard Chartered The bank still reiterated its long-term price target for Bitcoin to reach $200,000 by the end of 2025.

Crypto traders should have become accustomed to short-term retracements during the bull market. Fundstrat co-founder Tom Lee said on CNBC’s “Squawk Box” program that Bitcoin prices may correct to $70,000, then hit new highs, and eventually reach $70,000 by the end of the year. Between US$200,000 and US$250,000.

jinse

jinse

chaincatcher

chaincatcher