"Sales old capital" is not advisable, and the encryption field cannot rely on network effects to establish a moat to hold.

Reprinted from panewslab

04/01/2025·29DAuthor: Catrina , Encrypted KOL

Compiled by: Felix, PANews

Revisiting Web2's most popular Growth Hacking (PANews Note: Growth Hacking, i.e., helps companies grow rapidly through certain means and strategies): Why network effects are no longer the lasting moat of Web3.

First understand the definition of network effects and why it is important in Web2. The following results are from ChatGPT:

Definition: A network effect is created when a product or service gains additional value due to more people’s use. This means that each new user increases the overall value of the product or service to the existing user.

Benefits of Network Effects (NE):

- Strengthen the competition moat - more users make the product more valuable, thus blocking competitors.

- Reduce user acquisition costs – Existing users attract new users through word of mouth, integration or ecosystem effects.

- Create higher conversion costs and retention rates – As the network grows, users are increasingly integrated into the ecosystem (e.g., social connections, data, integration). This makes them expensive or inconvenient to leave, thereby improving retention and pricing power.

Someone may object here, but this article emphasizes that network effects are not a lasting moat in the field of encryption. Because cryptocurrencies have the following characteristics, they cannot give crypto companies the same endurance and sustainable competitive advantage as Web2 companies.

Feature 1: Encrypted users are often more profitable

Developer as a user: The developer is a user/buyer of the blockchain (L1, L2, other "layers"). Blockchain provides developers with a similar product: block space in an immutable database on-chain that records transaction history. Developers usually share common criteria when choosing where to build:

- Minimum transaction fees

- Fastest transaction processing

- The highest liquidity

- Most ecosystem/community support, including grants

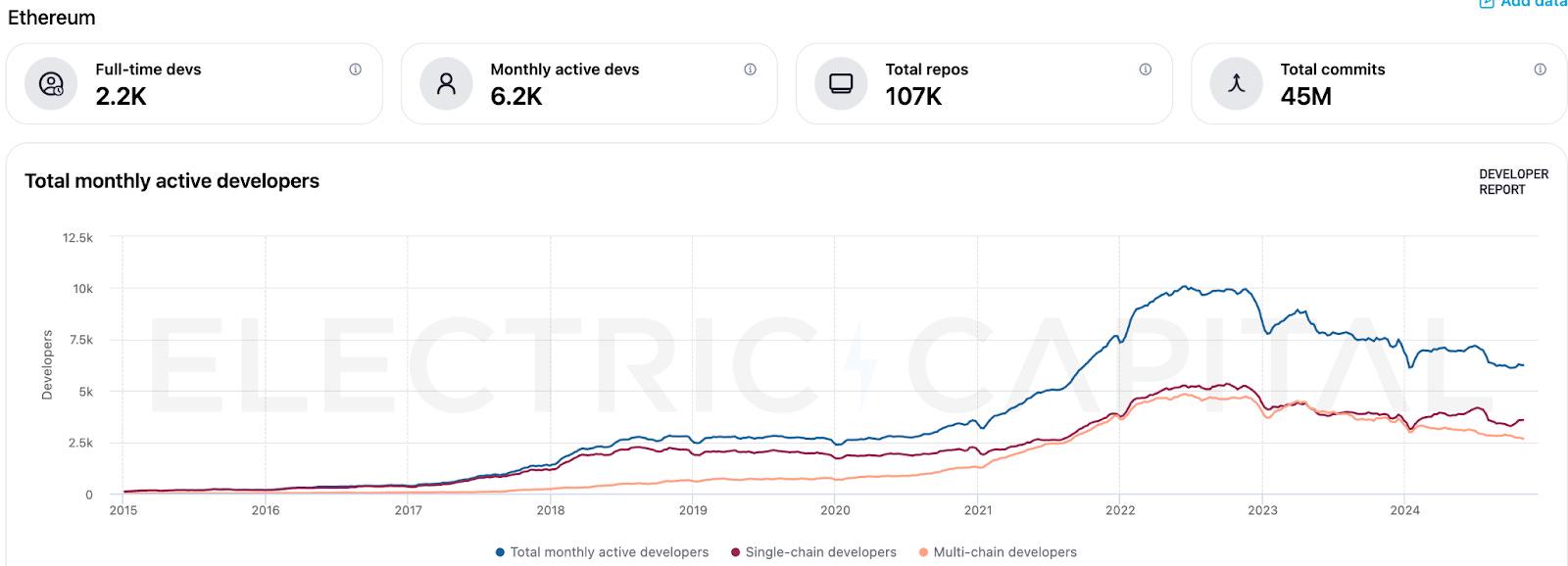

As Electric Capital’s developer report in the picture above shows, Ethereum initially benefited from the network effect, attracting most developers to build exclusively on Ethereum (“single-chain developers”). However, facing competitors such as Solana and Base, the network effect has failed to save Ethereum with poor performance and fragmented liquidity. This has led to a significant decline in the proportion of "single-chain developers" / "total monthly active developers" starting from 2022. This shift shows the nature of developers’ profit-oriented nature, and they will flow to where they meet their needs rather than staying for loyalty.

As a retail investor for users: As long as DeFi remains the primary use case for cryptocurrencies, liquidity providers and DeFi users will continue to seek:

- The highest liquidity returns

- The lowest slippage in trading

- The most types of tokens

- The most attractive mining rewards

This behavior is often not related to user experience or platform preferences.

In addition, the emergence of wallets makes switching between platforms such as Uniswap and Hyperliquid silky and easy.

As a user's validator: Verifiers naturally seek block rewards of the highest nominal value—whether from their interests (in the PoS network) or from the services provided (as DePIN providers).

Choosing to continue using or supporting a copycat L1, L2, application chain or DePIN project depends on simple cost-effective calculations. When making this choice, validators evaluate the economic value and the sustainability of block rewards.

Feature 2: Cryptocurrencies are open source by default, significantly

reducing the entry threshold for imitators

"Vampire Attack": SushiSwap copied Uniswap code and provided the exact same user experience, and then designed a more profitable token incentive to suck away Uniswap's liquidity providers and users.

Implementing similar attacks in Web2 is much more difficult. Someone has to steal Facebook’s entire code base, launch the same or better product, and then provide funds to all Facebook users to attract them to use the new platform.

Feature 3: Cryptocurrencies are interoperable by default, minimizing the

conversion costs of developers and retail investors

Taking USDC as an example, it can be said to be the most effective network in the field of encryption, and compare it with Visa Network, one of its Web2 peers. If USDC is not accepted, it does not take much time to redeem it on DEX or CEX.

However, it is much more troublesome for users to switch cards from Visa network to Mastercard.

Going back to the main point of this article, why network effects cannot enable crypto companies to gain the same advantages as their Web2 peers:

Network effects will not increase the competitive moat: due to the forkability and open source nature of cryptocurrencies, coupled with the competition between indiscriminate products (revenue, block space, liquidity) (PANews Note: that is, products are completely replaced between different manufacturers, so which oligopolis will win the entire market if the price is lower, while those with higher prices will not get any profit at all), network effects will not necessarily make pioneers with more users more "competitive".

Network effects cannot reduce the cost of obtaining encrypted users: encrypted users (whether retail investors or developers) are more profitable than Web2 users. Retail investors tend to have the best trading returns and rates of return. Developers tend to have the best performance and the deepest liquidity. Regardless of whether there is a network effect or not, as long as the gains are profitable to LP, liquidity will remain in the ecosystem.

Some people even believe that cryptocurrencies have the opposite effect to network effects: the more LPs in the pool, the lower the returns; the more users there are on a chain, the higher the fees and congestion are.

Network effects do not generate higher conversion costs and retention in the encryption field: Due to the default composability and interoperability of blockchains, conversion costs in the encryption field are extremely low.

There is no data moat in the encryption field. No data on the chain can be considered "proprietary data", and these are the key to large tech companies retaining users.

Finally, let’s take a look at a case study about Ethereum, which is widely regarded as a microcosm of the network effects in the crypto field. Ethereum has combined blockchain innovation with programmable currencies to benefit from early network effects since it was seen as a “computer in the world”:

- Developer Adoption: Ethereum attracted the largest community of blockchain developers in the early days, mainly because its EVM became the industry standard for initial blockchain development.

- Liquidity and DeFi dominance: Ethereum hosts most of the liquidity of cryptocurrencies through the DeFi platform – until recently surpassed by Solana. More liquidity attracts more users → easier and cheaper trading/lending → more liquidity.

- Security: The increased usage of Ethereum has enhanced its security and attracted more projects and users.

However, this trend has been broken this year. Ethereum has played a good hand in a bad way: delaying product improvements and over-dispersing its ecosystem by supporting L2, which cannibalize its own liquidity. This leads to:

- A large number of developers leaked: the number of monthly active developers fell by 17% in 2024, while the number of new developers in Solana increased by about 83%.

- Liquidity Outflow: DeFi's dominance has dropped from 100% to 50% according to DeFiLlama).

And Ethereum’s so-called network effect cannot reverse this trend.

By contrast, while the Web2 giants (i.e. Meta and Twitter) have also slacked off in innovation and delivery, they continue to easily dominate their respective markets. Why? Because the network effects of the Web2 version are indeed effective and have endurance:

- Competitors cannot fork their code and offer similar products.

- Twitter and Facebook data are truly proprietary and irreplaceable

- It cannot interoperate with any project except within its own ecosystem.

Given this, the traditional network effect that provides a long-term moat for Web2 companies is not applicable in the field of encryption.

Related Readings: Ethereum’s growth pain: From ETF “blood loss” to on-chain weakness, can ETF staking boost the market?

chaincatcher

chaincatcher